Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please can you calculate the total overhead. I know the total is $300,000 but I don't know which values are the ones. Also, can you

Please can you calculate the total overhead. I know the total is $300,000 but I don't know which values are the ones.

Also, can you do sections 4 and 5. That's all I need. Appreciate your help.

Thanks you.

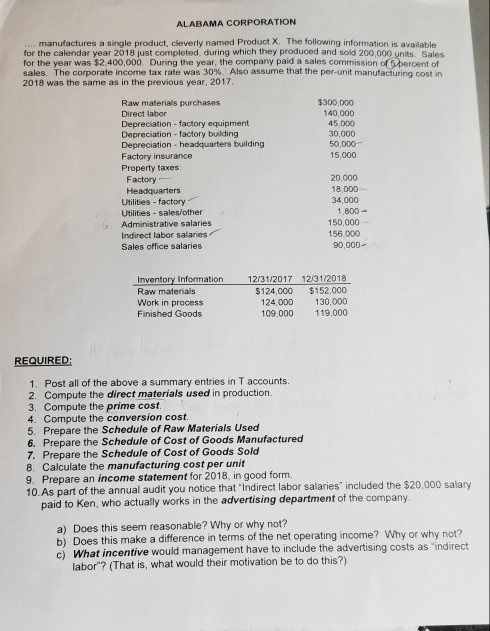

ALABAMA CORPORATION manufactures a single product, cleverly named Product X. The following information is available for the calendar year 2018 just completed, during which they produced and sold 200,000 units. Sales for the year was $2.400,000. During the year, the company paid a sales commission of 5percent of sales. The corporate income tax rate was 30%. Also assume that the per-unit manufacturing cost in 2018 was the same as in the previous year, 2017 $300,000 140,000 45,000 Raw materials purchases Direct labor Depreciation factory equipment Depreciation - factory building Depreciation- headquarters building Factory insurance Property taxes 50,000 15,000 20,000 18,000 34,000 Factory Headquarters Utilities-factory Utilities-sales/other Administrative salaries Indirect labor salaries Sales office salaries 1,800- sve salaries 150,000 156.000 90,000- Inventory Informatiorn Raw materials Work in process Finished Goods 12/31/2017 12/31/2018 $124,000 $152,000 124.000 130.000 109,000 119,000 REQUIRED: 1. Post all of the above a summary entries in T accounts 2. Compute the direct materials used in production 3. Compute the prime cost 4. Compute the conversion cost. 5. Prepare the Schedule of Raw Materials Used 6. Prepare the Schedule of Cost of Goods Manufactured 7. Prepare the Schedule of Cost of Goods Sold 8. Calculate the manufacturing cost per unit 9. Prepare an income statement for 2018, in good form. 10.As part of the annual audit you notice that Indirect labor salaries included the $20,000 salary paid to Ken, who actually works in the advertising department of the company a) Does this seem reasonable? Why or why not? b) Does this make a difference in terms of the net operating income? Why or why not? What incentive would management have to include the advertising costs as "indirect labor"? (That is, what would their motivation be to do this?)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started