Answered step by step

Verified Expert Solution

Question

1 Approved Answer

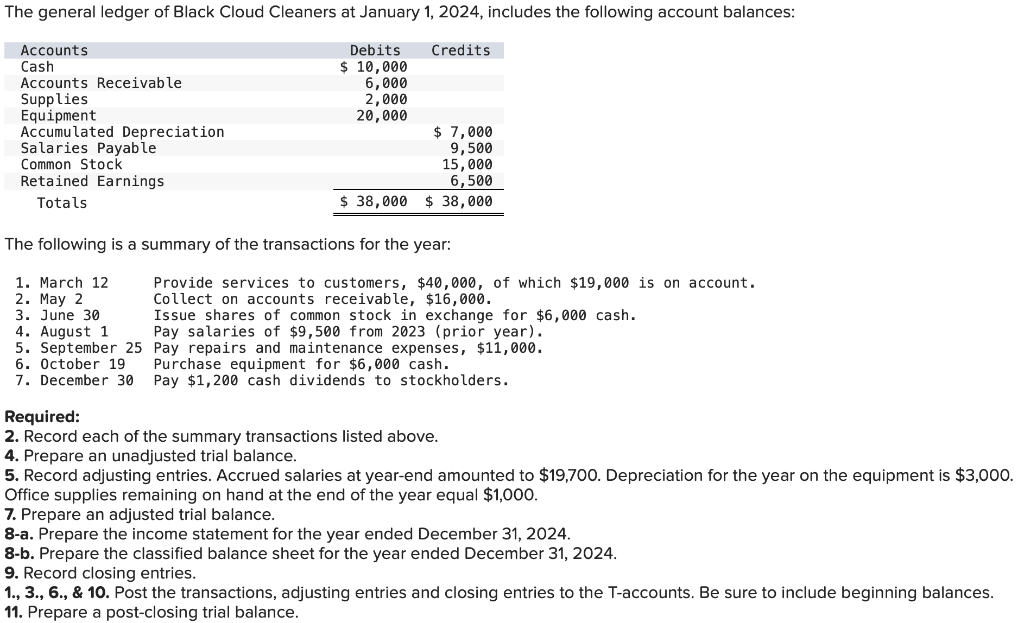

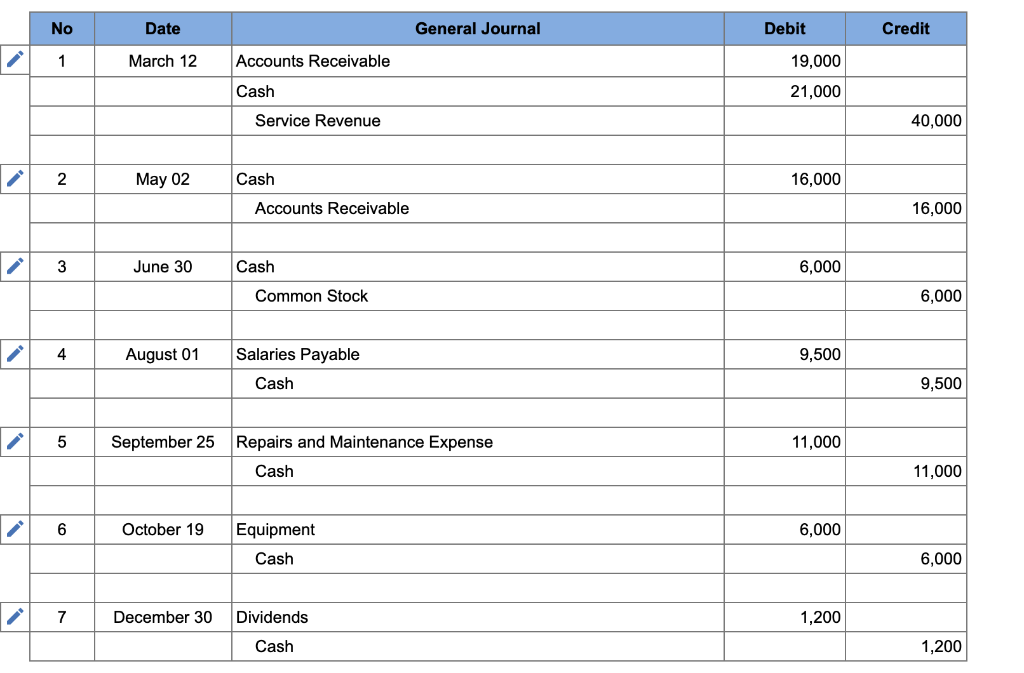

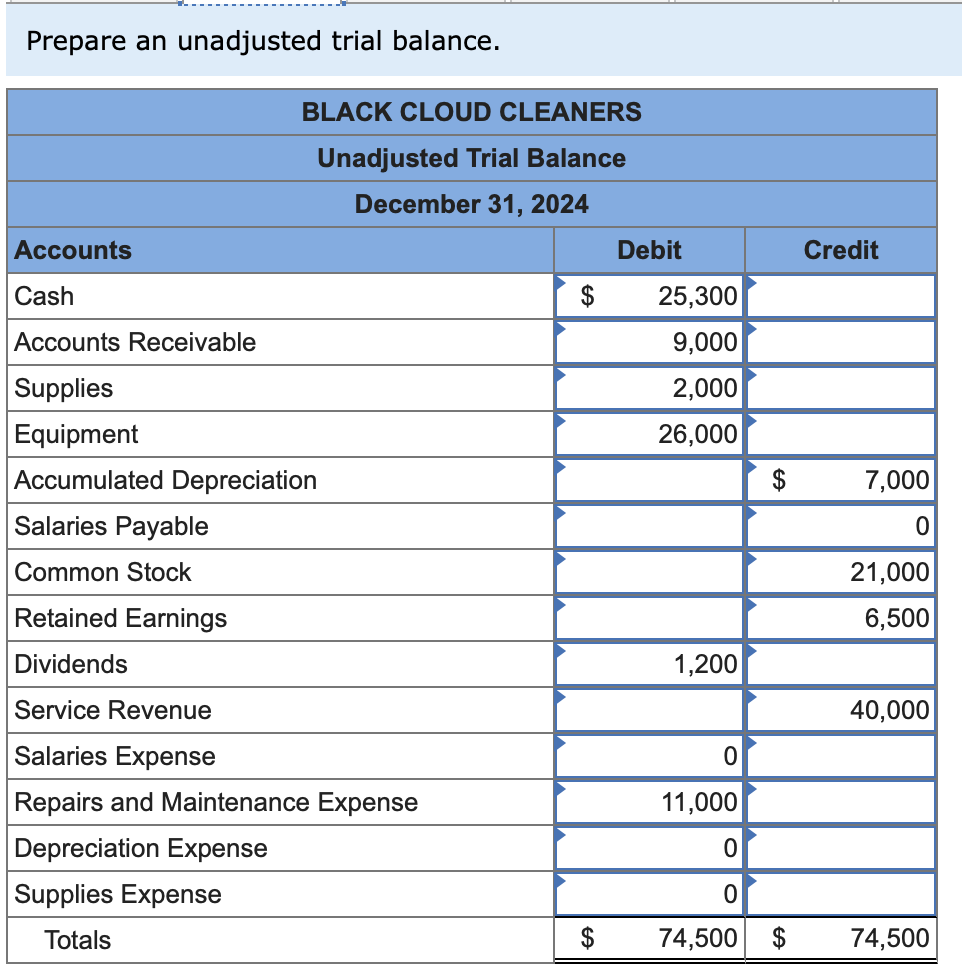

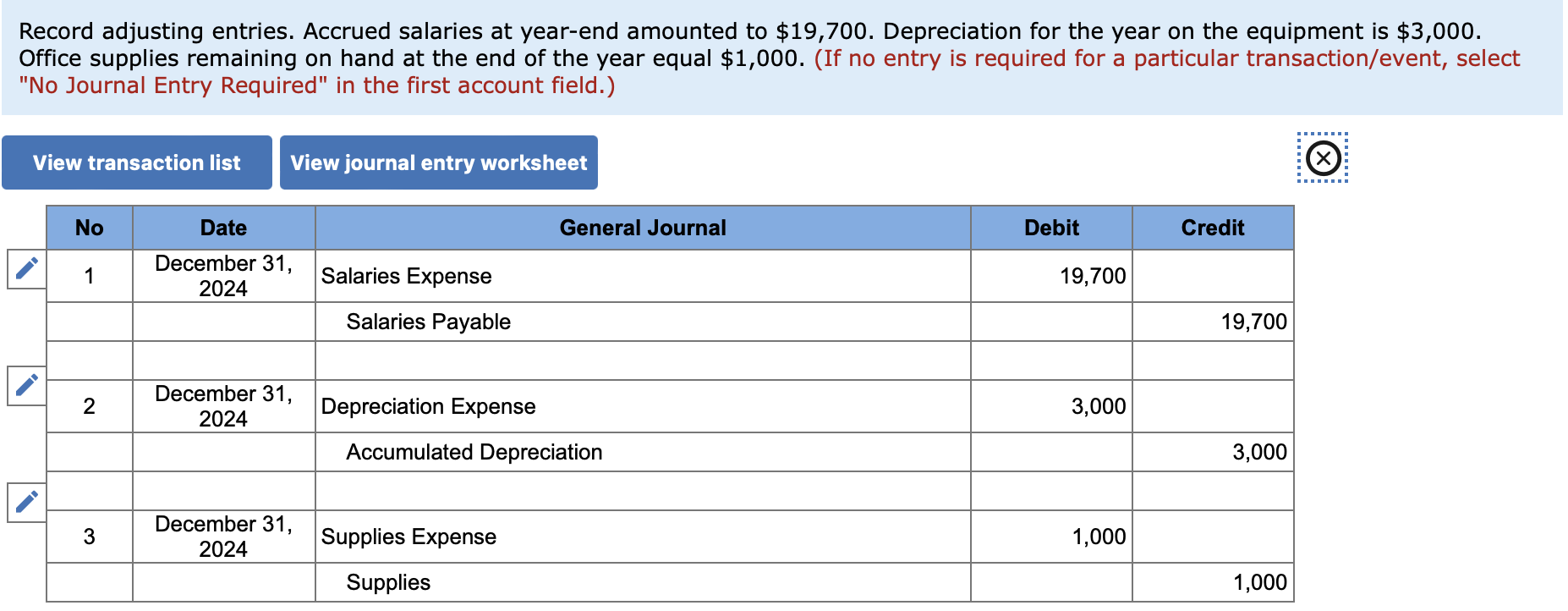

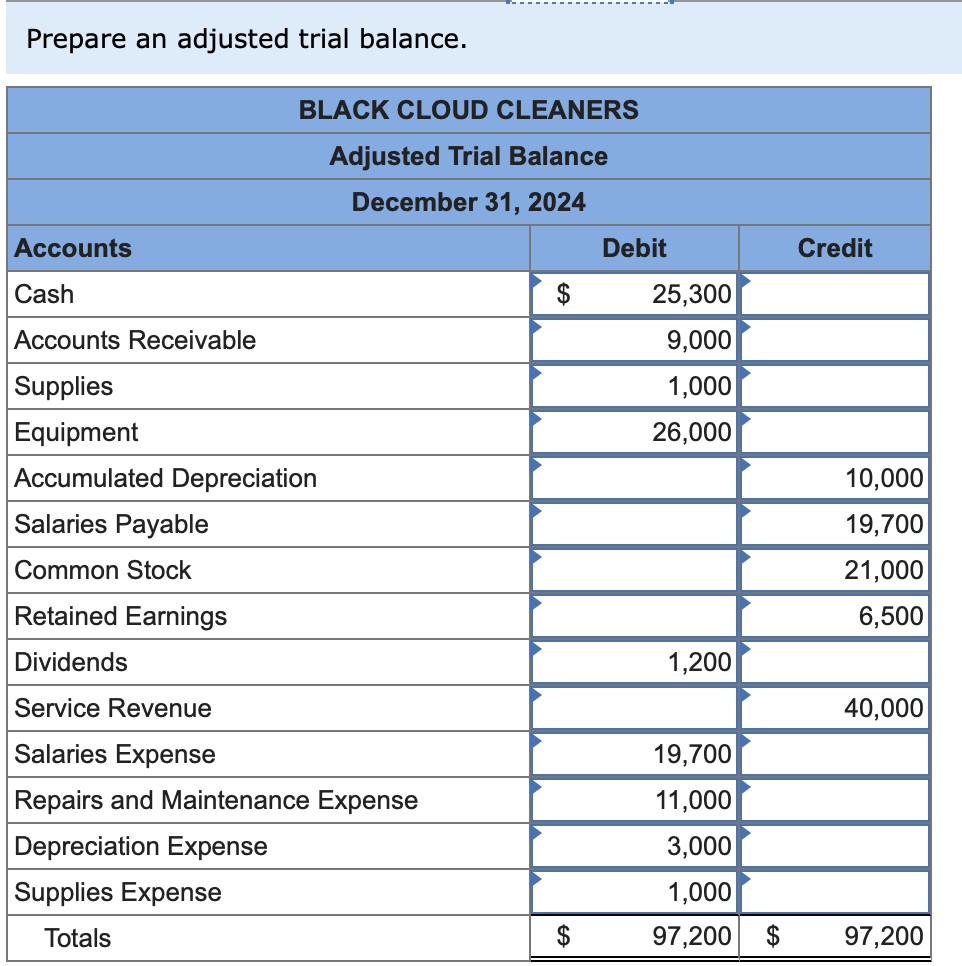

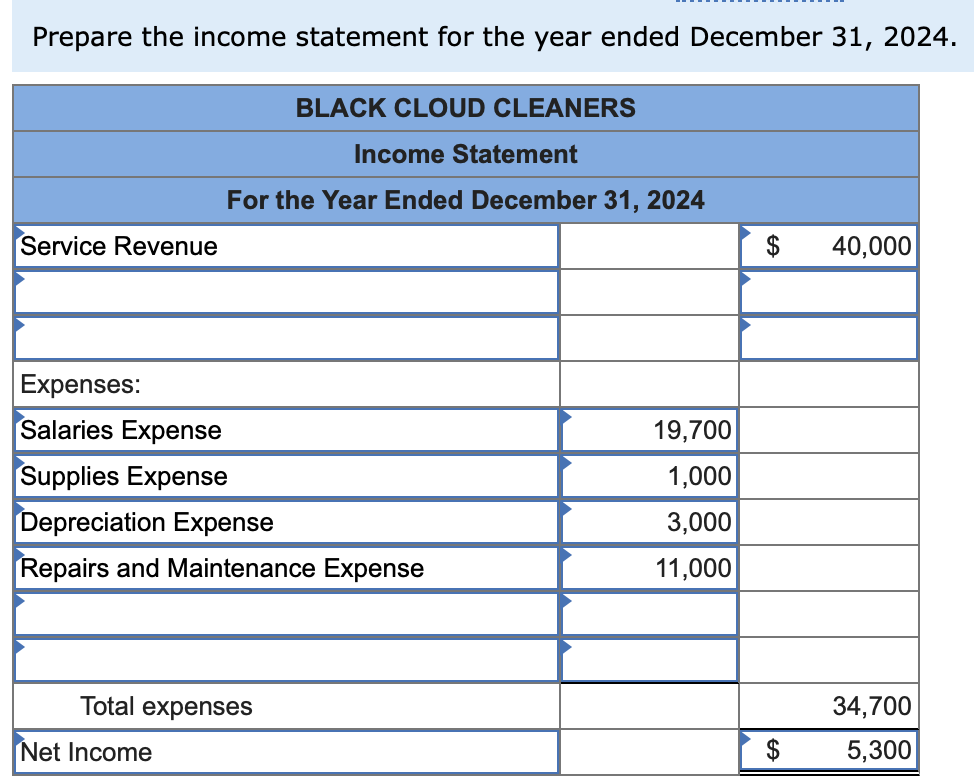

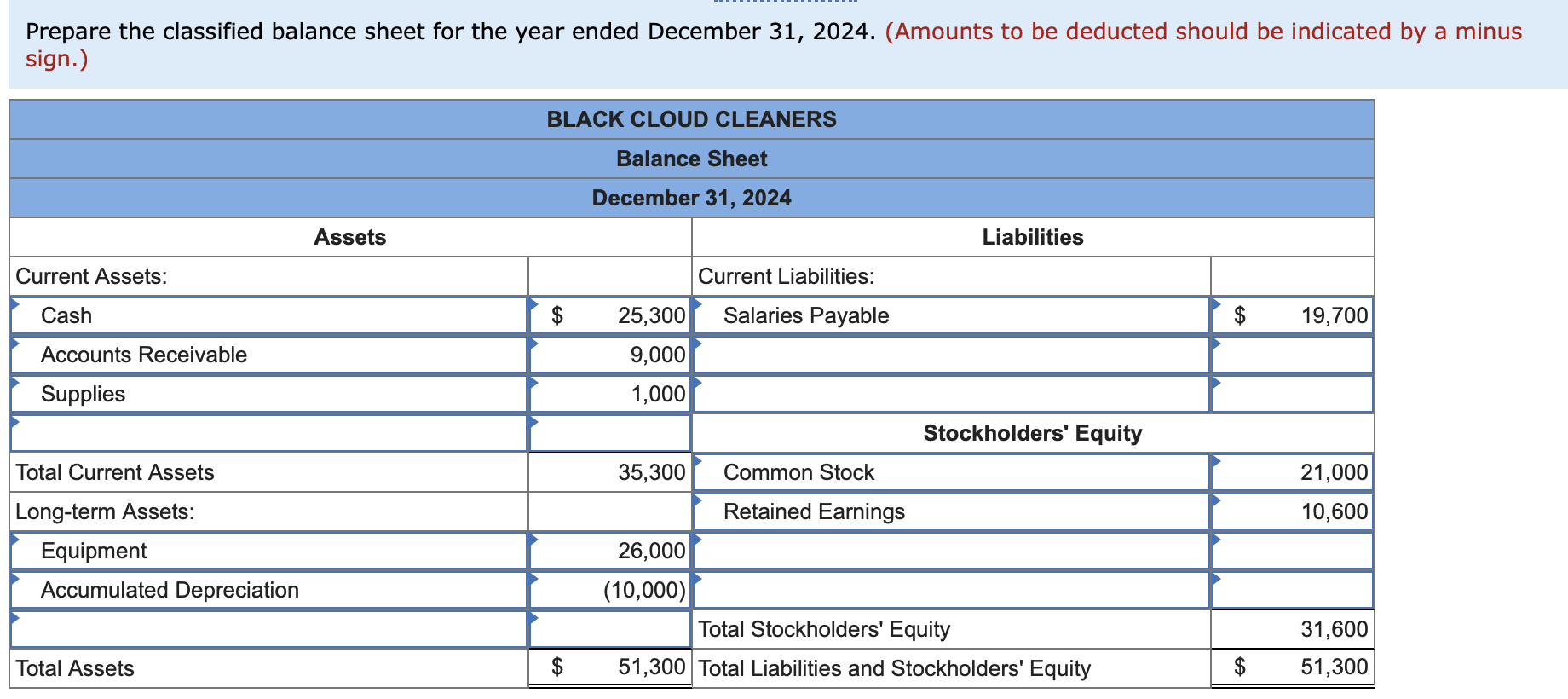

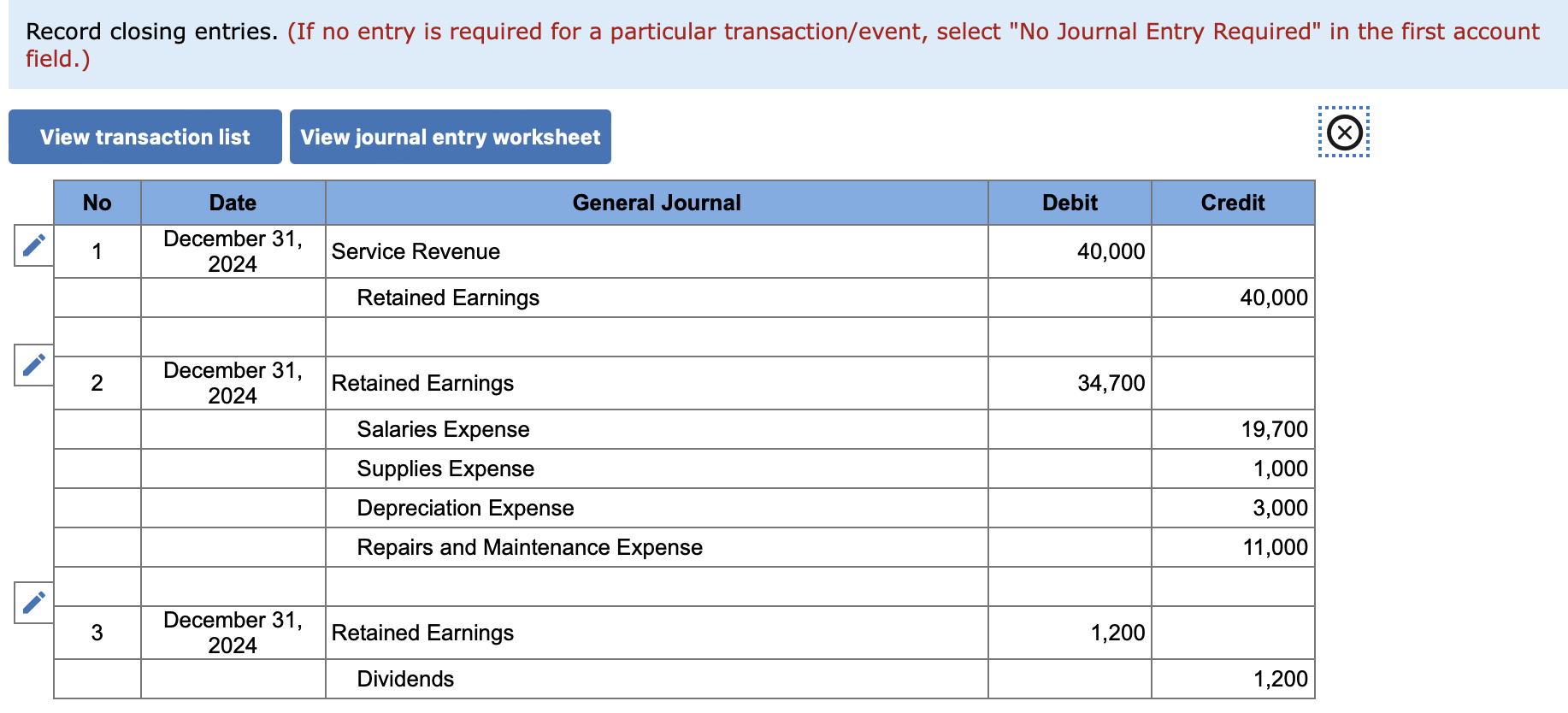

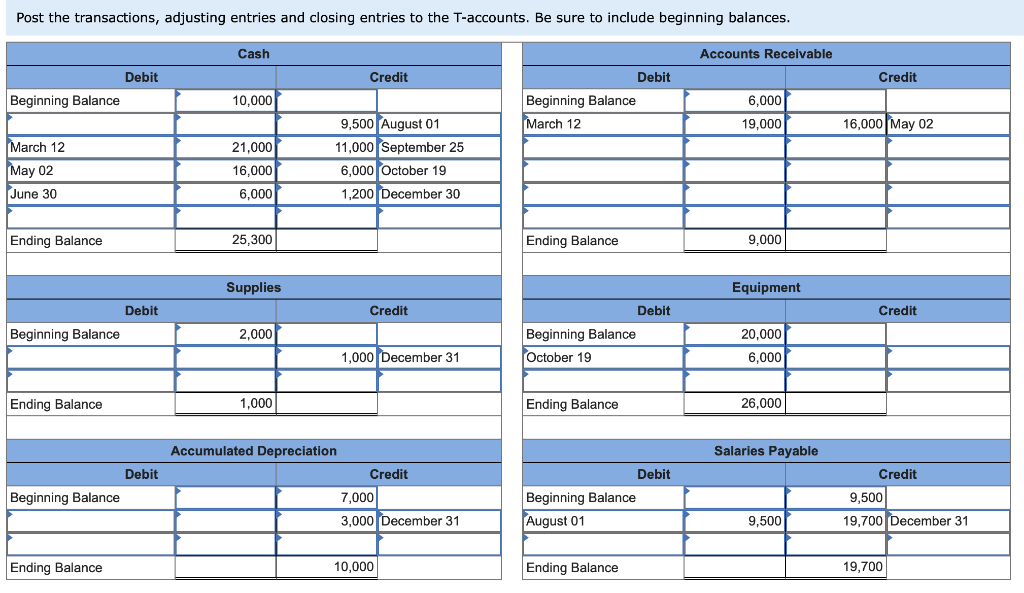

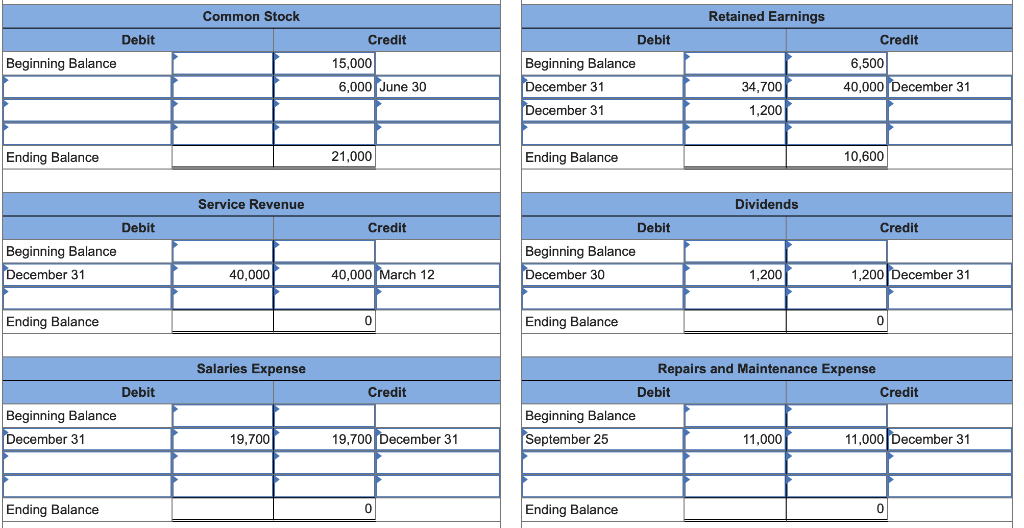

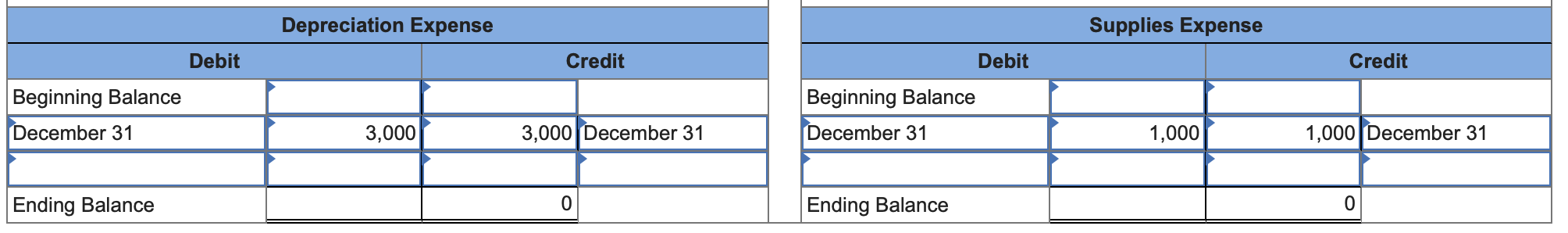

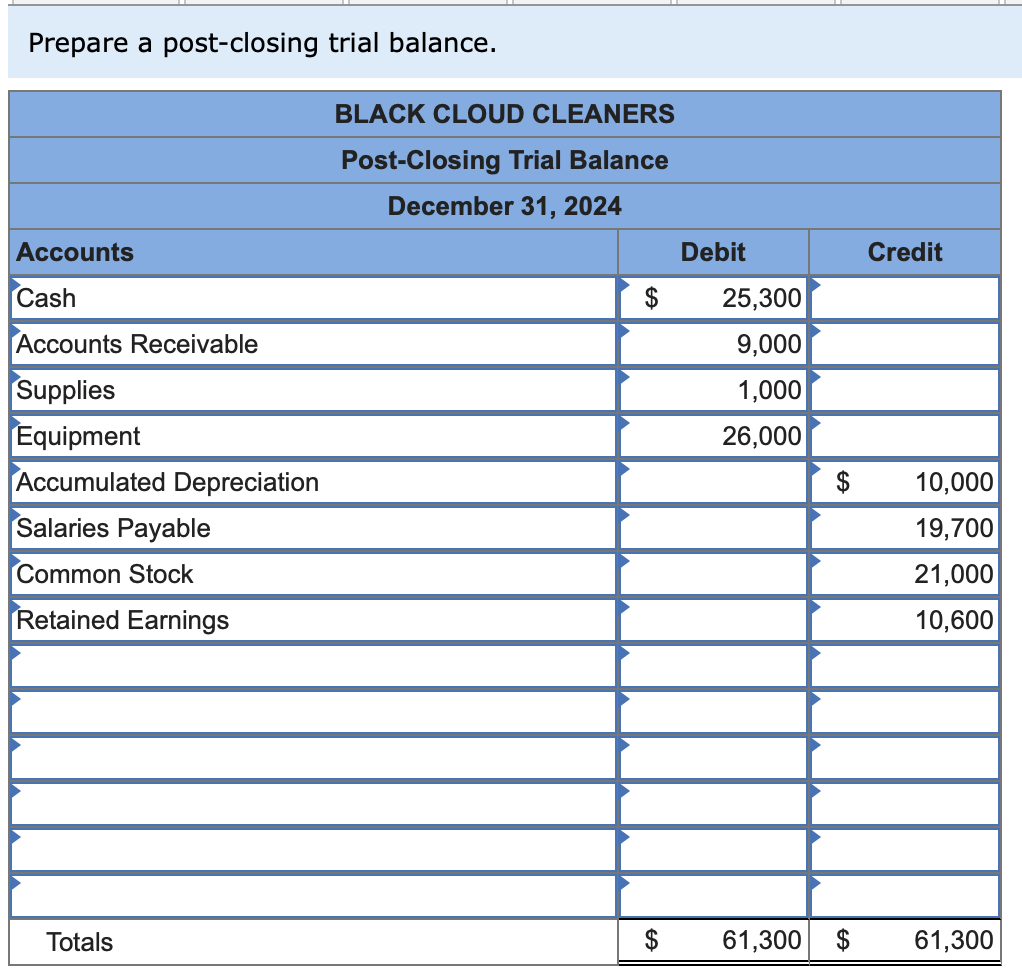

Please can you check ALL my work, if their is something wrong correct it please. Main Information (This below is the information that I used

Please can you check ALL my work, if their is something wrong correct it please.

Main Information (This below is the information that I used to answer this exercise)

Please check ALL my work below, if its all correct let me know, if their is something wrong please correct it please.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started