please can you? chrome://external-file/Final%20guidelines.pdf

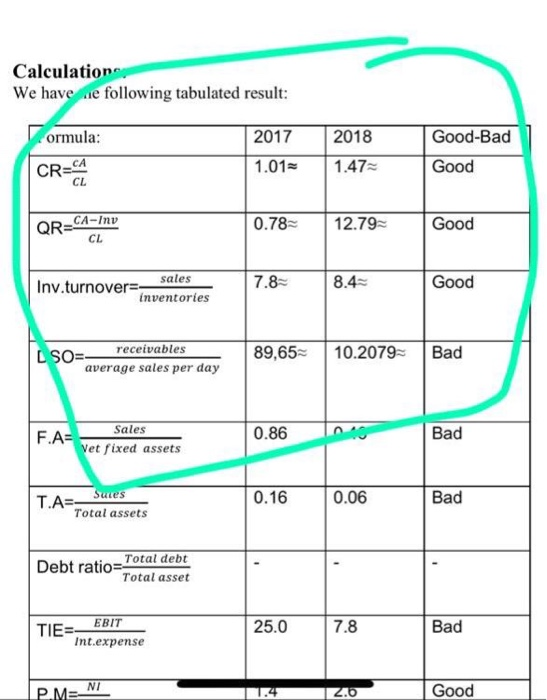

the dr already give me sabic company

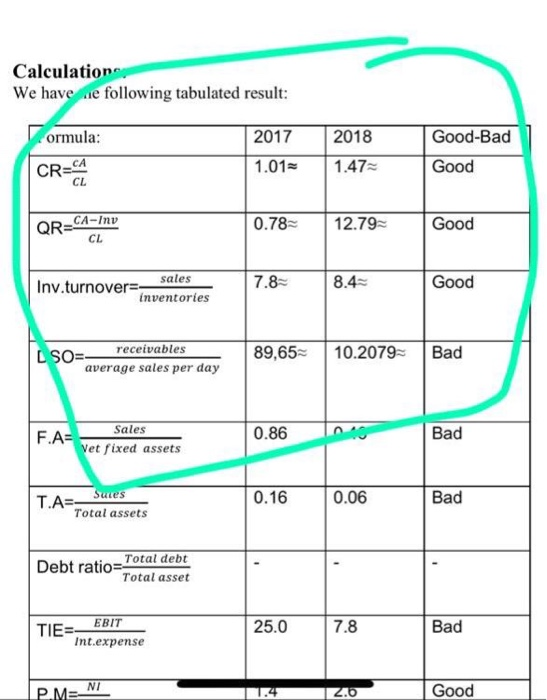

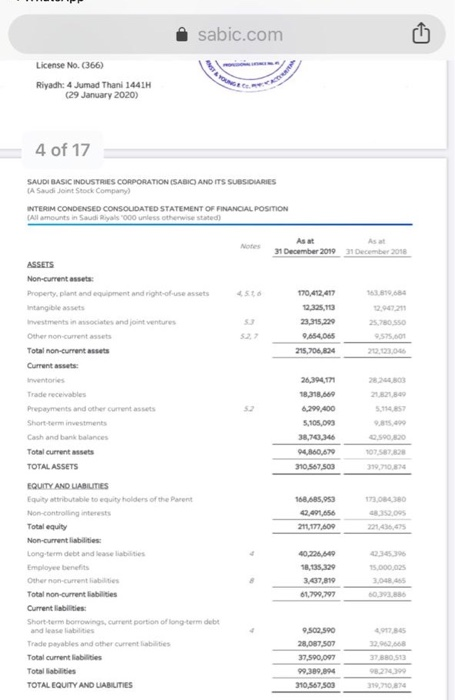

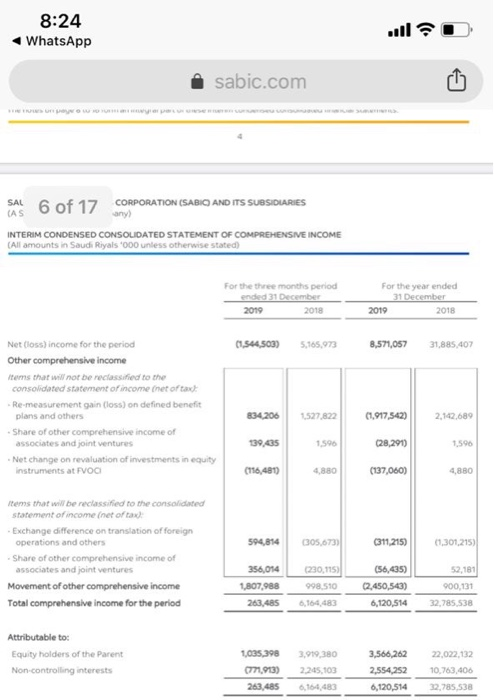

Calculations We have ne following tabulated result: ormula: CRECA 2017 1.01= 2018 1.47 Good-Bad Good QR-CA-IND 0.782 12.79 Good sales Inv.turnover 7.8 8.4 Good inventories receivables SO=- average sales per day 89.65 10.2079 | Bad F.A- Sales Vet fixed assets 0.86 m Bad Sutes 0.16 0.06 Bad T. Total assets Debt ratio Total debt Total asset EBIT 25.0 7.8 TIEN Int.expense Bad P. M NI 2.6 Good isabic.com License No. (366) Riyadh: 4 Jumad Thani 1441H (29 January 2020) 4 of 17 SAUDI BASIC INDUSTRIES CORPORATION (SABIC AND ITS SUBSIDIARIES Atom WTERIM CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION Amount 000 othed ber 2010 ASSETS Non-currents : Property, plant and e Intangible assets n tend to use assets St 170,412,417 23,315,229 9.654,066 215,706.024 25.780.550 9.575.son Othernon current assets Total non-current assets Current assets 2 006 tors Trade recables Pre n ts and other current assets 5114 26,394 1818. 6,299 400 5.105.00 103 AN Short term investments VO Cash and bank balances Total current TOTAL ASSETS 67.500 EQUITY AND ABILITIES Equity attributable to equity holders of the Parent 18 07656 200 Total Long-term dubitand Employee benefits 3.07.10 07 es Total non-currenti Currenties Short-term bow current portion of long-term dubt ies Tradeptes and other current Total current liabides Totalbes TOTAL EQUITY AND LIABILITIES 9.500.500 28.087.507 33 000 99300000 210557503 6 8:24 WhatsApp sabic.com Total TOTAL EQUITY AND LABUTIES 310567.503 SAUDI BASIC INDUSTRIES CORPORATION SABIO AND ITS SUBSIDIARIES A Saude Junt Stock Company INTERIM CONDENSED CONSOLIDATED STATEMENT OF INCOME Amount Su 0 00 less otherwise stated For the three months period For the year ended Revenue Cost of sale Gross profit 32.614. 5128,203,286 4.610,07 10.2014 10.10.203 08.073.220 (1042047120 2,196,093 35,535,581 0. 287016 11011 Selling and distribution expenses Loss) income from operations Q.705,772 0.562,940) 437,890 2.381.548) 2.766130) 540,115 10,546,967) 9.988,186) 15,000.00 Share o ut of downtures 2010 (563) 192.100 35.480) 25.11 Other expenses. Loss) income before it and income tax 107,901 Zaten A DD) 2.100.000 05.000 0227) SA SOT Net ) income for the period T O 0819.990 SOSTS Basic and duted earnings per shared 8:24 WhatsApp ... 10 isabic.com SAL 6 of 17 CORPORATION (SABIO AND ITS SUBSIDIARIES INTERIM CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (All amounts in Saudi Riyals '000 unless otherwise stated) For the year ended For the three months period ended 31 December 2019 2018 2019 2018 01.544.503) 5,165,973 8,571,057 31,885,407 Netloss) income for the period Other comprehensive Income Hams that will not be reclassified to the consolidated statement of income thet of taxt Re-measurement gain (loss) on defined benefit plans and others Share of other comprehensive income of associates and joint ventures Net change on evaluation of investments in equity Instruments at FVOO 834206 1.527822 (1.917,542) 2.10.09 139,435 1.596 28,299 1.596 (196,427 4,880 (137,000 480 594,814 305.673 311.215 01301215 Items that will be reclassified to the consolidated statement of income net ofta Exchange difference on translation of foreign operations and others Share of other comprehensive income of associates and joint ventures Movement of other comprehensive income Total comprehensive income for the period 356,054 1807988 263,485 1230,115 998510 4164483 (56,635) 0.450.543 6,120,514 52.181 00 32.785.538 Attributable to Equity holders of the Parent Non-controlling interests 1035.398 77.923) 263,485 3,919 380 2.245.103 0,164,480 3.566,262 2,554252 6,120,514 22.022,132 10,763,406 22,785,538 Calculations We have ne following tabulated result: ormula: CRECA 2017 1.01= 2018 1.47 Good-Bad Good QR-CA-IND 0.782 12.79 Good sales Inv.turnover 7.8 8.4 Good inventories receivables SO=- average sales per day 89.65 10.2079 | Bad F.A- Sales Vet fixed assets 0.86 m Bad Sutes 0.16 0.06 Bad T. Total assets Debt ratio Total debt Total asset EBIT 25.0 7.8 TIEN Int.expense Bad P. M NI 2.6 Good isabic.com License No. (366) Riyadh: 4 Jumad Thani 1441H (29 January 2020) 4 of 17 SAUDI BASIC INDUSTRIES CORPORATION (SABIC AND ITS SUBSIDIARIES Atom WTERIM CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION Amount 000 othed ber 2010 ASSETS Non-currents : Property, plant and e Intangible assets n tend to use assets St 170,412,417 23,315,229 9.654,066 215,706.024 25.780.550 9.575.son Othernon current assets Total non-current assets Current assets 2 006 tors Trade recables Pre n ts and other current assets 5114 26,394 1818. 6,299 400 5.105.00 103 AN Short term investments VO Cash and bank balances Total current TOTAL ASSETS 67.500 EQUITY AND ABILITIES Equity attributable to equity holders of the Parent 18 07656 200 Total Long-term dubitand Employee benefits 3.07.10 07 es Total non-currenti Currenties Short-term bow current portion of long-term dubt ies Tradeptes and other current Total current liabides Totalbes TOTAL EQUITY AND LIABILITIES 9.500.500 28.087.507 33 000 99300000 210557503 6 8:24 WhatsApp sabic.com Total TOTAL EQUITY AND LABUTIES 310567.503 SAUDI BASIC INDUSTRIES CORPORATION SABIO AND ITS SUBSIDIARIES A Saude Junt Stock Company INTERIM CONDENSED CONSOLIDATED STATEMENT OF INCOME Amount Su 0 00 less otherwise stated For the three months period For the year ended Revenue Cost of sale Gross profit 32.614. 5128,203,286 4.610,07 10.2014 10.10.203 08.073.220 (1042047120 2,196,093 35,535,581 0. 287016 11011 Selling and distribution expenses Loss) income from operations Q.705,772 0.562,940) 437,890 2.381.548) 2.766130) 540,115 10,546,967) 9.988,186) 15,000.00 Share o ut of downtures 2010 (563) 192.100 35.480) 25.11 Other expenses. Loss) income before it and income tax 107,901 Zaten A DD) 2.100.000 05.000 0227) SA SOT Net ) income for the period T O 0819.990 SOSTS Basic and duted earnings per shared 8:24 WhatsApp ... 10 isabic.com SAL 6 of 17 CORPORATION (SABIO AND ITS SUBSIDIARIES INTERIM CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (All amounts in Saudi Riyals '000 unless otherwise stated) For the year ended For the three months period ended 31 December 2019 2018 2019 2018 01.544.503) 5,165,973 8,571,057 31,885,407 Netloss) income for the period Other comprehensive Income Hams that will not be reclassified to the consolidated statement of income thet of taxt Re-measurement gain (loss) on defined benefit plans and others Share of other comprehensive income of associates and joint ventures Net change on evaluation of investments in equity Instruments at FVOO 834206 1.527822 (1.917,542) 2.10.09 139,435 1.596 28,299 1.596 (196,427 4,880 (137,000 480 594,814 305.673 311.215 01301215 Items that will be reclassified to the consolidated statement of income net ofta Exchange difference on translation of foreign operations and others Share of other comprehensive income of associates and joint ventures Movement of other comprehensive income Total comprehensive income for the period 356,054 1807988 263,485 1230,115 998510 4164483 (56,635) 0.450.543 6,120,514 52.181 00 32.785.538 Attributable to Equity holders of the Parent Non-controlling interests 1035.398 77.923) 263,485 3,919 380 2.245.103 0,164,480 3.566,262 2,554252 6,120,514 22.022,132 10,763,406 22,785,538