Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please, can you fix it Pearl paid $45,600 to replace part of the factory floor. The floor had been capitalized as part of the factory

please, can you fix it

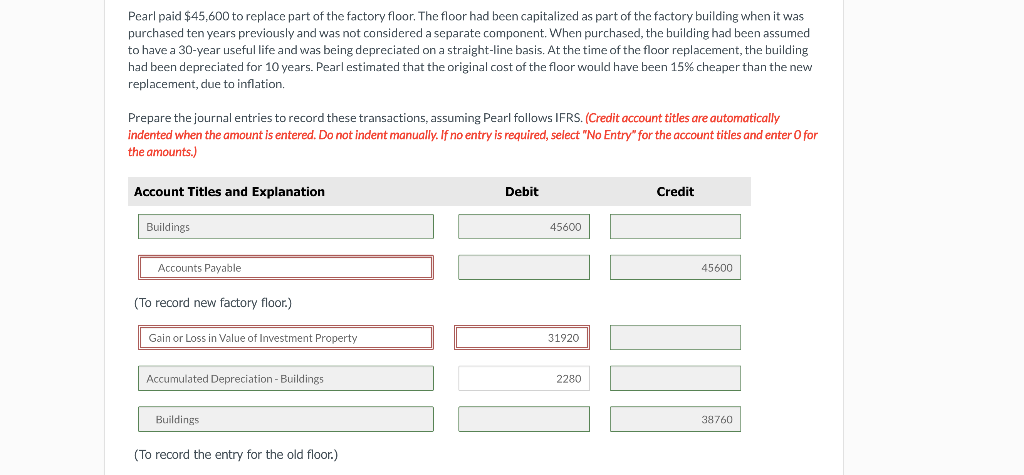

Pearl paid $45,600 to replace part of the factory floor. The floor had been capitalized as part of the factory building when it was purchased ten years previously and was not considered a separate component. When purchased the building had been assumed to have a 30-year useful life and was being depreciated on a straight-line basis. At the time of the floor replacement, the building had been depreciated for 10 years. Pearl estimated that the original cost of the floor would have been 15% cheaper than the new replacement, due to inflation. Prepare the journal entries to record these transactions, assuming Pearl follows IFRS. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry"for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit Buildings 45600 Accounts Payable 45600 (To record new factory floor.) Gain or Loss in Value of Investment Property 31920 Accumulated Depreciation - Buildings 2280 Buildings 38760 (To record the entry for the old floor.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started