Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please can you help me these questions?I need your help Question 8 (1 point) Sovet Assume you sell short 100 stares of common stock at

please can you help me these questions?I need your help

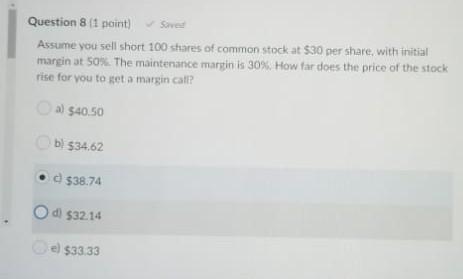

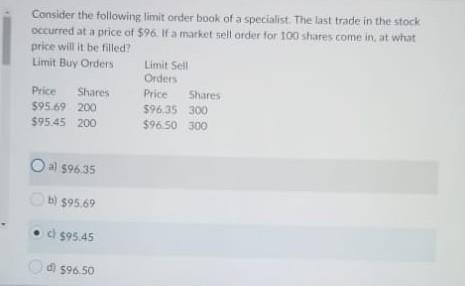

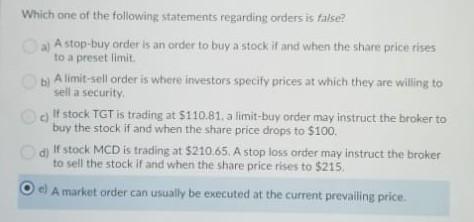

Question 8 (1 point) Sovet Assume you sell short 100 stares of common stock at $30 per share, with initial margin at 50%. The maintenance margin is 30%. How far does the price of the stock rise for you to set a margin cat? al $40.50 b! $34.62 } d $38.74 O di $32.14 e) $33.33 Consider the following limit order book of a specialist. The last trade in the stock occurred at a price of $96. If a market sell order for 100 shares come in at what price will it be filled? Limit Buy Orders Limit Sell Orders Price Shares Price Shares 595 69 200 596,35 300 $95.45 200 $96.50 300 al 596,35 1 $95.69 1.595.45 di 596,50 bl Which one of the following statements regarding orders is false? a) A stop-buy order is an order to buy a stock it and when the share price rises to a preset limit A limit-sell order is where investors specify prices at which they are willing to sell a security It stock TGT is trading at $110.81. a limit-buy order may instruct the broker to buy the stock it and when the share price drops to $100. If stock MCD is trading at $210,65. A stop loss order may instruct the broker to sell the stock it and when the share price rises to $215 el A market order can usually be executed at the current prevailing priceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started