Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please can you help with the solution to these questions Assignment Read the case notes below and consider the information shown in the appendix Determine

Please can you help with the solution to these questions

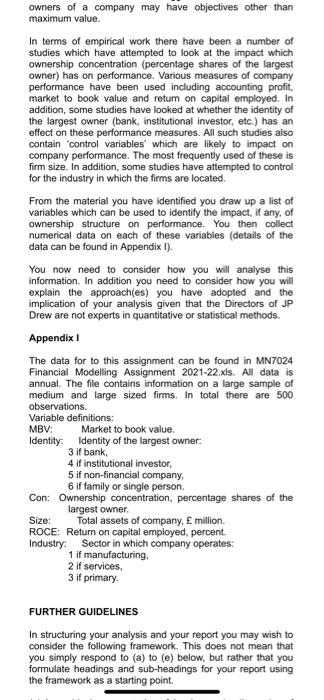

Assignment Read the case notes below and consider the information shown in the appendix Determine how this information can be used to shed light on the impact of ownership structure on company performance. Then write a report for the Directors of JP Drew which addresses this issue. Ownership Structure and Company Performance You have recently been appointed as an analyst within PMC Inc. PMC is a UK consultancy company that undertakes independent research for client organisations. Your first client is a large investment management firm (JP Drew) which provides advice and administrative services to both individuals and companies in relation to portfolio Selection and specific asset purchase (stocks, bonds, etc.). JP are interested in determining the impact which ownership structure has on company performance. In particular, the extent to which the separation of ownership and control provides opportunity for managers to undertake activities which negatively impact on performance and whether large shareholders can put pressure on managers to increase this performance You have been asked to undertake some quantitative analysis looking at this issue. While you are familiar with various different aspects of statistics and a number of statistical packages you have not undertaken a project of this nature before. Hence you start by conducting a literature search This search proves beneficial and you find that there are a number of existing studies which look at ownership structure and performance, although none specifically in a UK context. In terms of theoretical work one of the overarching themes is that of the principal/agent problem. This suggests that the owners of a firm will want to pursue profit or value maximisation, but that on many occasions share ownership is so dispersed that the ability of shareholders to push managers in this direction is extremely limited. In contrast managers will have other objectives such as empire building or a quest for higher salaries, with pursuit of these alternative objectives being possible at the expense of profit) because control cannot be exerted by shareholders. This implies that in situations where share ownership is not dispersed and instead resides to a large extent in the hands of a single organisation or individual then it should be possible to force managers to pursue value maximisation However, there is also the suggestion that some of the owners of a company may have objectives other than maximum value. owners of a company may have objectives other than maximum value. In terms of empirical work there have been a number of studies which have attempted to look at the impact which ownership concentration (percentage shares of the largest owner) has on performance. Various measures of company performance have been used including accounting profit. market to book value and return on capital employed. In addition, some studies have looked at whether the identity of the largest owner (bank, institutional investor, etc.) has an effect on these performance measures. All such studies also contain control variables which are likely to impact on company performance. The most frequently used of these is firm size. In addition, some studies have attempted to control for the industry in which the firms are located. From the material you have identified you draw up a list of variables which can be used to identify the impact, if any, of ownership structure on performance. You then collect numerical data on each of these variables (details of the data can be found in Appendix I). You now need to consider how you will analyse this information. In addition you need to consider how you will explain the approach(es) you have adopted and the implication of your analysis given that the Directors of JP Drew are not experts in quantitative or statistical methods. Appendix The data for to this assignment can be found in MN7024 Financial Modeling Assignment 2021-22.xls. All data is annual. The file contains information on a large sample of medium and large sized firms. In total there are 500 observations. Variable definitions: MBV: Market to book value. Identity: Identity of the largest owner: 3 if bank 4 if institutional investor, 5 if non-financial company, 6 if family or single person. Con: Ownership concentration, percentage shares of the largest owner Size: Total assets of company, million. ROCE: Return on capital employed, percent Industry: Sector in which company operates 1 if manufacturing 2 if services, 3 if primary FURTHER GUIDELINES In structuring your analysis and your report you may wish to consider the following framework. This does not mean that you simply respond to (a) to (e) below, but rather that you formulate headings and sub-headings for your report using the framework as a starting point

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started