Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please can you prepare Form 941, employer's Quarterly federal tax return and schedule B Form 941, employer's annual federal unemployment Tax return Form W2 Lauprechta

please can you prepare Form 941, employer's Quarterly federal tax return and schedule B

Form 941, employer's annual federal unemployment Tax return

Form W2

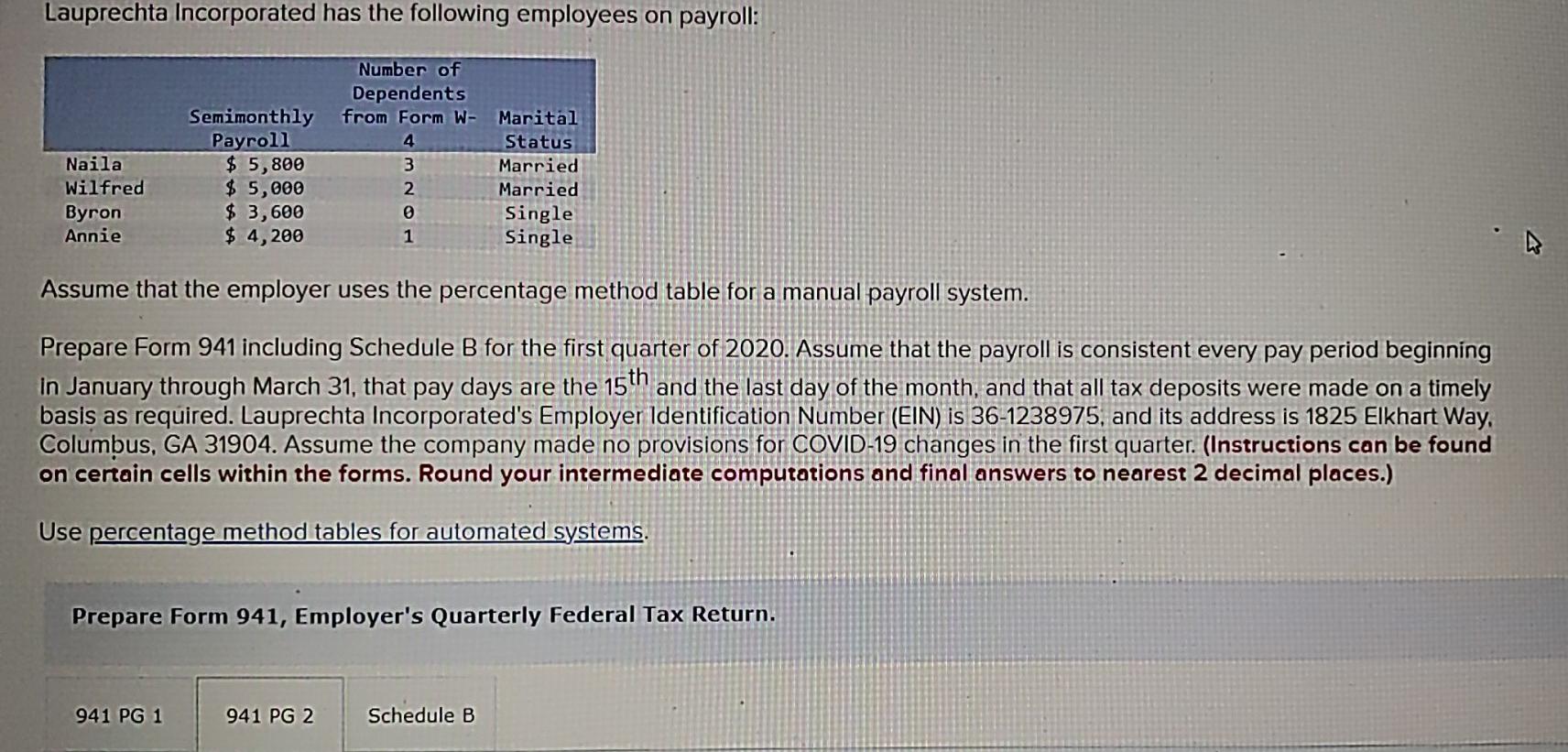

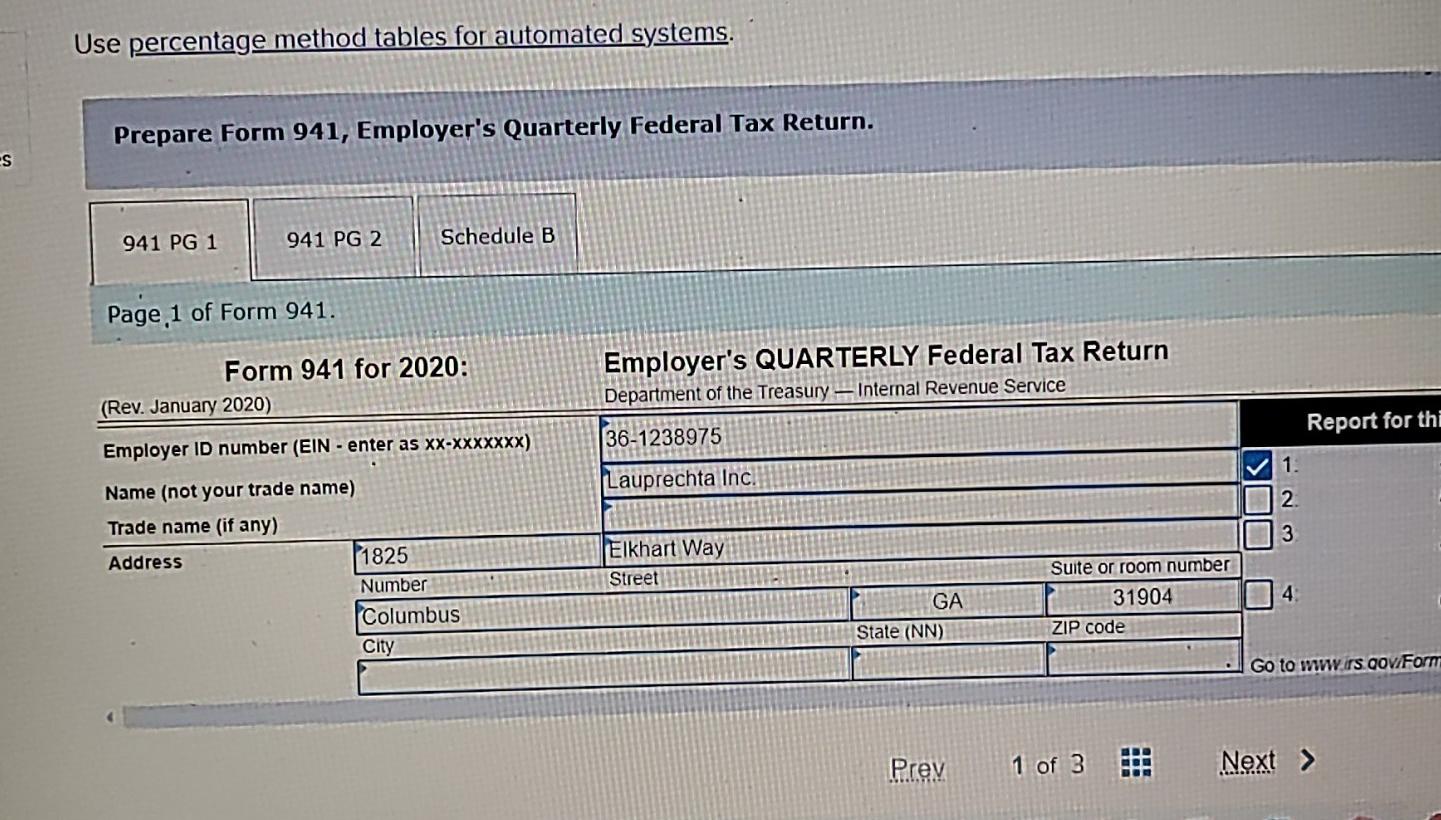

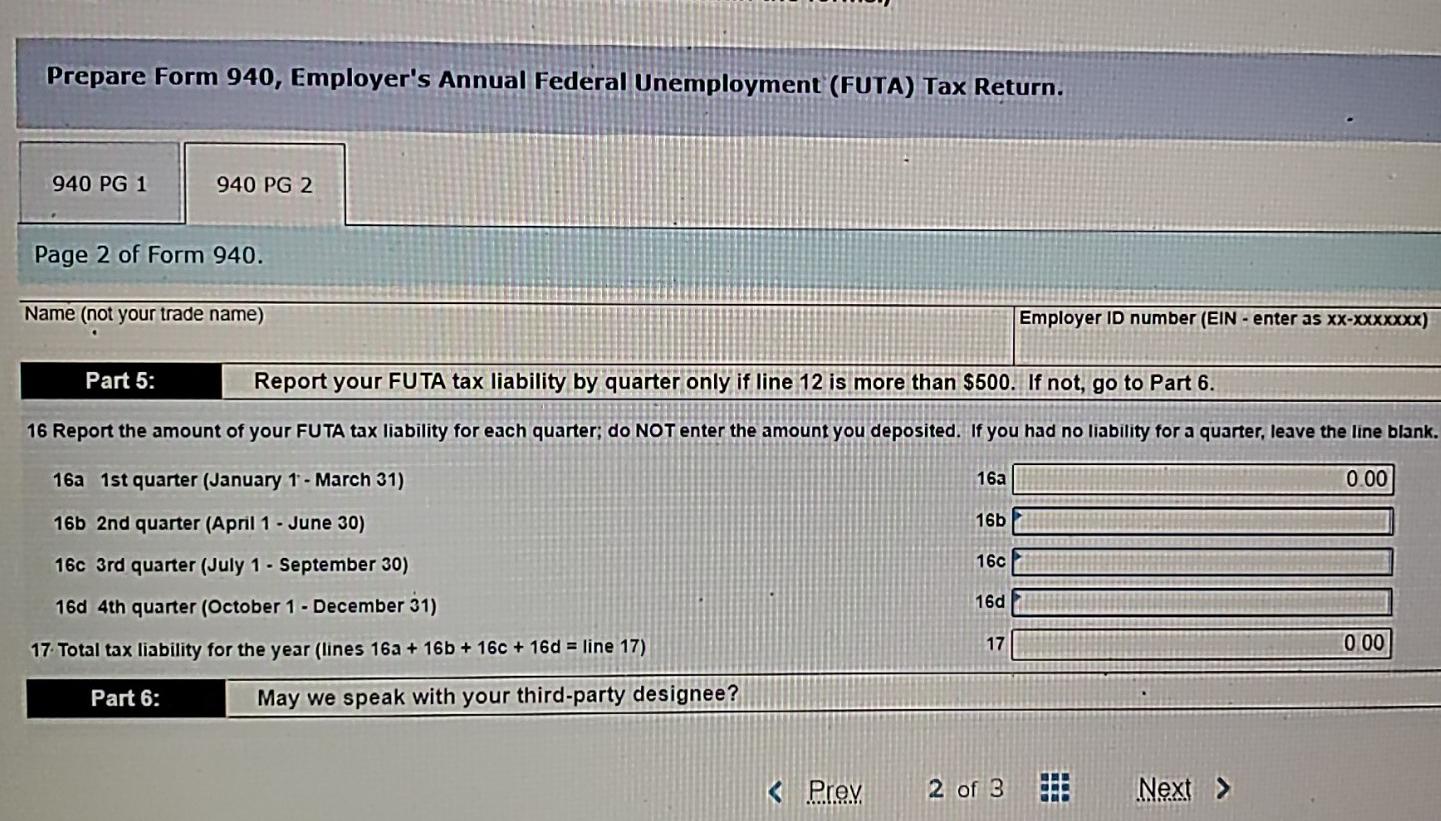

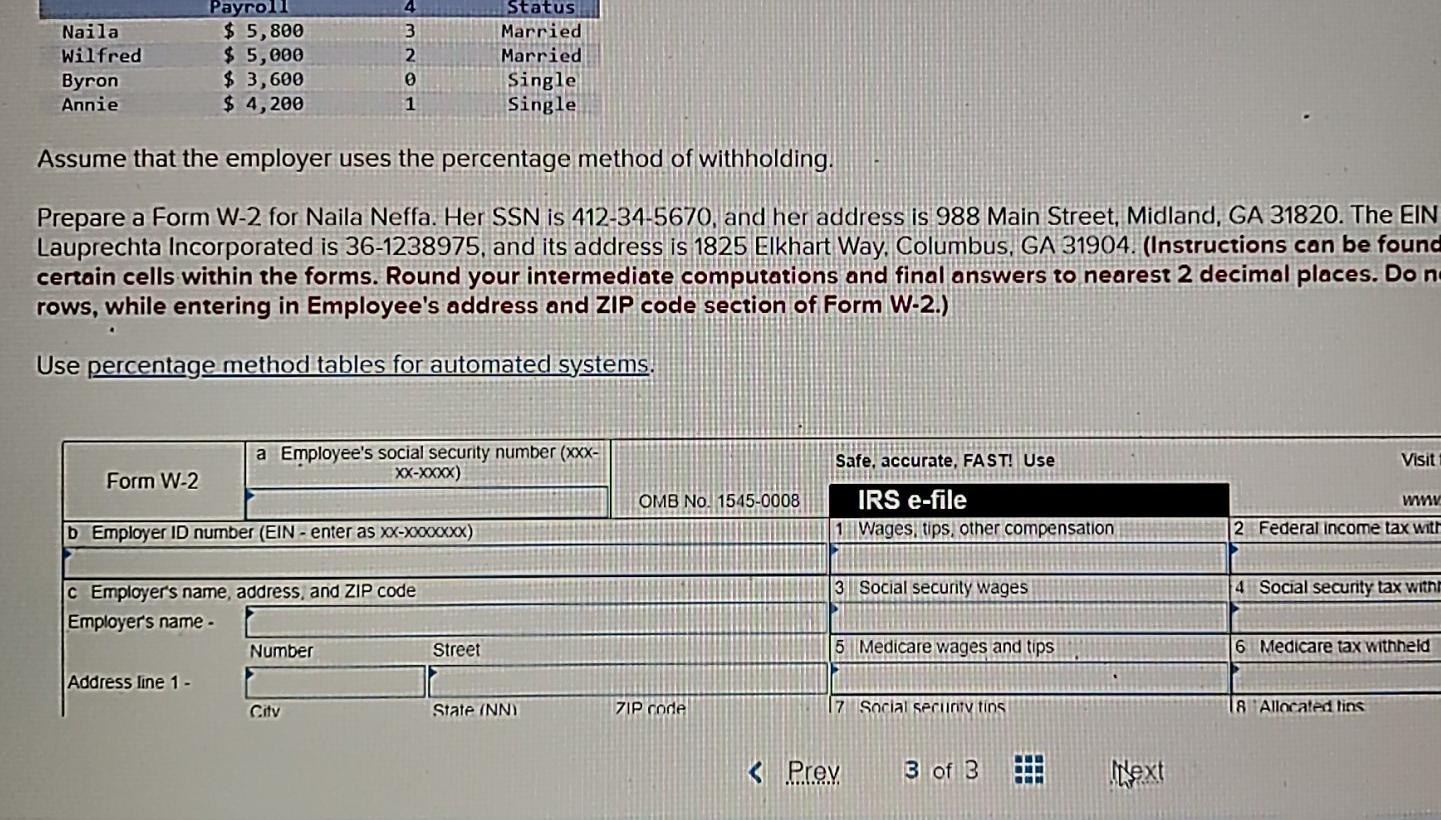

Lauprechta Incorporated has the following employees on payroll: Naila Wilfred Byron Annie Semimonthly Payroll $ 5,800 $ 5,000 $ 3,600 $ 4,200 Number of Dependents from Form W- Marital 4 Status 3 Married 2 Married 0 Single 1 Single Assume that the employer uses the percentage method table for a manual payroll system. Prepare Form 941 including Schedule B for the first quarter of 2020. Assume that the payroll is consistent every pay period beginning In January through March 31, that pay days are the 15th and the last day of the month, and that all tax deposits were made on a timely basis as required. Lauprechta Incorporated's Employer Identification Number (EIN) is 36-1238975, and its address is 1825 Elkhart Way, Columbus, GA 31904. Assume the company made no provisions for COVID-19 changes in the first quarter. (Instructions can be found on certain cells within the forms. Round your intermediate computations and final answers to nearest 2 decimal places.) Use percentage method tables for automated systems. Prepare Form 941, Employer's Quarterly Federal Tax Return. 941 PG 1 941 PG 2 Schedule B Use percentage method tables for automated systems. Prepare Form 941, Employer's Quarterly Federal Tax Return. -S 941 PG 1 941 PG 2 Schedule B Page 1 of Form 941. Form 941 for 2020: (Rev. January 2020) Employer's QUARTERLY Federal Tax Return Department of the Treasury - Internal Revenue Service Report for thi 36-1238975 Employer ID number (EIN - enter as XX-XXXXXXX) 1. Lauprechta Inc. 2. Name (not your trade name) Trade name (if any) Address 1825 Number Columbus City Elkhart Way Street Suite or room number 31904 ZIP code GA State (NN) 4 Go to www.rs.gov/Form Prev 1 of 3 Next > Prepare Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return. 940 PG 1 940 PG 2 Page 2 of Form 940. Name (not your trade name) Employer ID number (EIN - enter as XX-XXXXXXX) Part 5: Report your FUTA tax liability by quarter only if line 12 is more than $500. If not, go to Part 6. 16 Report the amount of your FUTA tax liability for each quarter; do NOT enter the amount you deposited. If you had no liability for a quarter, leave the line blank. 16a 1st quarter (January 1 - March 31) 16a 0.00 16b 2nd quarter (April 1 - June 30) 16b 16c 3rd quarter (July 1 - September 30) 160 160 16d 4th quarter (October 1 - December 31) 17 0.00 17 Total tax liability for the year (lines 16a + 16b + 16c + 160 = line 17) Part 6: May we speak with your third-party designee? UNO Naila Wilfred Byron Annie Payroll $ 5,800 $ 5,000 $ 3,600 $ 4,200 4 3 2 0 1 Status Married Married Single Single Assume that the employer uses the percentage method of withholding. Prepare a Form W-2 for Naila Neffa. Her SSN is 412-34-5670, and her address is 988 Main Street, Midland, GA 31820. The EIN Lauprechta Incorporated is 36-1238975, and its address is 1825 Elkhart Way, Columbus, GA 31904. (Instructions can be found certain cells within the forms. Round your intermediate computations and final answers to nearest 2 decimal places. Don rows, while entering in Employee's address and ZIP code section of Form W-2.) Use percentage method tables for automated systems. a Employee's social security number (XXX- XX-XXXX) Safe, accurate, FAST! Use Visit Form W-2 OMB No. 1545-0008 WW IRS e-file 11 Wages, tips, other compensation D Employer ID number (EIN - enter as XX- XXXXX) 2 Federal income tax with 3 Social security wages 4 Social security tax with C Employer's name, address, and ZIP code Employer's name. Number Street 5 Medicare wages and tips 6 Medicare tax withheld Address line 1 City State (NN) ZIP code 17 Social Securty tins 18 Allocated lins

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started