Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please check 8-11 Kylo Company generated $100,000 in credit sales during 20 times 9. In February 2 times 10, Kylo realized that $13, 500 of

Please check 8-11

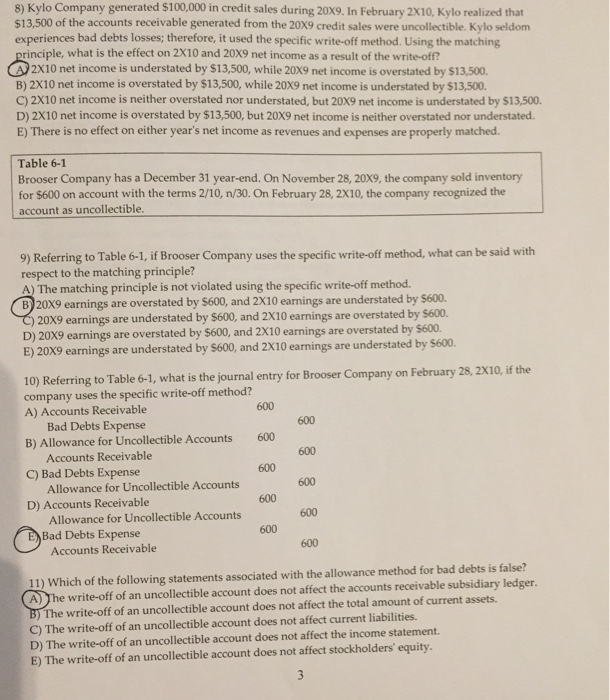

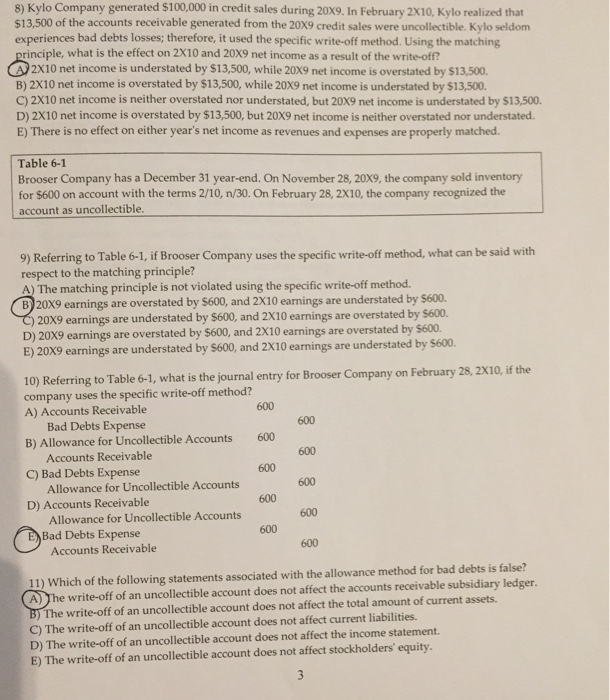

Kylo Company generated $100,000 in credit sales during 20 times 9. In February 2 times 10, Kylo realized that $13, 500 of the accounts receivable generated from the 20 times 9 credit sales were uncollectible. Kylo seldom experiences bad debts losses; therefore, it used the specific write-off method. Using the matching principle, what is the effect on 2 times 10 and 20 times 9 net income as a result of the wire-off? A) 2 times 10 net income is understated by $13, 500, while 20 times 9 net income is overstated by $13, 500. B) 2 times 10 net income is overstated by $13, 500, while 20 times 9 net income is understated by $13, 500 C) 2 times 10 net income is neither overstated nor understated, but 20 times 9 net income is understated by $13, 500. D) 2 times 10 net income is overstated by $13, 500, but 20 times 9 net income is neither overstated nor understated. E) There is no effect on either year's net income as revenues and expenses are properly matched. Brooser Company has a December 31 year-end. On November 28, 20 times 9, the company sold inventory for 5600 on account with the terms 2/10, n/30. On February 28, 2 times 10, the company recognized the account as uncollectible. Referring to Table 6-1, if Brooser Company uses the specific write-off method, what can be said with respect to the matching principle? A) The matching principle is not violated using the specific write-off method. B) 20 times 9 earnings are overstated by $600, and 2 times 10 earnings are understated by $600. C) 20 times 9 earnings are understated by $600, and 2 times 10 earnings are overstated by $600. D) 20 times 9 earnings are overstated by $600, and 2 times 10 earnings are overstated by $600. E) 20 times 9 earnings are understated by $600, and 2 times 10 earnings are understated by $600. Referring to Table 6-1, what is the journal entry for Brooser Company on February 28, 2 times 10, if the company uses the specific write-off method? A) Accounts Receivable 600 Bad Debts Expense 600 B) Allowance for Uncollectible Accounts 600 Accounts Receivable 600 C) Bad Debts Expense 600 Allowance for Uncollectible Accounts 600 D) Accounts Receivable 600 Allowance for Uncollectible Accounts 600 Bad Debts Expense 600 Accounts Receivable 600 Which of the following statements associated with the allowance method for bad debts is false? A) The write-off of an uncollectible account does not affect the accounts receivable subsidiary ledger. B) The write-off of an uncollectible account does not affect the total amount of current assets. C) The write-off of an uncollectible account does not affect current liabilities. D) The write-off of an uncollectible account does not affect the income statement. E) The write-off of an uncollectible account does not affect stockholders equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started