Please check for me thank you!

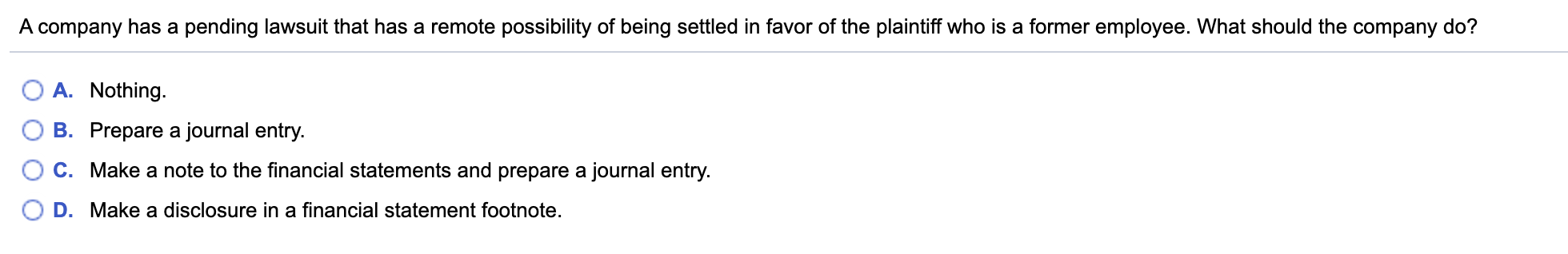

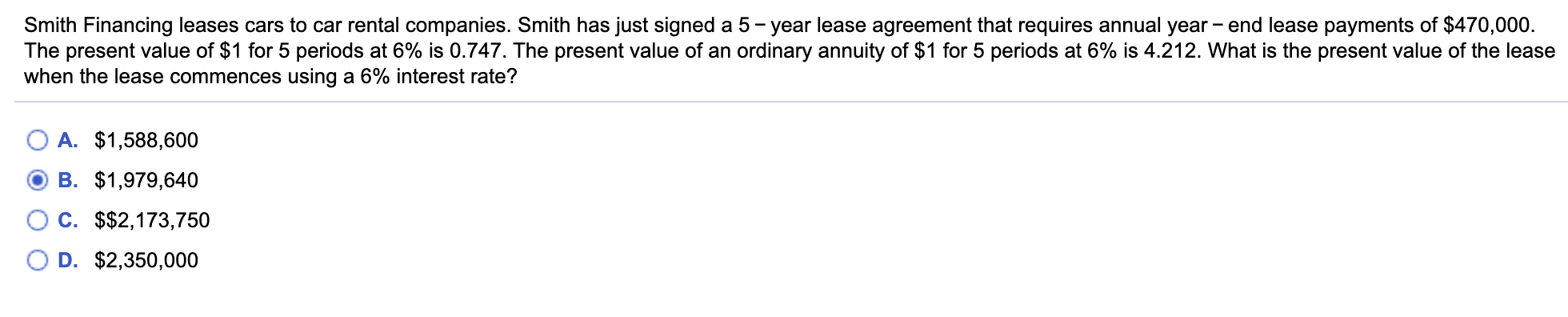

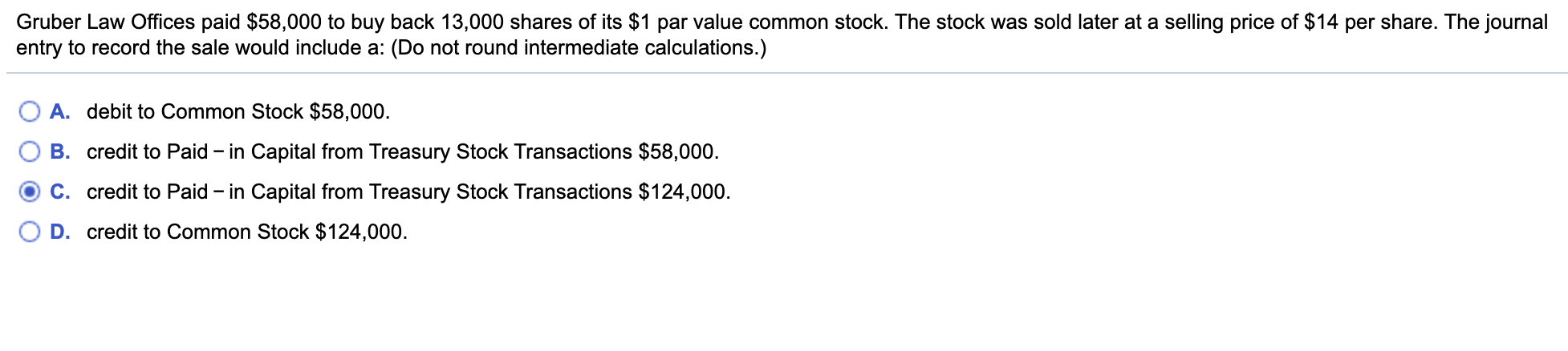

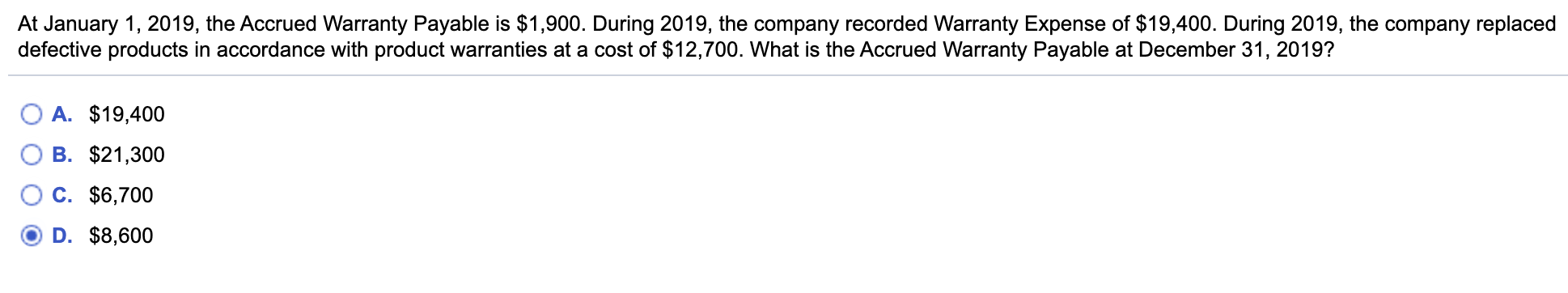

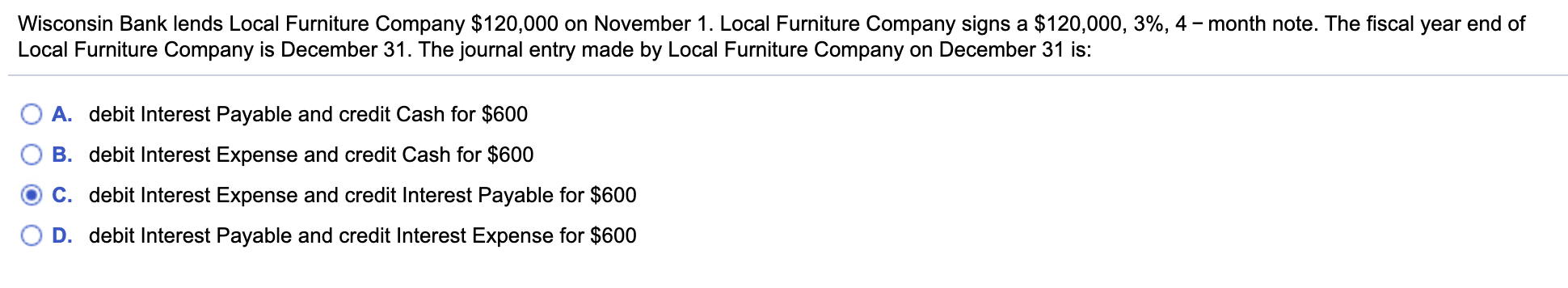

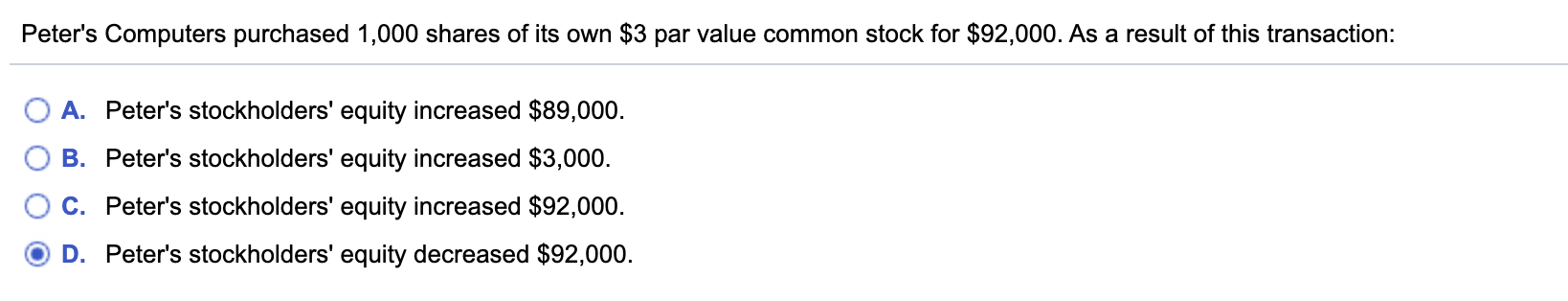

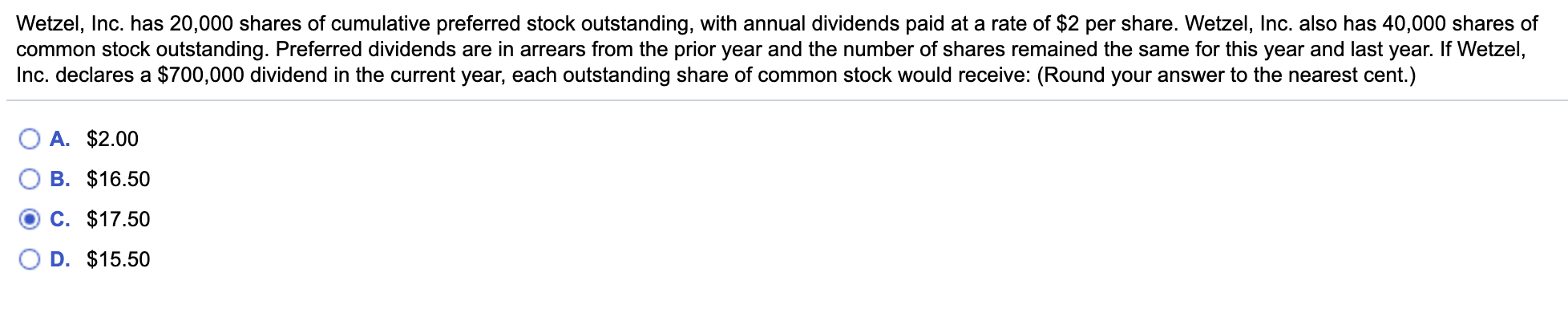

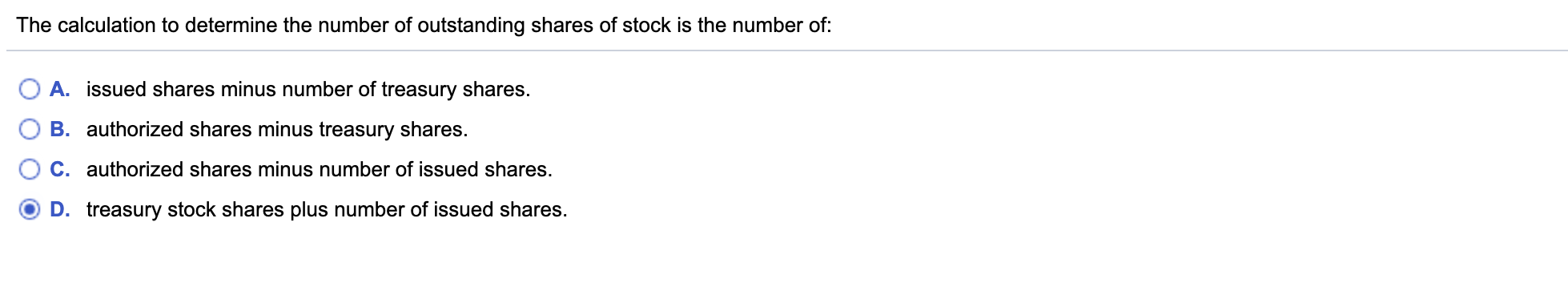

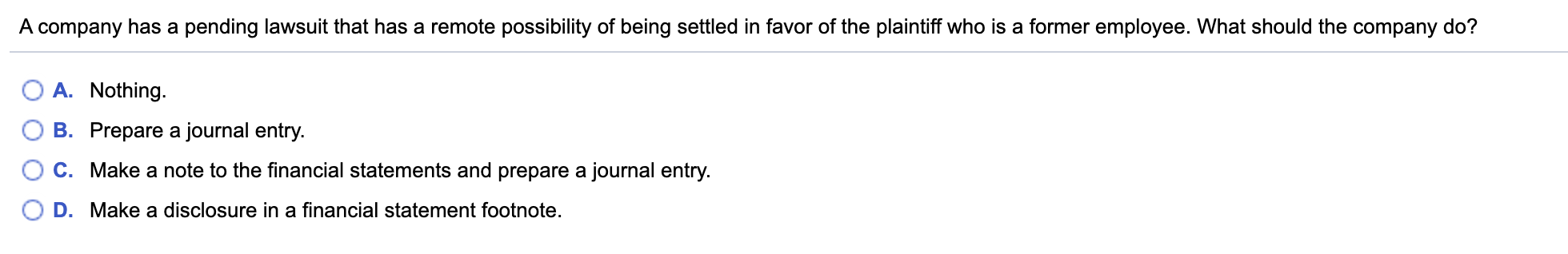

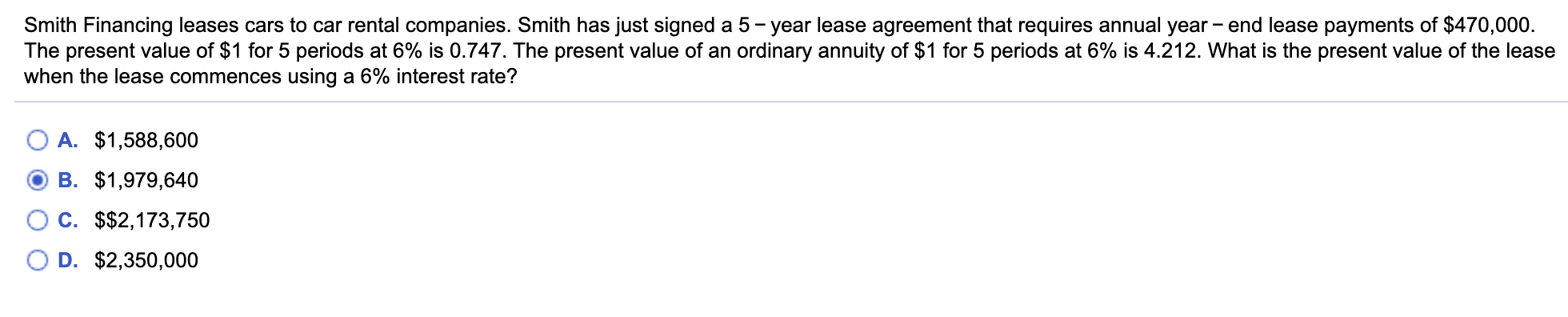

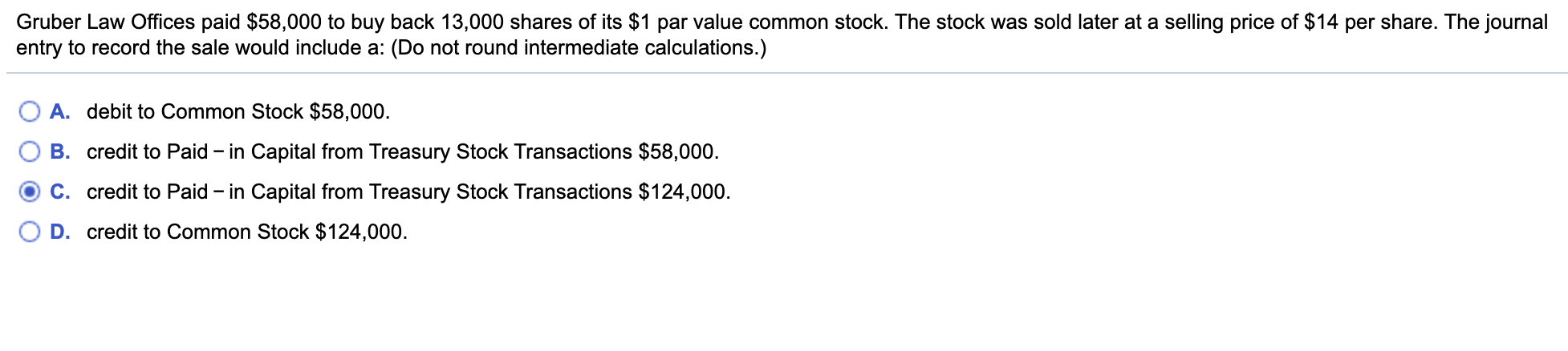

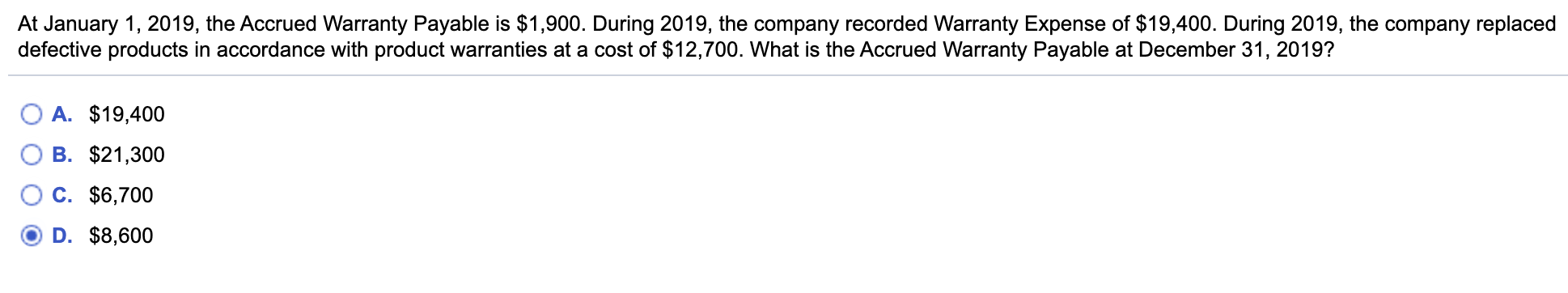

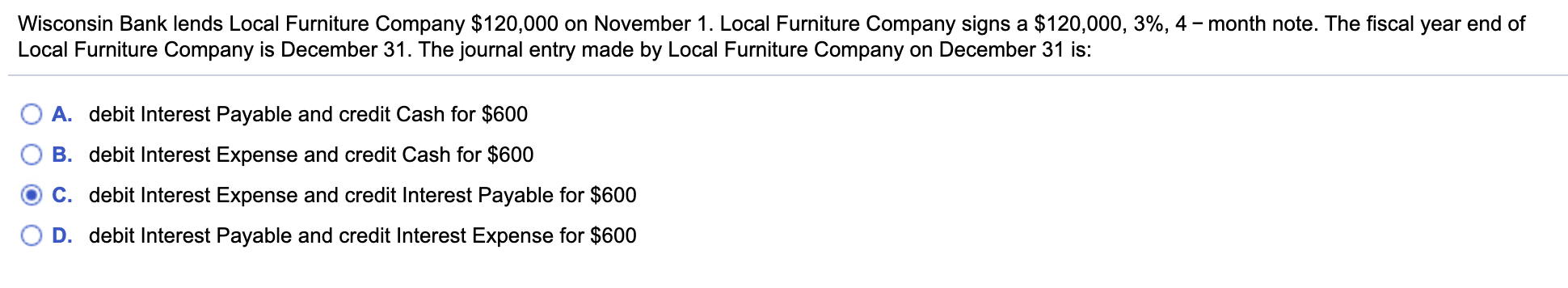

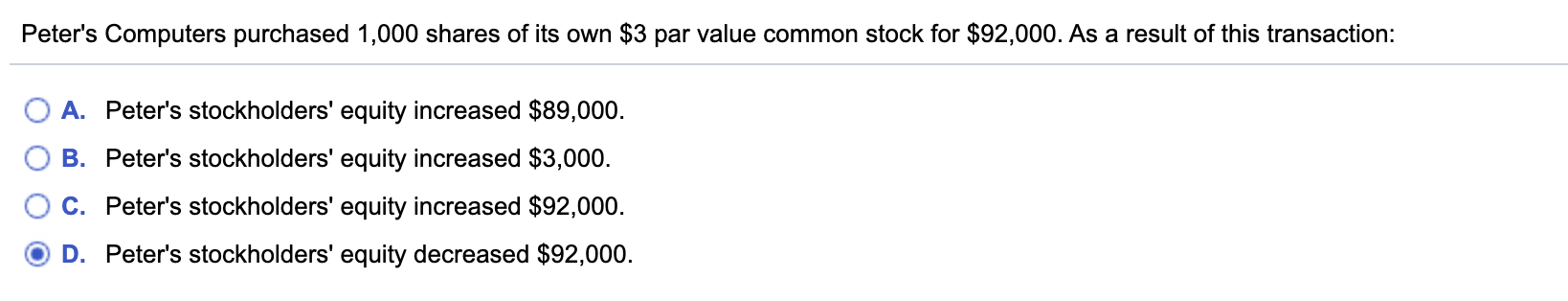

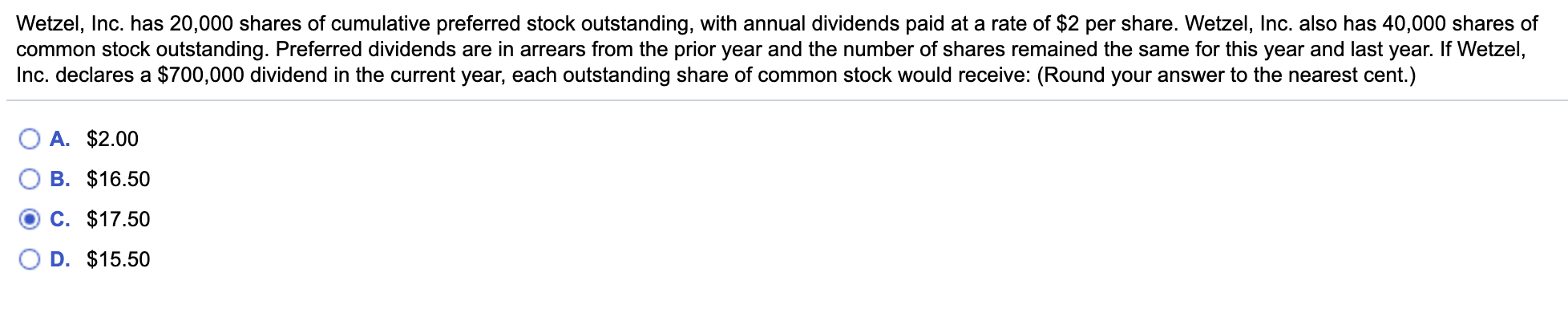

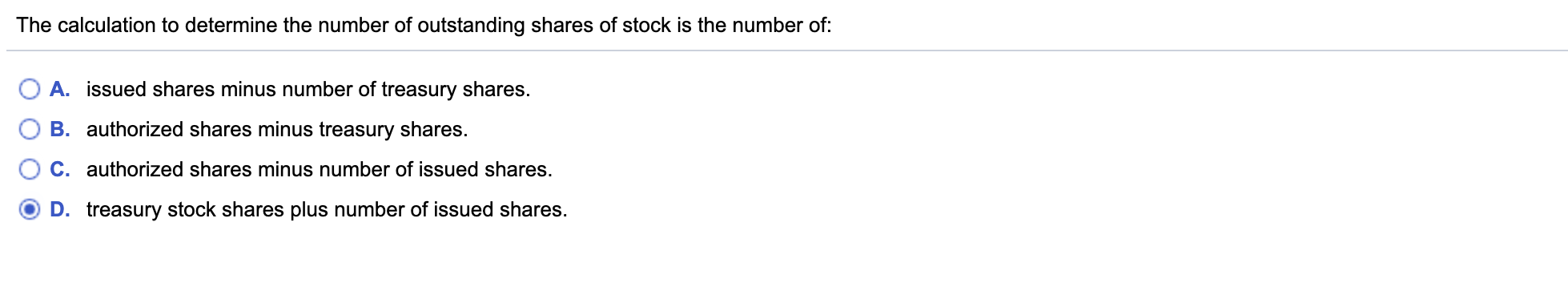

A company has a pending lawsuit that has a remote possibility of being settled in favor of the plaintiff who is a former employee. What should the company do? O A. Nothing. O B. Prepare a journal entry. O C. Make a note to the financial statements and prepare a journal entry. O D. Make a disclosure in a financial statement footnote. Smith Financing leases cars to car rental companies. Smith has just signed a 5-year lease agreement that requires annual year-end lease payments of $470,000. The present value of $1 for 5 periods at 6% is 0.747. The present value of an ordinary annuity of $1 for 5 periods at 6% is 4.212. What is the present value of the lease when the lease commences using a 6% interest rate? O A. $1,588,600 OB. $1,979,640 OC. $$2,173,750 O D. $2,350,000 Gruber Law Offices paid $58,000 to buy back 13,000 shares of its $1 par value common stock. The stock was sold later at a selling price of $14 per share. The journal entry to record the sale would include a: (Do not round intermediate calculations.) O A. debit to Common Stock $58,000. O B. credit to Paid - in Capital from Treasury Stock Transactions $58,000. C. credit to Paid in Capital from Treasury Stock Transactions $124,000. D. credit to Common Stock $124.000. At January 1, 2019, the Accrued Warranty Payable is $1,900. During 2019, the company recorded Warranty Expense of $19,400. During 2019, the company replaced defective products in accordance with product warranties at a cost of $12,700. What is the Accrued Warranty Payable at December 31, 2019? O A. $19,400 B. $21,300 OC. $6,700 O D. $8,600 Wisconsin Bank lends Local Furniture Company $120,000 on November 1. Local Furniture Company signs a $120,000, 3%, 4-month note. The fiscal year end of Local Furniture Company is December 31. The journal entry made by Local Furniture Company on December 31 is: O A. debit Interest Payable and credit Cash for $600 O B. debit Interest Expense and credit Cash for $600 O C. debit Interest Expense and credit Interest Payable for $600 O D. debit Interest Payable and credit Interest Expense for $600 Peter's Computers purchased 1,000 shares of its own $3 par value common stock for $92,000. As a result of this transaction: O A. Peter's stockholders' equity increased $89,000. O B. Peter's stockholders' equity increased $3,000. O C. Peter's stockholders' equity increased $92,000. O D. Peter's stockholders' equity decreased $92,000. Wetzel, Inc. has 20,000 shares of cumulative preferred stock outstanding, with annual dividends paid at a rate of $2 per share. Wetzel, Inc. also has 40,000 shares of common stock outstanding. Preferred dividends are in arrears from the prior year and the number of shares remained the same for this year and last year. If Wetzel, Inc. declares a $700,000 dividend in the current year, each outstanding share of common stock would receive: (Round your answer to the nearest cent.) O A. $2.00 O B. $16.50 C. $17.50 O D. $15.50 The calculation to determine the number of outstanding shares of stock is the number of: O A. issued shares minus number of treasury shares. O B. authorized shares minus treasury shares. O c. authorized shares minus number of issued shares. O D. treasury stock shares plus number of issued shares