Answered step by step

Verified Expert Solution

Question

1 Approved Answer

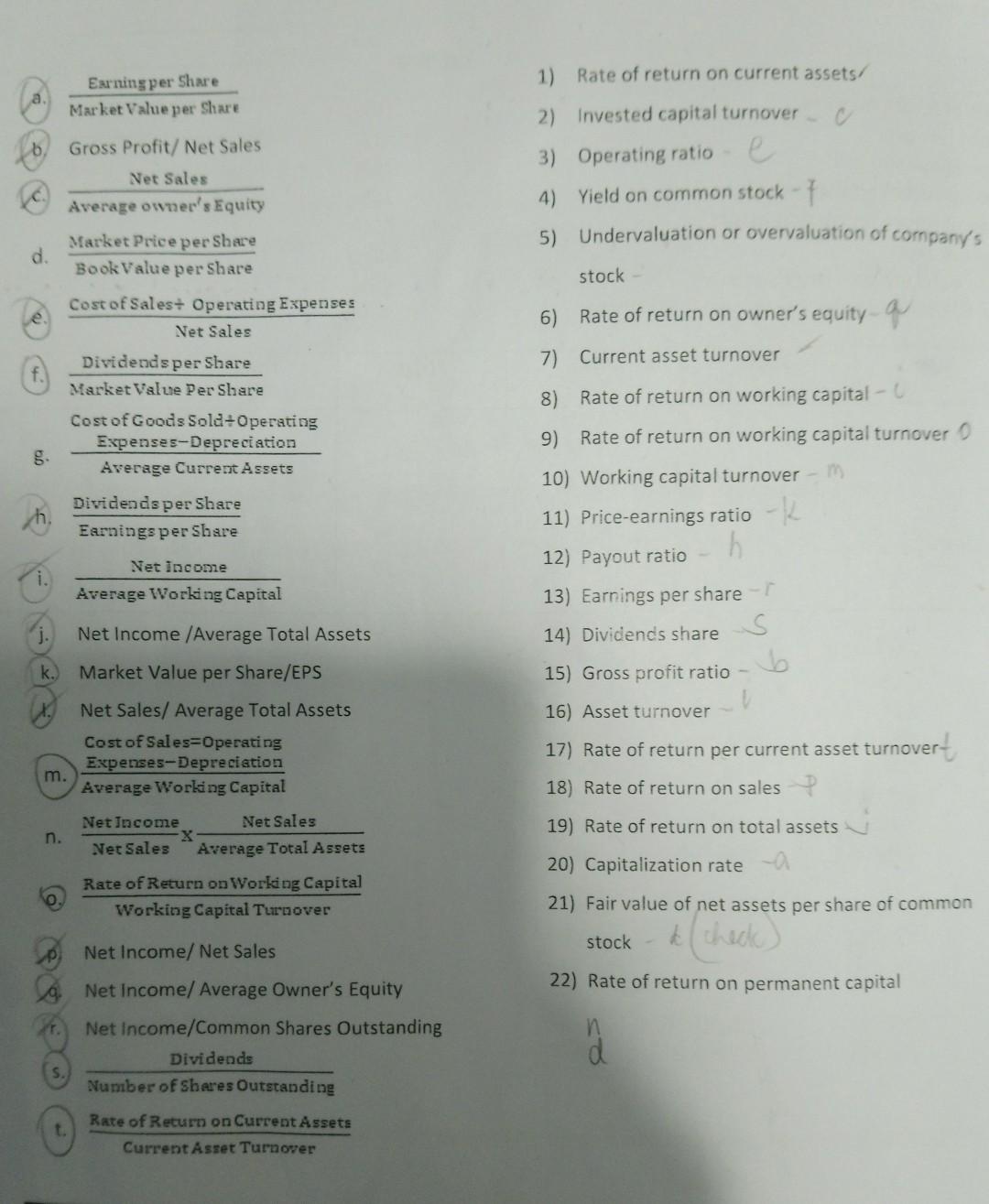

Please check my answer.. Others don't have answer in no. 5, 21,22 1) Rate of return on current assets/ a. Earning per Share Market Value

Please check my answer.. Others don't have answer in no. 5, 21,22

1) Rate of return on current assets/ a. Earning per Share Market Value per Share 6. Gross Profit/ Net Sales Net Sales Average owner's Equity Market Price per Share Book Value per Share d. e. Cost of Sales+ Operating Expenses Net Sales Dividends per Share Market Value Per Share Cost of Goods Sold Operating Expenses-Depreciation Average Current Assets Dividends per Share Earnings per Share 2) Invested capital turnover 3) Operating ratio e 4) Yield on common stock - 7 5) Undervaluation or overvaluation of company's stock 6) Rate of return on owner's equityq 7) Current asset turnover 8) Rate of return on working capital - 0 9) Rate of return on working capital turnover o 10) Working capital turnover 11) Price-earnings ratio - h 12) Payout ratio 13) Earnings per share - 14) Dividencis shares i. Net income Average Working Capital j. Net Income /Average Total Assets k. Market Value per Share/EPS 15) Gross profit ratio 16) Asset turnover 17) Rate of return per current asset turnover- 18) Rate of return on sales P m. Net Sales/ Average Total Assets Cost of Sales=Operating Expenses-Depreciation Average Working Capital Net Income Net Sales x Net Sales Average Total Assets Rate of Return on Working Capital Working Capital Turnover 19) Rate of return on total assets n. 20) Capitalization rate -a 21) Fair value of net assets per share of common stock Net Income/ Net Sales Net Income/ Average Owner's Equity 22) Rate of return on permanent capital r. Net Income/Common Shares Outstanding Dividends Number of Sheres Outstanding 2 S. Rate of Return on Current Assets Current Asset Turnover 1) Rate of return on current assets/ a. Earning per Share Market Value per Share 6. Gross Profit/ Net Sales Net Sales Average owner's Equity Market Price per Share Book Value per Share d. e. Cost of Sales+ Operating Expenses Net Sales Dividends per Share Market Value Per Share Cost of Goods Sold Operating Expenses-Depreciation Average Current Assets Dividends per Share Earnings per Share 2) Invested capital turnover 3) Operating ratio e 4) Yield on common stock - 7 5) Undervaluation or overvaluation of company's stock 6) Rate of return on owner's equityq 7) Current asset turnover 8) Rate of return on working capital - 0 9) Rate of return on working capital turnover o 10) Working capital turnover 11) Price-earnings ratio - h 12) Payout ratio 13) Earnings per share - 14) Dividencis shares i. Net income Average Working Capital j. Net Income /Average Total Assets k. Market Value per Share/EPS 15) Gross profit ratio 16) Asset turnover 17) Rate of return per current asset turnover- 18) Rate of return on sales P m. Net Sales/ Average Total Assets Cost of Sales=Operating Expenses-Depreciation Average Working Capital Net Income Net Sales x Net Sales Average Total Assets Rate of Return on Working Capital Working Capital Turnover 19) Rate of return on total assets n. 20) Capitalization rate -a 21) Fair value of net assets per share of common stock Net Income/ Net Sales Net Income/ Average Owner's Equity 22) Rate of return on permanent capital r. Net Income/Common Shares Outstanding Dividends Number of Sheres Outstanding 2 S. Rate of Return on Current Assets Current Asset TurnoverStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started