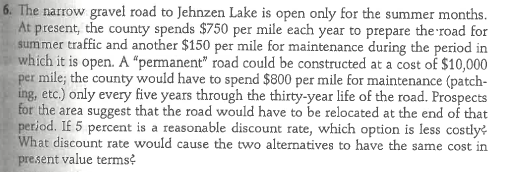

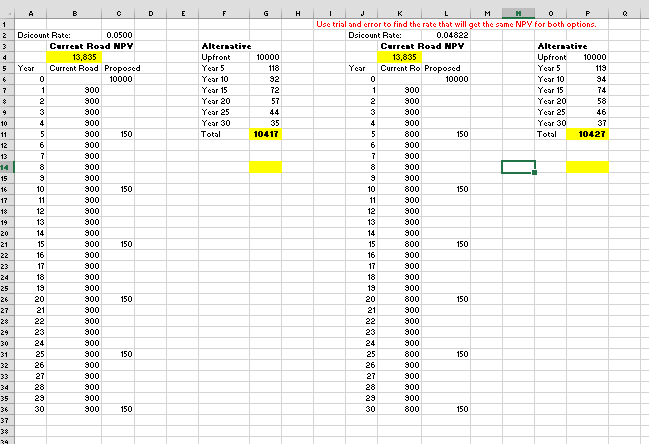

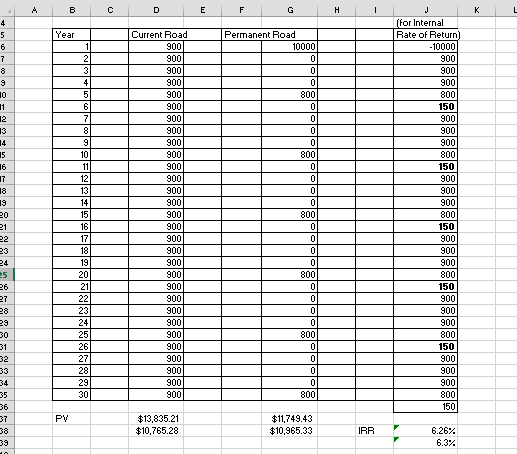

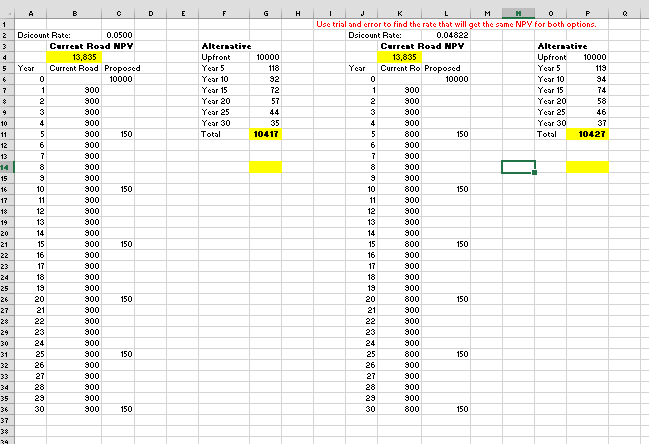

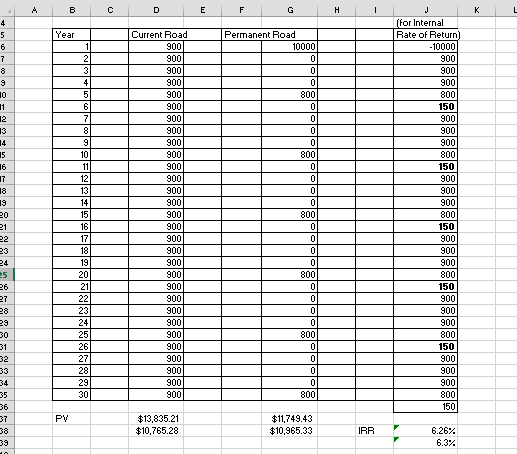

Please check my answers to the question below. Is this the correct setup for excel? If not, please put the correct numbers in this excel template.

6. The narrow gravel road to Jehnzen Lake is open only for the summer months. At present, the county spends $750 per mile each year to prepare the road for summer traffic and another $150 per mile for maintenance during the period in which it is open. A "permanent" road could be constructed at a cost of $10,000 per mile; the county would have to spend $800 per mile for maintenance (patch- ing, etc.) only every five years through the thirty-year life of the road. Prospects for the area suggest that the road would have to be relocated at the end of that period. If 5 percent is a reasonable discount rate, which option is less costly? What discount rate would cause the two alternatives to have the same cost in present value terms B D E F H Q 1 2 4 5 Dsicount Rate: 0.0500 Current Road MPY 13,835 Year Current Road Proposed 0 10000 1 900 2 900 Alternative Upfront 10000 Year 5 118 Year 10 Year 15 72 Year 20 57 Year 25 44 Year 30 Total 10417 900 150 4 5 6 7 8 - [i 150 8 4. 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 150 J M 0 P Use trial and crror to find the rate that will get the same NPV for both options. Dsicount Rate: 0.04822 Current Road HPY Alternative 13,835 Upfront 10000 Year Current Ro Proposed Year 5 119 0 10000 Year 10 94 1 900 Year 15 74 2 900 Year 20 58 3 900 Year 25 46 4 900 Year 30 37 5 800 150 Total 10427 6 900 7 900 8 900 9 900 10 800 150 11 900 12 900 13 900 14 900 15 800 150 16 900 17 900 18 900 19 900 20 800 150 21 900 22 900 23 900 24 900 25 800 150 26 900 27 900 28 900 29 900 30 800 150 900 900 900 900 900 900 900 900 900 900 900 900 900 900 900 900 900 900 900 900 900 900 900 900 900 900 900 150 27 28 29 30 31 32 150 34 35 36 37 150 B E F H 1 1 4 5 6 7 Permanent Road 10000 0 0 0 008 9 10 11 12 0 0 Current Road 900 900 900 900 900 900 900 900 900 900 900 900 900 900 900 900 for Internal Rate of Return -10000 900 900 900 800 150 900 900 900 800 150 900 900 900 800 150 0 0 008 14 15 16 17 0 0 Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 0 19 20 21 22 23 0 008 0 006 900 0 0 . 800 0 0 25 26 27 900 900 900 900 900 900 900 900 900 900 900 900 900 0 0 008 0 29 30 31 32 33 34 35 36 37 38 39 900 900 800 150 900 900 900 800 150 900 900 900 800 150 0 0 0 008 PY $13,835.21 $10,765.28 $11,749.43 $10,965.33 IRR 6.26% 6.3%