Answered step by step

Verified Expert Solution

Question

1 Approved Answer

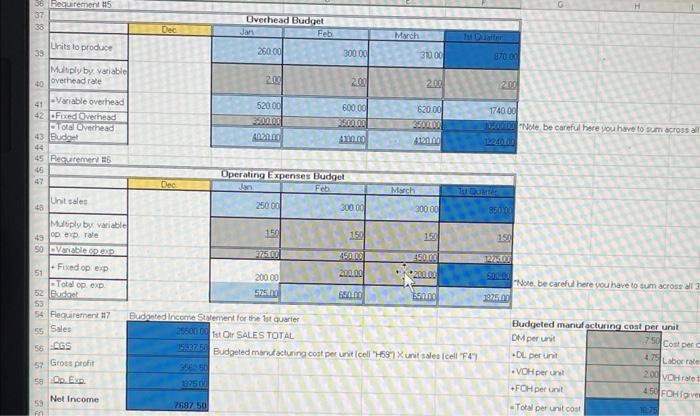

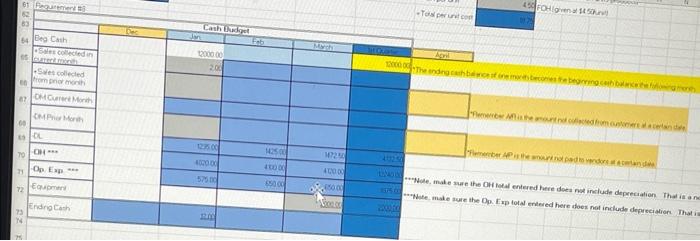

Please check my work and help with req #8 asap please Master Budget Project Husker Corporation is a manufacturing company that produces one product. The

Please check my work and help with req #8 asap please

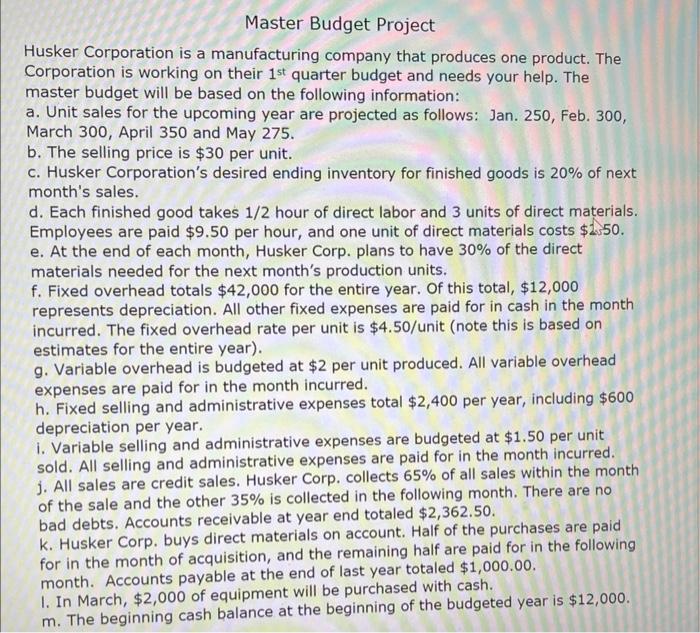

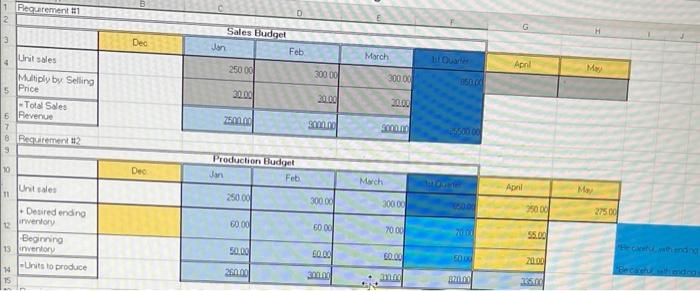

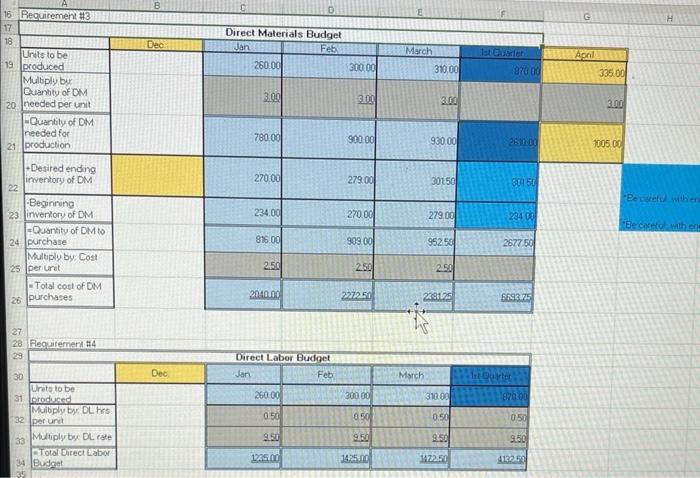

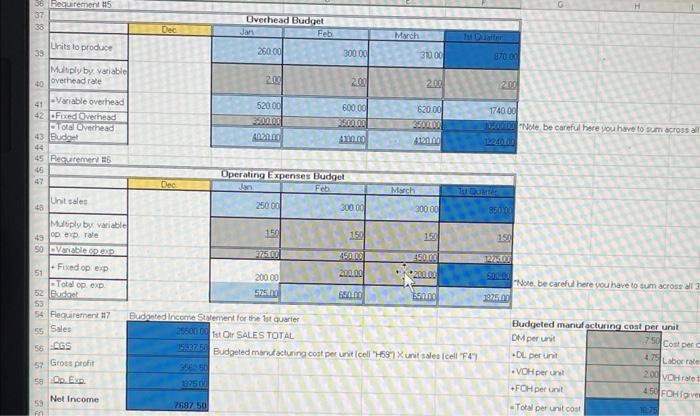

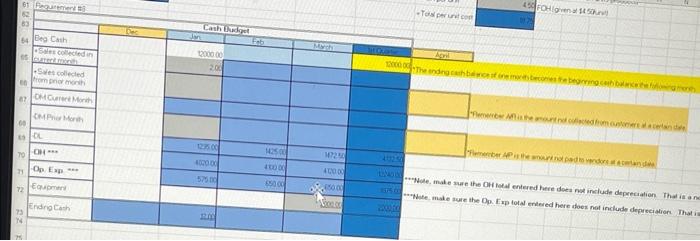

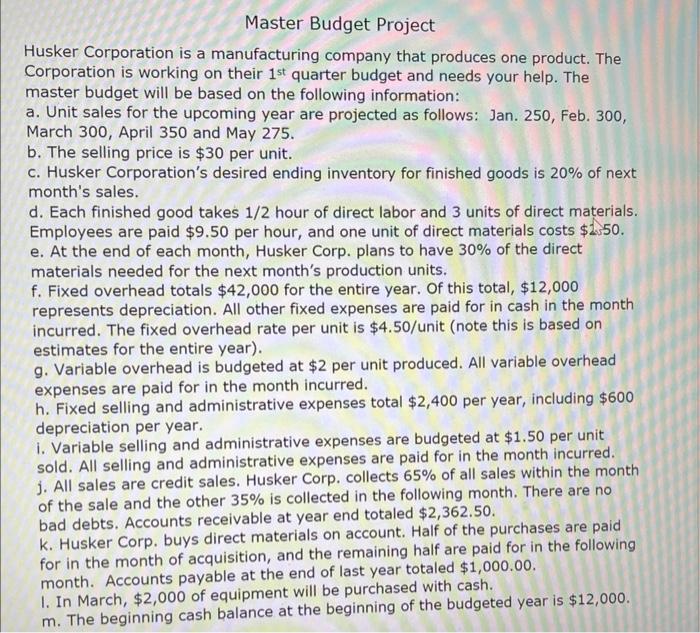

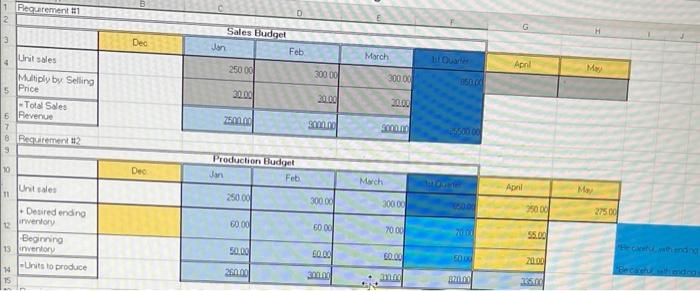

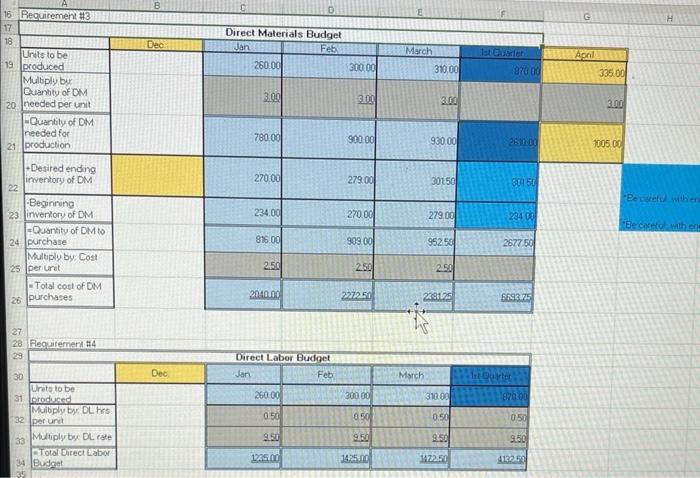

Master Budget Project Husker Corporation is a manufacturing company that produces one product. The Corporation is working on their 1st quarter budget and needs your help. The master budget will be based on the following information: a. Unit sales for the upcoming year are projected as follows: Jan. 250, Feb. 300, March 300, April 350 and May 275. b. The selling price is $30 per unit. c. Husker Corporation's desired ending inventory for finished goods is 20% of next month's sales. d. Each finished good takes 1/2 hour of direct labor and 3 units of direct materials. Employees are paid $9.50 per hour, and one unit of direct materials costs $2550. e. At the end of each month, Husker Corp. plans to have 30% of the direct materials needed for the next month's production units. f. Fixed overhead totals $42,000 for the entire year. Of this total, $12,000 represents depreciation. All other fixed expenses are paid for in cash in the month incurred. The fixed overhead rate per unit is $4.50/ unit (note this is based on estimates for the entire year). g. Variable overhead is budgeted at $2 per unit produced. All variable overhead expenses are paid for in the month incurred. h. Fixed selling and administrative expenses total $2,400 per year, including $600 depreciation per year. i. Variable selling and administrative expenses are budgeted at $1.50 per unit sold. All selling and administrative expenses are paid for in the month incurred. j. All sales are credit sales. Husker Corp. collects 65% of all sales within the month of the sale and the other 35% is collected in the following month. There are no bad debts. Accounts receivable at year end totaled $2,362.50. k. Husker Corp. buys direct materials on account. Half of the purchases are paid for in the month of acquisition, and the remaining half are paid for in the following month. Accounts payable at the end of last year totaled $1,000.00. I. In March, $2,000 of equipment will be purchased with cash. m. The beginning cash balance at the beginning of the budgeted year is $12,000. 16. Requirement H3 B Reguifemert \#4 Wole. be careful hare you hane to trum across al We. be carefu here vou have lo sum across all 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started