Answered step by step

Verified Expert Solution

Question

1 Approved Answer

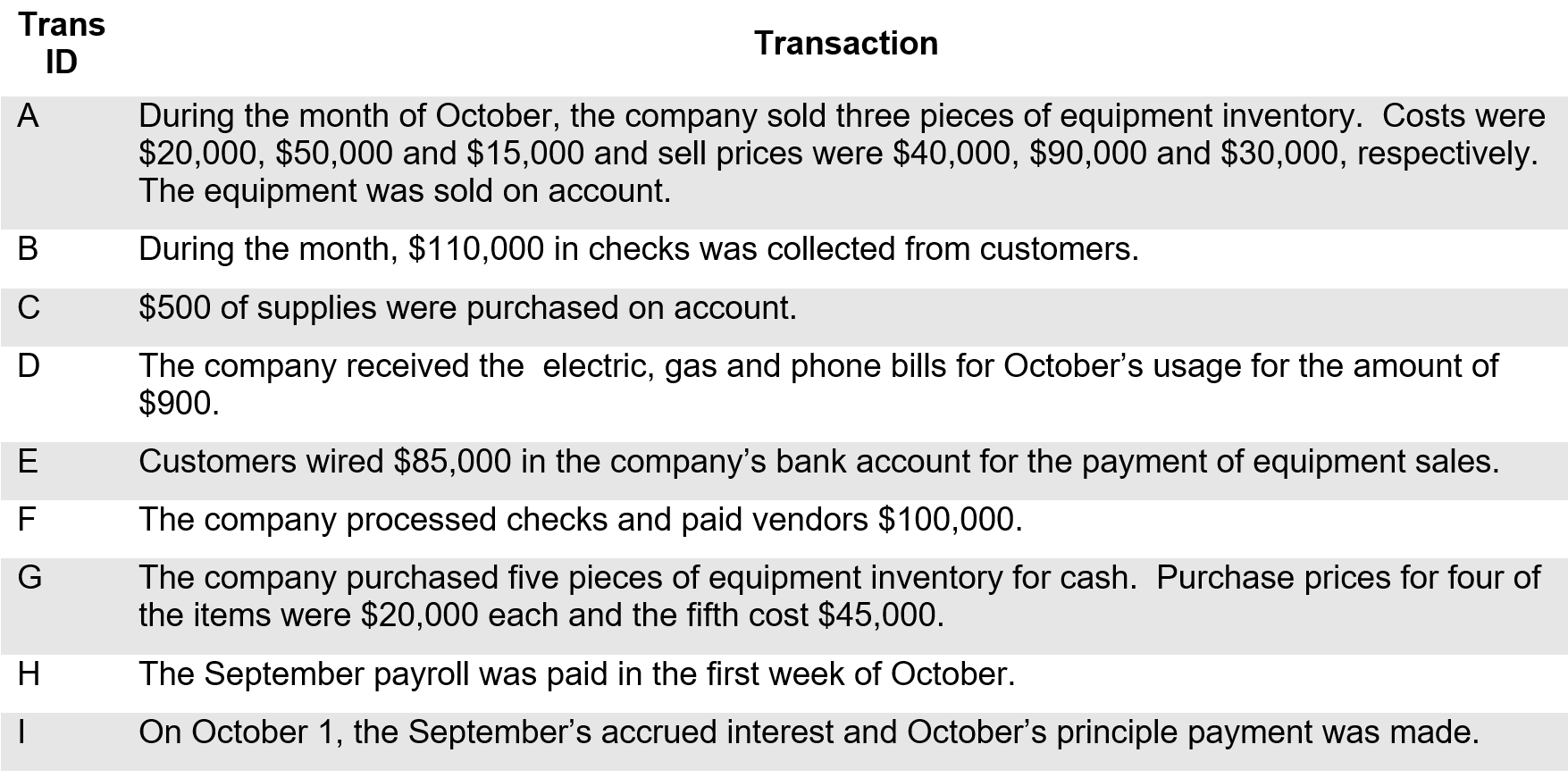

Please check my work for me. Trans ID Transaction A B D During the month of October, the company sold three pieces of equipment inventory.

Please check my work for me.

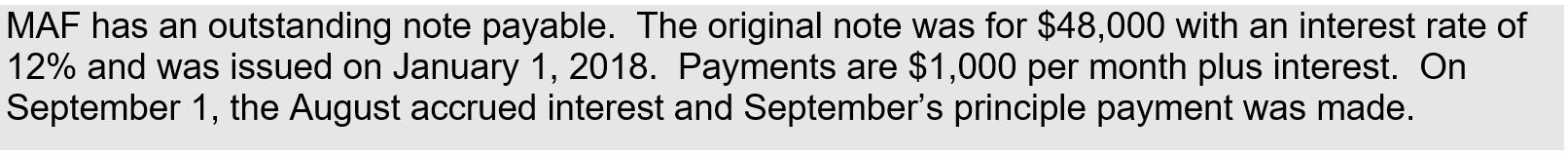

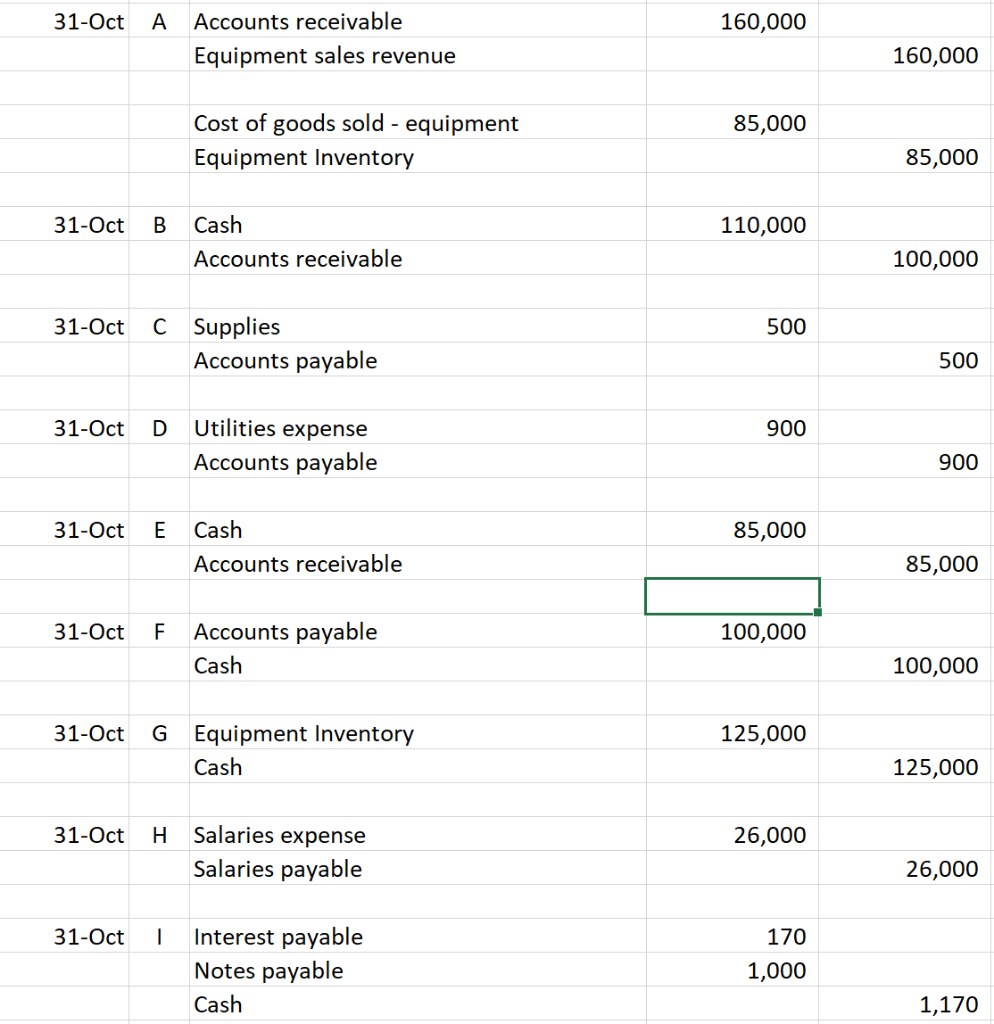

Trans ID Transaction A B D During the month of October, the company sold three pieces of equipment inventory. Costs were $20,000, $50,000 and $15,000 and sell prices were $40,000, $90,000 and $30,000, respectively. The equipment was sold on account. During the month, $110,000 in checks was collected from customers. $500 of supplies were purchased on account. The company received the electric, gas and phone bills for October's usage for the amount of $900. Customers wired $85,000 in the company's bank account for the payment of equipment sales. The company processed checks and paid vendors $100,000. The company purchased five pieces of equipment inventory for cash. Purchase prices for four of the items were $20,000 each and the fifth cost $45,000. The September payroll was paid in the first week of October. On October 1, the September's accrued interest and October's principle payment was made. E F G H MAF has an outstanding note payable. The original note was for $48,000 with an interest rate of 12% and was issued on January 1, 2018. Payments are $1,000 per month plus interest. On September 1, the August accrued interest and September's principle payment was made. 31-Oct 160,000 Accounts receivable Equipment sales revenue 160,000 85,000 Cost of goods sold - equipment Equipment Inventory 85,000 31-Oct B 110,000 Cash Accounts receivable 100,000 31-Oct 500 C Supplies Accounts payable 500 31-Oct D 900 Utilities expense Accounts payable 900 31-Oct E 85,000 Cash Accounts receivable 85,000 31-Oct F 100,000 Accounts payable Cash 100,000 31-Oct 125,000 G Equipment Inventory Cash 125,000 31-Oct H 26,000 Salaries expense Salaries payable 26,000 31-Oct Interest payable Notes payable Cash 170 1,000 1,170Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started