Answered step by step

Verified Expert Solution

Question

1 Approved Answer

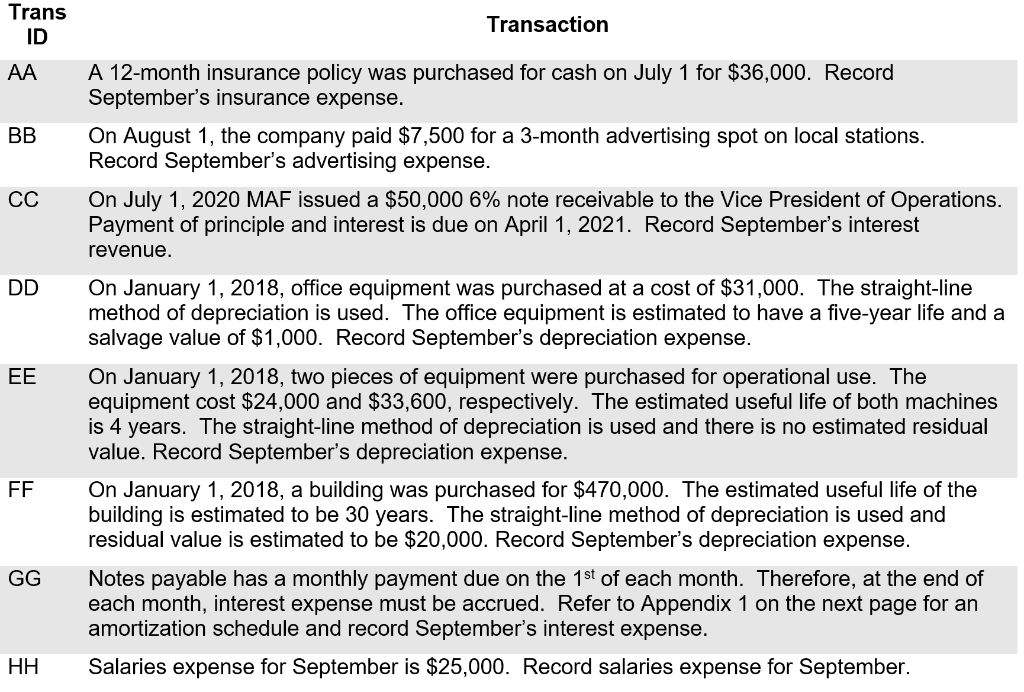

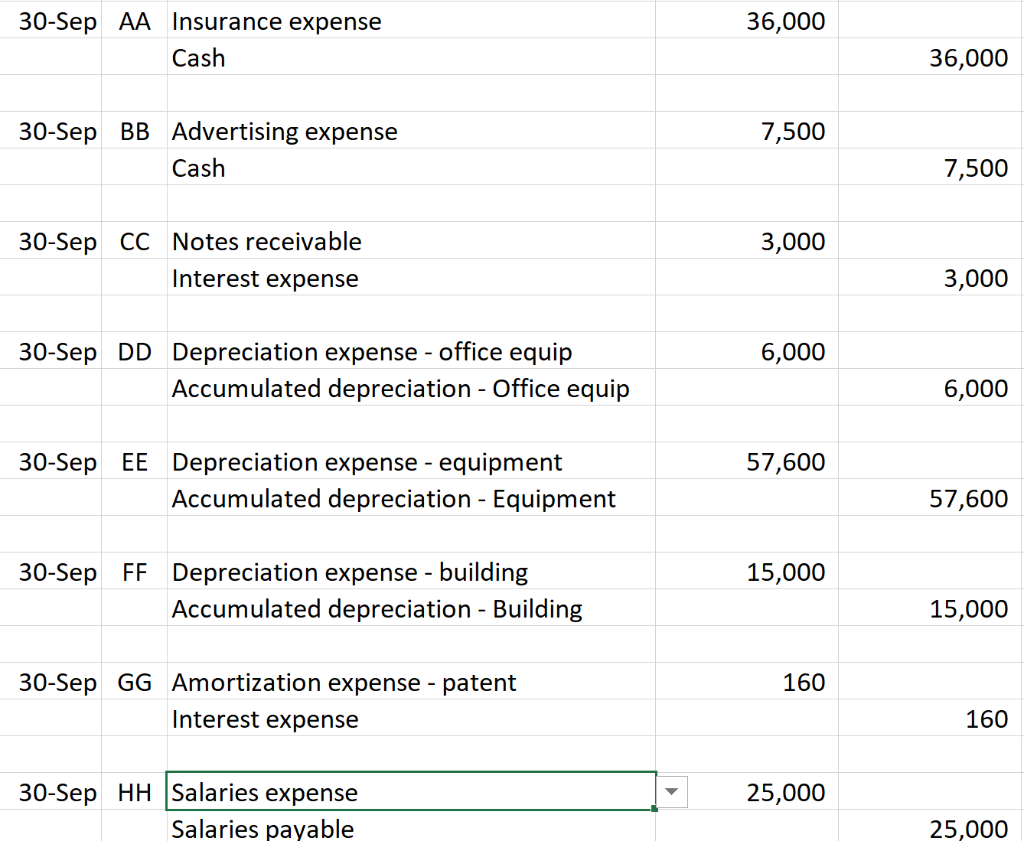

Please check my work. If i get any wrong please explain. Trans ID Transaction AA BB CC DD EE A 12-month insurance policy was purchased

Please check my work. If i get any wrong please explain.

Trans ID Transaction AA BB CC DD EE A 12-month insurance policy was purchased for cash on July 1 for $36,000. Record September's insurance expense. On August 1, the company paid $7,500 for a 3-month advertising spot on local stations. Record September's advertising expense. On July 1, 2020 MAF issued a $50,000 6% note receivable to the Vice President of Operations. Payment of principle and interest is due on April 1, 2021. Record September's interest revenue. On January 1, 2018, office equipment was purchased at a cost of $31,000. The straight-line method of depreciation is used. The office equipment is estimated to have a five-year life and a salvage value of $1,000. Record September's depreciation expense. On January 1, 2018, two pieces of equipment were purchased for operational use. The equipment cost $24,000 and $33,600, respectively. The estimated useful life of both machines is 4 years. The straight-line method of depreciation is used and there is no estimated residual value. Record September's depreciation expense. On January 1, 2018, a building was purchased for $470,000. The estimated useful life of the building is estimated to be 30 years. The straight-line method of depreciation is used and residual value is estimated to be $20,000. Record September's depreciation expense. Notes payable has a monthly payment due on the 1st of each month. Therefore, at the end of each month, interest expense must be accrued. Refer to Appendix 1 on the next page for an amortization schedule and record September's interest expense. Salaries expense for September is $25,000. Record salaries expense for September. FF GG HH 2020 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 24000 23000 22000 21000 20000 19000 18000 17000 16000 15000 14000 13000 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 240 230 220 210 200 190 180 170 160 150 140 130Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started