Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please check the appropriate box to explain how you would report each of the following items 15. Academic scholarship paid to cover your tuition at

Please check the appropriate box to explain how you would report each of the following items

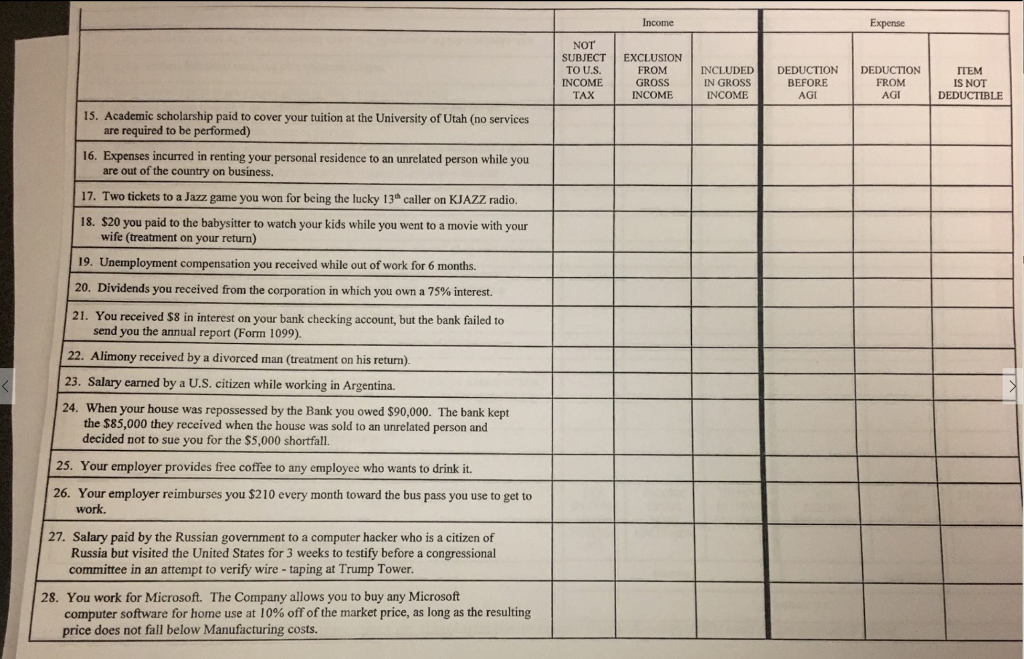

15. Academic scholarship paid to cover your tuition at the University of Utah (no services are required to be performed) 16. Expenses incurred in renting your personal residence to an unrelated person while you are out of the country on business. 17. Two tickets to a Jazz game you won for being the lucky 13th caller on KJAZZ radio 18. $20 you paid to the babysitter to watch your kids while you went to a movie with your wife (treatment on your return) 19. Unemployment compensation you received while out of work for 6 months 20. Dividends you received from the corporation in which you own a 75% interest. 21. You received S8 in interest on your bank checking account, but the bank failed to send you the annual report (Form 1099). 22. Alimony received by a divorced man (treatment on his return 23. Salary earned by a U.S. citizen while working in Argentina. 24. When your house was repossessed by the Bank you owed $90,000. The bank kept the $85,000 they received when the house was sold to an unrelated person and decided not to sue you for the $5,000 shortfall. 25. Your employer provides free coffee to any employee who wants to drink it. 26. Your employer reimburses you $210 every month toward the bus pass you use to get to work. 27. Salary paid by the Russian govemment to a computer hacker who is a citizen of Russia but visited the United States for 3 weeks to testify before a congressional committee in an attempt to verify wire taping at Trump Tower. 28. You work for Microsoft. The Company allows you to buy any Microsoft computer software for home use at 10% off ofthe market price, as long as the resulting price does not fall below Manufacturing costs NOT SUBJECT EXCLUSION FROM GROS INCOME INCLUDED DEDUCTION DEDUCTION FROM BEFORE IS NOT DEDUCTIBLE 15. Academic scholarship paid to cover your tuition at the University of Utah (no services are required to be performed) 16. Expenses incurred in renting your personal residence to an unrelated person while you are out of the country on business. 17. Two tickets to a Jazz game you won for being the lucky 13th caller on KJAZZ radio 18. $20 you paid to the babysitter to watch your kids while you went to a movie with your wife (treatment on your return) 19. Unemployment compensation you received while out of work for 6 months 20. Dividends you received from the corporation in which you own a 75% interest. 21. You received S8 in interest on your bank checking account, but the bank failed to send you the annual report (Form 1099). 22. Alimony received by a divorced man (treatment on his return 23. Salary earned by a U.S. citizen while working in Argentina. 24. When your house was repossessed by the Bank you owed $90,000. The bank kept the $85,000 they received when the house was sold to an unrelated person and decided not to sue you for the $5,000 shortfall. 25. Your employer provides free coffee to any employee who wants to drink it. 26. Your employer reimburses you $210 every month toward the bus pass you use to get to work. 27. Salary paid by the Russian govemment to a computer hacker who is a citizen of Russia but visited the United States for 3 weeks to testify before a congressional committee in an attempt to verify wire taping at Trump Tower. 28. You work for Microsoft. The Company allows you to buy any Microsoft computer software for home use at 10% off ofthe market price, as long as the resulting price does not fall below Manufacturing costs NOT SUBJECT EXCLUSION FROM GROS INCOME INCLUDED DEDUCTION DEDUCTION FROM BEFORE IS NOT DEDUCTIBLEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started