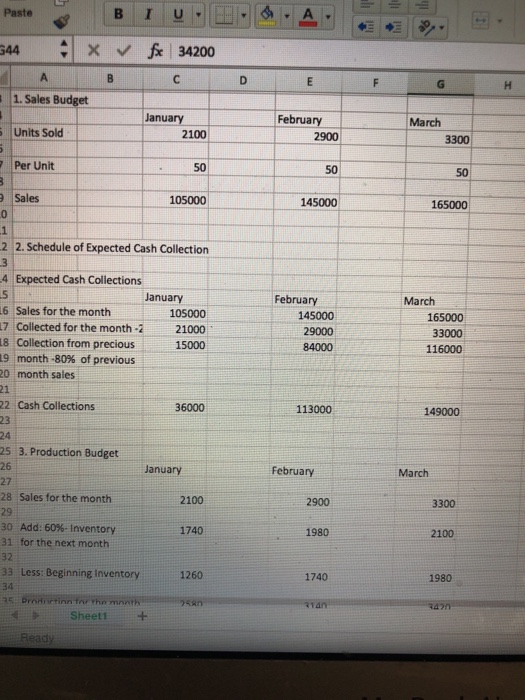

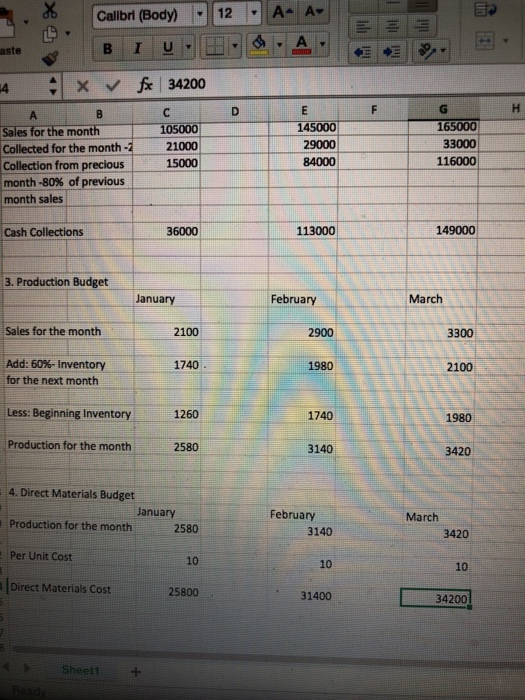

Please check the work 1-4 for and answer 5 and 6. Thank you

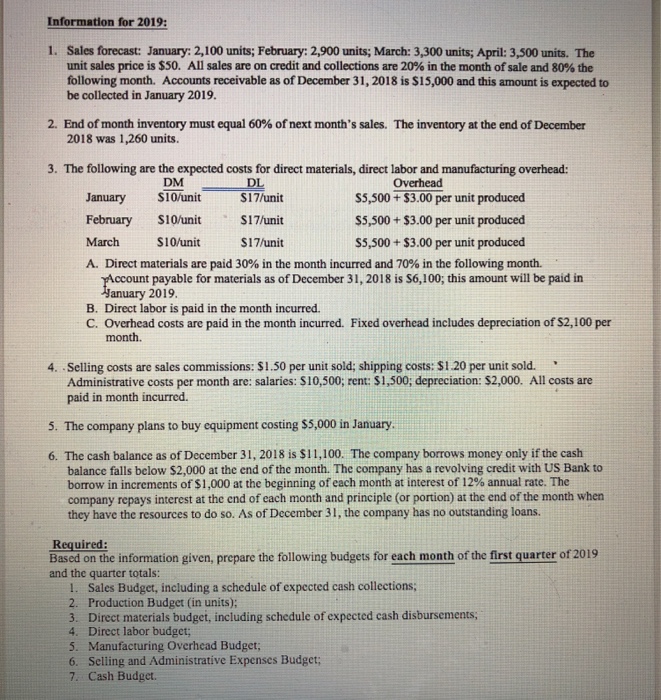

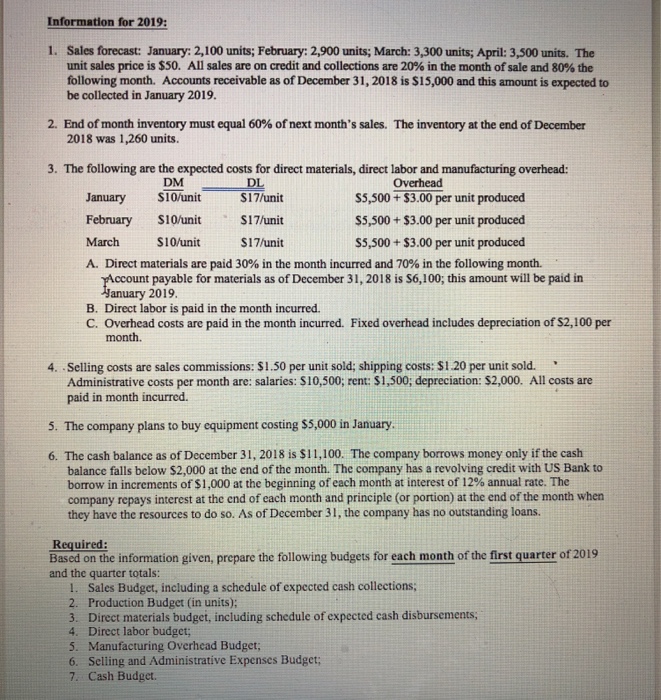

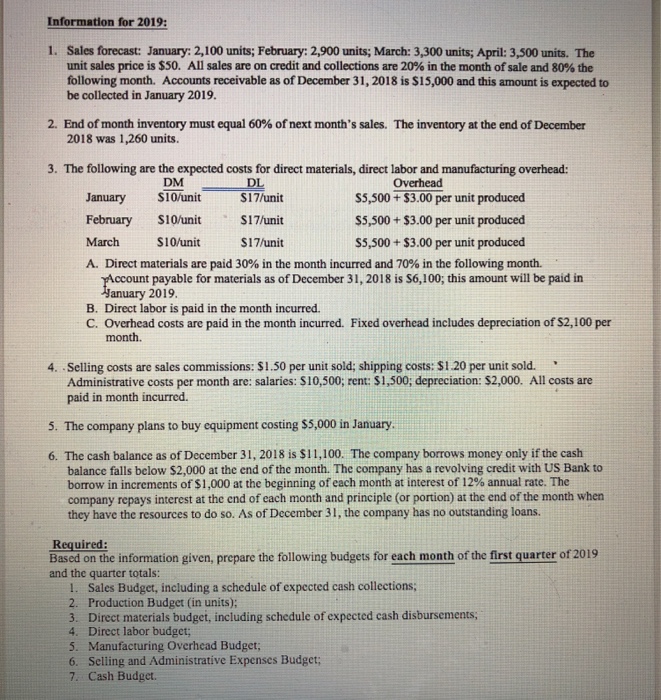

Information for 2019: 1. Sales forecast: January: 2,100 units; February: 2,900 units; March: 3,300 units; April: 3,500 units. The unit sales price is $50. All sales are on credit and collections are 20% in the month of sale and 80% the following month. Accounts receivable as of December 31, 2018 is $15,000 and this amount is expected to be collected in January 2019 2, End of month inventory must equal 60% of next month's sales. The inventory at the end of December 2018 was 1,260 units. 3. The following are the expected costs for direct materials, direct labor and manufacturing overhead: DM DL S17/unit January S1Ofunit February S10/unit S17/unit March S10/unit A. Direct materials are paid 30% in the month incurred and 70% in the following month. s5,500+$3.00 per unit produced s5,500+53.00 per unit produced $5,500 + S3.00 per unit produced S17/unit t payable for materials as of December 31, 2018 is S6,100; this amount will be paid in anuary 2019 B. Direct labor is paid in the month incurred. C. Overhead costs are paid in the month incurred. Fixed overhead includes depreciation of $2,100 per month. 4. Selling costs are sales commissions: $1.50 per unit sold; shipping costs: $1.20 per unit sold. Administrative costs per month are: salaries: $10,500; rent: $1,500; depreciation: $2,000. All costs are paid in month incurred. 5. The company plans to buy equipment costing $5,000 in January 6. The cash balance as of December 31, 2018 is $11,100. The company borrows money only if the cash balance falls below $2,000 at the end of the month. The company has a revolving credit with US Bank to borrow in increments of $1,000 at the beginning of each month at interest of 12% annual rate. The company repays interest at the end of each month and principle (or portion) at the end of the month when they have the resources to do so. As of December 31, the company has no outstanding loans. Required: Based on the information given, prepare the following budgets for each month of the first quarter of 2019 and the quarter totals: l. Sales Budget, including a schedule of expected cash collections; 2. Production Budget (in units); 3. Direct materials budget, including schedule of expected cash disbursements; 4. Direct labor budget; 5. Manufacturing Overhead Budget 6. Selling and Administrative Expenses Budget; 7. Cash Budget