Answered step by step

Verified Expert Solution

Question

1 Approved Answer

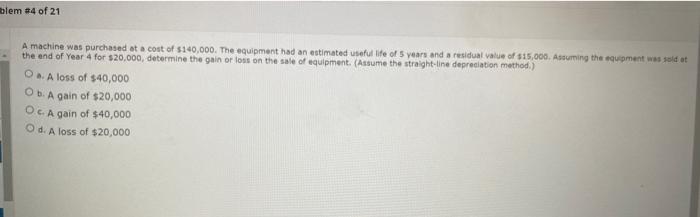

please choose corect answer A machine was purchased at a cost of 3140,000 . The equipment had an estimated useful life of 5 years and

please choose corect answer

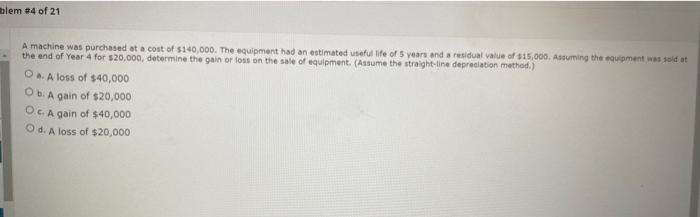

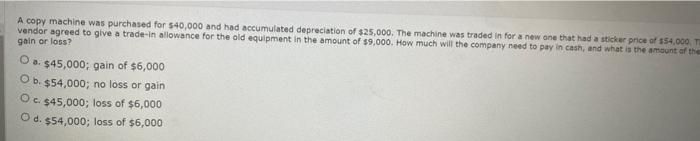

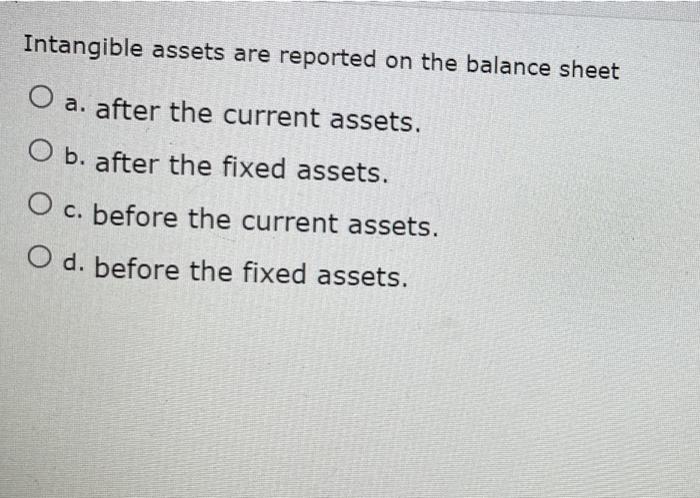

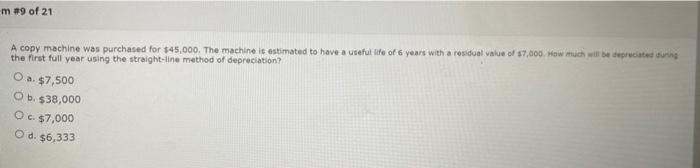

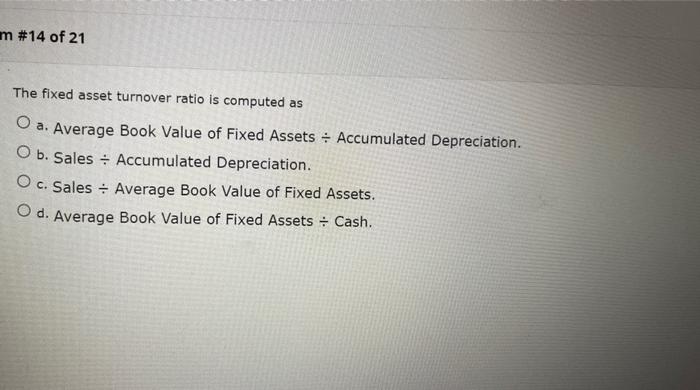

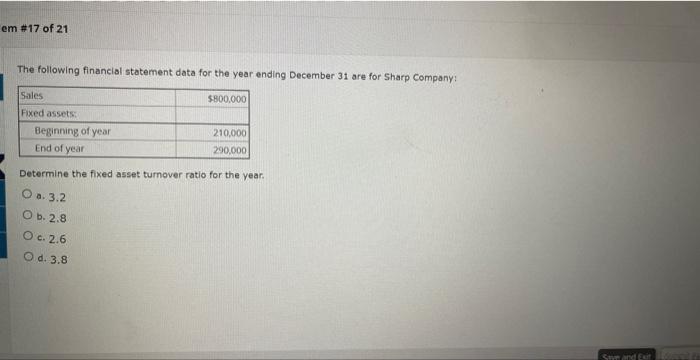

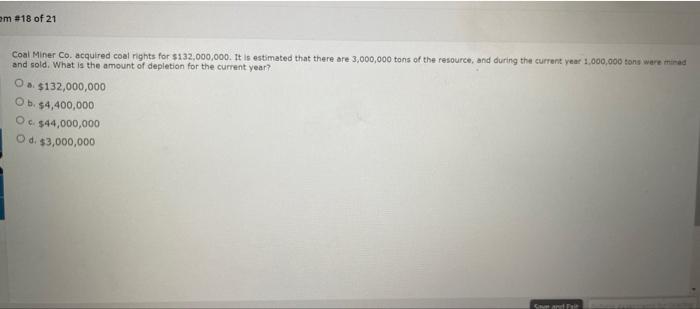

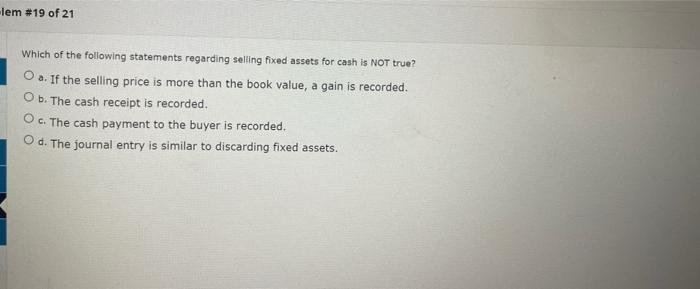

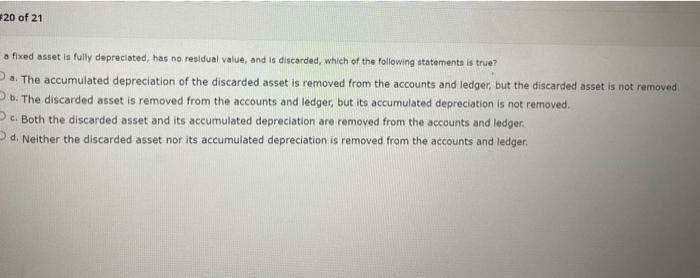

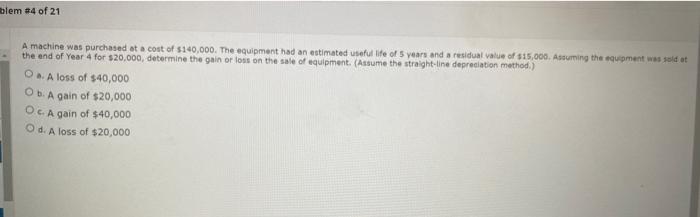

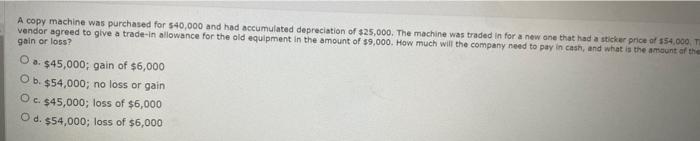

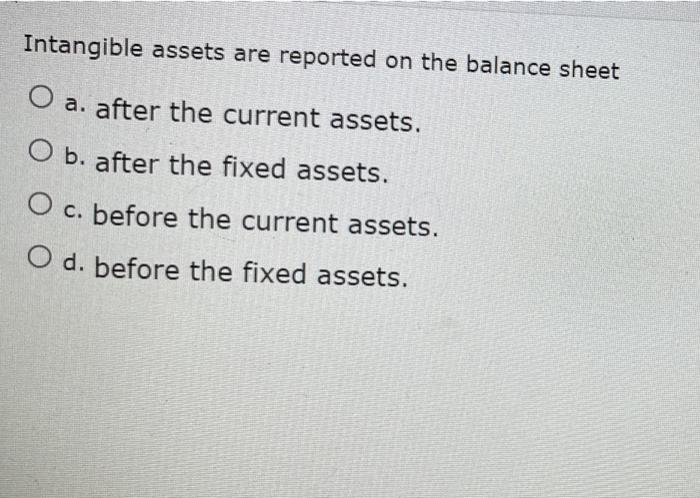

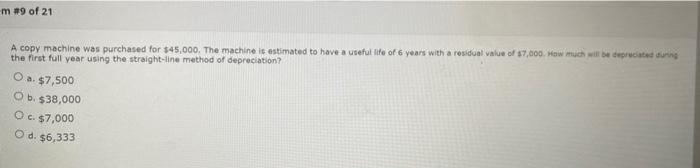

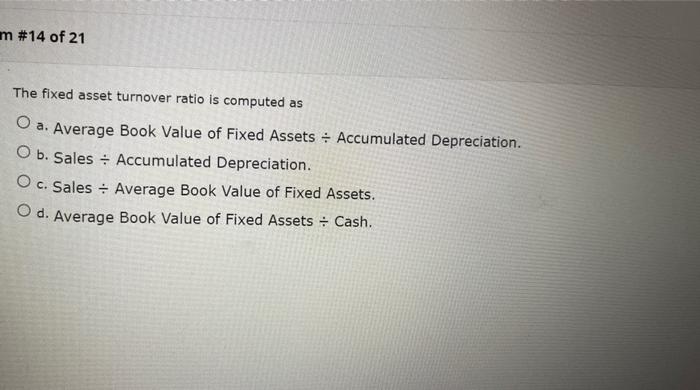

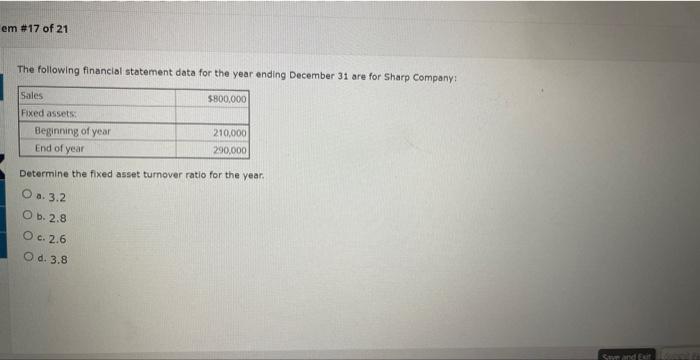

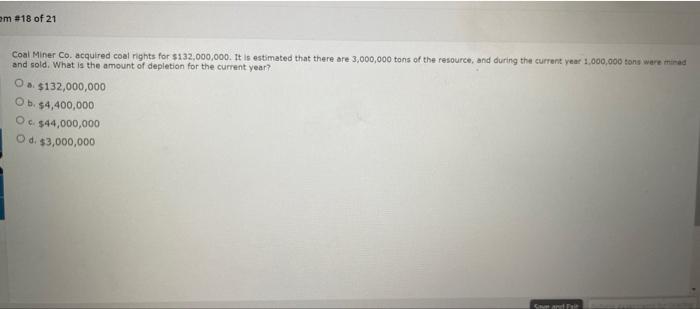

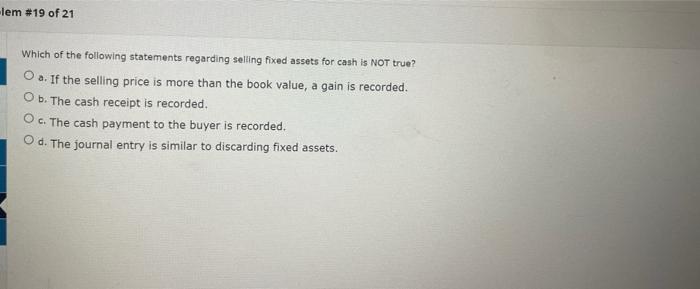

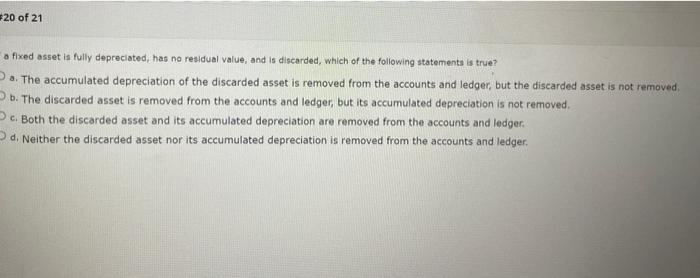

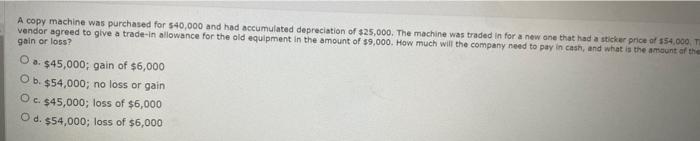

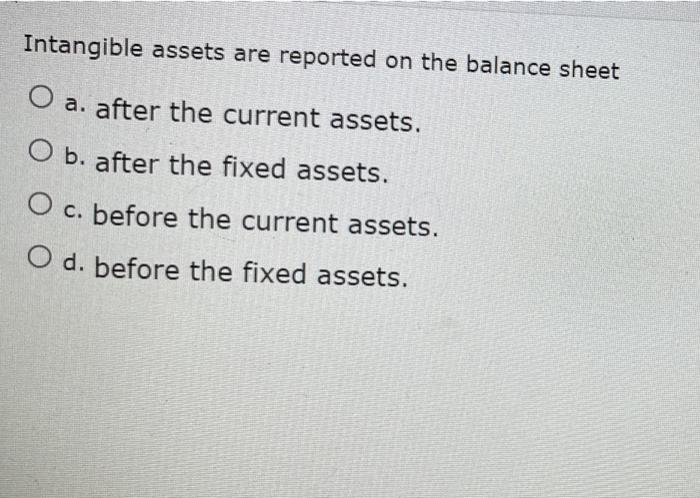

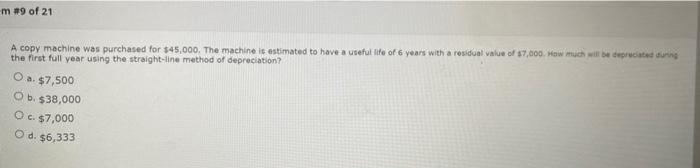

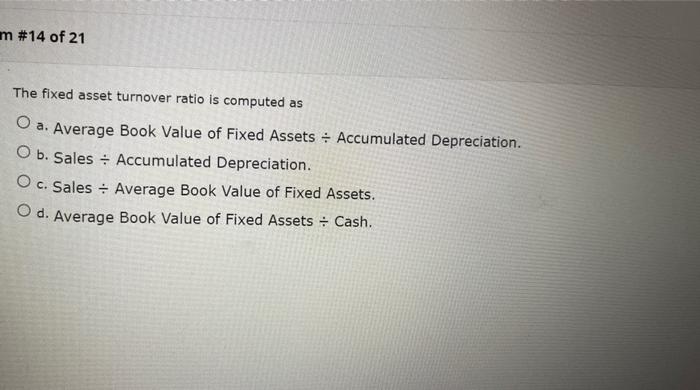

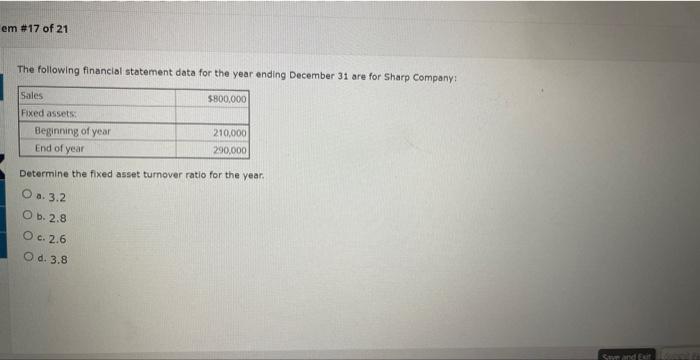

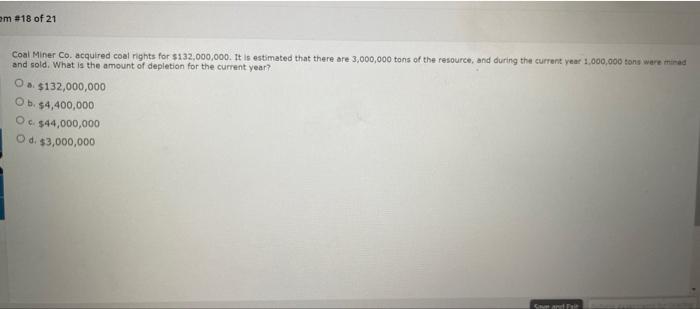

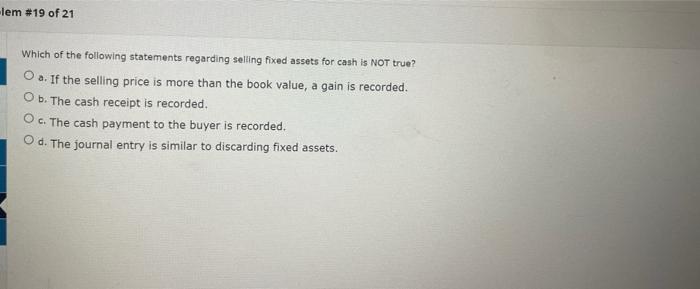

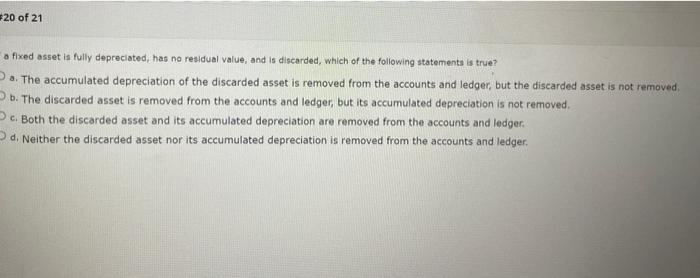

A machine was purchased at a cost of 3140,000 . The equipment had an estimated useful life of 5 years and a residual value of 115,000 , Assuming the equepment was sold ot the end of Year 4 for $20,000, determine the gain or loss on the sale of equipment. (Assume the straight-line depreciation method.). a. A loss of $40,000 b. A gain of $20,000 c. A gain of $40,000 d. A loss of $20,000 A copy machine was purchased for 540,000 and had accumulated depreciation of $25,000. The machine was traded in for a new one that had a sticker price of 154,000 . 7 vendor agreed to give a trade-in allowance for the old equipment in the amount of 39,000 . How much will the company need to pay in cash, and what is the armsunt af the a. $45,000; gain of $6,000 b. $54,000; no loss or 9 ain c. $45,000; loss of $6,000 d. $54,000; loss of $6,000 Intangible assets are reported on the balance sheet a. after the current assets. b. after the fixed assets. c. before the current assets. d. before the fixed assets. A copy mechine was purchased for $45,000. The machine is estimated to have a useful life of 6 years with a residual value of s7,000. 3 igw much wir se irgruciates surns the first full year using the straight-line method of depreciation? a. $7,500 b. 538,000 c. $7,000 d. $6,333 The fixed asset turnover ratio is computed as a. Average Book Value of Fixed Assets Accumulated Depreciation. b. Sales Accumulated Depreciation. c. Sales Average Book Value of Fixed Assets. d. Average Book Value of Fixed Assets Cash. The following financial statement data for the year ending December 31 are for Sharp Company: Determine the fixed asset tumover ratio for the year. a. 3.2 b. 2.8 c. 2,6 d. 3.8 Coal Miner Co. acquired coal rights for $132,000,000. It is estimated that there are 3,000,000 tons of the resource; and during the current year 1,000,000 tons were inirad and sold. What is the amount of depletion for the current year? a. $132,000,000 b. $4,400,000 c. $44,000,000 d. $3,000,000 Which of the following statements regarding selling fixed assets for cash is NOT true? a. If the selling price is more than the book value, a gain is recorded. b. The cash receipt is recorded. c. The cash payment to the buyer is recorded. d. The journal entry is similar to discarding fixed assets. o fixed asset is fully depreciated, has no residual value, and is discarded, which of the following statements is true? a. The accumulated depreciation of the discarded asset is removed from the accounts and ledger, but the discarded asset is not removed, b. The discarded asset is removed from the accounts and ledger, but its accumulated depreciation is not removed. c. Both the discarded asset and its accumulated depreciation are removed from the accounts and ledger: d. Neither the discarded asset nor its accumulated depreciation is removed from the accounts and ledger

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started