Answered step by step

Verified Expert Solution

Question

1 Approved Answer

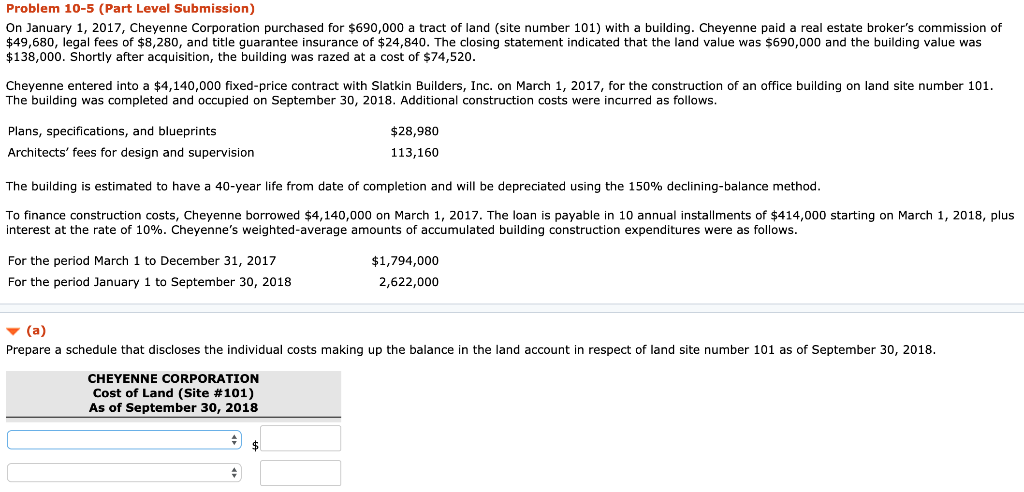

please choose from those choices Problem 10-5 (Part Level Submission) On January 1, 2017, Cheyenne Corporation purchased for $690,000 a tract of land (site number

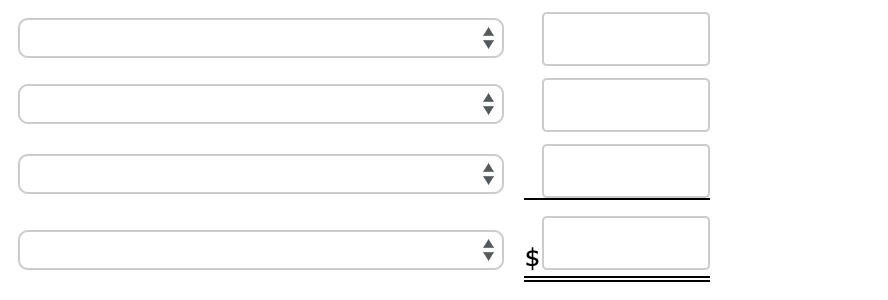

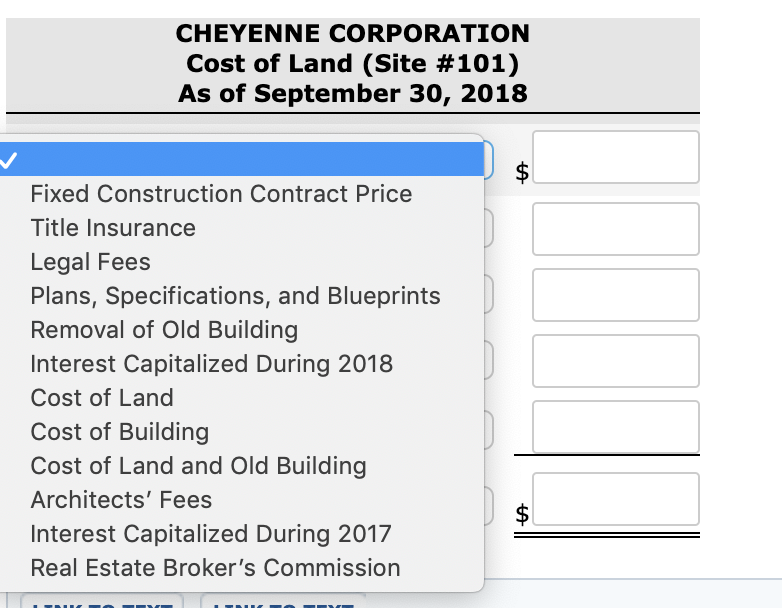

please choose from those choices

Problem 10-5 (Part Level Submission) On January 1, 2017, Cheyenne Corporation purchased for $690,000 a tract of land (site number 101) with a building. Cheyenne paid a real estate broker's commission of $49,680, legal fees of $8,280, and title guarantee insurance of $24,840. The closing statement indicated that the land value was $690,000 and the building value was $138,000. Shortly after acquisition, the building was razed at cost of $74,520. Cheyenne entered into a $4,140,000 fixed-price contract with Slatkin Builders, Inc. on March 1, 2017, for the construction of an office building on land site number 101. The building was completed and occupied on September 30, 2018. Additional construction costs were incurred as follows. Plans, specifications, and blueprints $28,980 Architects' fees for design and supervision 113,160 The building is estimated to have a 40-year life from date of completion and will be depreciated using the 150% declining-balance method. To finance construction costs, Cheyenne borrowed $4,140,000 on March 1, 2017. The loan is payable in 10 annual installments of $414,000 starting on March 1, 2018, plus interest at the rate of 10%. Cheyenne's weighted-average amounts of accumulated building construction expenditures were as follows For the period March 1 to December 31, 2017 $1,794,000 For the period January 1 to September 30, 2018 2,622,000 (a) Prepare a schedule that discloses the individual costs making up the balance n the land account in respect of land site number 101 as of September 30, 2018. CHEYENNE CORPORATION Cost of Land (Site #101) As of September 30, 2018 $ CHEYENNE CORPORATION Cost of Land (Site #101) As of September 30, 2018 $ Fixed Construction Contract Price Title Insurance Legal Fees Plans, Specifications, and Blueprints Removal of Old Building Interest Capitalized During 2018 Cost of Land Cost of Building Cost of Land and Old Building Architects' Fees $ Interest Capitalized During 2017 Real Estate Broker's Commission tAStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started