Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please choose the correct answers for these MCQ'S. Question 4 Ignoring GST, what is the correct accounting entry that would need to be made for

Please choose the correct answers for these MCQ'S.

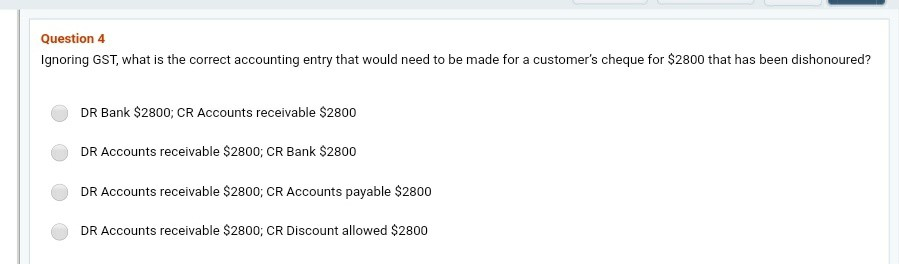

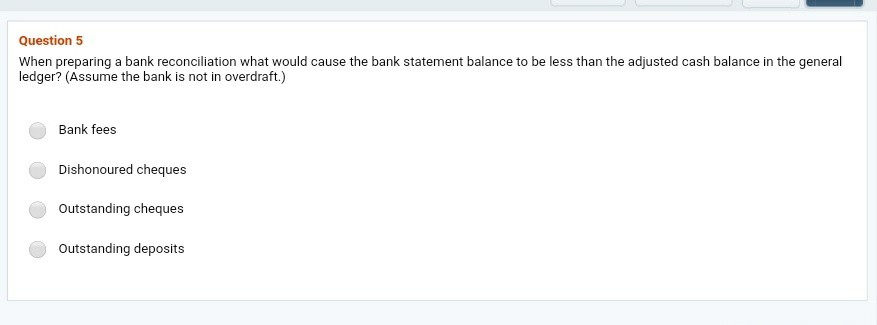

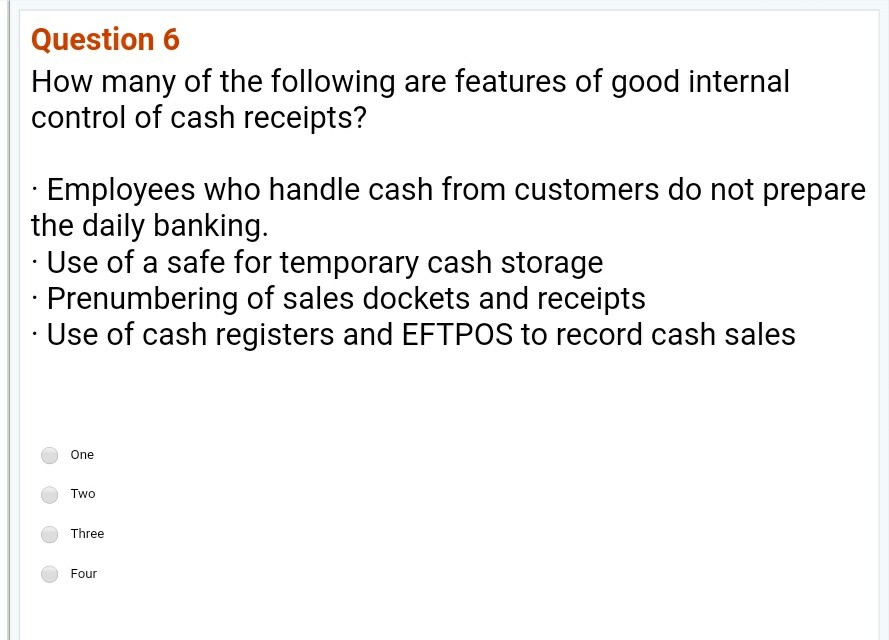

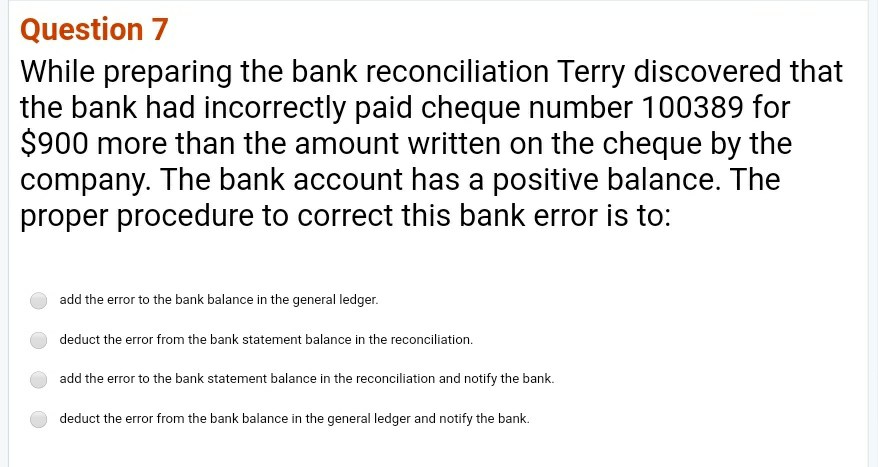

Question 4 Ignoring GST, what is the correct accounting entry that would need to be made for a customer's cheque for $2800 that has been dishonoured? DR Bank $2800; CR Accounts receivable $2800 DR Accounts receivable $2800; CR Bank $2800 DR Accounts receivable $2800; CR Accounts payable $2800 DR Accounts receivable $2800; CR Discount allowed $2800 Question 5 When preparing a bank reconciliation what would cause the bank statement balance to be less than the adjusted cash balance in the general ledger? (Assume the bank is not in overdraft.) Bank fees Dishonoured cheques Outstanding cheques Outstanding deposits Question 6 How many of the following are features of good internal control of cash receipts? Employees who handle cash from customers do not prepare the daily banking. Use of a safe for temporary cash storage Prenumbering of sales dockets and receipts Use of cash registers and EFTPOS to record cash sales One Two Three Four Question 7 While preparing the bank reconciliation Terry discovered that the bank had incorrectly paid cheque number 100389 for $900 more than the amount written on the cheque by the company. The bank account has a positive balance. The proper procedure to correct this bank error is to: add the error to the bank balance in the general ledger. deduct the error from the bank statement balance in the reconciliation. add the error to the bank statement balance in the reconciliation and notify the bank. deduct the error from the bank balance in the general ledger and notify the bankStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started