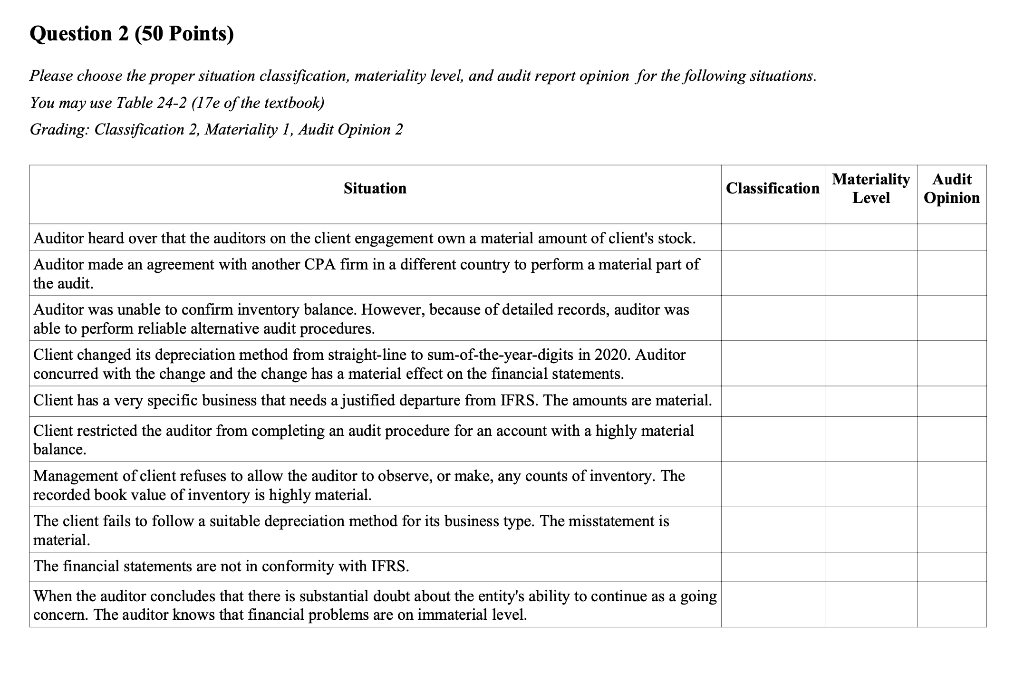

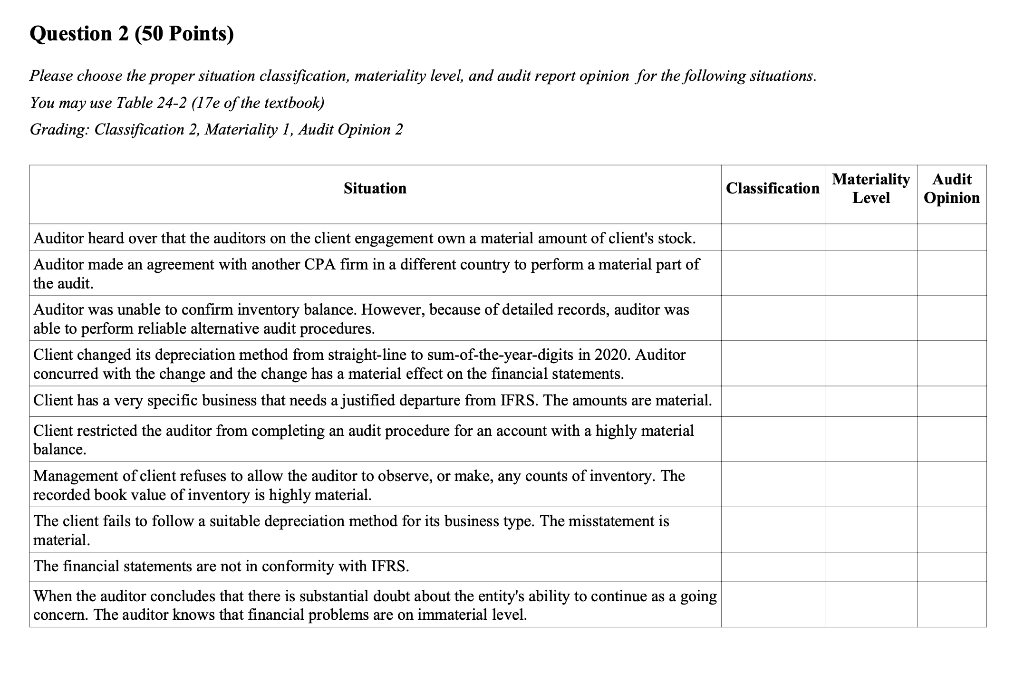

Please choose the proper situation classification, materiality level, and audit report opinion for the following situations. You may use Table 24-2 (17e of the textbook) Grading: Classification 2, Materiality 1, Audit Opinion 2

| Situation | Classification | Materiality Level | Audit Opinion |

| Auditor heard over that the auditors on the client engagement own a material amount of client's stock. | | | |

| Auditor made an agreement with another CPA firm in a different country to perform a material part of the audit. | | | |

| Auditor was unable to confirm inventory balance. However, because of detailed records, auditor was able to perform reliable alternative audit procedures. | | | |

| Client changed its depreciation method from straight-line to sum-of-the-year-digits in 2020. Auditor concurred with the change and the change has a material effect on the financial statements. | | | |

| Client has a very specific business that needs a justified departure from IFRS. The amounts are material. | | | |

| Client restricted the auditor from completing an audit procedure for an account with a highly material balance. | | | |

| Management of client refuses to allow the auditor to observe, or make, any counts of inventory. The recorded book value of inventory is highly material. | | | |

| The client fails to follow a suitable depreciation method for its business type. The misstatement is material. | | | |

| The financial statements are not in conformity with IFRS. | | | |

| When the auditor concludes that there is substantial doubt about the entity's ability to continue as a going concern. The auditor knows that financial problems are on immaterial level. | | | |

Question 2 (50 Points) Please choose the proper situation classification, materiality level, and audit report opinion for the following situations. You may use Table 24-2 (17e of the textbook) Grading: Classification 2, Materiality 1, Audit Opinion 2 Situation Classification Materiality Level Audit Opinion Auditor heard over that the auditors on the client engagement own a material amount of client's stock. Auditor made an agreement with another CPA firm in a different country to perform a material part of the audit. Auditor was unable to confirm inventory balance. However, because of detailed records, auditor was able to perform reliable alternative audit procedures. Client changed its depreciation method from straight-line to sum-of-the-year-digits in 2020. Auditor concurred with the change and the change has a material effect on the financial statements. Client has a very specific business that needs a justified departure from IFRS. The amounts are material. Client restricted the auditor from completing an audit procedure for an account with a highly material balance. Management of client refuses to allow the auditor to observe, or make, any counts of inventory. The recorded book value of inventory is highly material. The client fails to follow a suitable depreciation method for its business type. The misstatement is material. The financial statements are not in conformity with IFRS. When the auditor concludes that there is substantial doubt about the entity's ability to continue as a going concern. The auditor knows that financial problems are on immaterial level. Question 2 (50 Points) Please choose the proper situation classification, materiality level, and audit report opinion for the following situations. You may use Table 24-2 (17e of the textbook) Grading: Classification 2, Materiality 1, Audit Opinion 2 Situation Classification Materiality Level Audit Opinion Auditor heard over that the auditors on the client engagement own a material amount of client's stock. Auditor made an agreement with another CPA firm in a different country to perform a material part of the audit. Auditor was unable to confirm inventory balance. However, because of detailed records, auditor was able to perform reliable alternative audit procedures. Client changed its depreciation method from straight-line to sum-of-the-year-digits in 2020. Auditor concurred with the change and the change has a material effect on the financial statements. Client has a very specific business that needs a justified departure from IFRS. The amounts are material. Client restricted the auditor from completing an audit procedure for an account with a highly material balance. Management of client refuses to allow the auditor to observe, or make, any counts of inventory. The recorded book value of inventory is highly material. The client fails to follow a suitable depreciation method for its business type. The misstatement is material. The financial statements are not in conformity with IFRS. When the auditor concludes that there is substantial doubt about the entity's ability to continue as a going concern. The auditor knows that financial problems are on immaterial level