Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please clarify what is wrong here. Suppose in its income statement for the year ended June 30, 2017, The Clorox Company reported the following condensed

Please clarify what is wrong here.

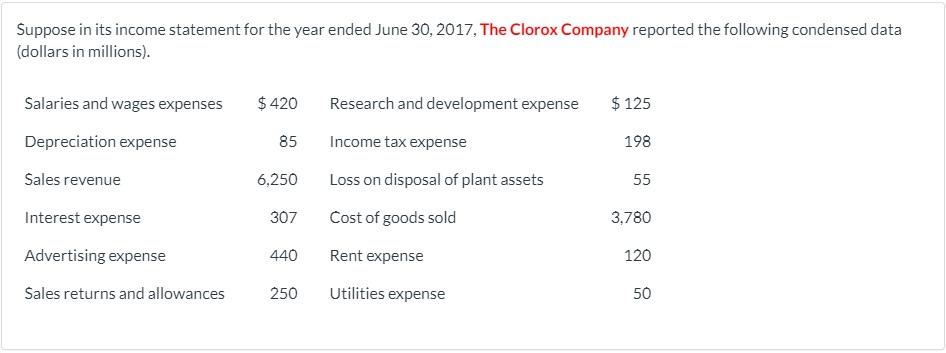

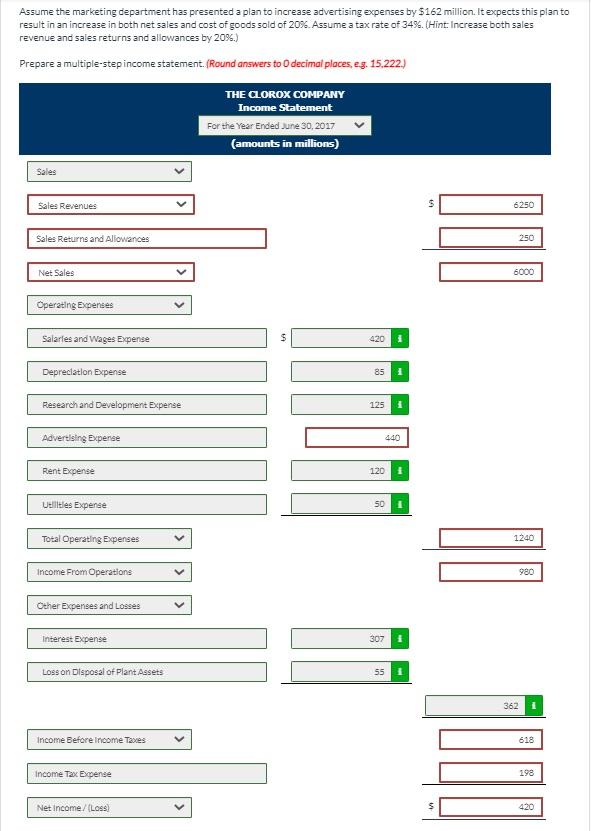

Suppose in its income statement for the year ended June 30, 2017, The Clorox Company reported the following condensed data (dollars in millions). Salaries and wages expenses $ 420 Research and development expense $ 125 Depreciation expense 85 Income tax expense 198 Sales revenue 6,250 Loss on disposal of plant assets 55 Interest expense 307 Cost of goods sold 3.780 Advertising expense 440 Rent expense 120 Sales returns and allowances 250 Utilities expense 50 Assume the marketing department has presented a plan to increase advertising expenses by $162 million. It expects this plan to result in an increase in both net sales and cost of goods sold of 20%. Assume a tax rate of 3495. (Hint: Increase both sales revenue and sales returns and allowances by 2095.) Prepare a multiple-step income statement. (Round answers to decimal places, eg. 15.222.) THE CLOROX COMPANY Income Statement For the Year Ended June 30, 2017 (amounts in millions) Sales Sales Revenues 6250 Sales Returns and Allowances 250 Net Sales 6000 Operating Expenses Salaries and Wages Expense $ 420 Depreciation Expense 85 Research and Development Expense 125 Advertising Expense 440 Rent Expense 120 Utilitles Expende 50 Total Operating Expenses 1240 Income From Operations V 980 Other Expenses and Losses Interest Expense 307 Loss on Disposal of Plant Assets 55 362 Income Before Income Taxes 618 Income Tax Expense 198 Net Income/(Los) 420Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started