Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please compare two Canadian companies on behalf of image instructions Project Project Scenario You have been an Analyst for the professional service firm, FINACC LLP.

please compare two Canadian companies on behalf of image instructions

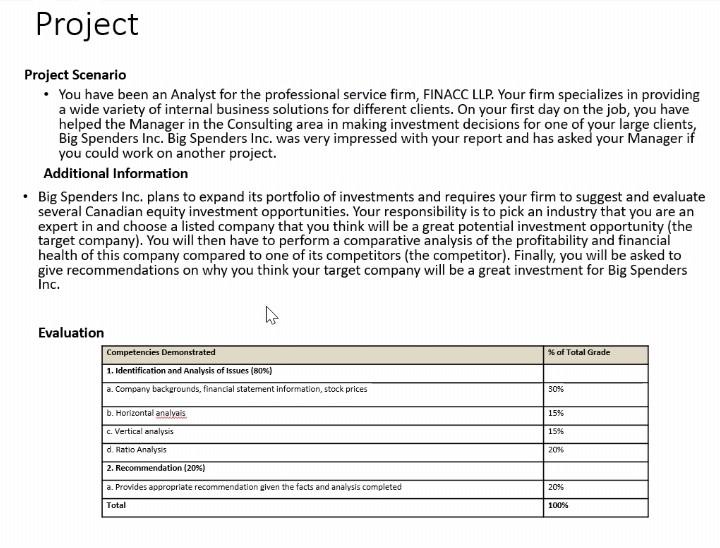

Project Project Scenario You have been an Analyst for the professional service firm, FINACC LLP. Your firm specializes in providing a wide variety of internal business solutions for different clients. On your first day on the job, you have helped the Manager in the Consulting area in making investment decisions for one of your large clients, Big Spenders Inc. Big Spenders Inc. was very impressed with your report and has asked your Manager if you could work on another project. Additional Information Big Spenders Inc. plans to expand its portfolio of investments and requires your firm to suggest and evaluate several Canadian equity investment opportunities. Your responsibility is to pick an industry that you are an expert in and choose a listed company that you think will be a great potential investment opportunity (the target company). You will then have to perform a comparative analysis of the profitability and financial health of this company compared to one of its competitors (the competitor). Finally, you will be asked to give recommendations on why you think your target company will be a great investment for Big Spenders Inc. % of Total Grade Evaluation Competencies Demonstrated 1. Identification and Analysis of Issues (80%) a. Company backgrounds, financial statement information, stock prices 30% 15% b. Horizontal analvais c. Vertical analysis d. Ratio Analysis 15% 20% 2. Recommendation (20%) a. Provides appropriate recommendation given the facts and analysis completed 20% Total 100% Project Project Scenario You have been an Analyst for the professional service firm, FINACC LLP. Your firm specializes in providing a wide variety of internal business solutions for different clients. On your first day on the job, you have helped the Manager in the Consulting area in making investment decisions for one of your large clients, Big Spenders Inc. Big Spenders Inc. was very impressed with your report and has asked your Manager if you could work on another project. Additional Information Big Spenders Inc. plans to expand its portfolio of investments and requires your firm to suggest and evaluate several Canadian equity investment opportunities. Your responsibility is to pick an industry that you are an expert in and choose a listed company that you think will be a great potential investment opportunity (the target company). You will then have to perform a comparative analysis of the profitability and financial health of this company compared to one of its competitors (the competitor). Finally, you will be asked to give recommendations on why you think your target company will be a great investment for Big Spenders Inc. % of Total Grade Evaluation Competencies Demonstrated 1. Identification and Analysis of Issues (80%) a. Company backgrounds, financial statement information, stock prices 30% 15% b. Horizontal analvais c. Vertical analysis d. Ratio Analysis 15% 20% 2. Recommendation (20%) a. Provides appropriate recommendation given the facts and analysis completed 20% Total 100%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started