please compelte all parts

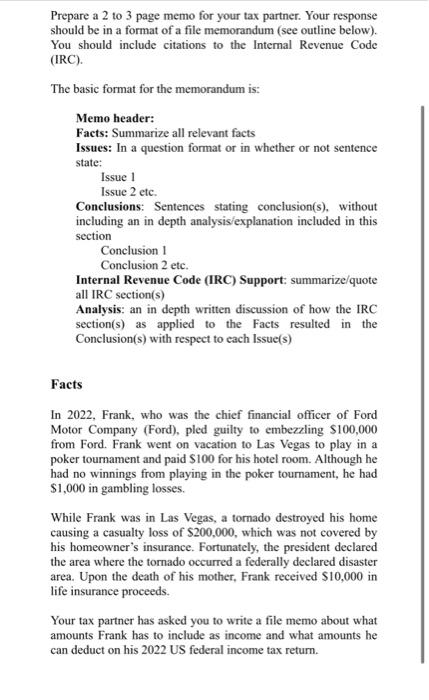

- Content knowledge item 1: Identify tax planning opportunities, strategies, and techniques using the US federal income tax laws - Content knowledge item 2: Analyze the legal and ethical considerations of tax planning strategies and techniques using US federal income tax laws 1. Step 1: Read the case 2. Step 2: Identify the legal issues 3. Step 3: To answer the identified legal issues, research the Internal Revenue Code and other tax sources 4. Step 4: Apply the results of legal research to the identified legal issues 5. Step 5: Determine the conclusions to the identified legal issues 6. Step 6: Write a memo (see requirements and other information in the attached Word Document) Prepare a 2 to 3 page memo for your tax partner. Your response should be in a format of a file memorandum (see outline below). You should include citations to the Internal Revenue Code (IRC). The basic format for the memorandum is: Memo header: Facts: Summarize all relevant facts Issues: In a question format or in whether or not sentence state: Issue 1 Issue 2ctc. Conclusions: Sentences stating conclusion(s), without including an in depth analysis/explanation included in this section Conclusion 1 Conclusion 2 etc. Internal Revenue Code (IRC) Support: summarize/quote all IRC section(s) Analysis: an in depth written discussion of how the IRC section(s) as applied to the Facts resulted in the Conclusion(s) with respect to each Issue(s) Facts In 2022, Frank, who was the chief financial officer of Ford Motor Company (Ford), pled guilty to embezzling $100,000 from Ford. Frank went on vacation to Las Vegas to play in a poker tournament and paid $100 for his hotel room. Although he had no winnings from playing in the poker tournament, he had $1,000 in gambling losses. While Frank was in Las Vegas, a tornado destroyed his home causing a casualty loss of $200,000, which was not covered by his homeowner's insurance. Fortunately, the president declared the area where the tormado occurred a federally declared disaster area. Upon the death of his mother, Frank received $10,000 in life insurance proceeds. Your tax partner has asked you to write a file memo about what amounts Frank has to include as income and what amounts he can deduct on his 2022 US federal income tax return