Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete a,b,c,d. P6-4 Pete Mouton trades as Pieman Pete from a mobile kiosk which is parked on a plot of land on the outskirts

Please complete a,b,c,d.

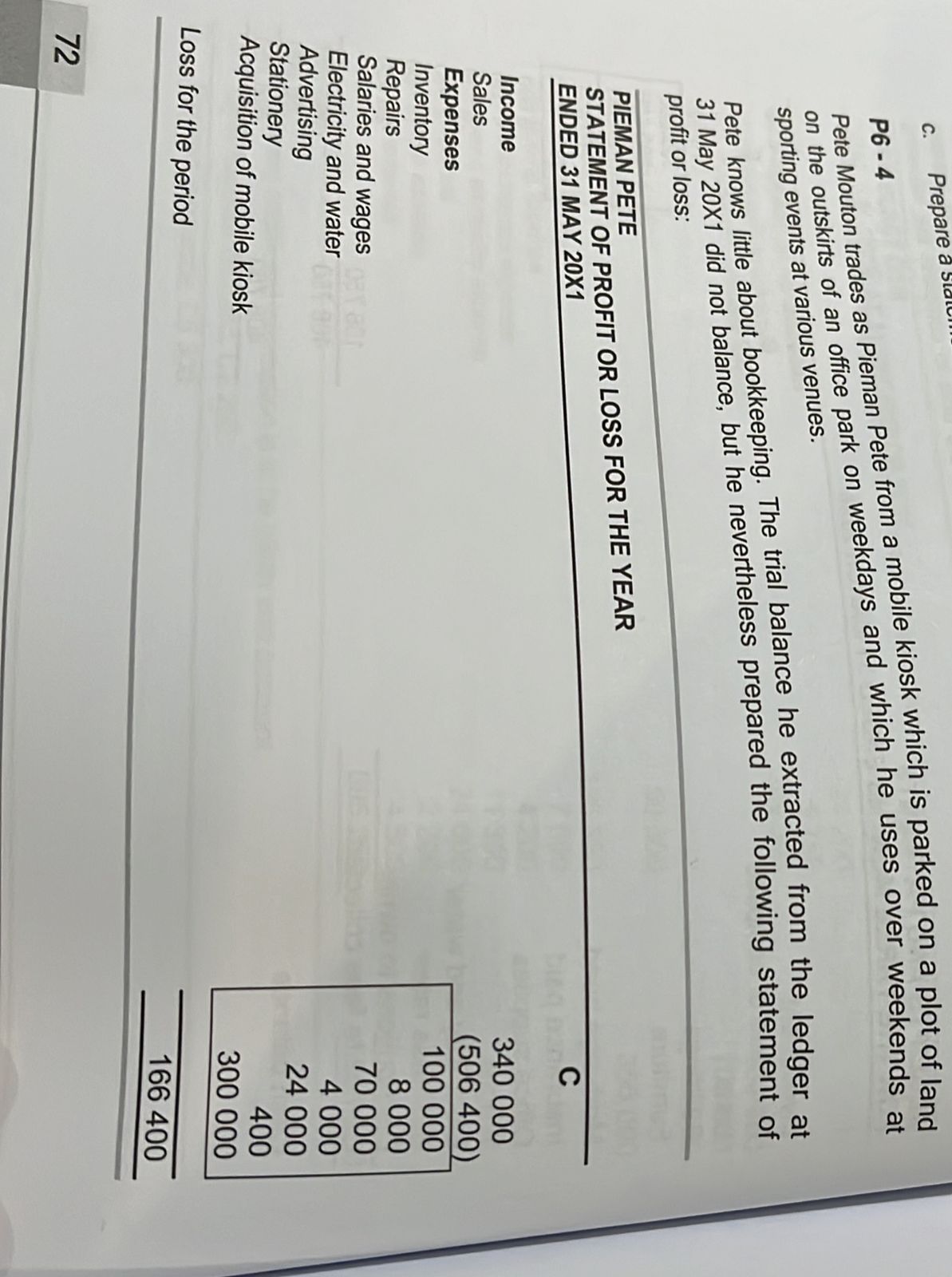

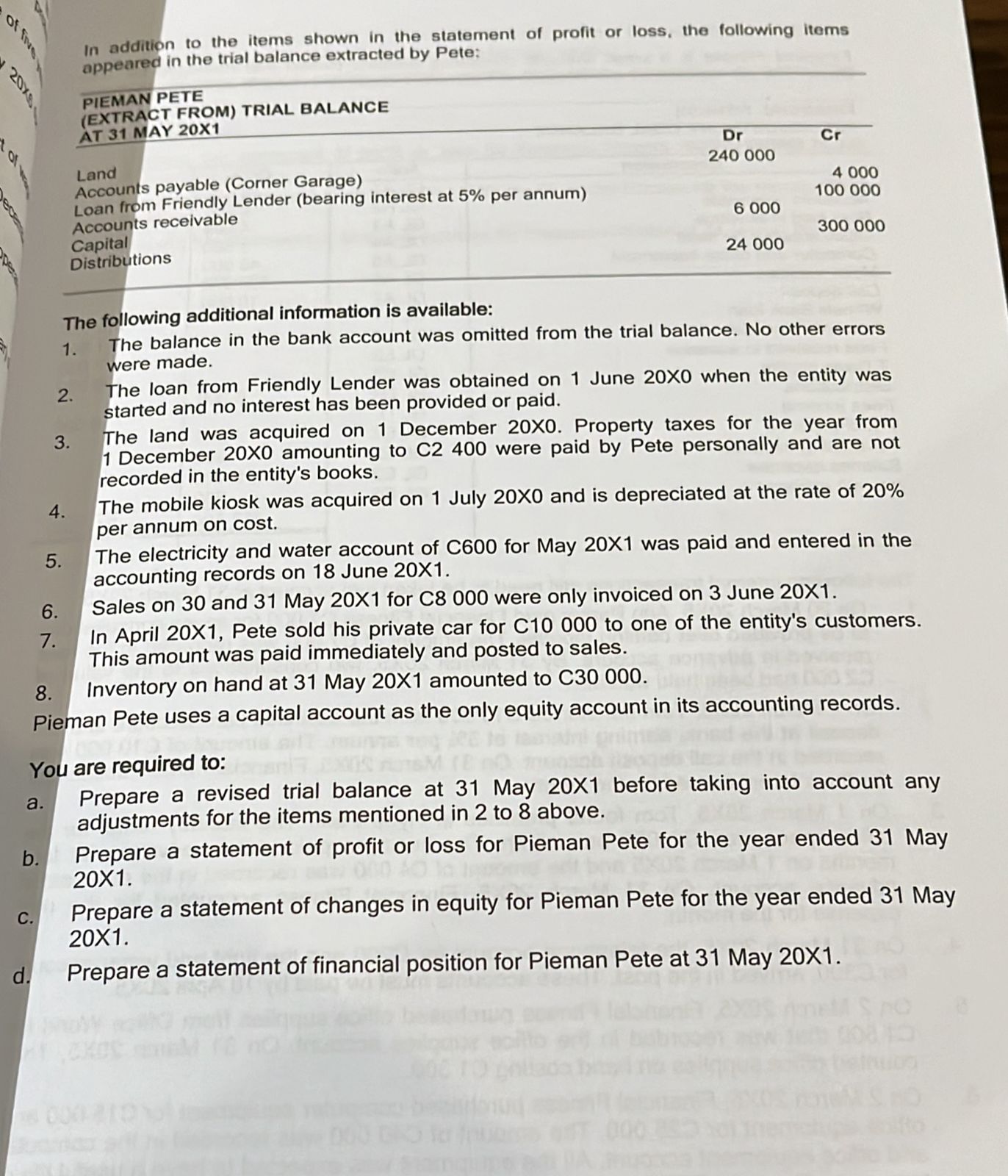

P6-4 Pete Mouton trades as Pieman Pete from a mobile kiosk which is parked on a plot of land on the outskirts of an office park on weekdays and which he uses over weekends at In addition to the items shown in the statement of profit or loss, the following items appeared in the trial balance extracted by Pete: The following additional information is available: 1. The balance in the bank account was omitted from the trial balance. No other errors were made. 2. The loan from Friendly Lender was obtained on 1 June 200 when the entity was started and no interest has been provided or paid. 3. The land was acquired on 1 December 20X0. Property taxes for the year from 1 December 200 amounting to C2 400 were paid by Pete personally and are not recorded in the entity's books. 4. The mobile kiosk was acquired on 1 July 200 and is depreciated at the rate of 20% per annum on cost. 5. The electricity and water account of C600 for May 201 was paid and entered in the accounting records on 18 June 201. 6. Sales on 30 and 31 May 201 for C8 000 were only invoiced on 3 June 201. 7. In April 20X1, Pete sold his private car for C10 000 to one of the entity's customers. This amount was paid immediately and posted to sales. 8. Inventory on hand at 31 May 201 amounted to C30 000. Pieman Pete uses a capital account as the only equity account in its accounting records. You are required to: a. Prepare a revised trial balance at 31 May 201 before taking into account any adjustments for the items mentioned in 2 to 8 above. b. Prepare a statement of profit or loss for Pieman Pete for the year ended 31 May 201. Prepare a statement of changes in equity for Pieman Pete for the year ended 31 May 201. Prepare a statement of financial position for Pieman Pete at 31 May 201. P6-4 Pete Mouton trades as Pieman Pete from a mobile kiosk which is parked on a plot of land on the outskirts of an office park on weekdays and which he uses over weekends at In addition to the items shown in the statement of profit or loss, the following items appeared in the trial balance extracted by Pete: The following additional information is available: 1. The balance in the bank account was omitted from the trial balance. No other errors were made. 2. The loan from Friendly Lender was obtained on 1 June 200 when the entity was started and no interest has been provided or paid. 3. The land was acquired on 1 December 20X0. Property taxes for the year from 1 December 200 amounting to C2 400 were paid by Pete personally and are not recorded in the entity's books. 4. The mobile kiosk was acquired on 1 July 200 and is depreciated at the rate of 20% per annum on cost. 5. The electricity and water account of C600 for May 201 was paid and entered in the accounting records on 18 June 201. 6. Sales on 30 and 31 May 201 for C8 000 were only invoiced on 3 June 201. 7. In April 20X1, Pete sold his private car for C10 000 to one of the entity's customers. This amount was paid immediately and posted to sales. 8. Inventory on hand at 31 May 201 amounted to C30 000. Pieman Pete uses a capital account as the only equity account in its accounting records. You are required to: a. Prepare a revised trial balance at 31 May 201 before taking into account any adjustments for the items mentioned in 2 to 8 above. b. Prepare a statement of profit or loss for Pieman Pete for the year ended 31 May 201. Prepare a statement of changes in equity for Pieman Pete for the year ended 31 May 201. Prepare a statement of financial position for Pieman Pete at 31 May 201Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started