Please complete all of the requirements. Thank you!

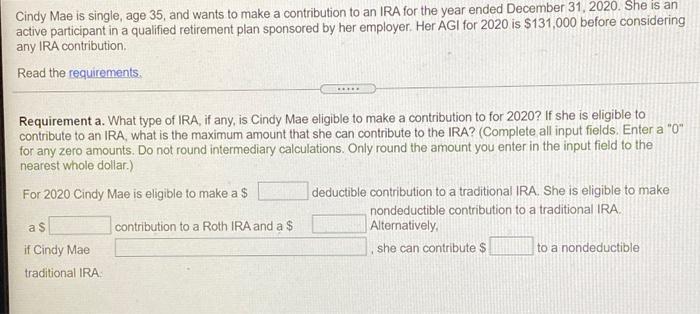

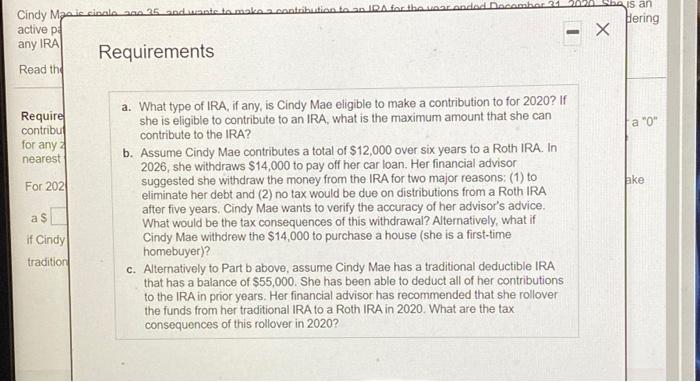

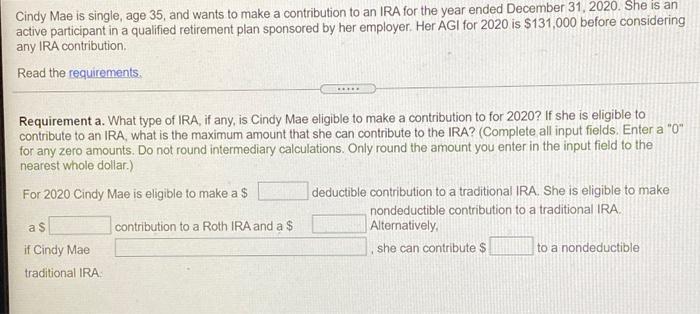

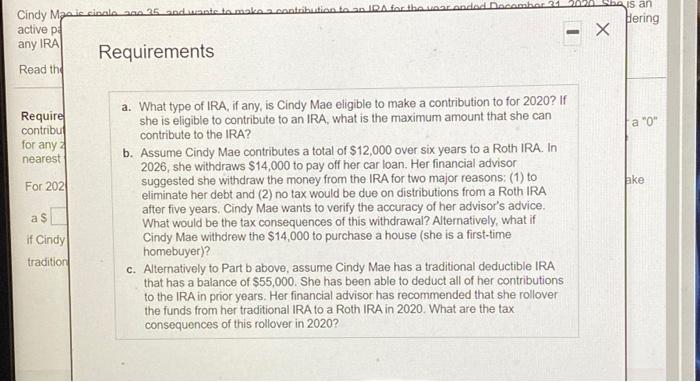

Cindy Mae is single, age 35 and wants to make a contribution to an IRA for the year ended December 31, 2020. She is an active participant in a qualified retirement plan sponsored by her employer. Her AGI for 2020 is $131,000 before considering any IRA contribution Read the requirements Requirement a. What type of IRA, if any, is Cindy Mae eligible to make a contribution to for 2020? If she is eligible to contribute to an IRA, what is the maximum amount that she can contribute to the IRA? (Complete all input fields. Enter a "0" for any zero amounts. Do not round intermediary calculations. Only round the amount you enter in the input field to the nearest whole dollar.) For 2020 Cindy Mae is eligible to make a $ deductible contribution to a traditional IRA. She is eligible to make nondeductible contribution to a traditional IRA. as contribution to a Roth IRA and a $ Alternatively, if Cindy Mae she can contribute $ to a nondeductible traditional IRA is an Hering Cindy Mae e cinco ano 25 and want to make a contribution to an IRA for the car onded December 24 active pl Requirements Read the any IRA Require contribu ta '09 for any nearest ake For 2021 a s a. What type of IRA, if any, is Cindy Mae eligible to make a contribution to for 2020? If she is eligible to contribute to an IRA, what is the maximum amount that she can contribute to the IRA? b. Assume Cindy Mae contributes a total of $12,000 over six years to a Roth IRA. In 2026, she withdraws $14,000 to pay off her car loan. Her financial advisor suggested she withdraw the money from the IRA for two major reasons: (1) to eliminate her debt and (2) no tax would be due on distributions from a Roth IRA after five years. Cindy Mae wants to verify the accuracy of her advisor's advice. What would be the tax consequences of this withdrawal? Alternatively, what if Cindy Mae withdrew the $14,000 to purchase a house (she is a first-time homebuyer)? c. Alternatively to Part b above, assume Cindy Mae has a traditional deductible IRA that has a balance of $55,000. She has been able to deduct all of her contributions to the IRA in prior years. Her financial advisor has recommended that she rollover the funds from her traditional IRA to a Roth IRA in 2020. What are the tax consequences of this rollover in 2020? if Cindy tradition