Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please complete all of the requirements. thank you Connor, whose tax rate is 32%, sells each of the following assets for $235,000. Each case is

please complete all of the requirements. thank you

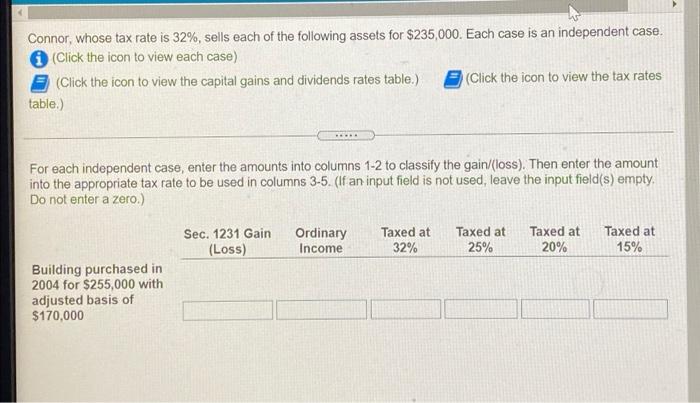

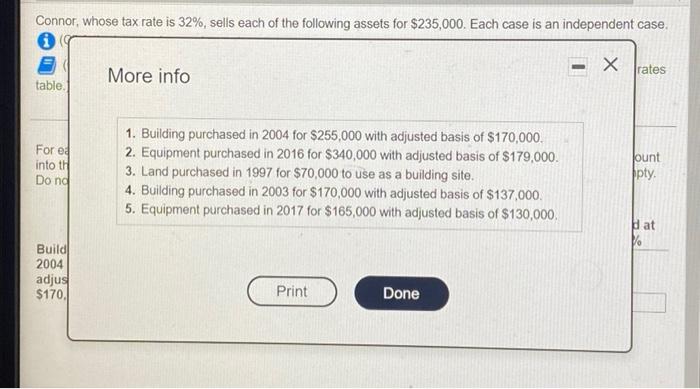

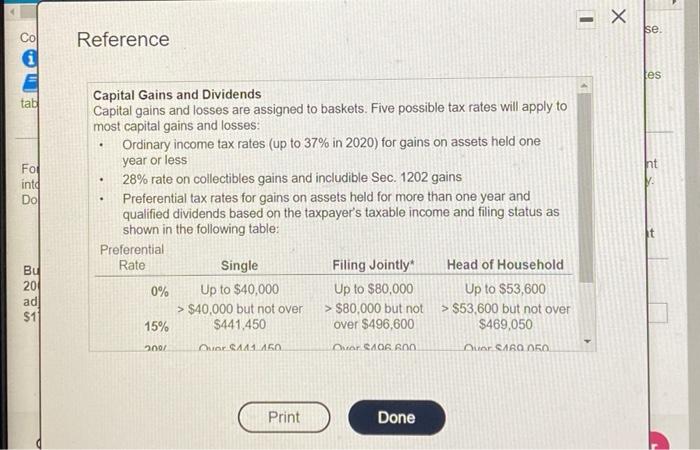

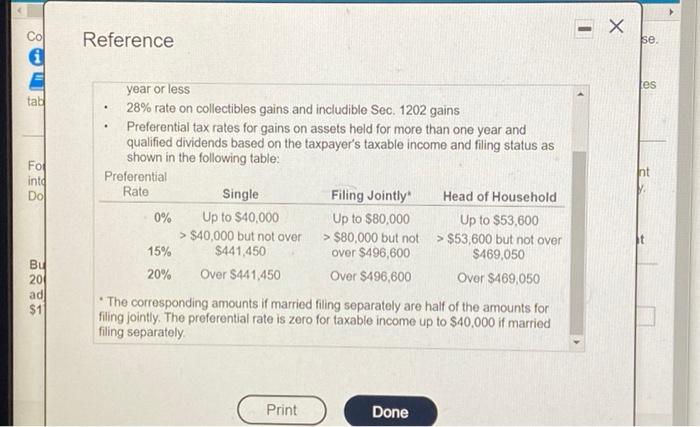

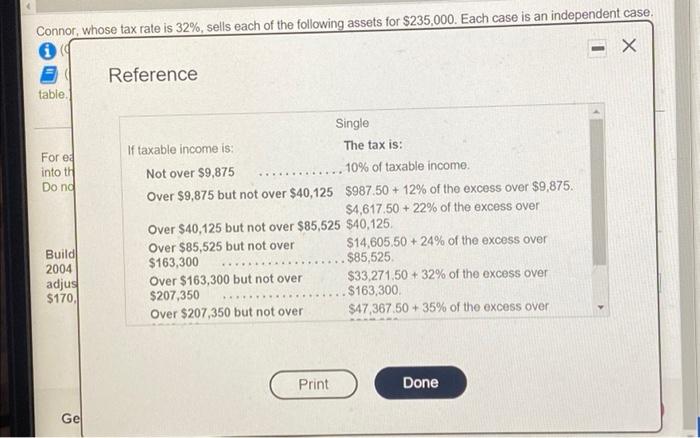

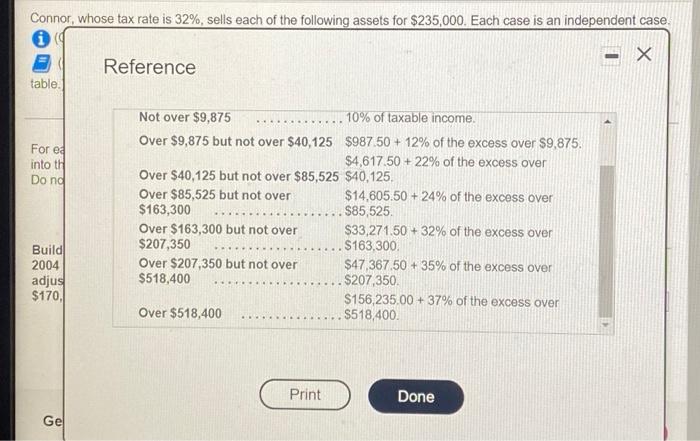

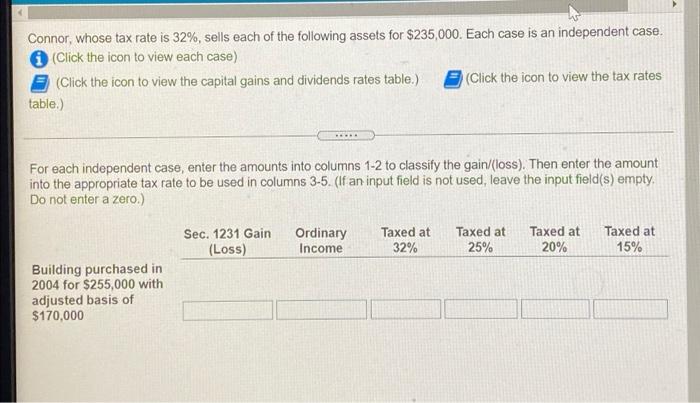

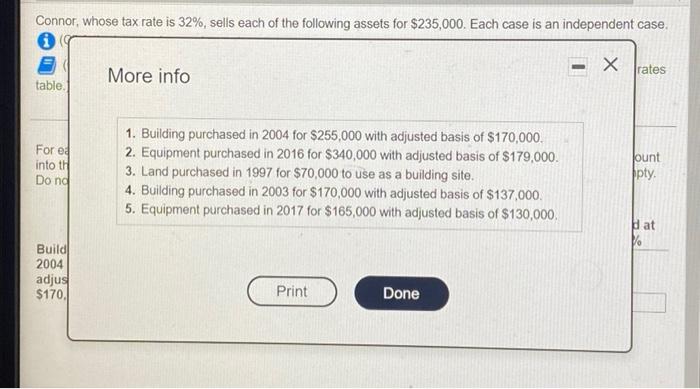

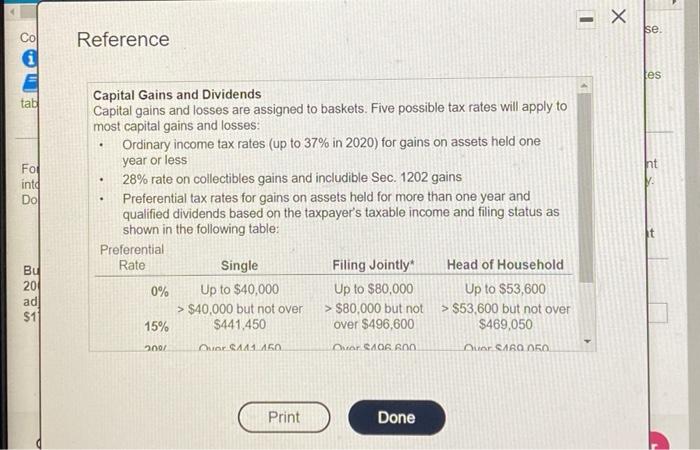

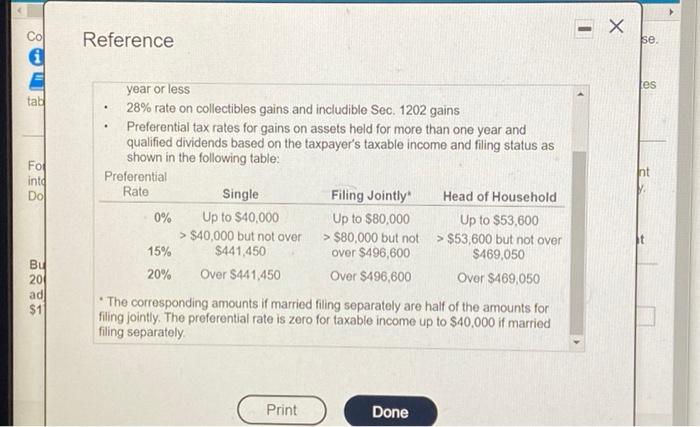

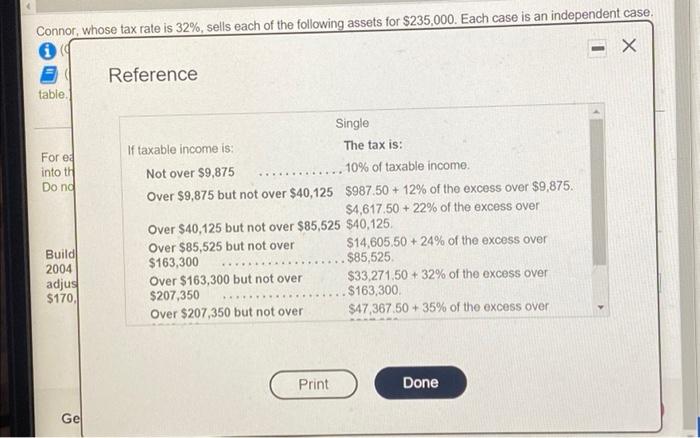

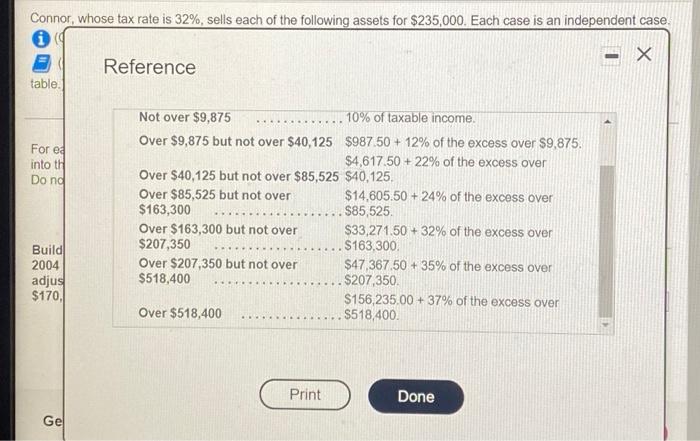

Connor, whose tax rate is 32%, sells each of the following assets for $235,000. Each case is an independent case. (Click the icon to view each case) (Click the icon to view the capital gains and dividends rates table.) (Click the icon to view the tax rates table.) For each independent case, enter the amounts into columns 1-2 to classify the gain/loss). Then enter the amount into the appropriate tax rate to be used in columns 3-5. (If an input field is not used, leave the input field(s) empty. Do not enter a zero.) Sec. 1231 Gain (Loss) Ordinary Income Taxed at 32% Taxed at 25% Taxed at Taxed 20% 15% Building purchased in 2004 for $255,000 with adjusted basis of $170,000 Connor, whose tax rate is 32%, sells each of the following assets for $235,000. Each case is an independent case. x rates More info table. Fored into tH Dond 1. Building purchased in 2004 for $255,000 with adjusted basis of $170,000 2. Equipment purchased in 2016 for $340,000 with adjusted basis of $179,000. 3. Land purchased in 1997 for $70,000 to use as a building site. 4. Building purchased in 2003 for $170,000 with adjusted basis of $137,000 5. Equipment purchased in 2017 for $165,000 with adjusted basis of $130,000 ount fpty Hat Build 2004 adjus $170. Print Done 1 se. Reference tes tal . Foll into Dol . Capital Gains and Dividends Capital gains and losses are assigned to baskets. Five possible tax rates will apply to most capital gains and losses: Ordinary income tax rates (up to 37% in 2020) for gains on assets held one year or less 28% rate on collectibles gains and includible Sec. 1202 gains Preferential tax rates for gains on assets held for more than one year and qualified dividends based on the taxpayer's taxable income and filing status as shown in the following table: Preferential Rate Single Filing Jointly Head of Household 0% Up to $40,000 Up to $80,000 Up to $53,600 > $40,000 but not over > $80,000 but not > $53,600 but not over 15% $441,450 over $496,600 $469,050 Our CA 450 Over S106.600 Our SABA050 It Bu 20 ad $1 2001 Print Done - X CO Reference se les tal . Foll into DO year or less 28% rate on collectibles gains and includible Sec, 1202 gains Preferential tax rates for gains on assets held for more than one year and qualified dividends based on the taxpayer's taxable income and filing status as shown in the following table: Preferential Rate Single Filing Jointly Head of Household 0% Up to $40,000 Up to $80,000 Up to $53,600 > $40,000 but not over > $80,000 but not > $53,600 but not over 15% $441,450 over $496,600 $469,050 20% Over $441,450 Over $496,600 Over $469,050 The corresponding amounts if married filing separately are half of the amounts for filing jointly. The preferential rate is zero for taxable income up to $40,000 if married filing separately Bu 20 ad $1 Print Done Connor, whose tax rate is 32%, sells each of the following assets for $235.000. Each case is an independent case. Reference table Fored into the Do nd Single If taxable income is: The tax is: Not over $9,875 10% of taxable income. Over $9,875 but not over $40,125 $987.50 + 12% of the excess over $9,875. $4,617.50 + 22% of the excess over Over $40,125 but not over $85,525 $40,125 Over $85,525 but not over $14,605,50 +24% of the excess over $163,300 $85,525 Over $163,300 but not over $33,271.50 + 32% of the excess over $207,350 $163,300 Over $207,350 but not over $47,367.50 + 35% of the excess over Build 2004 adjus $170, Print Done Ge Connor, whose tax rate is 32%, sells each of the following assets for $235,000. Each case is an independent case. 09 Reference table . Fored into the Do nd Not over $9,875 10% of taxable income. Over $9,875 but not over $40,125 $987.50 + 12% of the excess over $9,875. $4,617.50 +22% of the excess over Over $40,125 but not over $85,525 $40,125. Over $85,525 but not over $14,605.50 +24% of the excess over $163,300 $85,525. Over $163,300 but not over $33,271.50 + 32% of the excess over $207,350 $ 163,300 Over $207,350 but not over $47,367.50 + 35% of the excess over $518,400 $207,350 $156,235.00 + 37% of the excess over Over $518,400 $518,400. Build 2004 adjus $170,1 Print Done Gel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started