Please complete all of the requirements/parts. Please do not respond unless you are able to complete all of the requirements.

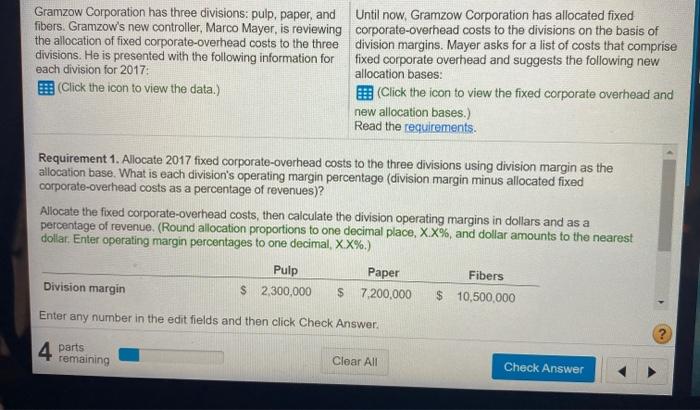

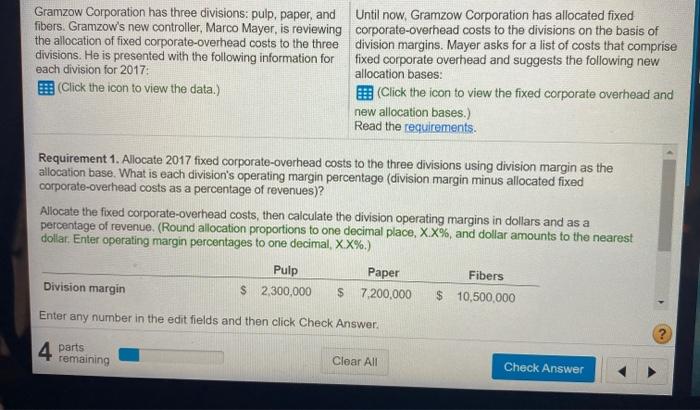

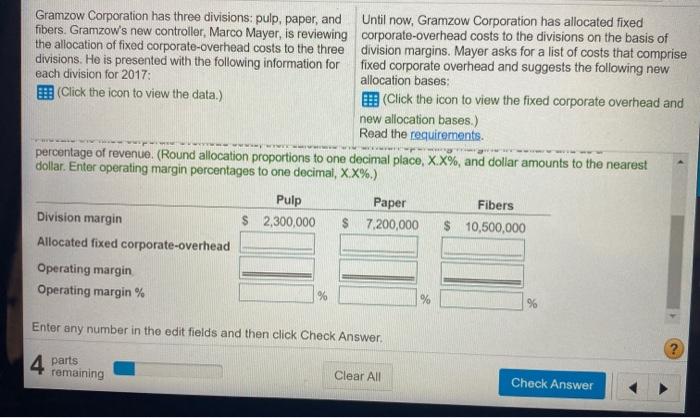

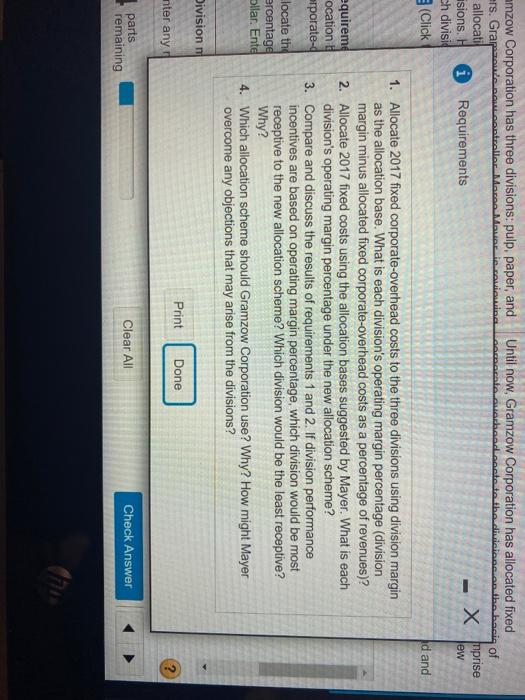

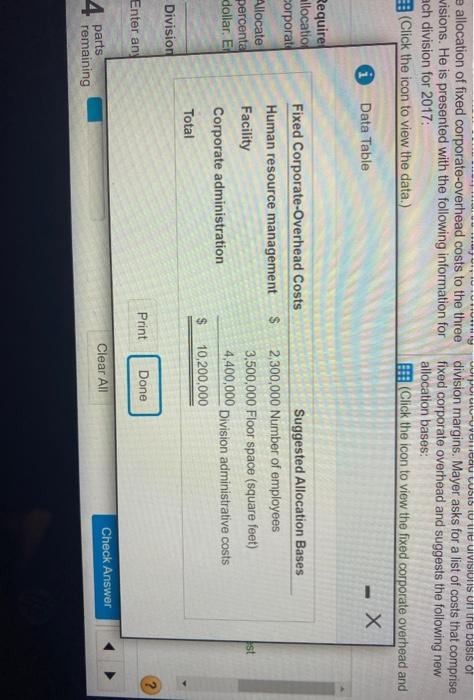

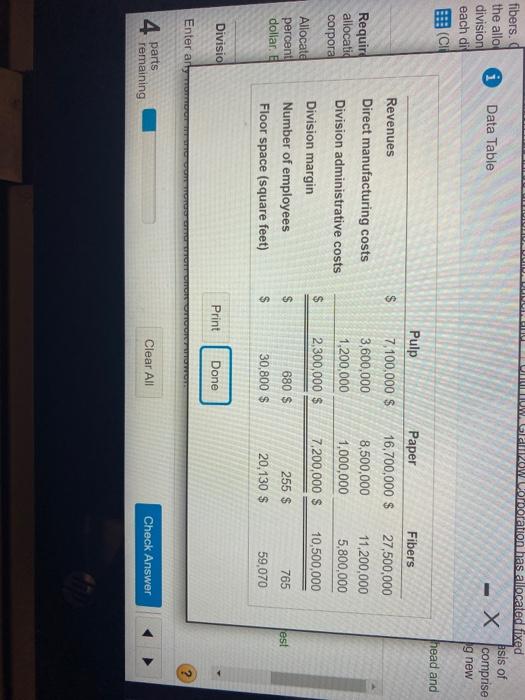

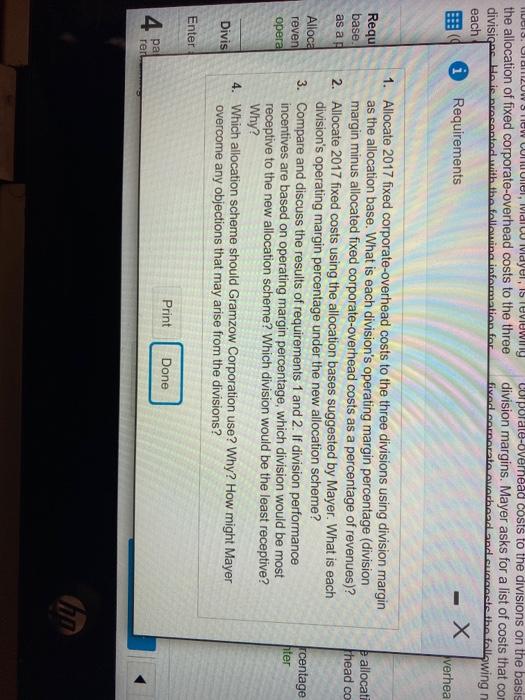

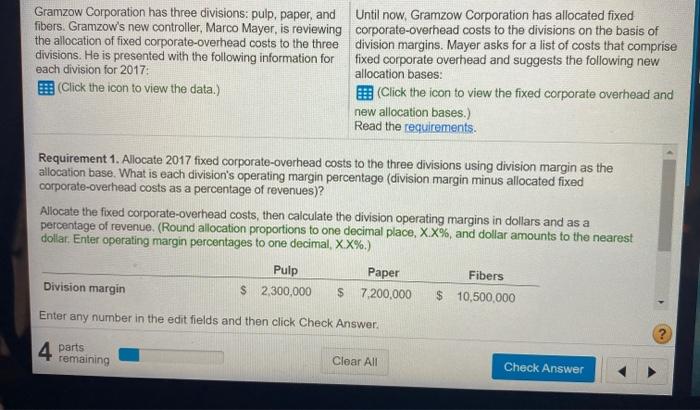

Gramzow Corporation has three divisions: pulp, paper, and Until now. Gramzow Corporation has allocated fixed fibers. Gramzow's new controller, Marco Mayer, is reviewing corporate-overhead costs to the divisions on the basis of the allocation of fixed corporate-overhead costs to the three division margins. Mayer asks for a list of costs that comprise divisions. He is presented with the following information for fixed corporate overhead and suggests the following new each division for 2017: allocation bases: (Click the icon to view the data.) (Click the icon to view the fixed corporate overhead and new allocation bases.) Read the requirements Requirement 1. Allocate 2017 fixed corporate-overhead costs to the three divisions using division margin as the allocation base. What is each division's operating margin percentage (division margin minus allocated fixed corporate-overhead costs as a percentage of revenues)? Allocate the fixed corporate-overhead costs, then calculate the division operating margins in dollars and as a percentage of revenue. (Round allocation proportions to one decimal place, X.X%, and dollar amounts to the nearest dollar. Enter operating margin percentages to one decimal, XX%.) Pulp Paper Fibers Division margin $ 2,300,000 $ 7.200,000 $ 10,500,000 Enter any number in the edit fields and then click Check Answer. 4 parts remaining Clear All Check Answer Gramzow Corporation has three divisions: pulp, paper, and Until now, Gramzow Corporation has allocated fixed fibers. Gramzow's new controller, Marco Mayer, is reviewing corporate-overhead costs to the divisions on the basis of the allocation of fixed corporate-overhead costs to the three division margins. Mayer asks for a list of costs that comprise divisions. He is presented with the following information for fixed corporate overhead and suggests the following new each division for 2017: allocation bases: (Click the icon to view the data.) Click the icon to view the fixed corporate overhead and new allocation bases.) Read the requirements percentage of revenue. (Round allocation proportions to one decimal place, X.X%, and dollar amounts to the nearest dollar. Enter operating margin percentages to one decimal, X.X%.) Pulp Paper Fibers Division margin $ 2,300,000 $ 7.200,000 $ 10,500,000 Allocated fixed corporate-overhead Operating margin Operating margin % % % Enter any number in the edit fields and then click Check Answer, 4 parts remaining Clear All Check Answer rs . Gra= Until now, Gramzow Corporation has allocated fixed wachandangto do the divisions. the basis of SOS mmzow Corporation has three divisions: pulp, paper, and . allocati isions. 1 Requirements sh divisid (Click x frprise ew d and equireme ocation orporate- locate the ercentage ollar. Ente 1. Allocate 2017 fixed corporate-overhead costs to the three divisions using division margin as the allocation base. What is each division's operating margin percentage (division margin minus allocated fixed corporate-overhead costs as a percentage of revenues)? 2. Allocate 2017 fixed costs using the allocation bases suggested by Mayer. What is each division's operating margin percentage under the new allocation scheme? 3. Compare and discuss the results of requirements 1 and 2. If division performance incentives are based on operating margin percentage, which division would be most receptive to the new allocation scheme? Which division would be the least receptive? Why? 4. Which allocation scheme should Gramzow Corporation use? Why? How might Mayer overcome any objections that may arise from the divisions? Division Print Done nter any ? parts remaining Clear All Check Answer FRIGOU WOUIVISIONIS Ull the basis OT e allocation of fixed corporate-overhead costs to the three division margins. Mayer asks for a list of costs that comprise visions. He is presented with the following information for fixed corporate overhead and suggests the following new ach division for 2017: allocation bases: (Click the icon to view the data.) (Click the icon to view the fixed corporate overhead and i Data Table Require allocation corporate Allocate percenta dollar Fixed Corporate-Overhead Costs Suggested Allocation Bases Human resource management $ 2,300,000 Number of employees Facility 3,500,000 Floor space (square feet) Corporate administration 4,400,000 Division administrative costs $ 10,200,000 Total st Division Print Done Enter an Clear All Check Answer 4 parts remaining ILLUWA Data Table fibers. the allo division each di ECH OW Uomboration has allocated fixed asis of comprise 1g new head and Fibers $ Revenues Direct manufacturing costs Division administrative costs Requir allocatid corpora Pulp 7,100,000 $ 3,600,000 1,200,000 2,300,000 $ Paper 16,700,000 $ 8,500,000 1,000,000 27,500,000 11,200,000 5,800,000 10,500,000 $ 7,200,000 $ Allocate percent dollar. Division margin Number of employees Floor space (square feet) $ 255 $ 765 est 680 $ 30,800 $ $ 20,130 $ 59,070 Divisio Print Done Enter art 4 parts remaining Clear All Check Answer UCIS. UID2UWS TOW VOLUNUI, Iviac Ividyel, IS TUVIUwing the allocation of fixed corporate-overhead costs to the three divisiga Hai Dracontact with the following information for each * Requirements corporale-Vernead costs to the divisions on the basis division margins. Mayer asks for a list of costs that com fived comparato Avadhead and cuacate the following - X verhea Requ base as a e allocati head co Alloca reven opera 1. Allocate 2017 fixed corporate-overhead costs to the three divisions using division margin as the allocation base. What is each division's operating margin percentage (division margin minus allocated fixed corporate-overhead costs as a percentage of revenues)? 2. Allocate 2017 fixed costs using the allocation bases suggested by Mayer. What is each division's operating margin percentage under the new allocation scheme? 3. Compare and discuss the results of requirements 1 and 2. If division performance incentives are based on operating margin percentage, which division would be most receptive to the new allocation scheme? Which division would be the least receptive? Why? 4. Which allocation scheme should Gramzow Corporation use? Why? How might Mayer overcome any objections that may arise from the divisions? rcentage fiter Divis Enter Print Done 4 pa rer