Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please complete ALL parts by creating a memo curry 1. Step 1: Read the case 2. Step 2: Identify the legal issues 3. Step 3:

please complete ALL parts by creating a memo

curry

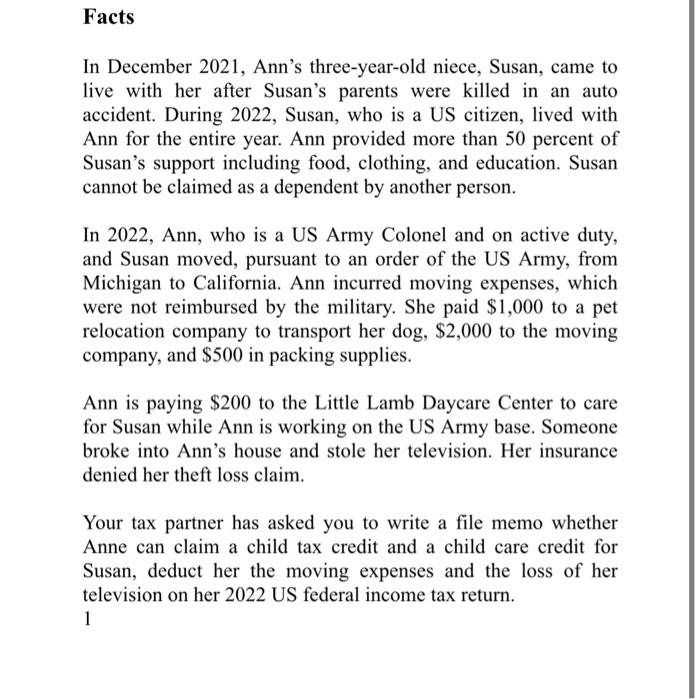

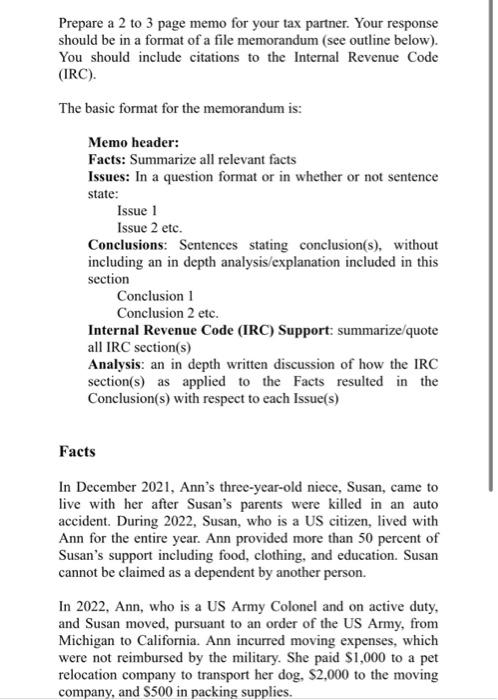

1. Step 1: Read the case 2. Step 2: Identify the legal issues 3. Step 3: To answer the identified legal issues, research the Internal Revenue Code and other tax sources 4. Step 4: Apply the results of legal research to the identified legal issues 5. Step 5: Determine the conclusions to the identified legal issues 6. Step 6: Write a memo (see requirements and Facts In December 2021, Ann's three-year-old niece, Susan, came to live with her after Susan's parents were killed in an auto accident. During 2022, Susan, who is a US citizen, lived with Ann for the entire year. Ann provided more than 50 percent of Susan's support including food, clothing, and education. Susan cannot be claimed as a dependent by another person. In 2022, Ann, who is a US Army Colonel and on active duty, and Susan moved, pursuant to an order of the US Army, from Michigan to California. Ann incurred moving expenses, which were not reimbursed by the military. She paid $1,000 to a pet relocation company to transport her dog, $2,000 to the moving company, and $500 in packing supplies. Ann is paying $200 to the Little Lamb Daycare Center to care for Susan while Ann is working on the US Army base. Someone broke into Ann's house and stole her television. Her insurance denied her theft loss claim. Your tax partner has asked you to write a file memo whether Anne can claim a child tax credit and a child care credit for Susan, deduct her the moving expenses and the loss of her television on her 2022 US federal income tax return. 1 Prepare a 2 to 3 page memo for your tax partner. Your response should be in a format of a file memorandum (see outline below). You should include citations to the Internal Revenue Code (IRC). The basic format for the memorandum is: Memo header: Facts: Summarize all relevant facts Issues: In a question format or in whether or not sentence state: Issue 1 Issue 2 etc. Conclusions: Sentences stating conclusion(s), without including an in depth analysis/explanation included in this section Conclusion 1 Conclusion 2 etc. Internal Revenue Code (IRC) Support: summarize/quote all IRC section(s) Analysis: an in depth written discussion of how the IRC section(s) as applied to the Facts resulted in the Conclusion(s) with respect to each Issue(s) Facts In December 2021, Ann's three-year-old niece, Susan, came to live with her after Susan's parents were killed in an auto accident. During 2022, Susan, who is a US citizen, lived with Ann for the entire year. Ann provided more than 50 percent of Susan's support including food, clothing, and education. Susan cannot be claimed as a dependent by another person. In 2022, Ann, who is a US Army Colonel and on active duty, and Susan moved, pursuant to an order of the US Army, from Michigan to California. Ann incurred moving expenses, which were not reimbursed by the military. She paid $1,000 to a pet relocation company to transport her dog, $2,000 to the moving company, and $500 in packing supplies. 1. Step 1: Read the case 2. Step 2: Identify the legal issues 3. Step 3: To answer the identified legal issues, research the Internal Revenue Code and other tax sources 4. Step 4: Apply the results of legal research to the identified legal issues 5. Step 5: Determine the conclusions to the identified legal issues 6. Step 6: Write a memo (see requirements and Facts In December 2021, Ann's three-year-old niece, Susan, came to live with her after Susan's parents were killed in an auto accident. During 2022, Susan, who is a US citizen, lived with Ann for the entire year. Ann provided more than 50 percent of Susan's support including food, clothing, and education. Susan cannot be claimed as a dependent by another person. In 2022, Ann, who is a US Army Colonel and on active duty, and Susan moved, pursuant to an order of the US Army, from Michigan to California. Ann incurred moving expenses, which were not reimbursed by the military. She paid $1,000 to a pet relocation company to transport her dog, $2,000 to the moving company, and $500 in packing supplies. Ann is paying $200 to the Little Lamb Daycare Center to care for Susan while Ann is working on the US Army base. Someone broke into Ann's house and stole her television. Her insurance denied her theft loss claim. Your tax partner has asked you to write a file memo whether Anne can claim a child tax credit and a child care credit for Susan, deduct her the moving expenses and the loss of her television on her 2022 US federal income tax return. 1 Prepare a 2 to 3 page memo for your tax partner. Your response should be in a format of a file memorandum (see outline below). You should include citations to the Internal Revenue Code (IRC). The basic format for the memorandum is: Memo header: Facts: Summarize all relevant facts Issues: In a question format or in whether or not sentence state: Issue 1 Issue 2 etc. Conclusions: Sentences stating conclusion(s), without including an in depth analysis/explanation included in this section Conclusion 1 Conclusion 2 etc. Internal Revenue Code (IRC) Support: summarize/quote all IRC section(s) Analysis: an in depth written discussion of how the IRC section(s) as applied to the Facts resulted in the Conclusion(s) with respect to each Issue(s) Facts In December 2021, Ann's three-year-old niece, Susan, came to live with her after Susan's parents were killed in an auto accident. During 2022, Susan, who is a US citizen, lived with Ann for the entire year. Ann provided more than 50 percent of Susan's support including food, clothing, and education. Susan cannot be claimed as a dependent by another person. In 2022, Ann, who is a US Army Colonel and on active duty, and Susan moved, pursuant to an order of the US Army, from Michigan to California. Ann incurred moving expenses, which were not reimbursed by the military. She paid $1,000 to a pet relocation company to transport her dog, $2,000 to the moving company, and $500 in packing supplies Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started