Answered step by step

Verified Expert Solution

Question

1 Approved Answer

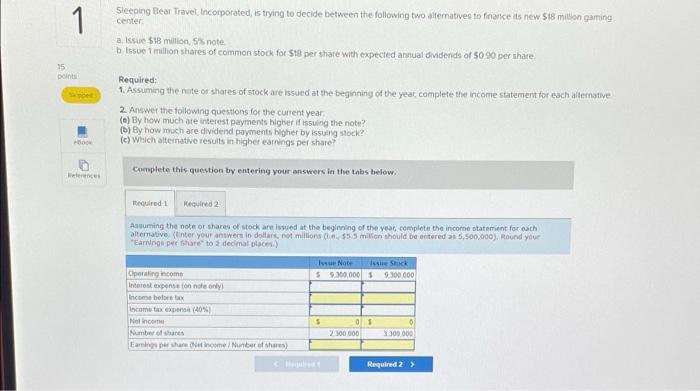

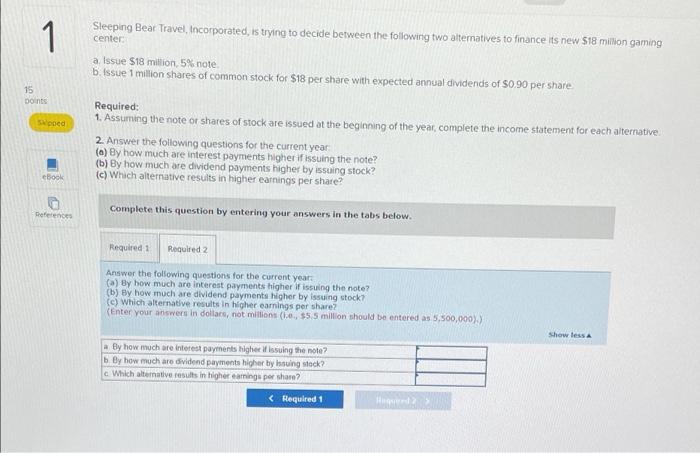

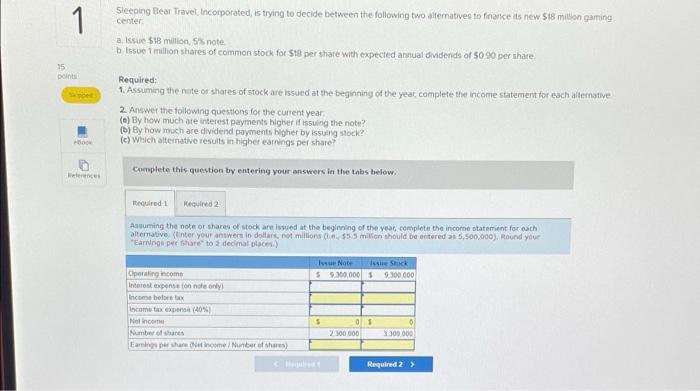

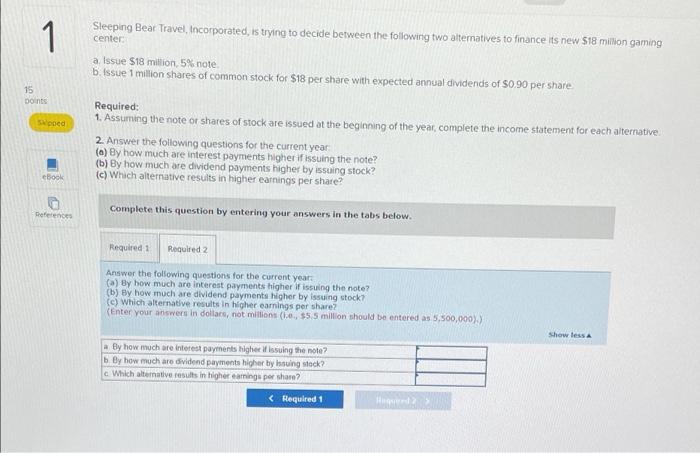

please complete all parts of both questions! thank you 1 Sleeping Bear Travel, Incorporated, is trying to decide between the following two atematives to finance

please complete all parts of both questions! thank you

1 Sleeping Bear Travel, Incorporated, is trying to decide between the following two atematives to finance its new 518 million gaming center a. Issue 518 million, 5 note bIssue 1 million shares of common stock for sta per share with expected annual dividends of 50 90 per share 15 Required: 1. Assuming the note or shares of stock are issued at the beginning of the year, complete the income statement for each alternative 2. Answer the following questions for the current year (6) By how much are interest payments higher if issuing the note? (b) By how much are dividend payments higher by issuing stock? (c) Which alternative results in higher earnings per share Complete this question by entering your answers in the tabs below. Wences Required Required 2 Assuming the note or shares of stock arewed at the beginning of the year, complete the income statement for each alternative enter your answers in dollars, not millions (55.5 milion should be entered a 5.500,000). Round your "Earrings per Share to 2 decimal places) Issue Note Issue Stack $9.300.000 5 9.300 000 Operating income Interest expense onnonly! Income before Locate fix expens(40% Nel com Number of res Eameshare.com/ Numbers) 3 05 2100 000 300000 Required 2 > 1 Sleeping Bear Travel, Incorporated, is trying to decide between the following two alternatives to finance its new $18 million gaming center a Issue $18 million, 5% note b. issue 1 million shares of common stock for $18 per share with expected annual dividends of $0.90 per share 15 Doints poed Required: 1. Assuming the note or shares of stock are issued at the beginning of the year, complete the income statement for each alternative 2. Answer the following questions for the current year (6) By how much are interest payments higher if issuing the note? (b) By how much are dividend payments higher by issuing stock? (c) Which alternative results in higher earnings per share eBook Deferences Complete this question by entering your answers in the tabs below. Required 1 Required 2 Answer the following questions for the current years (a) By how much are interest payments higher if issuing the note? (b) By how much are dividend payments higher by issuing stock? (e) which alternative results in higher earnings per share? (Enter your answers in dollars, not milions ($55 million should be entered as 5.500,000). Show less a By how much are interest payments higher issuing the note? 6 By how much are dividend payments higher by hauing stock? c Witch alternative results in higher earnings per share?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started