Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please complete all parts, thank you! this is what i have so far, i hope this is correct and good enough to proceed on to

please complete all parts, thank you!

this is what i have so far, i hope this is correct and good enough to proceed on to the last 3 parts of the question. thank you for all your help!

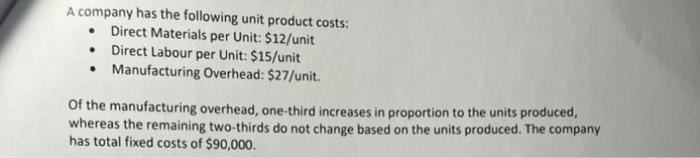

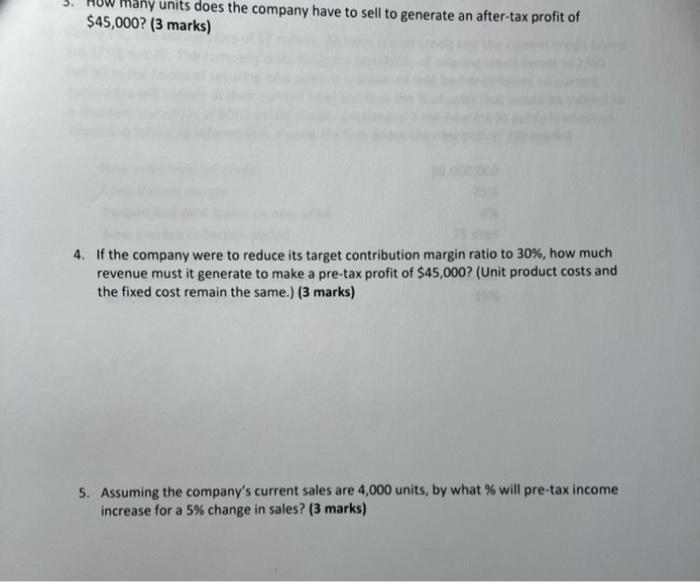

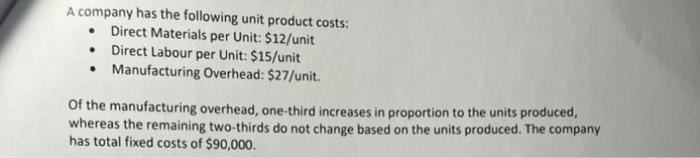

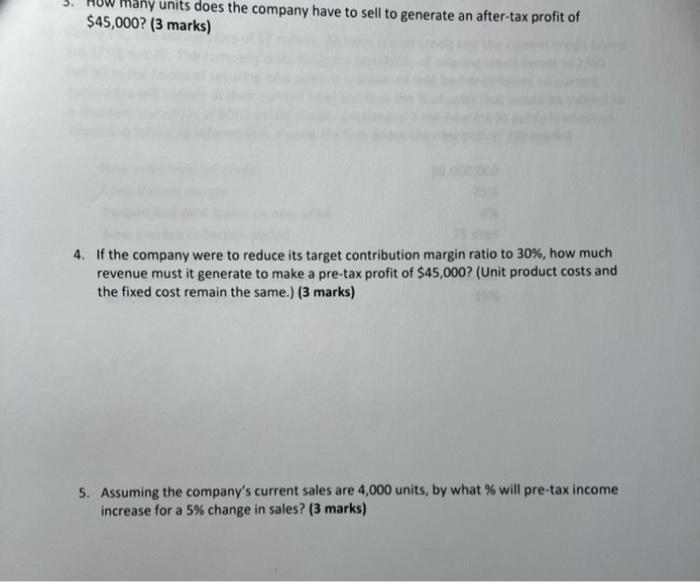

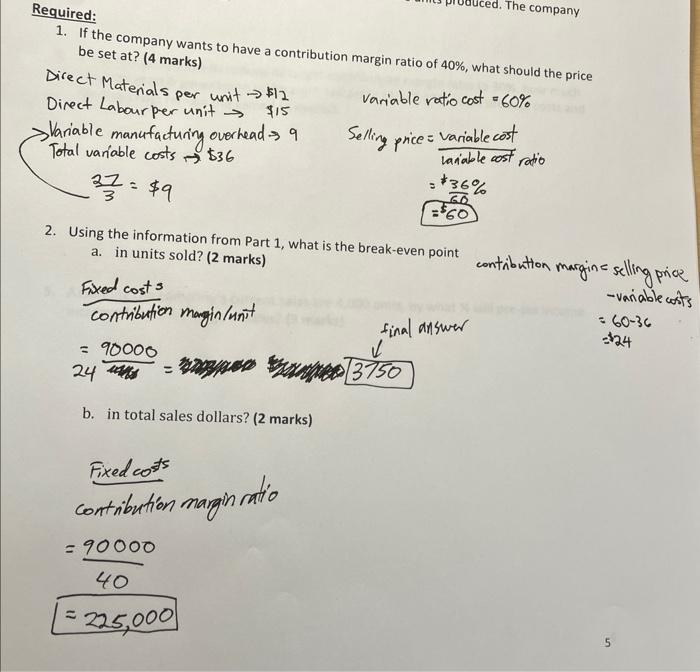

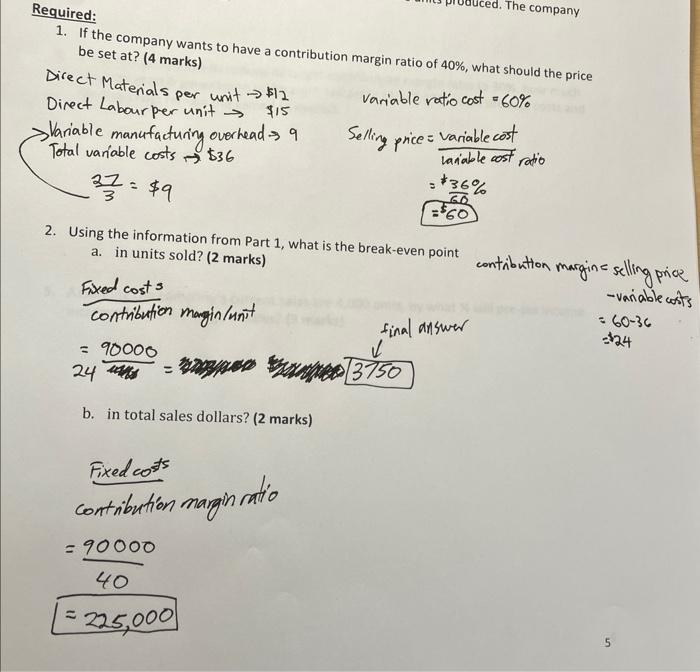

A company has the following unit product costs: - Direct Materials per Unit: \$12/unit - Direct Labour per Unit: \$15/unit - Manufacturing Overhead: \$27/unit. Of the manufacturing overhead, one-third increases in proportion to the units produced, whereas the remaining two-thirds do not change based on the units produced. The company has total fixed costs of $90,000. Fow many units does the company have to sell to generate an after-tax profit of $45,000? ( 3 marks) 4. If the company were to reduce its target contribution margin ratio to 30%, how much revenue must it generate to make a pre-tax profit of $45,000 ? (Unit product costs and the fixed cost remain the same.) ( 3 marks) 5. Assuming the company's current sales are 4,000 units, by what % will pre-tax income increase for a 5% change in sales? ( 3 marks) 1. If the company wants to have a contribution margin ratio of 40%, what should the price be set at? (4 marks) Direct Materials per unit $12 variable ratio cost =60% Direct Labourper unit $15 Variable manufacturing overhead 9 Total variable costs $36 327=$9 Selling price =lariablecostratiovariablecost 2. Using the information from Part 1, what is the break-even point a. in units sold? ( 2 marks) Fixed costs 3 - contribution margine selling price contribution mangin/unit =2490000=vfinal b. in total sales dollars? (2 marks) Fixed coss contribution margin ratio =4090000=225,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started