Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please complete all parts to the problem and explain 8. Risks of investing in bonds The higher the risk of a security, the higher its

please complete all parts to the problem and explain

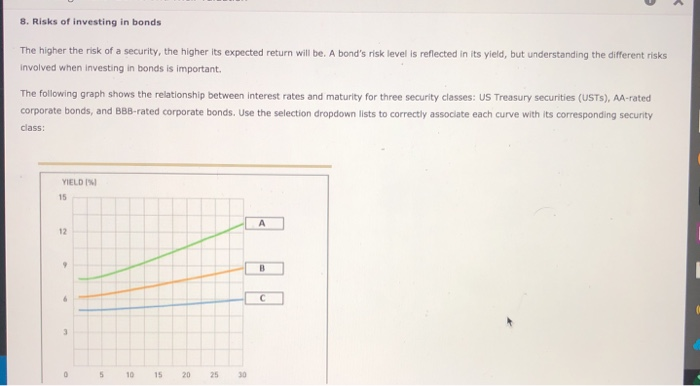

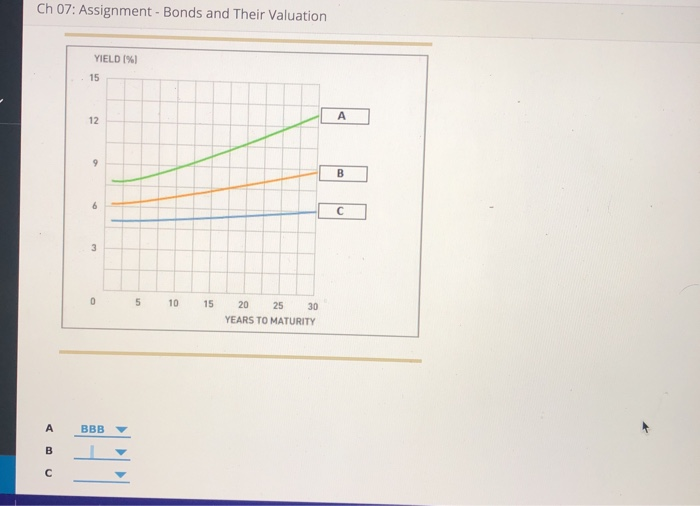

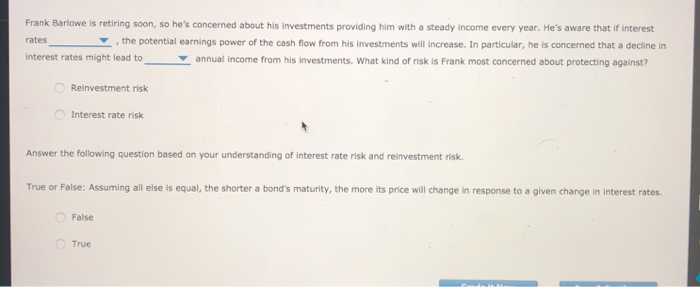

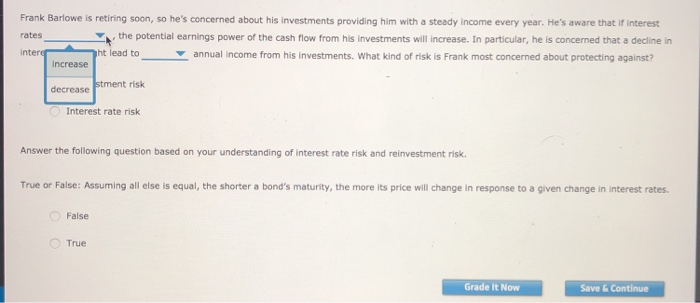

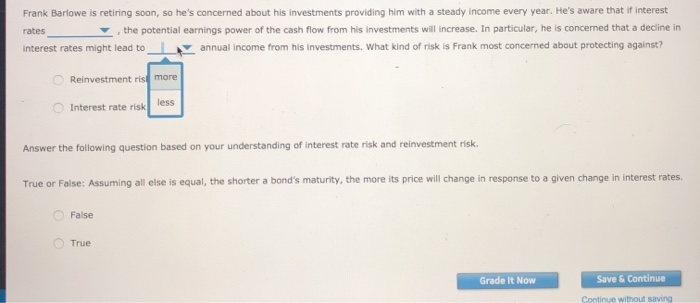

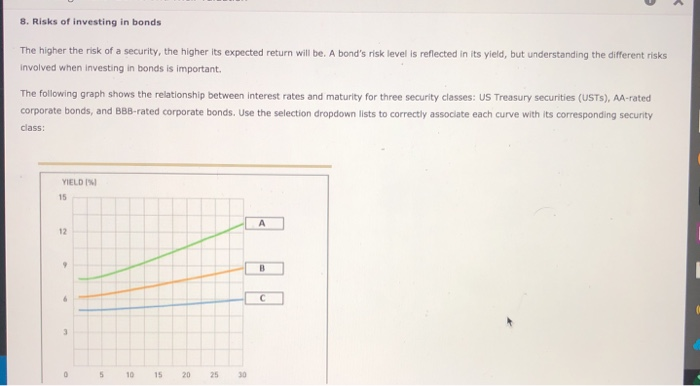

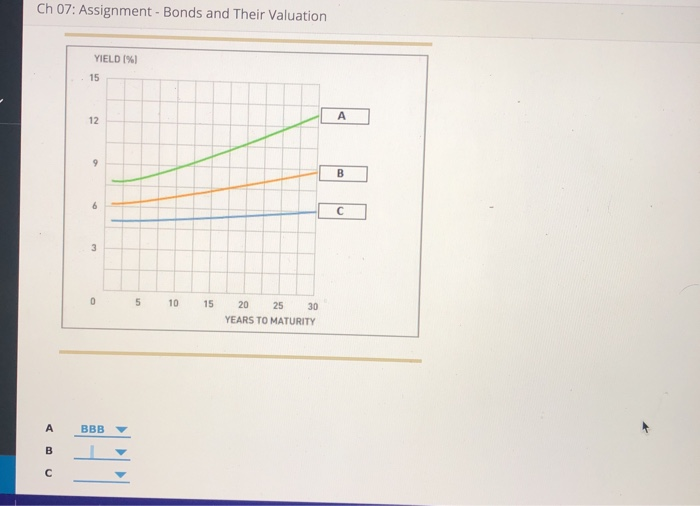

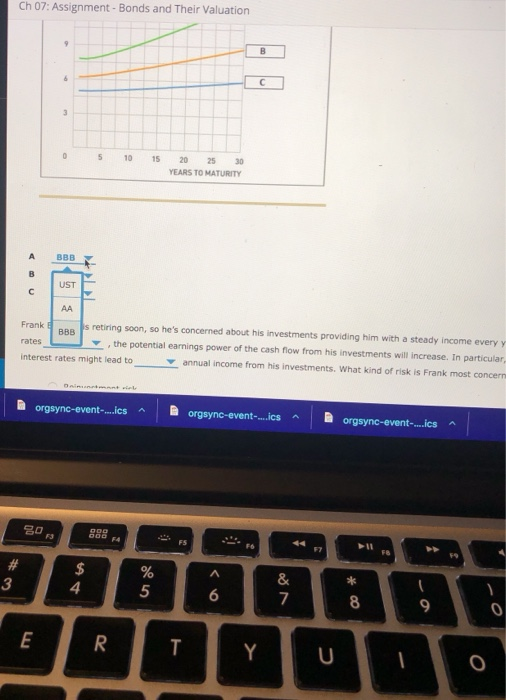

8. Risks of investing in bonds The higher the risk of a security, the higher its expected return will be. A bond's risk level is reflected in its yield, but understanding the different risks involved when investing in bonds is important. The following graph shows the relationship between interest rates and maturity for three security classes: US Treasury securities (USTS), AA-rated corporate bonds, and BBB-rated corporate bonds. Use the selection dropdown lists to correctly associate each curve with its corresponding security class: YIELD IN 0 5 10 15 20 25 30 Ch 07: Assignment - Bonds and Their Valuation YIELD 1%) 0 5 10 15 20 25 30 YEARS TO MATURITY BBB Ch 07: Assignment - Bonds and Their Valuation 5 10 15 20 25 30 YEARS TO MATURITY Frank s retiring soon, so he's concerned about his investments providing him with a steady income every y 888 rates the potential earnings power of the cash flow from his investments will increase. In particular, interest rates might lead to annual income from his investments. What kind of risk is Frank most concern orgsync-event-..ics orgsync-event-... ics o rgsync-event-...ics Frank Barlowe is retiring soon, so he's concerned about his investments providing him with a steady income every year. He's aware that if interest rates the potential earnings power of the cash flow from his investments will increase. In particular, he is concerned that a decline in interest rates might lead to annual income from his investments. What kind of risk is Frank most concerned about protecting against? Reinvestment risk Interest rate risk Answer the following question based on your understanding of interest rate risk and reinvestment risk. True or False: Assuming all else is equal, the shorter a bond's maturity, the more its price will change in response to a given change in interest rates. False True Frank Barlowe is retiring soon, so he's concerned about his investments providing him with a steady income every year. He's aware that if interest rates the potential earnings power of the cash flow from his investments will increase. In particular, he is concerned that a decline in intere ht lead to annual income from his investments. What kind of risk is Frank most concerned about protecting against? Increase decrease stment risk Interest rate risk Answer the following question based on your understanding of interest rate risk and reinvestment risk. True or False: Assuming all else is equal, the shorter a bond's maturity, the more its price will change in response to a given change in interest rates. False True Grade It Now Save & Continue Frank Barlowe is retiring soon, so he's concerned about his investments providing him with a steady income every year. He's aware that if interest rates the potential earnings power of the cash flow from his investments will increase. In particular, he is concerned that a decline in interest rates might lead to annual income from his investments. What kind of risk is Frank most concerned about protecting against? Reinvestment is more Interest rate risk less Answer the following question based on your understanding of interest rate risk and reinvestment risk. True or False: Assuming all else is equal, the shorter a bond's maturity, the more its price will change in response to a given change in interest rates. False True Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started