Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE COMPLETE ALL QUESTIONS. Assume that the inflation rate during the last year was 1.29 percent. US government T-bills had the nominal rates of return

PLEASE COMPLETE ALL QUESTIONS.

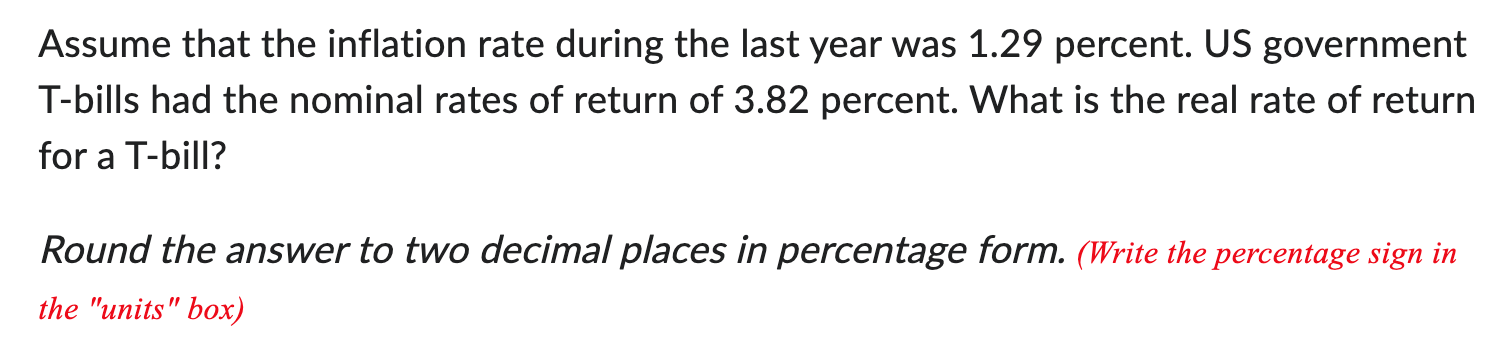

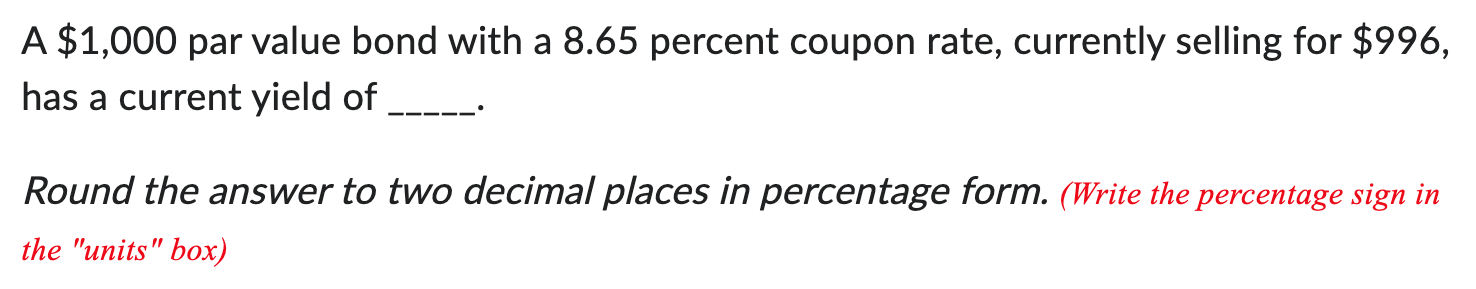

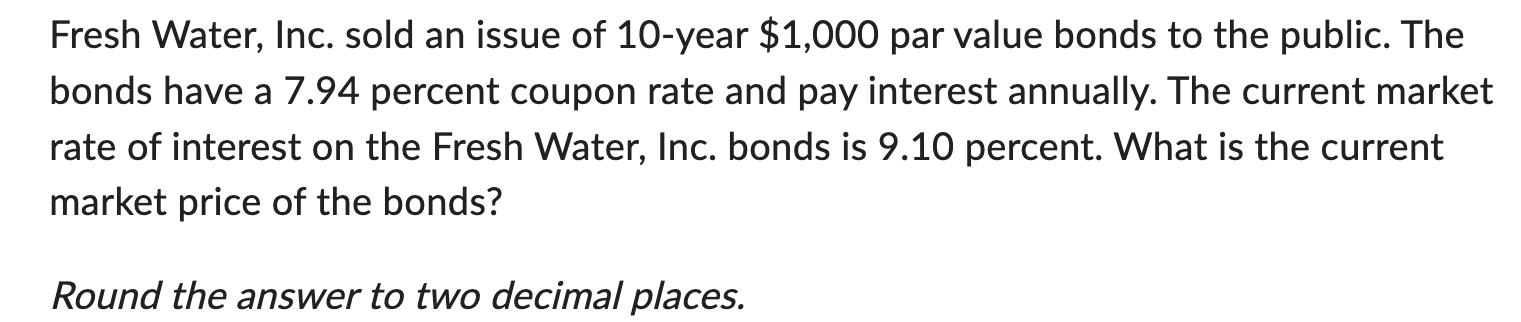

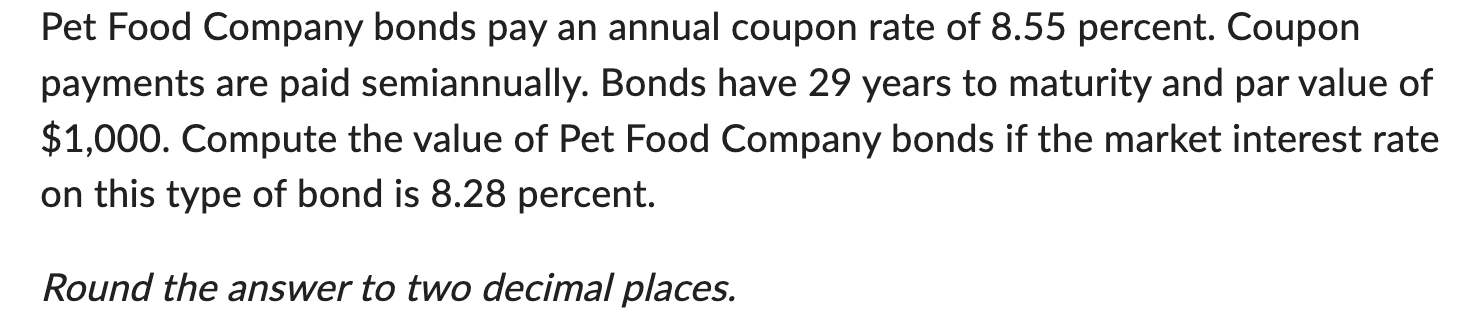

Assume that the inflation rate during the last year was 1.29 percent. US government T-bills had the nominal rates of return of 3.82 percent. What is the real rate of return for a T-bill? Round the answer to two decimal places in percentage form. (Write the percentage sign in the "units" box) A $1,000 par value bond with a 8.65 percent coupon rate, currently selling for $996, has a current yield of Round the answer to two decimal places in percentage form. (Write the percentage sign in the "units" box) Pet Food Company bonds pay an annual coupon rate of 8.55 percent. Coupon payments are paid semiannually. Bonds have 29 years to maturity and par value of $1,000. Compute the value of Pet Food Company bonds if the market interest rate on this type of bond is 8.28 percent. Round the answer to two decimal places. Fresh Water, Inc. sold an issue of 10 -year $1,000 par value bonds to the public. The bonds have a 7.94 percent coupon rate and pay interest annually. The current market rate of interest on the Fresh Water, Inc. bonds is 9.10 percent. What is the current market price of the bonds? Round the answer to two decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started