Please complete f1, f2, g1, g2 and show work. Thank you!

Please complete F1, f2, g1, g2 and show work. Thank you!

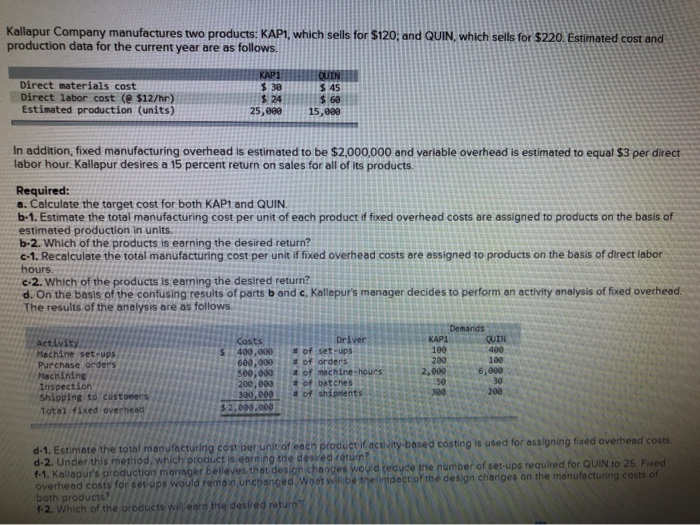

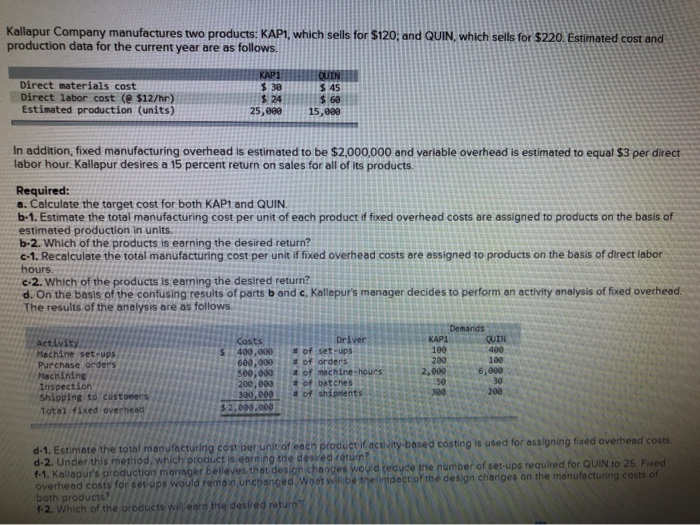

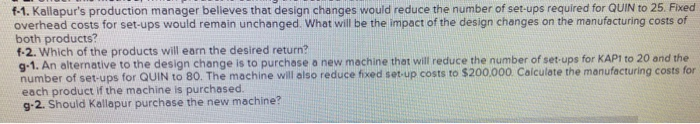

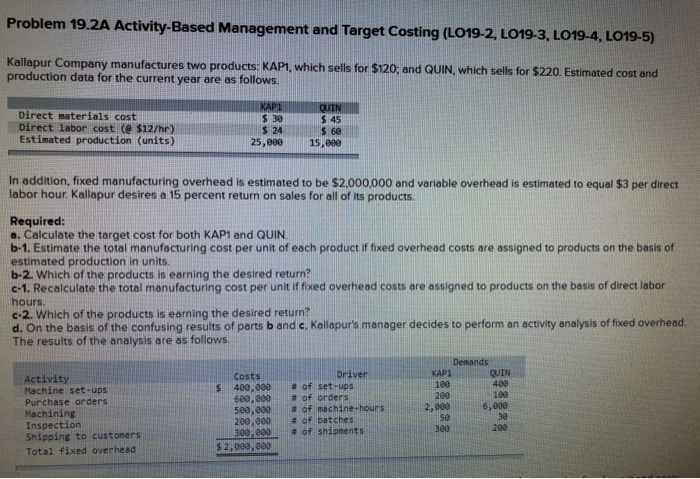

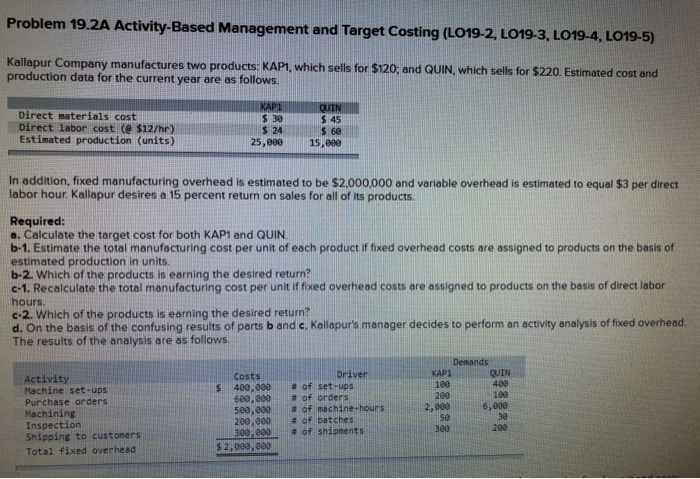

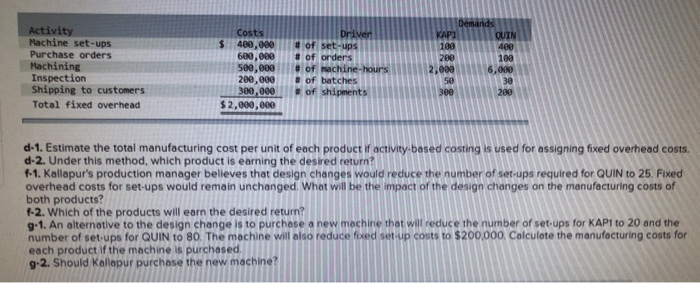

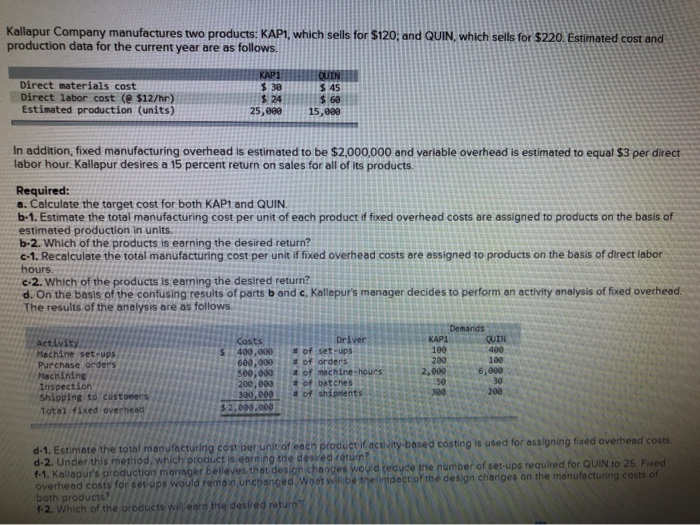

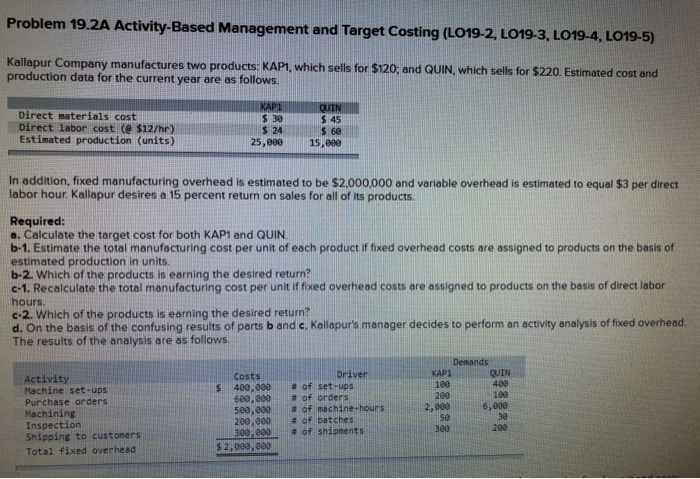

Kallapur Company manufactures two products: KAP1, which sells for $120; and QUIN, which sells for $220. Estimated cost and production data for the current year are as follows. KAP1 $ 30 $ 24 25,000 QUIN $45 $ 60 15,000 Direct materials cost Direct labor cost (@ $12/hr) Estimated production (units) In addition, fixed manufacturing overhead is estimated to be $2,000,000 and variable overhead is estimated to equal $3 per direct labor hour. Kallapur desires a 15 percent return on sales for all of its products. Required: a. Calculate the target cost for both KAP1.and QUIN b-1. Estimate the total manufacturing cost per unit of each product if fixed overhead costs are assigned to products on the basis of estimated production in units. b-2. Which of the products is earning the desired return? c-1. Recalculate the total manufacturing cost per unit if fixed overhead costs are assigned to products on the basis of direct labor hours c-2. Which of the products is earning the desired return? d. On the basis of the confusing results of parts b and c, Kallepur's manager decides to perform an activity analysis of fixed overhead. The results of the anelysis are as follows Demands Driver #of set-ups # of orders # of machine-hours # of batches a of shipments KAP1 100 200 QUIN 400 Activity Machine set-ups Purchase orders Machining Inspection Shipping to custonens Total fixed overhead Costs 400,000 600,000 500,000 200,000 300,000 $2,000,000 100 2,000 50 6,000 30 200 380 d-1. Estimate the total manufacturing cost per unit of eech product if activity-bosed costing is used for assigning fixed overhead costs d-2. Under this method, which product is eorning the dsiredrturn? f-1. Kallopur's production monager belleves that desichichanges wouid reduce the number of set-ups required for QUIN to 25 Fixed overhead costs for set-ups would remoin uncbanced Woot willibe thelimpectiof the design changes on the manufacturing costs of both products? f-2. Which of the products will eare the desired return? f-1. Kallapur's production manager believes that design changes would reduce the number of set-ups required for QUIN to 25. Fixed overhead costs for set-ups would remain unchanged. What will be the impact of the design changes on the manufacturing costs of both products? f-2. Which of the products will earn the desired return? g-1. An alternative to the design change is to purchase a new machine that will reduce the number of set-ups for KAP1 to 20 and the number of set-ups for QUIN to 80. The machine will also reduce fixed set-up costs to $200,000 Calculate the manufacturing costs for each product if the machine is purchased. g-2. Should Kallapur purchase the new machine? Problem 19.2A Activity-Based Management and Target Costing (LO19-2, LO19-3, LO19-4, LO19-5) Kallapur Company manufactures two products: KAP1, which sells for $120; and QUIN, which sells for $220. Estimated cost and production data for the current year are as follows. KAP1 $30 $ 24 25,000 QUIN $ 45 $ 60 15,e0e Direct materials cost Direct labor cost (e $12/hr) Estimated production (units) In addition, fixed manufacturing overhead is estimated to be $2,000,000 and variable overhead is estimated to equal $3 per direct labor hour. Kallapur desires a 15 percent return on sales for all of its products. Required: a. Calculate the target cost for both KAP1 and QUIN. b-1. Estimate the total manufacturing cost per unit of each product if fixed overhead costs are assigned to products on the basis of estimated production in units b-2. Which of the products is earning the desired return? c-1. Recalculate the total manufacturing cost per unit if fixed overhead costs are assigned to products on the basis of direct labor hours. c-2. Which of the products is earning the desired return? d. On the basis of the confusing results of parts b and c. Kallapur's manager decides to perform an activity analysis of fixed overhead. The results of the analysis are as follows. Demands QUIN 400 100 6,e00 30 KAP1 Driver Costs Activity Machine set-ups Purchase orders Machining Inspection Shipping to customers 100 # of set -ups 400,000 600,000 500,000 200,000 200 2,000 se 300 # of orders # of machine-hours # of batches of shipments 200 $2,000,000 Total fixed overhead Demands QUIN 400 100 6,000 30 Activity Machine set-ups Purchase orders Machining Inspection Shipping to customers Costs $ Driver # of set-ups # of orders # of nachine-hours # of batches # of shipments KAP1 400,000 600,000 500,000 200,000 300,000 $2,000,000 100 280 2,000 50 300 200 Total fixed overhead d-1. Estimate the total manufacturing cost per unit of each product if activity-based costing is used for assigning fixed overhead costs. d-2. Under this method, which product is earning the desired return? f-1. Kallapur's production manager believes that design changes would reduce the number of set-ups required for QUIN to 25. Fixed overhead costs for set-ups would remain unchanged. What will be the impact of the design changes on the manufacturing costs of both products? f-2. Which of the products will earn the desired return? g-1. An alternative to the design change is to purchase a new machine that will reduce the number of set-ups for KAP1 to 20 and the number of set-ups for QUIN to 80. The machine will elso reduce foxed set-up costs to $200,000, Calculete the manufacturing costs for each product if the machine is purchased. g-2. Should Kallapur purchase the new machine