Answered step by step

Verified Expert Solution

Question

1 Approved Answer

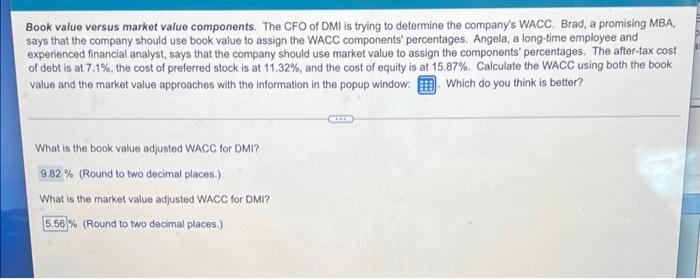

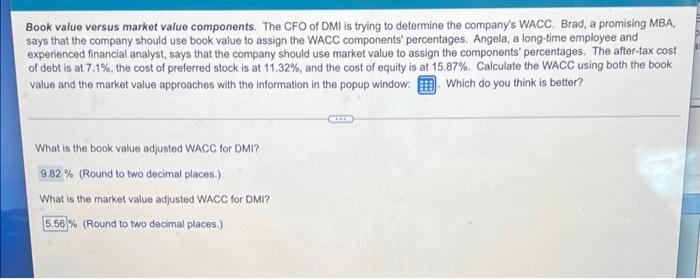

please complete final part! Book value versus market value components. The CFO of DMI is trying to determine the company's WACC, Brad, a promising MBA,

please complete final part!

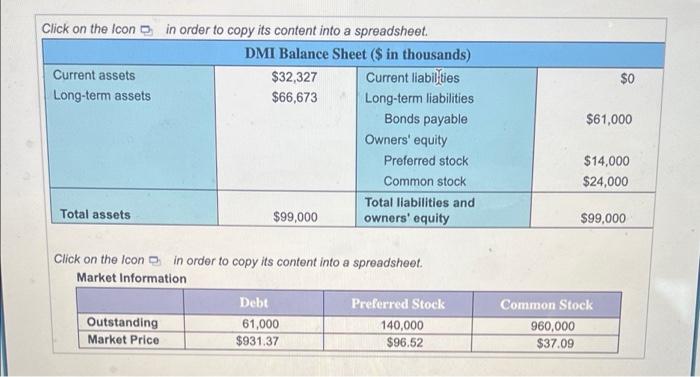

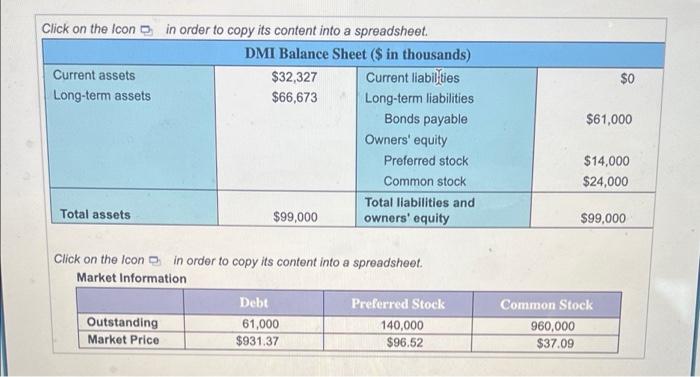

Book value versus market value components. The CFO of DMI is trying to determine the company's WACC, Brad, a promising MBA, says that the company should use book value to assign the WACC components' percentages. Angela, a long-time employee and experienced financial analyst, says that the company should use market value to assign the components' percentages. The after-tax cost of debt is at 7.1%, the cost of preferred stock is at 11.32%, and the cost of equity is at 15.87% Calculate the WACC using both the book value and the market value approaches with the information in the popup window: Which do you think is better? What is the book value adjusted WACC for DMI? 9.82 % (Round to two decimal places.) What is the market value adjusted WACC for DMI? 5,56% (Round to two decimal places.) $0 Click on the Icon in order to copy its content into a spreadsheet. DMI Balance Sheet ($ in thousands) Current assets $32,327 Current liabilities Long-term assets $66,673 Long-term liabilities Bonds payable Owners' equity Preferred stock Common stock Total liabilities and Total assets $99,000 owners' equity $61,000 $14,000 $24,000 $99,000 Click on the icon in order to copy its content into a spreadsheet. Market Information Debt Preferred Stock Outstanding 61,000 140,000 Market Price $931.37 $96.52 Common Stock 960,000 $37.09

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started