Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete in excel showing functions Directions: Utilize the Sample Quiz #1 Bond Spreadsheet Template to answer both questions. Follow all of the directions described

Please complete in excel showing functions

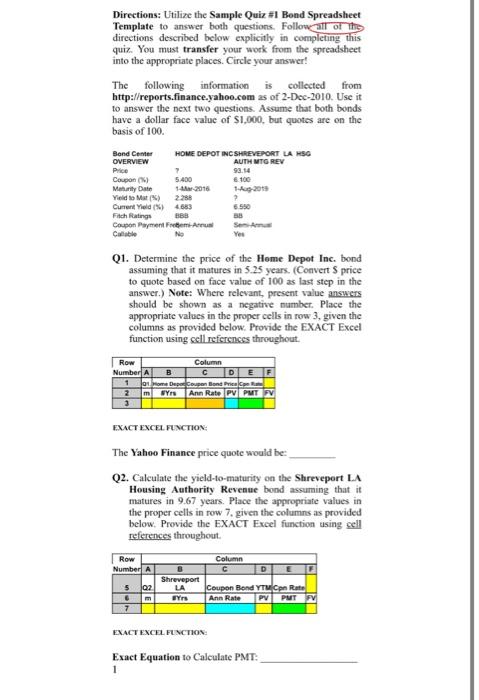

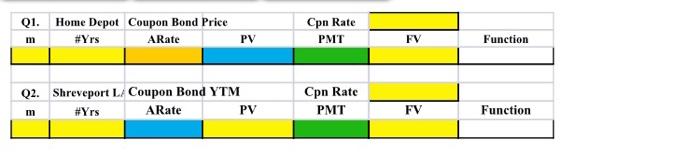

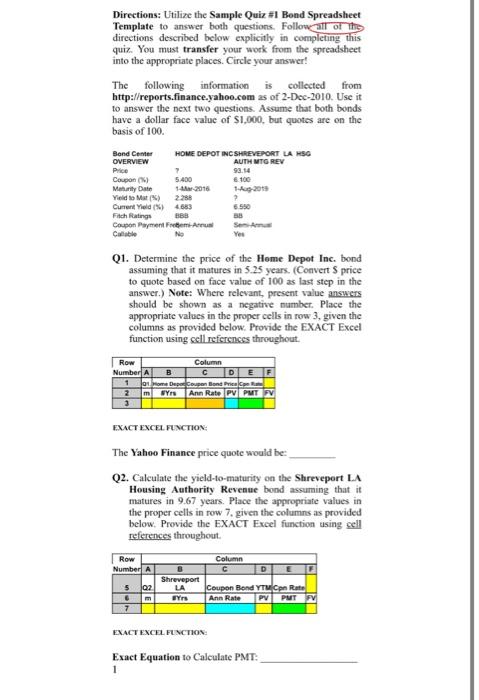

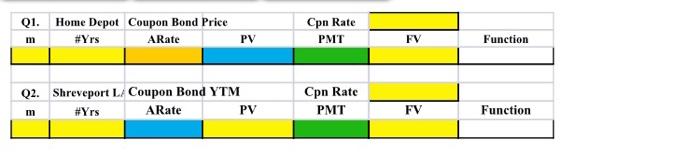

Directions: Utilize the Sample Quiz #1 Bond Spreadsheet Template to answer both questions. Follow all of the directions described below explicitly in completing this quiz. You must transfer your work from the spreadsheet into the appropriate places. Circle your answer! The following information is collected from http://reports.finance.yahoo.com as of 2-Dec-2010. Use it to answer the next two questions. Assume that both bonds have a dollar face value of $1,000, but quotes are on the basis of 100. 6100 Band Center HOME DEPOT INC SHREVEPORT LA MSG OVERVIEW AUTHMTG REV Price 93.14 Coupons 5.400 Maturity Date A 2016 14 2013 Yield Mat) 2256 ? Current Yield() 4683 5550 Fitch Ratings BBS 56 Coupon Payment Calable Yes Q1. Determine the price of the Home Depot Inc. bond assuming that it matures in 5.25 years. (Convert S price to quote based on face value of 100 as last step in the answer.) Note: Where relevant, present value answers should be shown as a negative number. Place the appropriate values in the proper cells in row 3, given the columns as provided below. Provide the EXACT Excel function using sell references throughout Row Column Number A B D EF 11. Depar. Soupon Bon Price 2 mWYrs Ann Rate PVPMT 3 EXACT EXCEL FUNCTION The Yahoo Finance price quote would be: Q2. Calculate the yield-to-maturity on the Shreveport LA Housing Authority Revenue bond assuming that it matures in 9.67 years. Place the appropriate values in the proper cells in row 7 given the columns as provided below. Provide the EXACT Excel function using cell references throughout Row Column Number A B D E Shreveport 502 LA Coupon Bond yr Con Rate Yrs Ann Rate PV PUT EXACT EXCEL FUNCTION Exact Equation to Calculate PMT: 1 Q1. Home Depot Coupon Bond Price #Yrs ARate Cpn Rate PMT m PV FV Function Q2. Shreveport L/Coupon Bond YTM #Yrs ARate PV Cpn Rate PMT m FV Function Directions: Utilize the Sample Quiz #1 Bond Spreadsheet Template to answer both questions. Follow all of the directions described below explicitly in completing this quiz. You must transfer your work from the spreadsheet into the appropriate places. Circle your answer! The following information is collected from http://reports.finance.yahoo.com as of 2-Dec-2010. Use it to answer the next two questions. Assume that both bonds have a dollar face value of $1,000, but quotes are on the basis of 100. 6100 Band Center HOME DEPOT INC SHREVEPORT LA MSG OVERVIEW AUTHMTG REV Price 93.14 Coupons 5.400 Maturity Date A 2016 14 2013 Yield Mat) 2256 ? Current Yield() 4683 5550 Fitch Ratings BBS 56 Coupon Payment Calable Yes Q1. Determine the price of the Home Depot Inc. bond assuming that it matures in 5.25 years. (Convert S price to quote based on face value of 100 as last step in the answer.) Note: Where relevant, present value answers should be shown as a negative number. Place the appropriate values in the proper cells in row 3, given the columns as provided below. Provide the EXACT Excel function using sell references throughout Row Column Number A B D EF 11. Depar. Soupon Bon Price 2 mWYrs Ann Rate PVPMT 3 EXACT EXCEL FUNCTION The Yahoo Finance price quote would be: Q2. Calculate the yield-to-maturity on the Shreveport LA Housing Authority Revenue bond assuming that it matures in 9.67 years. Place the appropriate values in the proper cells in row 7 given the columns as provided below. Provide the EXACT Excel function using cell references throughout Row Column Number A B D E Shreveport 502 LA Coupon Bond yr Con Rate Yrs Ann Rate PV PUT EXACT EXCEL FUNCTION Exact Equation to Calculate PMT: 1 Q1. Home Depot Coupon Bond Price #Yrs ARate Cpn Rate PMT m PV FV Function Q2. Shreveport L/Coupon Bond YTM #Yrs ARate PV Cpn Rate PMT m FV Function

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started