Answered step by step

Verified Expert Solution

Question

1 Approved Answer

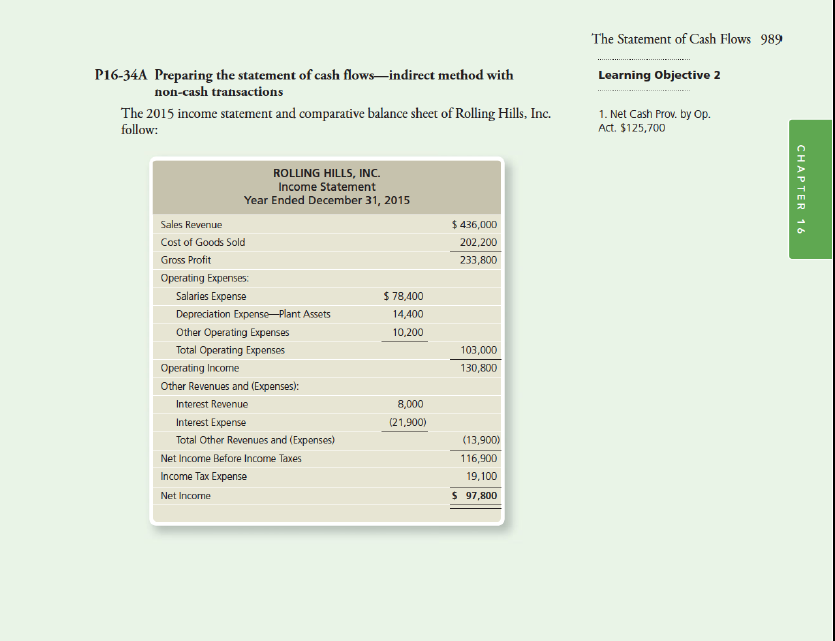

Please complete in excel The Statement of Cash Flows 989 P16-34A Preparing the statement of cash flows-indirect method with Learning Objective 2 non-cash transactions The

Please complete in excel

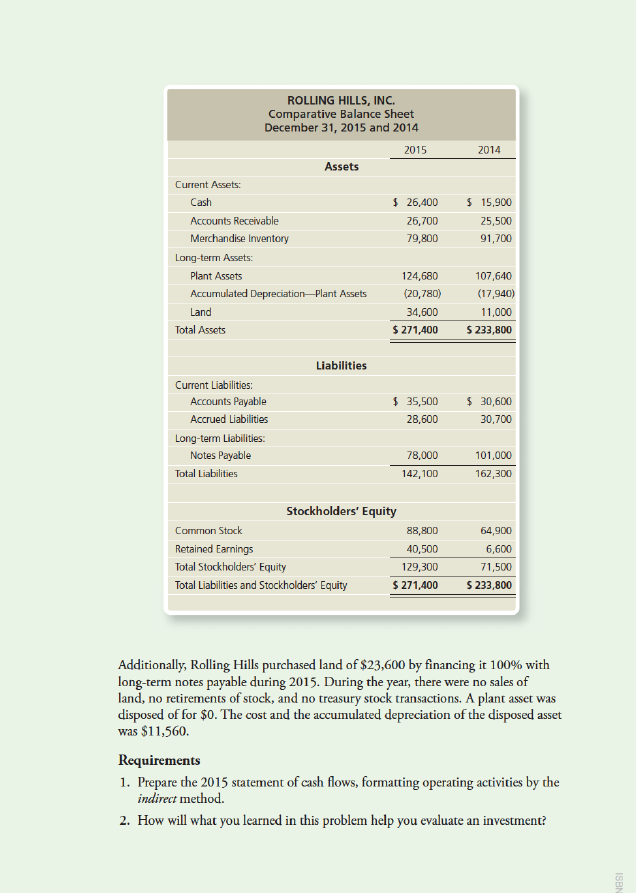

The Statement of Cash Flows 989 P16-34A Preparing the statement of cash flows-indirect method with Learning Objective 2 non-cash transactions The 2015 income statement and comparaive balance sheet of Rolling Hills, Inc. follow 1. Net Cash Prov. by Op. Act. $125,700 ROLLING HILLS, INC. Income Statement Year Ended December 31, 2015 Sales Revenue $436,000 Cost of Goods Sold 202,200 Gross Profit 233,800 Operating Expenses Salaries Expense $78,400 Depreciation Expense-Plant Assets 14,400 Other Operating Expenses 10,200 Total Operating Expenses 103,000 130,800 Operating Income Other Revenues and (Expenses) Interest Revenue 8,000 Interest Expense (21,900) Total Other Revenues and (Expenses) (13,900) 116,900 Net Income Before Income Taxes 19,100 Income Tax Expense $ 97,800 Net Income CHAPTER 16 ROLLING HILLS, INC. Comparative Balance Sheet December 31, 2015 and 2014 2015 2014 Assets Current Assets Cash 26,400 S15.900 Accounts Receivable 26,700 25,500 Merchandise Inventory 79,800 91,700 Long-term Assets: Plant Assets 107,640 124,680 (17,940) Accumulated Depreciation Plant Assets (20,780) Land 34,600 11,000 Total Assets $271,400 S 233,800 Liabilities Current Liabilities: $ 35,500 $ 30,600 Accounts Payable Accrued Liabilities 28,600 30,700 Long-term Liabilities Notes Payable 78,000 101,000 Total Liabilities 142,100 162,300 Stockholders' Equity Common Stock 88,800 64,900 Retained Earnings 40,500 6,600 Total Stockholders' Equity 129,300 71,500 Total Liabilities and Stockholders' Equity S 233,800 $271,400 Additionally, Rolling Hills purchased land of $23,600 by financing it 100% with long-term notes payable during 2015. During the year, there were no sales of land, no retirements of stock, and no treasury stock transactions. A plant asset was disposed of for $0. The cost and the accumulated depreciation of the disposed asset was $11,560 Requirements 1. Prepare the 2015 statement of cash flows, formatting operating activities by the indirect method. 2. How will what you learned in this problem help you evaluate an investmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started