Answered step by step

Verified Expert Solution

Question

1 Approved Answer

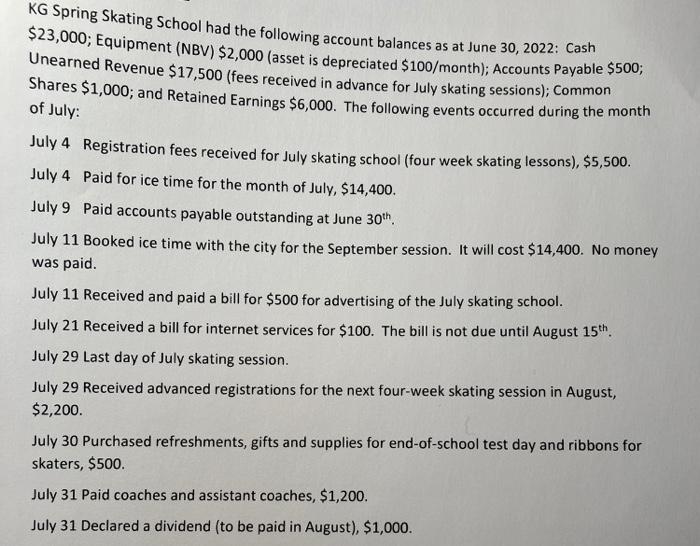

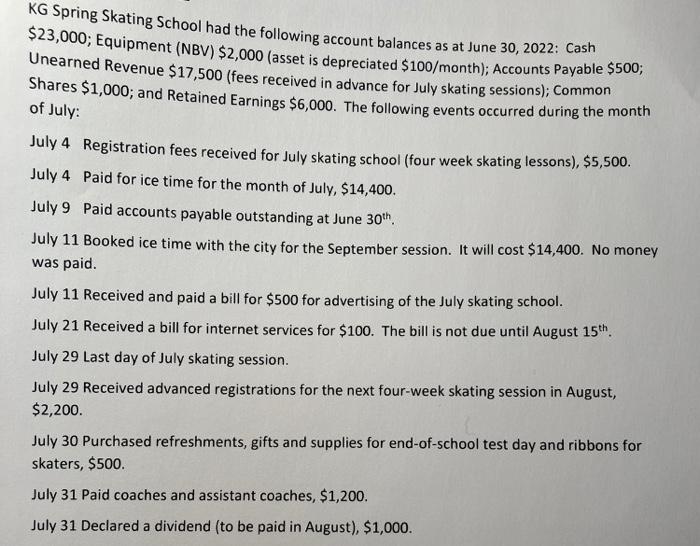

please complete in full detail, thank you! Unearned Revenue $17,500 (Nees (asset is depreciated $100 /month); Accounts Payable $500; Shares $1,000; and $17,500 (fees received

please complete in full detail, thank you!

Unearned Revenue $17,500 (Nees (asset is depreciated $100 /month); Accounts Payable $500; Shares $1,000; and $17,500 (fees received in advance for July skating sessions); Common of July: of July: July 4 Registration fees received for July skating school (four week skating lessons), $5,500. July 4 Paid for ice time for the month of July, $14,400. July 9 Paid accounts payable outstanding at June 30th. July 11 Booked ice time with the city for the September session. It will cost$14,400. No money was paid. July 11 Received and paid a bill for $500 for advertising of the July skating school. July 21 Received a bill for internet services for $100. The bill is not due until August 15th. July 29 Last day of July skating session. July 29 Received advanced registrations for the next four-week skating session in August, $2,200. July 30 Purchased refreshments, gifts and supplies for end-of-school test day and ribbons for skaters, $500. July 31 Paid coaches and assistant coaches, \$1,200. July 31 Declared a dividend (to be paid in August), $1,000. b) Prepare a classified Balance Sheet (i.e. Statement of Financial Position) as at July 31, 2022. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started