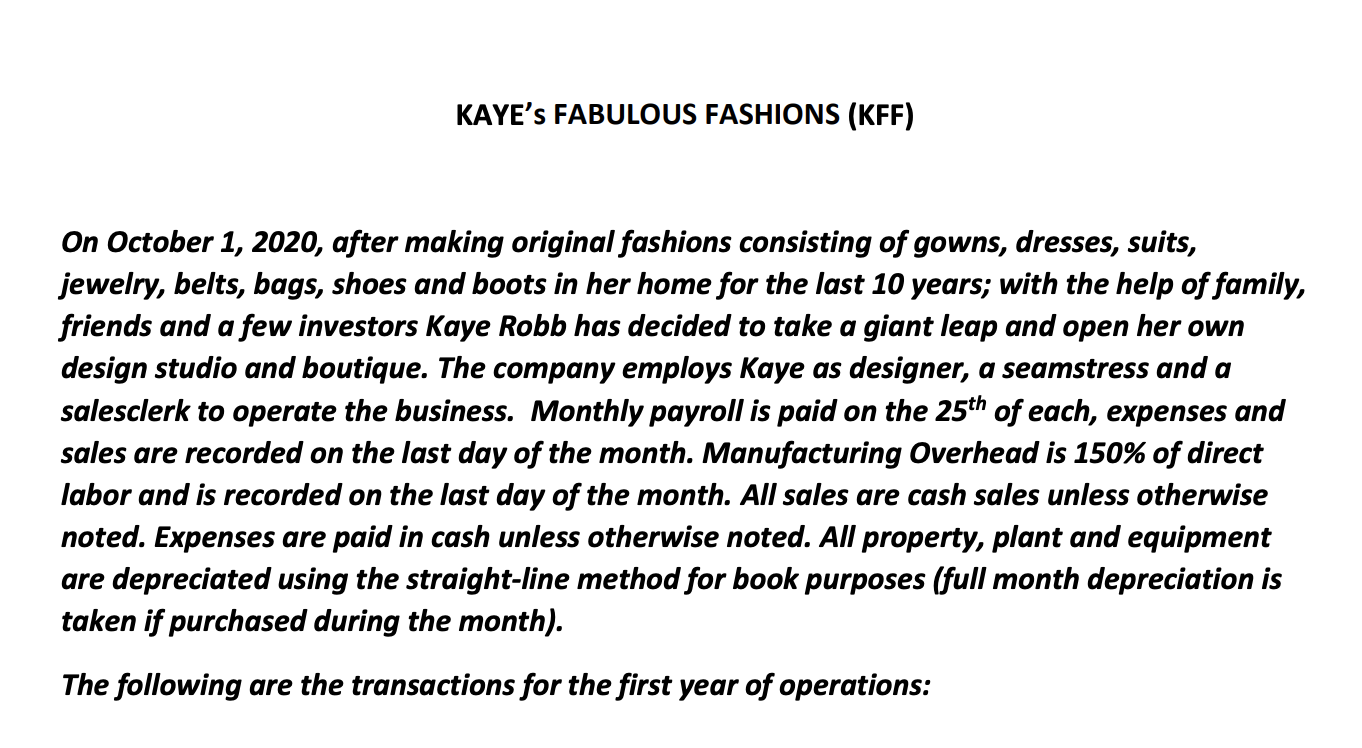

Please complete journal entries for transaction. Quickbooks is not needed right now.

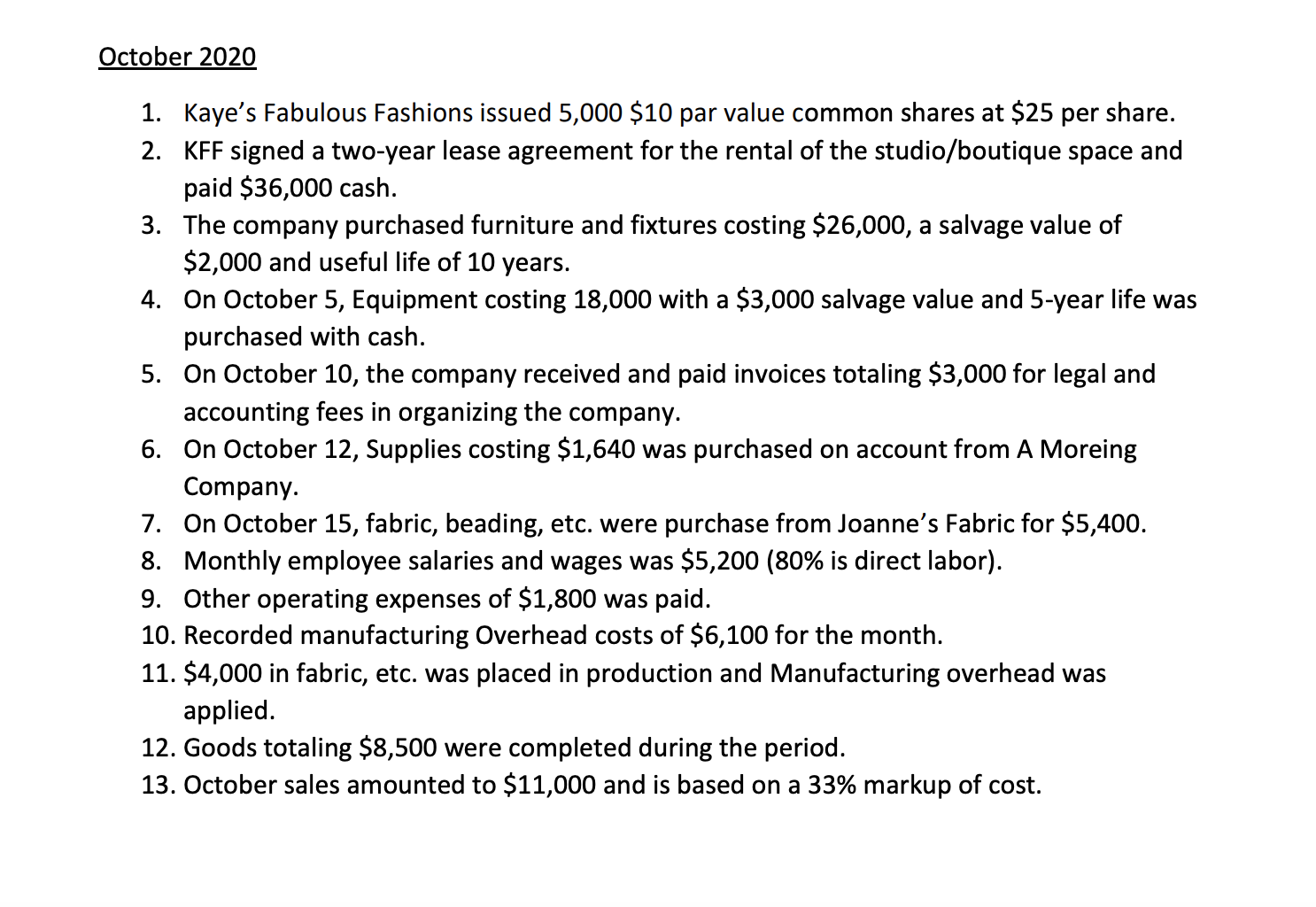

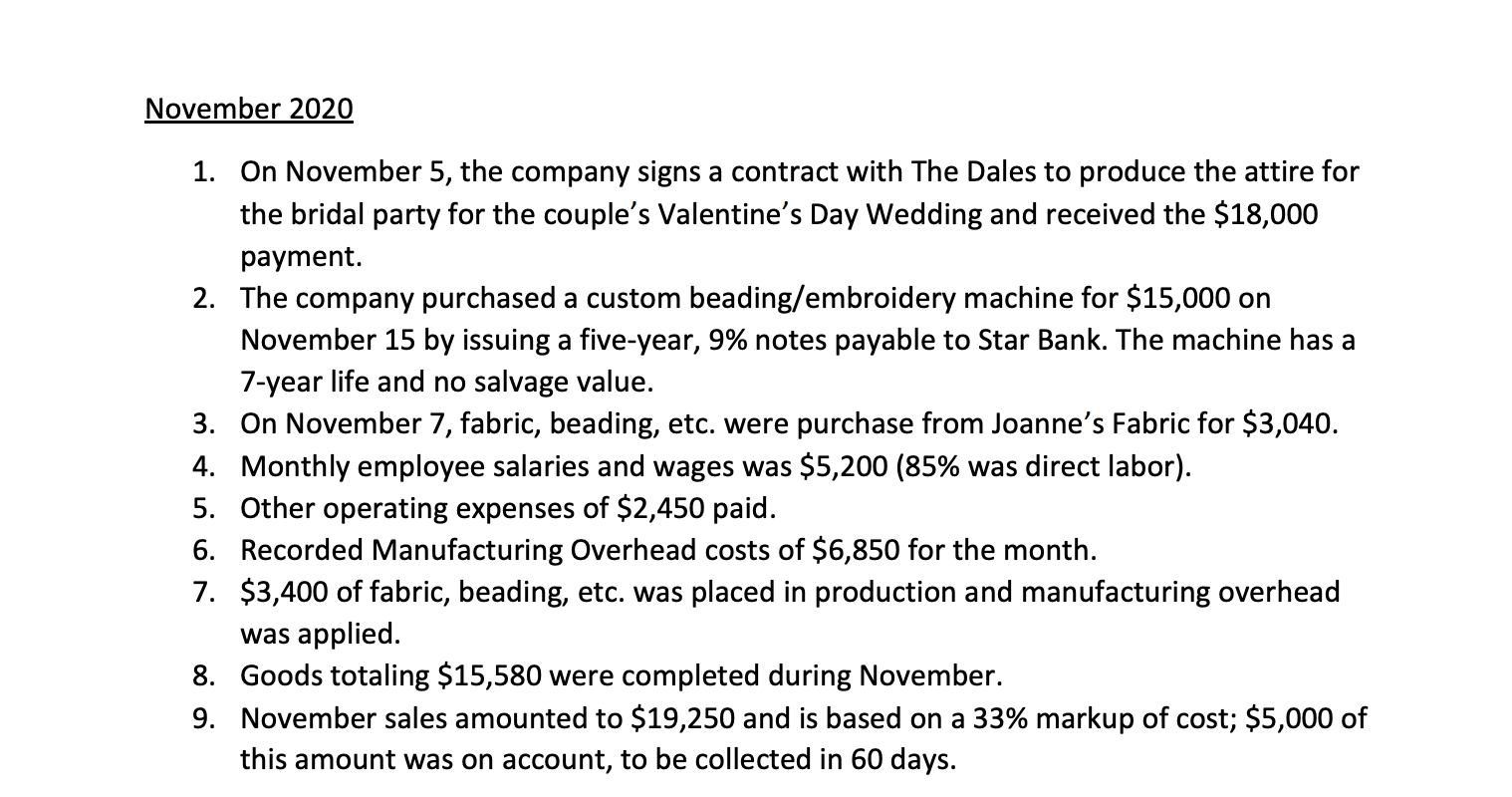

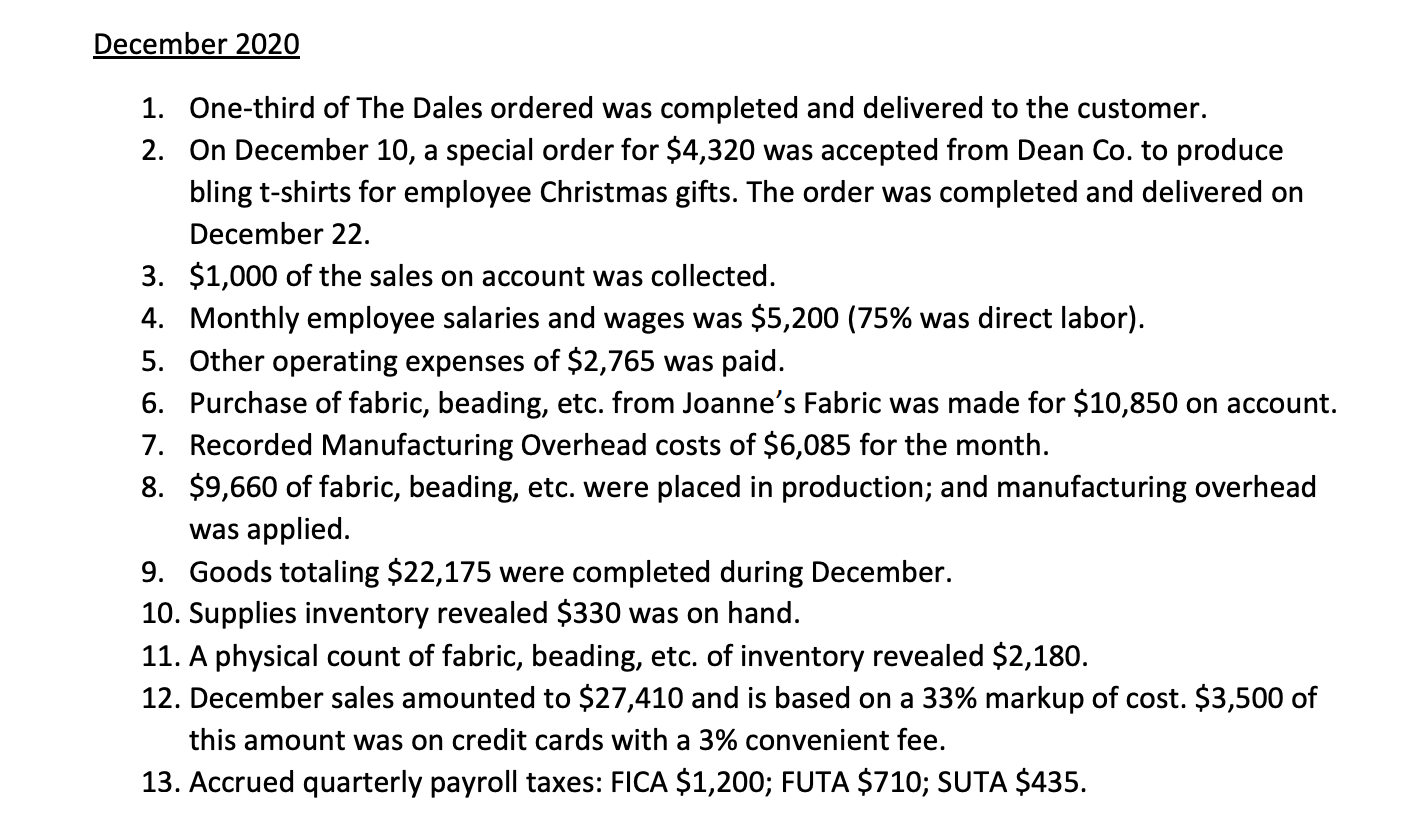

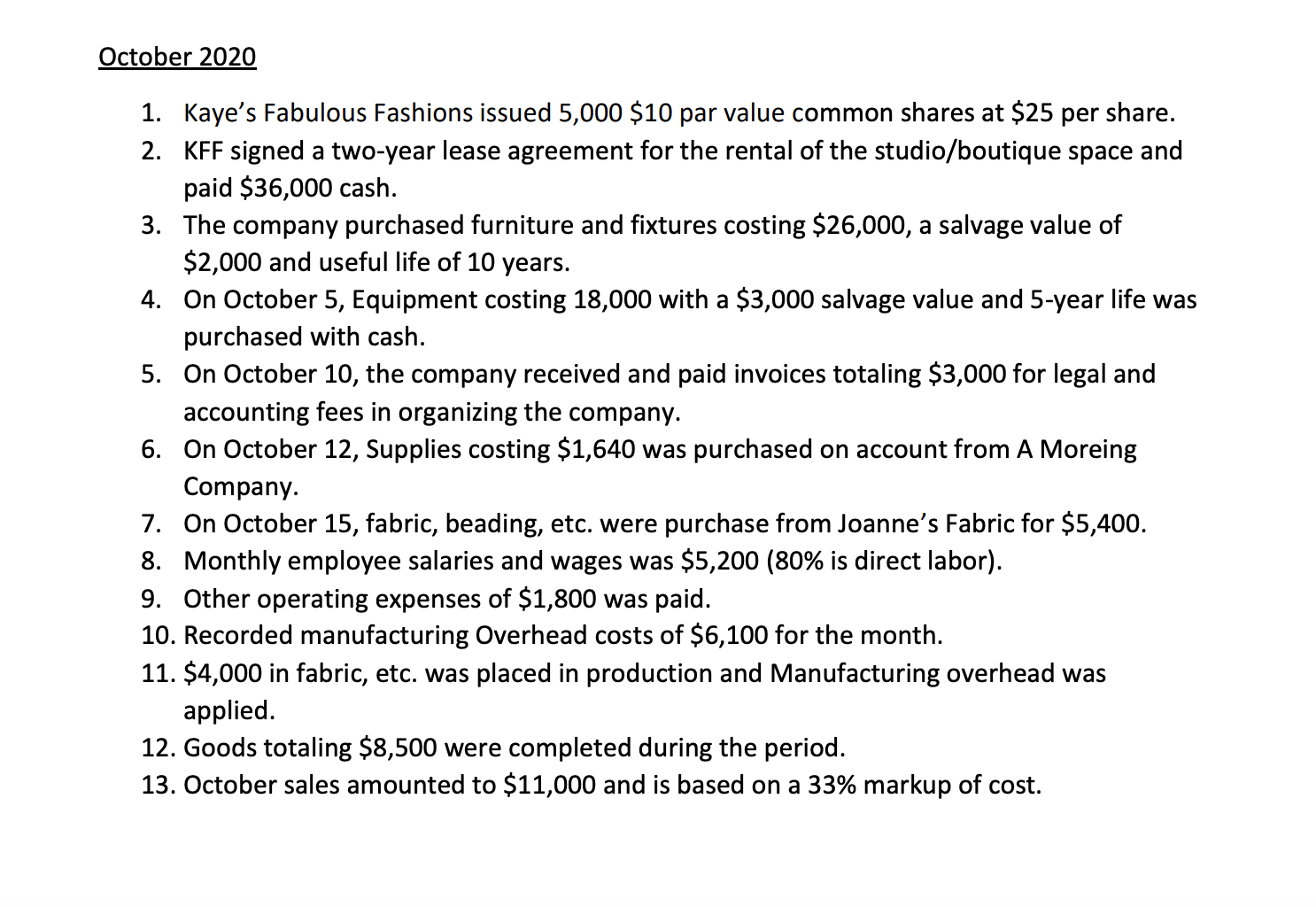

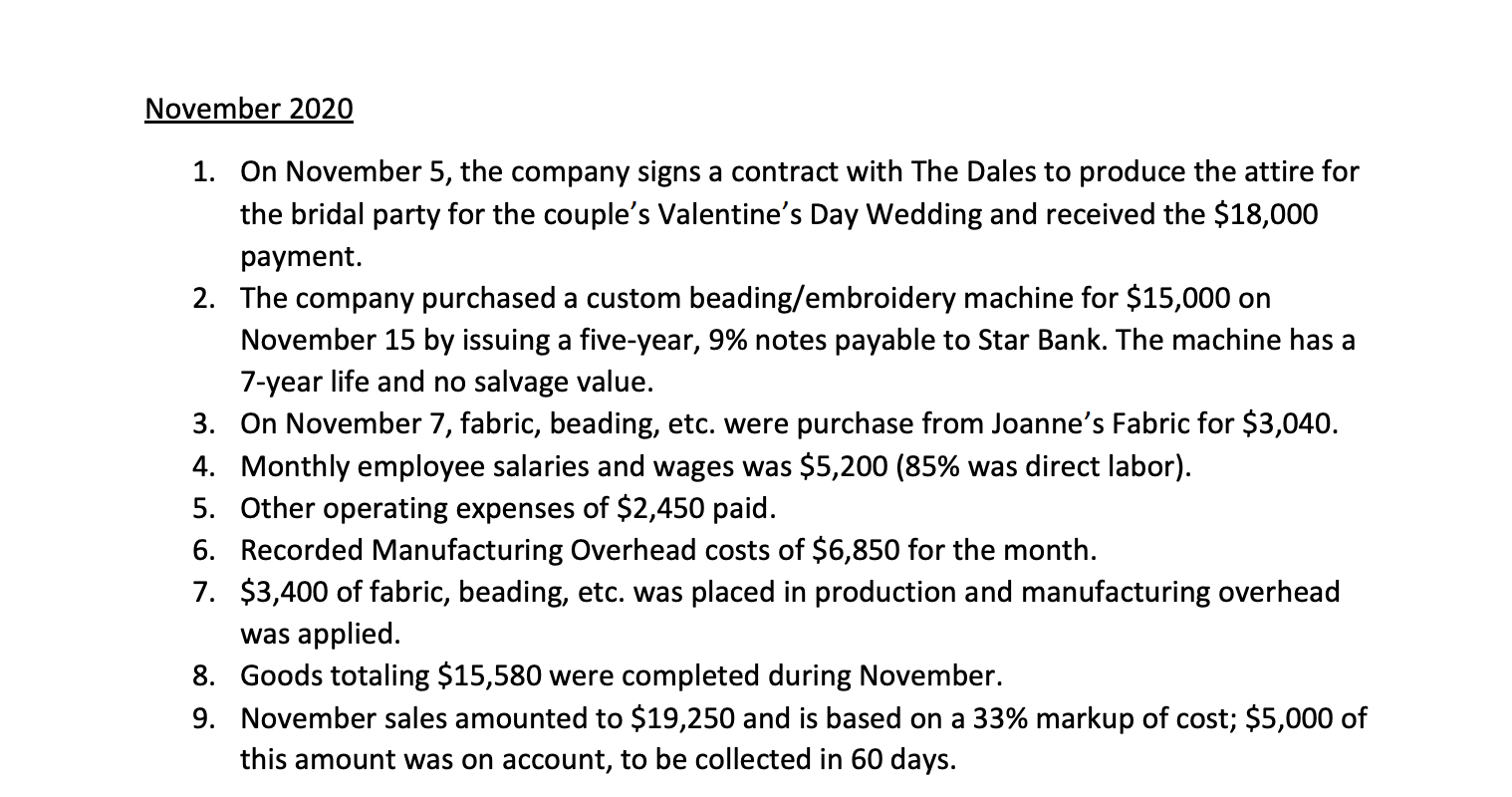

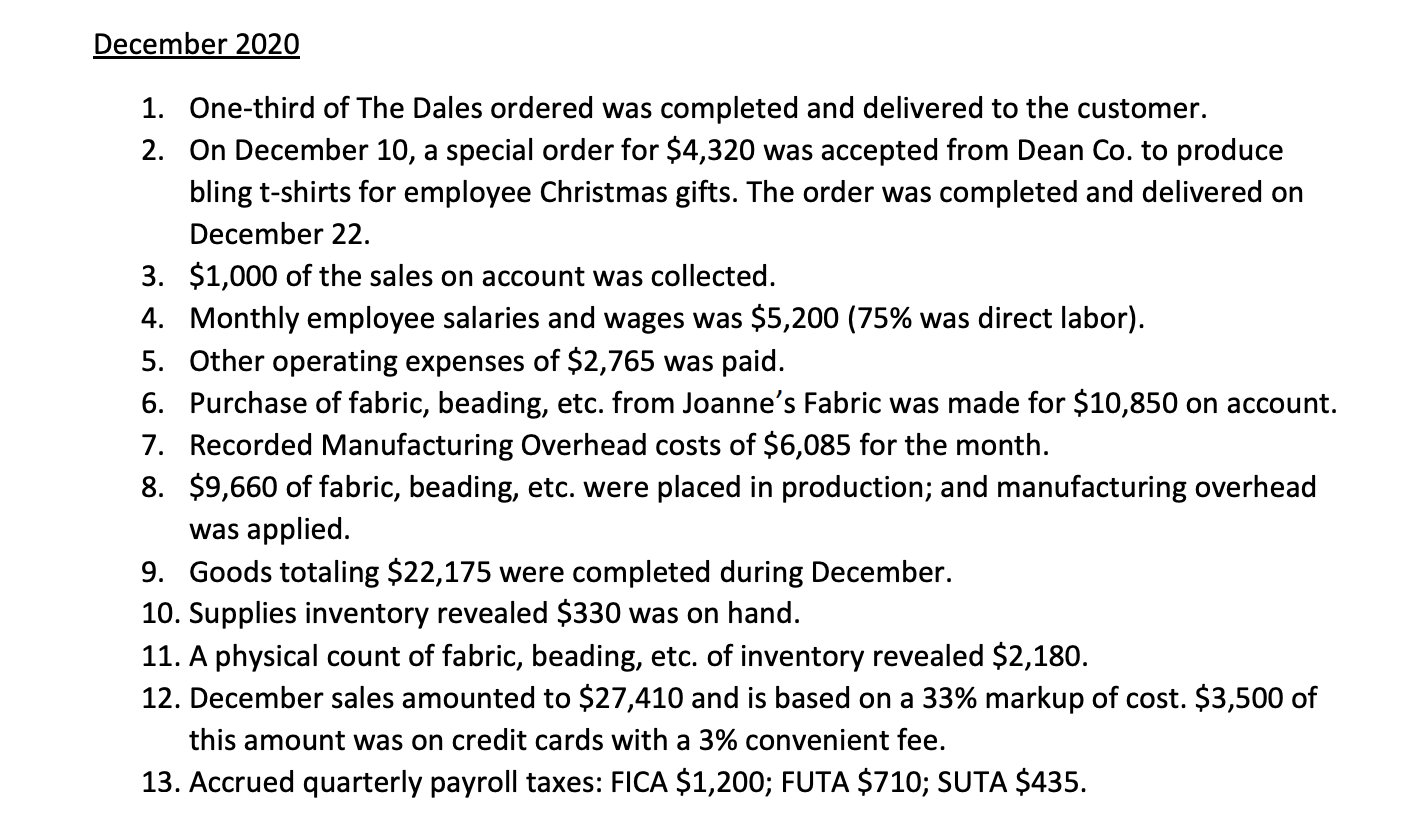

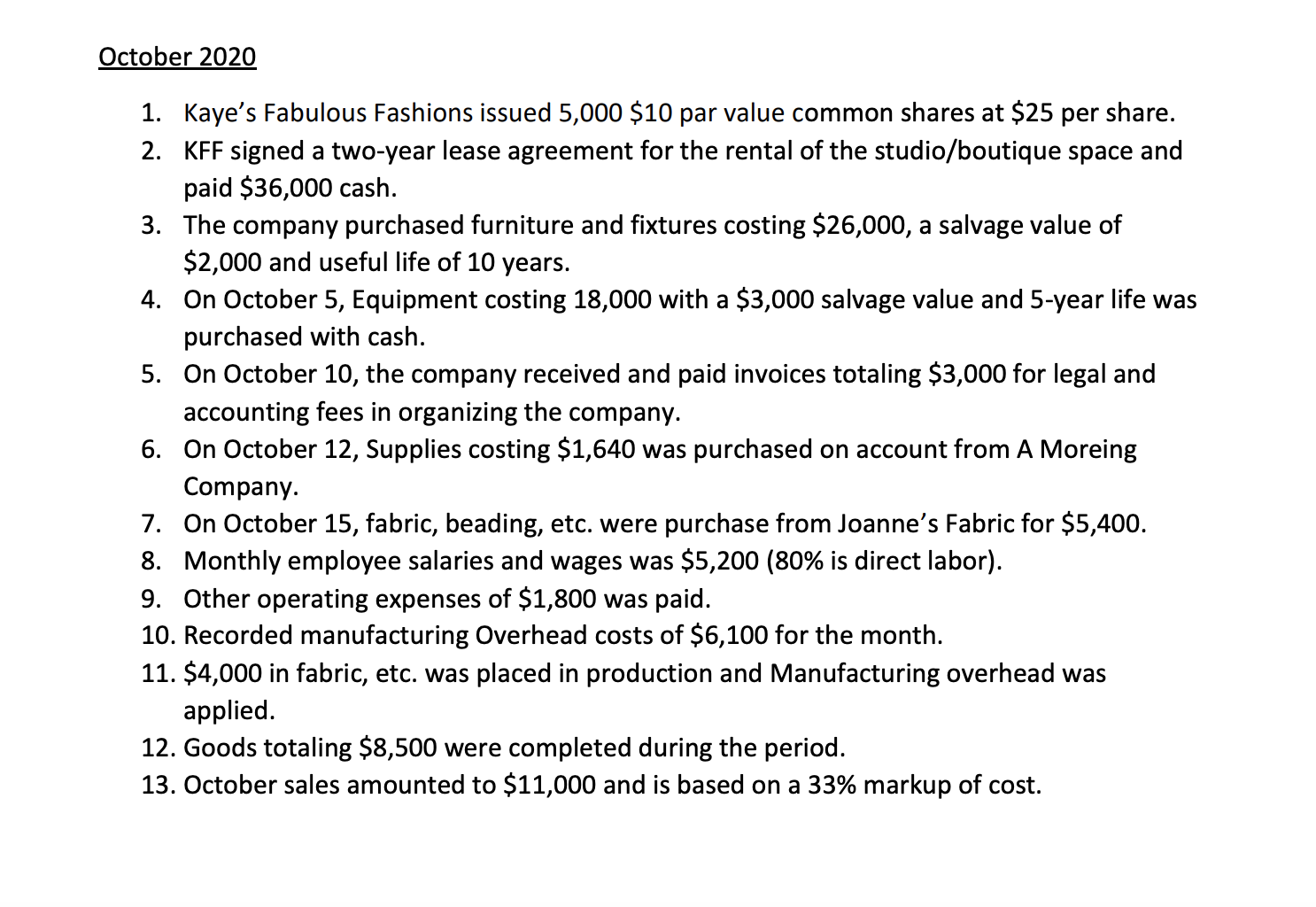

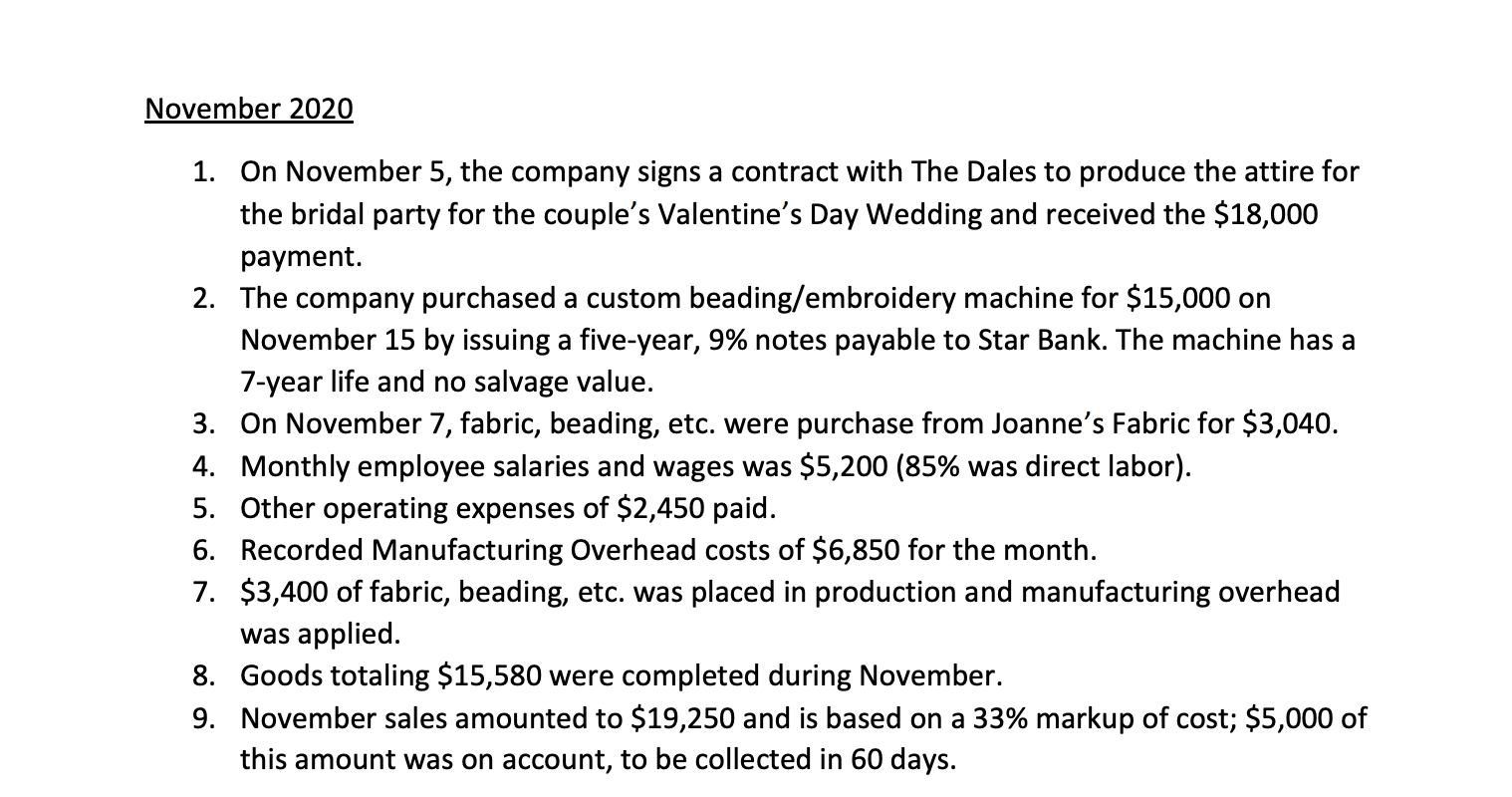

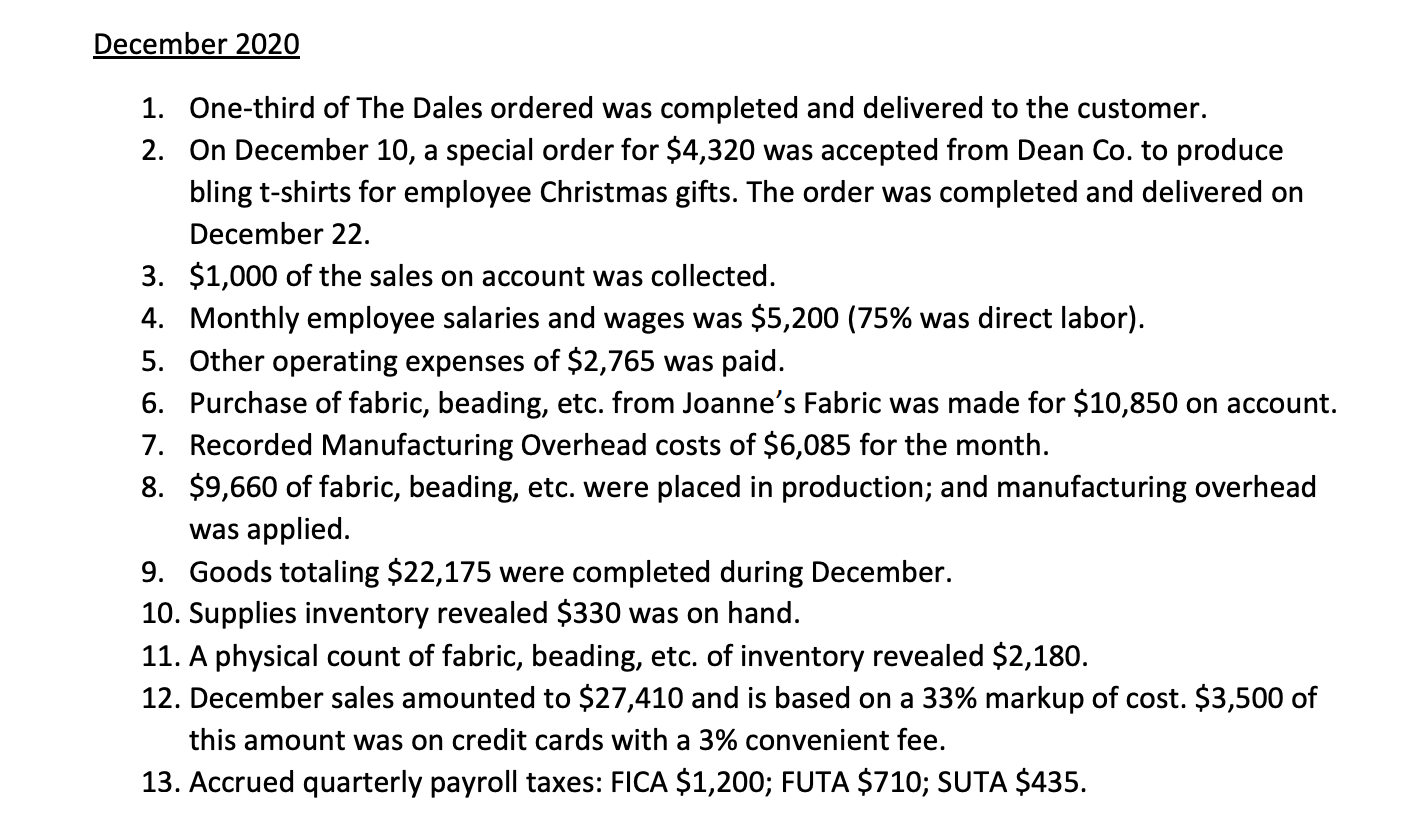

KAYE'S FABULOUS FASHIONS (KFF) On October 1, 2020, after making original fashions consisting of gowns, dresses, suits, jewelry, belts, bags, shoes and boots in her home for the last 10 years; with the help of family, friends and a few investors Kaye Robb has decided to take a giant leap and open her own design studio and boutique. The company employs Kaye as designer, a seamstress and a salescierk to operate the business. Monthly payroll is paid on the 25'\" of each, expenses and sales are recorded on the last day of the month. Manufacturing Overhead is 150% of direct labor and is recorded on the iast day of the month. Ail sales are cash sales unless otherwise noted. Expenses are paid in cash unless otherwise noted. All property, plant and equipment are depreciated using the straight-line method for book purposes (full month depreciation is taken if purchased during the month}. The following are the transactions for the first year of operations: October 2020 1. 2. Kaye's Fabulous Fashions issued 5,000 $10 par value common shares at $25 per share. KFF signed a two-year lease agreement for the rental of the studio/boutique space and paid $36,000 cash. The company purchased furniture and fixtures costing $26,000, a salvage value of $2,000 and useful life of 10 years. On October 5, Equipment costing 18,000 with a $3,000 salvage value and 5-year life was purchased with cash. On October 10, the company received and paid invoices totaling $3,000 for legal and accounting fees in organizing the company. On October 12, Supplies costing $1,640 was purchased on account from A Moreing Company. On October 15, fabric, beading, etc. were purchase from Joanne's Fabric for $5,400. Monthly employee salaries and wages was $5,200 (80% is direct labor). Other operating expenses of $1,800 was paid. . Recorded manufacturing Overhead costs of $6,100 for the month. . $4,000 in fabric, etc. was placed in production and Manufacturing overhead was applied. . Goods totaling $8,500 were completed during the period. . October sales amounted to $11,000 and is based on a 33% markup of cost. November 2020 1. HF'F'PP' 9 On November 5, the company signs a contract with The Dales to produce the attire for the bridal party for the couple's Valentine's Day Wedding and received the $18,000 payment. The company purchased a custom beading/embroidery machine for $15,000 on November 15 by issuing a five-year, 9% notes payable to Star Bank. The machine has a 7-year life and no salvage value. On November 7, fabric, beading, etc. were purchase from Joanne's Fabric for $3,040. Monthly employee salaries and wages was $5,200 (85% was direct labor). Other operating expenses of $2,450 paid. Recorded Manufacturing Overhead costs of $6,850 for the month. $3,400 of fabric, beading, etc. was placed in production and manufacturing overhead was applied. Goods totaling $15,580 were completed during November. November sales amounted to $19,250 and is based on a 33% markup of cost; $5,000 of this amount was on account, to be collected in 60 days. W N POHP'P'PP' 10. 11. 12. 13. One-third of The Dales ordered was completed and delivered to the customer. On December 10, a special order for $4,320 was accepted from Dean Co. to produce bling t-shirts for employee Christmas gifts. The order was completed and delivered on December 22. $1,000 of the sales on account was collected. Monthly employee salaries and wages was $5,200 (75% was direct labor). Other operating expenses of $2,765 was paid. Purchase of fabric, beading, etc. from Joanne's Fabric was made for $10,850 on account. Recorded Manufacturing Overhead costs of $6,085 for the month. $9,660 of fabric, beading, etc. were placed in production; and manufacturing overhead was applied. Goods totaling $22,175 were completed during December. Supplies inventory revealed $330 was on hand. A physical count of fabric, beading, etc. of inventory revealed $2,180. December sales amounted to $27,410 and is based on a 33% markup of cost. $3,500 of this amount was on credit cards with a 3% convenient fee. Accrued quarterly payroll taxes: FICA $1,200; FUTA $710; SUTA $435