Answered step by step

Verified Expert Solution

Question

1 Approved Answer

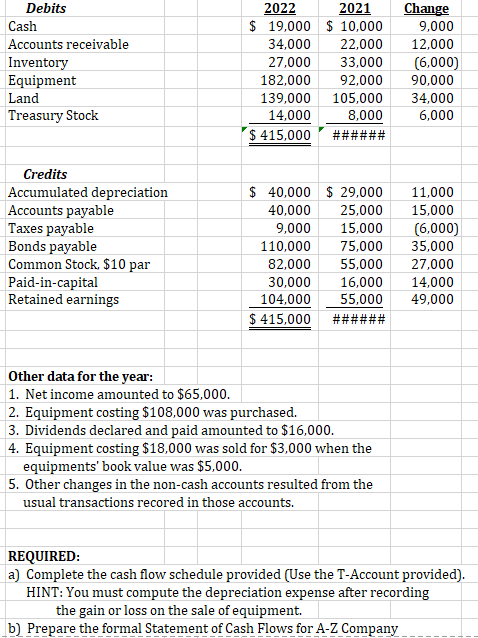

Please complete part a, using the T charts. Debits Cash Accounts receivable Inventory Equipment Land Treasury Stock 2022 2021 $ 19,000 $10,000 34,000 22,000 27,000

Please complete part a, using the T charts.

Debits Cash Accounts receivable Inventory Equipment Land Treasury Stock 2022 2021 $ 19,000 $10,000 34,000 22,000 27,000 33,000 182,000 92,000 139,000 105,000 14,000 8,000 $ 415,000 ###### Change 9,000 12.000 (6,000) 90,000 34,000 6,000 Credits Accumulated depreciation Accounts payable Taxes payable Bonds payable Common Stock $10 par Paid-in-capital Retained earnings $ 40,000 $ 29,000 40,000 25,000 9,000 15,000 110,000 75,000 82,000 55,000 30,000 16,000 104,000 55,000 $ 415,000 ###### 11,000 15,000 (6,000) 35,000 27,000 14,000 49,000 Other data for the year: 1. Net income amounted to $65,000. 2. Equipment costing $108,000 was purchased. 3. Dividends declared and paid amounted to $16,000. 4. Equipment costing $18,000 was sold for $3,000 when the equipments' book value was $5,000. 5. Other changes in the non-cash accounts resulted from the usual transactions recored in those accounts. REQUIRED: a) Complete the cash flow schedule provided (Use the T-Account provided). HINT: You must compute the depreciation expense after recording the gain or loss on the sale of equipment. b) Prepare the formal Statement of Cash Flows for A-Z CompanyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started