Answered step by step

Verified Expert Solution

Question

1 Approved Answer

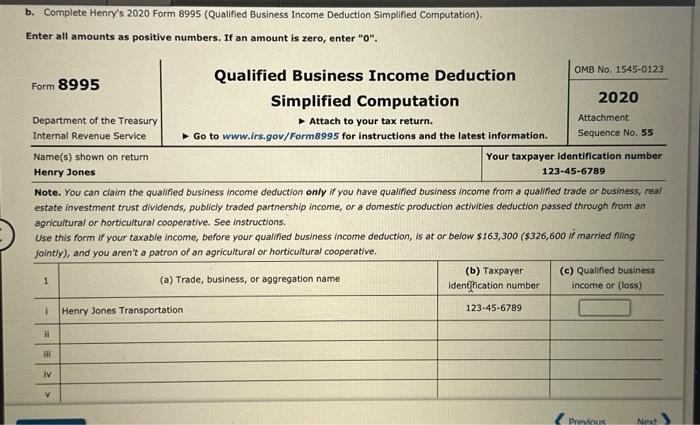

please complete part B i gave you all the information 2 Total qualified business income or (loss), Combine lines 11 through 1v, column (c) ..

please complete part B

i gave you all the information

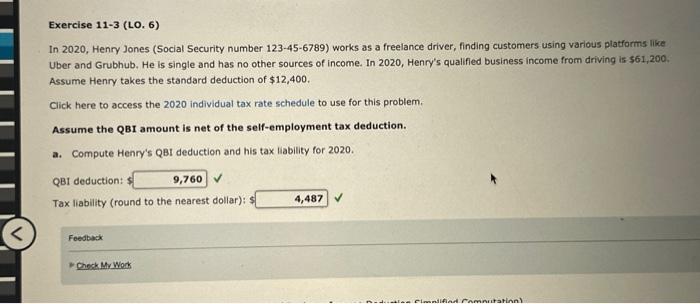

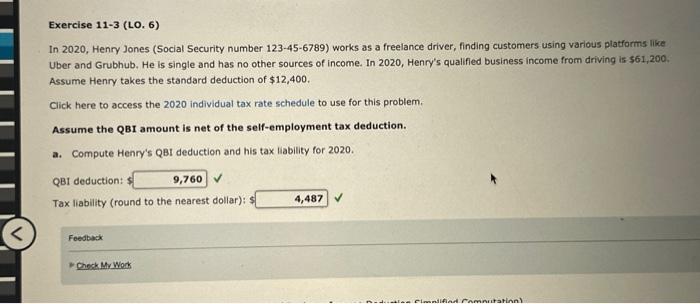

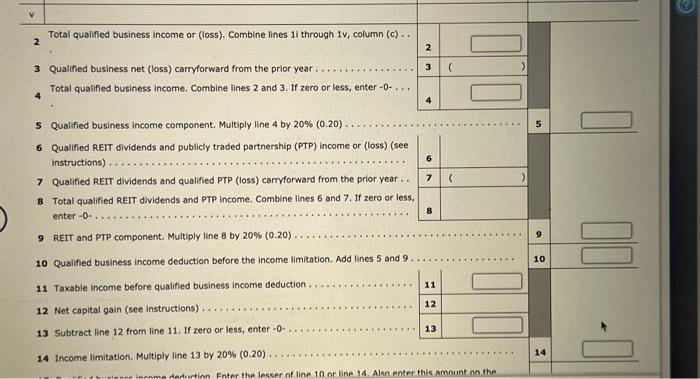

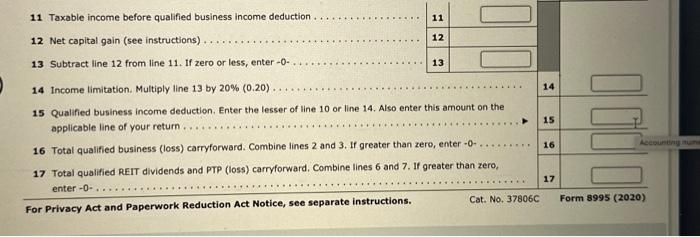

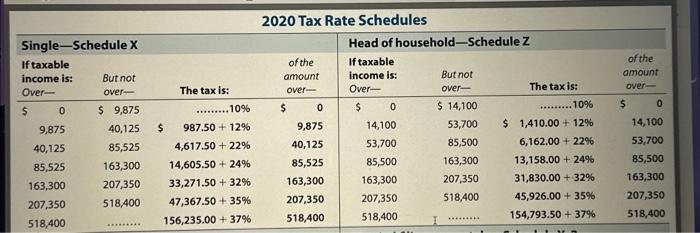

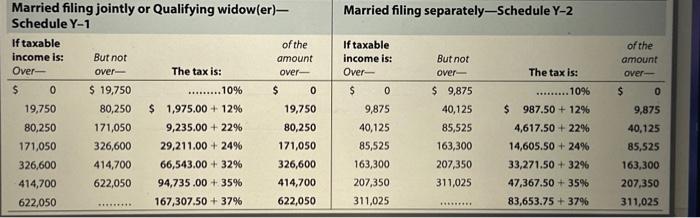

2 Total qualified business income or (loss), Combine lines 11 through 1v, column (c) .. 3 Qualified business net (loss) carryforward from the prior year 4 Total qualified business income. Combine lines 2 and 3. If zero or less, enter - 0 5 Qualified business income component. Multiply line 4 by 20%(0.20) 6 Qualified REIT dividends and publicly traded partnership (PTP) income or (loss) (see instructions) 7 Qualified REIT dividends and qualified PTP (loss) carryforward from the prior year.. 8. Total qualified REIT dividends and PTP income. Combine lines 6 and 7. If zero or less, enter -0 . 9 REIT and PTP component. Multiply line 8 by 20%(0.20) 10 Qualified business income deduction before the income limitation. Add lines 5 and 9 11 Taxable income before qualified business income deduction 12 Net capital gain (see instructions) 13 Subtract line 12 from line 11 . If zero or less, enter -0 . 14 Income limitation. Multiply line 13 by 20%(0.20) 11 Taxable income before qualified business income deduction 12 Net capital gain (see instructions) 13 Subtract line 12 from line 11 . If zero or less, enter -0 \begin{tabular}{|c|c|} \hline 11 & \\ \hline 12 & \\ \hline 13 & \\ \hline \end{tabular} 14 Income limitation. Multiply line 13 by 20%(0.20) 15 Qualified business income deduction. Enter the lesser of line 10 or line 14. Also enter this amount on the applicable line of your return 16 Total qualified business (loss) carryforward. Combine lines 2 and 3 . If greater than zero, enter -0 - 17 Total qualified REIT dividends and PTP (loss) carryforward, Combine lines 6 and 7. If greater than zero, enter -0 . For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No, 37806C Form 8995 (2020) In 2020, Henry Jones (Social Security number 123-45-6789) works as a freelance driver, finding customers using various platforms like Uber and Grubhub. He is single and has no other sources of income. In 2020, Henry's qualified business income from driving is 561,200. Assume Henry takes the standard deduction of $12,400. Click here to access the 2020 individual tax rate schedule to use for this problem. Assume the QBI amount is net of the self-employment tax deduction. a. Compute Henry's QBI deduction and his tax liability for 2020. QBI deduction: $ Tax liability (round to the nearest dollar): $ b. Complete Henry's 2020 Form 8995 (Qualified Business Income Deduction Simplified Computation). Enter all amounts as positive numbers. If an amount is zero, enter " 0 ". \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{\begin{tabular}{l} Married filing jointly or Qualifying widow(er)- \\ Schedule Y-1 \end{tabular}} & \multicolumn{4}{|c|}{ Married filing separately-Schedule Y-2 } \\ \hline \begin{tabular}{l} If taxable \\ income is: \\ Over- \end{tabular} & \begin{tabular}{l} But not \\ over- \end{tabular} & The tax is: & \begin{tabular}{l} of the \\ amount \\ over- \end{tabular} & \begin{tabular}{l} If taxable \\ income is: \\ Over- \end{tabular} & \begin{tabular}{l} But not \\ over- \end{tabular} & The tax is: & \begin{tabular}{l} of the \\ amount \\ over- \end{tabular} \\ \hline 0 & $19,750 & ..10% & 0 & 0 & \$ 9,875 & .........10\% & $ \\ \hline 19,750 & 80,250 & $1,975.00+12% & 19,750 & 9,875 & 40,125 & $987.50+12% & 9,875 \\ \hline 80,250 & 171,050 & 9,235.00+22% & 80,250 & 40,125 & 85,525 & 4,617.50+22% & 40,125 \\ \hline 171,050 & 326,600 & 29,211.00+24% & 171,050 & 85,525 & 163,300 & 14,605.50+24% & 85,525 \\ \hline 326,600 & 414,700 & 66,543.00+32% & 326,600 & 163,300 & 207,350 & 33,271.50+32% & 163,300 \\ \hline 414,700 & 622,050 & 94,735.00+35% & 414,700 & 207,350 & 311,025 & 47,367.50+35% & 207,350 \\ \hline 622,050 & .......... & 167,307.50+37% & 622,050 & 311,025 & ........... & 83,653.75+37% & 311,025 \\ \hline \end{tabular} 2020 Tax Rate Schedules 2 Total qualified business income or (loss), Combine lines 11 through 1v, column (c) .. 3 Qualified business net (loss) carryforward from the prior year 4 Total qualified business income. Combine lines 2 and 3. If zero or less, enter - 0 5 Qualified business income component. Multiply line 4 by 20%(0.20) 6 Qualified REIT dividends and publicly traded partnership (PTP) income or (loss) (see instructions) 7 Qualified REIT dividends and qualified PTP (loss) carryforward from the prior year.. 8. Total qualified REIT dividends and PTP income. Combine lines 6 and 7. If zero or less, enter -0 . 9 REIT and PTP component. Multiply line 8 by 20%(0.20) 10 Qualified business income deduction before the income limitation. Add lines 5 and 9 11 Taxable income before qualified business income deduction 12 Net capital gain (see instructions) 13 Subtract line 12 from line 11 . If zero or less, enter -0 . 14 Income limitation. Multiply line 13 by 20%(0.20) 11 Taxable income before qualified business income deduction 12 Net capital gain (see instructions) 13 Subtract line 12 from line 11 . If zero or less, enter -0 \begin{tabular}{|c|c|} \hline 11 & \\ \hline 12 & \\ \hline 13 & \\ \hline \end{tabular} 14 Income limitation. Multiply line 13 by 20%(0.20) 15 Qualified business income deduction. Enter the lesser of line 10 or line 14. Also enter this amount on the applicable line of your return 16 Total qualified business (loss) carryforward. Combine lines 2 and 3 . If greater than zero, enter -0 - 17 Total qualified REIT dividends and PTP (loss) carryforward, Combine lines 6 and 7. If greater than zero, enter -0 . For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No, 37806C Form 8995 (2020) In 2020, Henry Jones (Social Security number 123-45-6789) works as a freelance driver, finding customers using various platforms like Uber and Grubhub. He is single and has no other sources of income. In 2020, Henry's qualified business income from driving is 561,200. Assume Henry takes the standard deduction of $12,400. Click here to access the 2020 individual tax rate schedule to use for this problem. Assume the QBI amount is net of the self-employment tax deduction. a. Compute Henry's QBI deduction and his tax liability for 2020. QBI deduction: $ Tax liability (round to the nearest dollar): $ b. Complete Henry's 2020 Form 8995 (Qualified Business Income Deduction Simplified Computation). Enter all amounts as positive numbers. If an amount is zero, enter " 0 ". \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{\begin{tabular}{l} Married filing jointly or Qualifying widow(er)- \\ Schedule Y-1 \end{tabular}} & \multicolumn{4}{|c|}{ Married filing separately-Schedule Y-2 } \\ \hline \begin{tabular}{l} If taxable \\ income is: \\ Over- \end{tabular} & \begin{tabular}{l} But not \\ over- \end{tabular} & The tax is: & \begin{tabular}{l} of the \\ amount \\ over- \end{tabular} & \begin{tabular}{l} If taxable \\ income is: \\ Over- \end{tabular} & \begin{tabular}{l} But not \\ over- \end{tabular} & The tax is: & \begin{tabular}{l} of the \\ amount \\ over- \end{tabular} \\ \hline 0 & $19,750 & ..10% & 0 & 0 & \$ 9,875 & .........10\% & $ \\ \hline 19,750 & 80,250 & $1,975.00+12% & 19,750 & 9,875 & 40,125 & $987.50+12% & 9,875 \\ \hline 80,250 & 171,050 & 9,235.00+22% & 80,250 & 40,125 & 85,525 & 4,617.50+22% & 40,125 \\ \hline 171,050 & 326,600 & 29,211.00+24% & 171,050 & 85,525 & 163,300 & 14,605.50+24% & 85,525 \\ \hline 326,600 & 414,700 & 66,543.00+32% & 326,600 & 163,300 & 207,350 & 33,271.50+32% & 163,300 \\ \hline 414,700 & 622,050 & 94,735.00+35% & 414,700 & 207,350 & 311,025 & 47,367.50+35% & 207,350 \\ \hline 622,050 & .......... & 167,307.50+37% & 622,050 & 311,025 & ........... & 83,653.75+37% & 311,025 \\ \hline \end{tabular} 2020 Tax Rate Schedules Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started