Question

Please complete part b) Romez Limited borrowed $47,280 from National bank on July 1 for three months; 5% interest is payable the first of each

Please complete part b)

Romez Limited borrowed $47,280 from National bank on July 1 for three months; 5% interest is payable the first of each month, starting August 1. Romezs year end is August 31 and the company records adjusting entries only at that time.

a) Prepare a journal entry to record the receipt of the bank loan on July 1

July 1 Cash 47280

Bank Loan Payable 47280

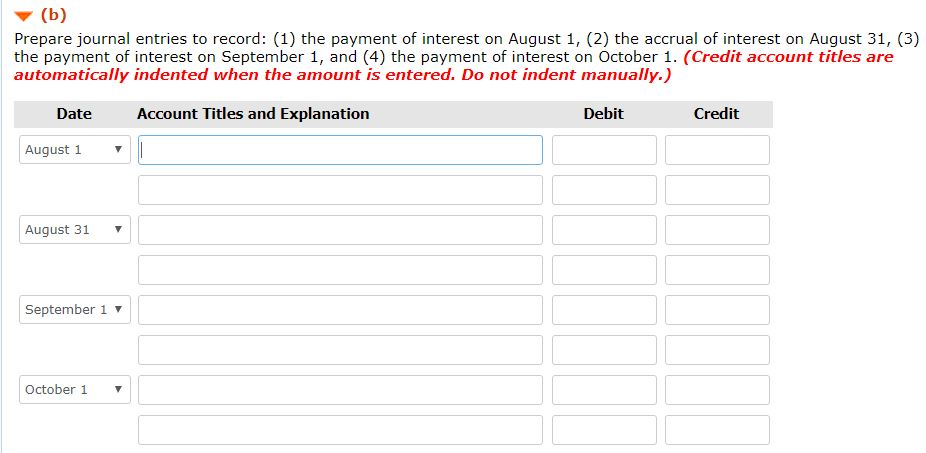

b) Prepare journal entries to record: (i) the payment of interest on August 1, (ii) the accrual of interest on August 31, (iii) the payment of interest on September 1, and (iv) the payment of interest on October 1. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Prepare journal entries to record: (1) the payment of interest on August 1, (2) the accrual of interest on August 31, (3) the payment of interest on September 1, and (4) the payment of interest on October 1. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit August 1 August 31 September 1 ? October 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started