Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete problems 2&3. Please show all work for a thorough understanding. Handwriting MUST be LEGIBLE. 2. A self-employed person deposits $3,000 annually in a

Please complete problems 2&3. Please show all work for a thorough understanding. Handwriting MUST be LEGIBLE.

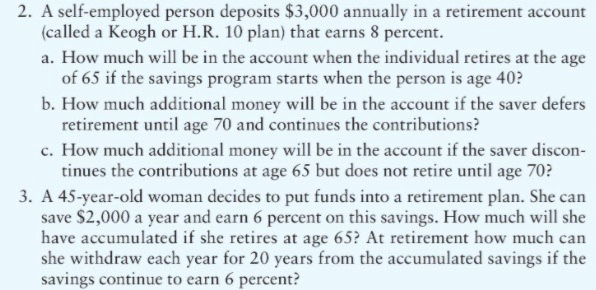

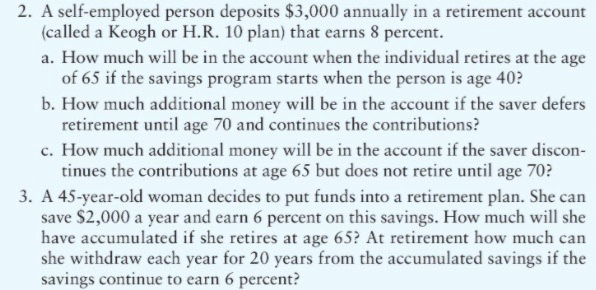

2. A self-employed person deposits $3,000 annually in a retirement account (called a Keogh or H.R. 10 plan) that earns 8 percent. a. How much will be in the account when the individual retires at the age of 65 if the savings program starts when the person is age 40? b. How much additional money will be in the account if the saver defers retirement until age 70 and continues the contributions? c. How much additional money will be in the account if the saver discon- tinues the contributions at age 65 but does not retire until age 702 3. A 45-year-old woman decides to put funds into a retirement plan. She can save $2,000 a year and earn 6 percent on this savings. How much will she have accumulated if she retires at age 65? At retirement how much can she withdraw each year for 20 years from the accumulated savings if the savings continue to earn 6 percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started