please complete requirements 1 and 2. requirement 1 consists of 3 journal entries.

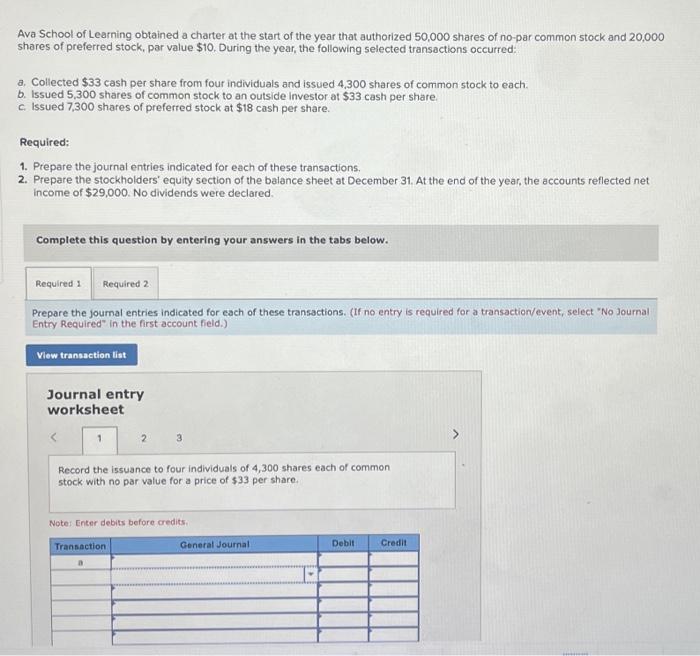

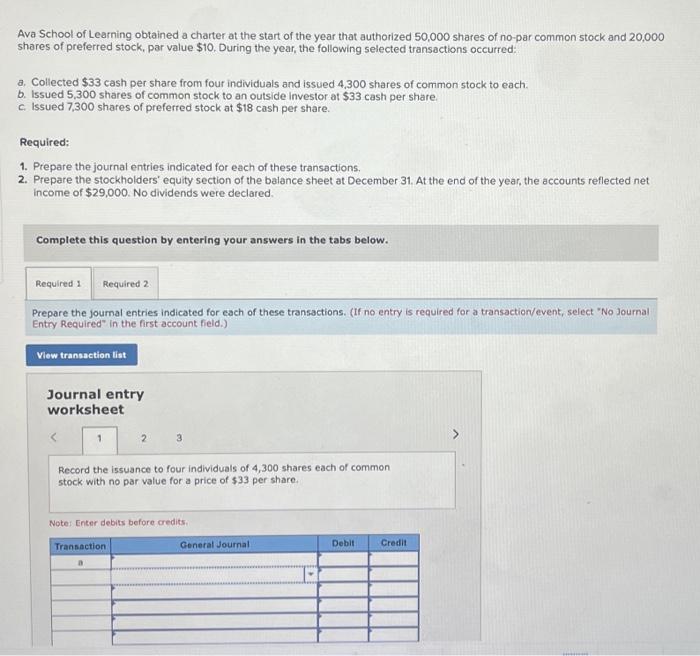

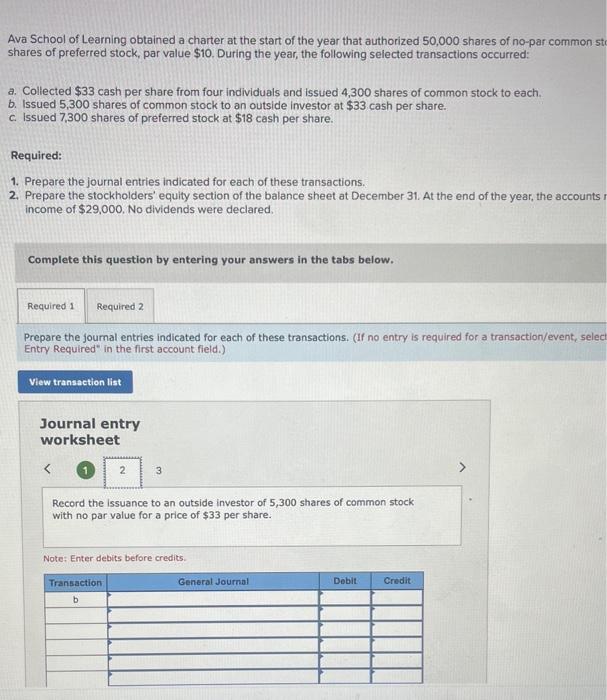

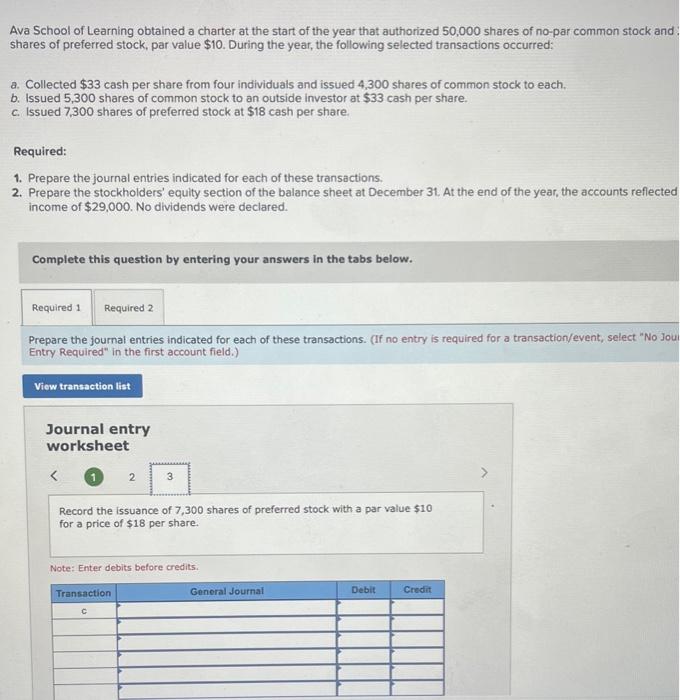

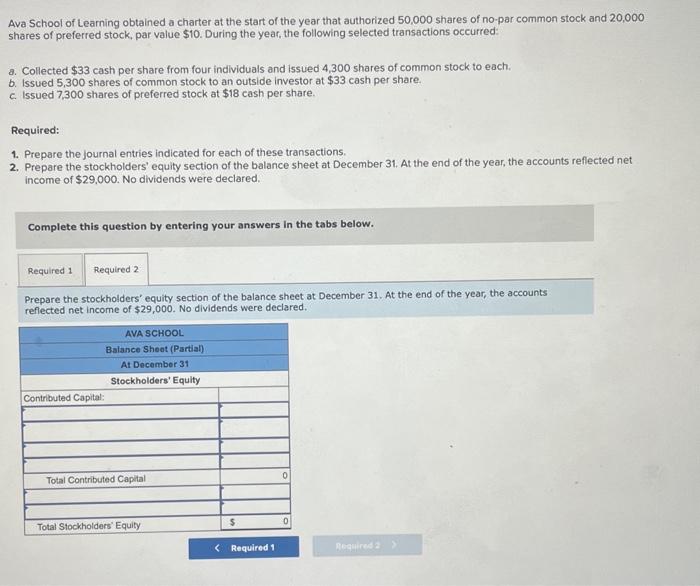

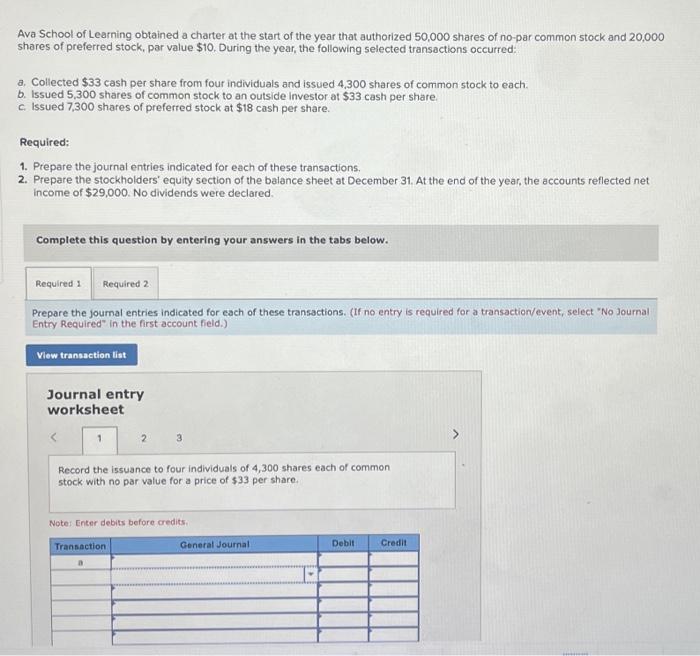

Ava School of Learning obtained a charter at the start of the year that authorized 50,000 shares of no-par common stock and 20,000 shares of preferred stock, par value $10. During the year, the following selected transactions occurred: a. Collected $33 cash per share from four individuals and issued 4.300 shares of common stock to each. b. Issued 5,300 shares of common stock to an outside investor at $33 cash per share. c. Issued 7,300 shares of preferred stock at $18 cash per share. Required: 1. Prepare the journal entries indicated for each of these transactions. 2. Prepare the stockholders' equity section of the balance sheet at December 31. At the end of the year, the accounts reflected net income of $29,000. No dividends were declared. Complete this question by entering your answers in the tabs below. Prepare the journal entries indicated for each of these transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 3 Record the issuance to four individuals of 4,300 shares each of common stock with no par value for a price of $33 per share. Note: Enter debits before credits. Ava School of Learning obtained a charter at the start of the year that authorized 50,000 shares of no-par common st shares of preferred stock, par value $10. During the year, the following selected transactions occurred: a. Collected $33 cash per share from four individuals and issued 4,300 shares of common stock to each. b. Issued 5,300 shares of common stock to an outside investor at $33 cash per share. c. Issued 7,300 shares of preferred stock at $18 cash per share. Required: 1. Prepare the journal entries indicated for each of these transactions. 2. Prepare the stockholders' equity section of the balance sheet at December 31. At the end of the year, the accounts income of $29,000. No dividends were declared Complete this question by entering your answers in the tabs below. Prepare the journal entries indicated for each of these transactions. (If no entry is required for a transaction/event, selec Entry Required in the first account field.) Journal entry worksheet Record the issuance to an outside investor of 5,300 shares of common stock with no par value for a price of $33 per share. Note: Enter debits before credits. Ava School of Learning obtained a charter at the start of the year that authorized 50,000 shares of no-par common stock and shares of preferred stock, par value $10. During the year, the following selected transactions occurred: a. Collected $33 cash per share from four individuals and issued 4,300 shares of common stock to each. b. Issued 5,300 shares of common stock to an outside investor at $33 cash per share. c. Issued 7,300 shares of preferred stock at $18 cash per share. Required: 1. Prepare the journal entries indicated for each of these transactions. 2. Prepare the stockholders' equity section of the balance sheet at December 31. At the end of the year, the accounts reflected income of $29,000. No dividends were declared. Complete this question by entering your answers in the tabs below. Prepare the journal entries indicated for each of these transactions. (If no entry is required for a transaction/event, select "No Jou Entry Required" in the first account field.) Journal entry worksheet Record the issuance of 7,300 shares of preferred stock with a par value $10 for a price of $18 per share. Note: Enter debits before credits. Ava School of Leaming obtained a charter at the start of the year that authorized 50,000 shares of no-par common stock and 20,000 shares of preferred stock, par value $10. During the year, the following selected transactions occurred: a. Collected $33 cash per share from four indlviduals and issued 4,300 shares of common stock to each. b. Issued 5,300 shares of common stock to an outside investor at $33 cash per share. c. Issued 7,300 shares of preferred stock at $18 cash per share. Required: 1. Prepare the journal entries indicated for each of these transactions. 2. Prepare the stockholders' equity section of the balance sheet at December 31 . At the end of the year, the accounts reflected net income of $29,000. No dividends were declared. Complete this question by entering your answers in the tabs below. Prepare the stockholders' equity section of the balance sheet at December 31 . At the end of the year, the accounts reflected net income of $29,000. No dividends were declared