Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please complete s11-2 , s11-3, s11-4 requirements long-term liability (LTL). Objective 1 Objective 1 S11-2 Recording sales tax On July 5, Williams Company recorded sales

please complete s11-2 , s11-3, s11-4 requirements

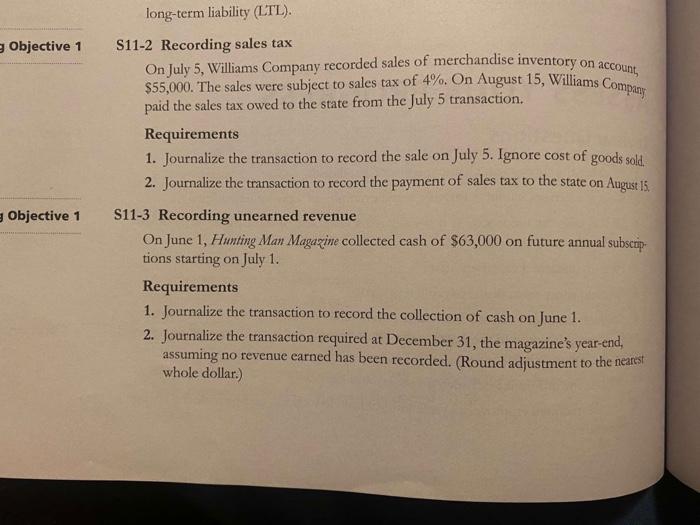

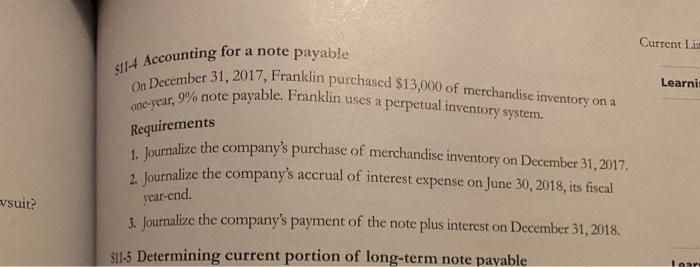

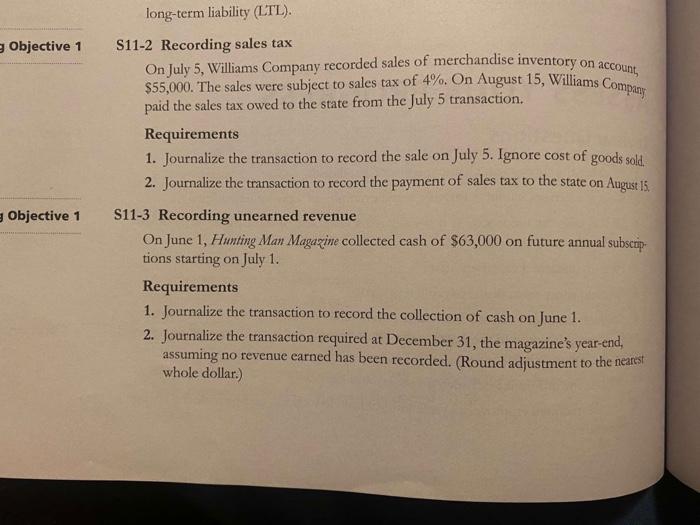

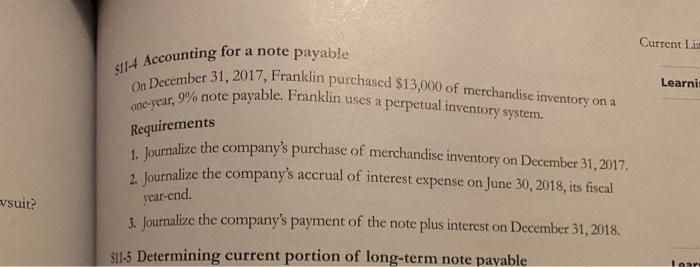

long-term liability (LTL). Objective 1 Objective 1 S11-2 Recording sales tax On July 5, Williams Company recorded sales of merchandise inventory on account, $55,000. The sales were subject to sales tax of 4%. On August 15, Williams Company paid the sales tax owed to the state from the July 5 transaction. Requirements 1. Journalize the transaction to record the sale on July 5. Ignore cost of goods sold. 2. Journalize the transaction to record the payment of sales tax to the state on August 15. S11-3 Recording unearned revenue On June 1, Hunting Man Magazine collected cash of $63,000 on future annual subsctip- tions starting on July 1. Requirements 1. Journalize the transaction to record the collection of cash on June 1. 2. Journalize the transaction required at December 31, the magazine's year-end, assuming no revenue earned has been recorded. (Round adjustment to the nearest whole dollar.) Current Lis $11-4 Accounting for a note payable Learni On December 31, 2017, Franklin purchased $13,000 of merchandise inventory on a one-year, 9% note payable. Franklin uses a perpetual inventory system. Requirements 1. Journalize the company's purchase of merchandise inventory on December 31, 2017. 2. Journalize the company's accrual of interest expense on June 30, 2018, its fiscal vsuit? year-end. 3. Journalize the company's payment of the note plus interest on December 31, 2018 $11-5 Determining current portion of long-term note payable Are

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started