Question

Please complete the attached PDF's with the info provided below. Analyzing Transactions Using the Financial Statement Effects Template and Preparing Financial Statements Schrand Aerobics, Inc.,

Please complete the attached PDF's with the info provided below.

Analyzing Transactions Using the Financial Statement Effects Template and Preparing Financial Statements

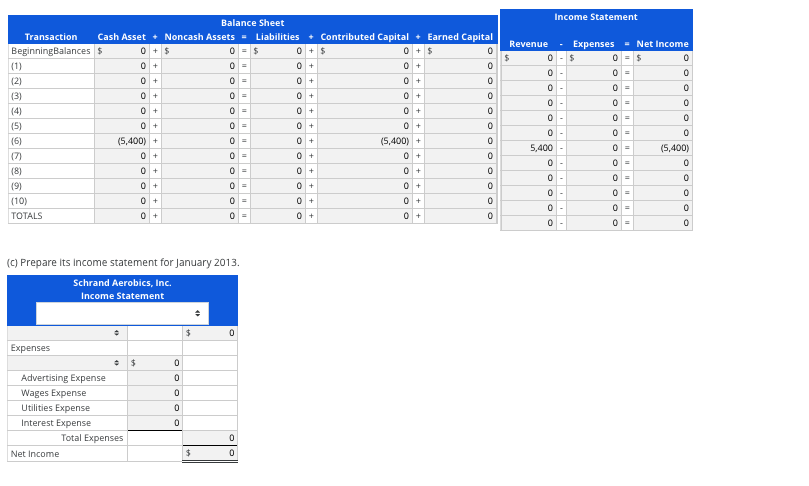

Schrand Aerobics, Inc., rents studio space (including a sound system) and specializes in offering aerobics classes. On January 1, 2013, its beginning account balances are as follows: Cash, $11,250; Accounts Receivable, $11,700; Equipment, $0; Notes Payable, $5,625; Accounts Payable, $2,250; Common Stock, $12,375; Retained Earnings, $2,700; Services Revenue, $0; Rent Expense, $0; Advertising Expense, $0; Wages Expense, $0; Utilities Expense, $0; Interest Expense, $0.

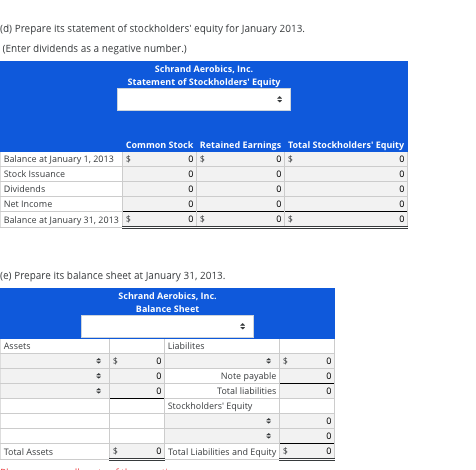

The following transactions occurred during January.

Required

(1) Paid $1,350 cash toward accounts payable

(2) Paid $8,100 cash for January rent

(3) Billed clients $25,875 for January classes

(4) Received $1,125 invoice from supplier for T-shirts given to January class members as an advertising promotion

(5) Collected $22,500 cash from clients previously billed for services rendered

(6) Paid $5,400 cash for employee wages

(7) Received $1,530 invoice for January utilities expense

(8) Paid $45 cash to bank as January interest on notes payable

(9) Declared and paid $2,025 cash dividend to stockholders

(10) Paid $9,000 cash on January 31 to purchase sound equipment to replace the rental system

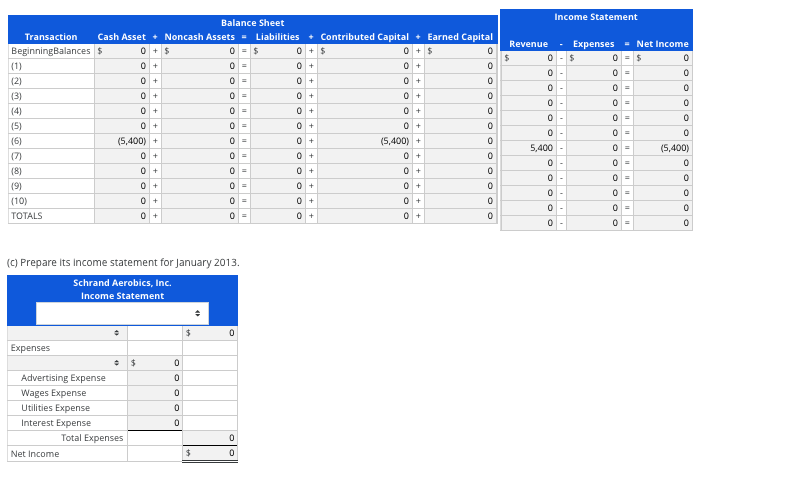

(a) Using the financial statement effects template, enter January 1 beginning amounts in the appropriate columns of the first row. (Hint: Beginning balances for columns can include amounts from more than one account.)

(b) Report the effects for each of the separate transactions 1 through 10 in the financial statement effects template set up in part (a). Total all columns and prove that (1) assets equal liabilities plus equity at January 31, and (2) revenues less expenses equal net income for January.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started