Please complete the attached PWC Analysis for Restaurant Co. The spreadsheet is attached along with the necessary financial information.

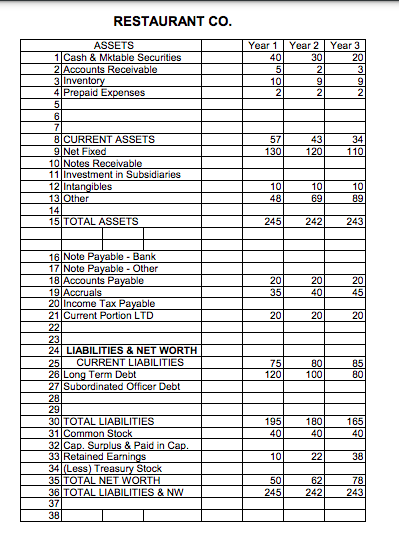

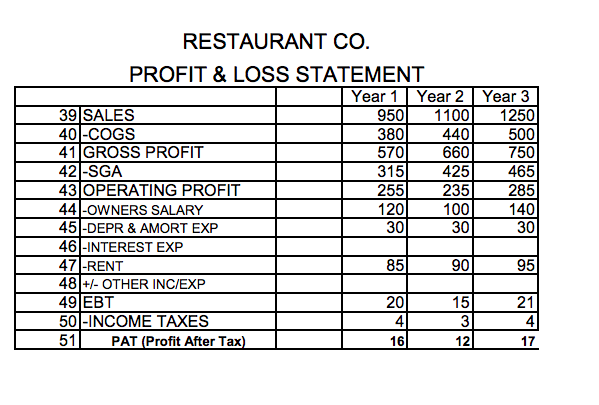

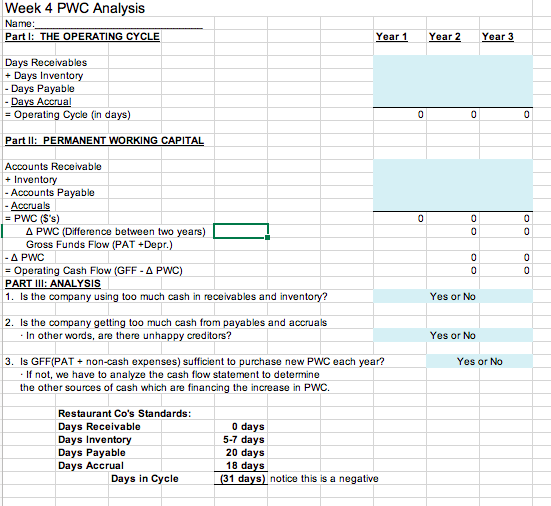

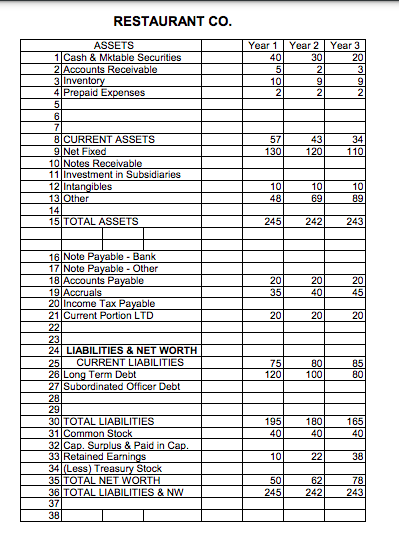

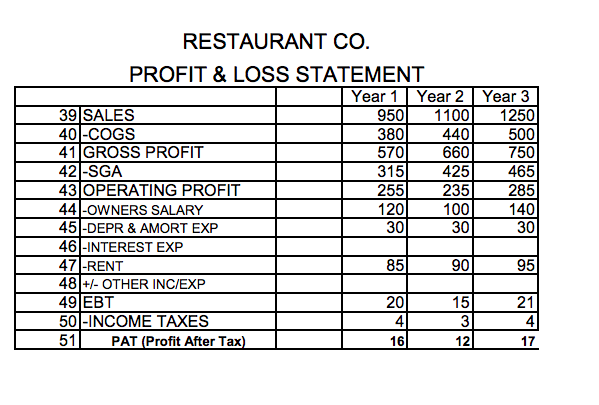

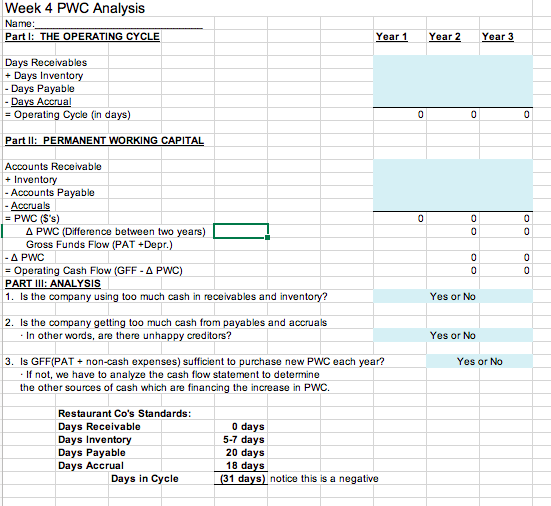

RESTAURANT CO. Year 1 40 5 10 2 Year 2 Year 3 30 20 2 3 9 9 2 2 ASSETS 1 Cash & Mktable Securities 2 Accounts Receivable 3 Inventory 4 Prepaid Expenses 5 6 7 8 CURRENT ASSETS 9 Net Fixed 10 Notes Receivable 11 Investment in Subsidiaries 12 Intangibles 13 Other 14 15 TOTAL ASSETS 57 130 43 120 34 110 10 48 10 69 10 89 245 242 243 20 35 20 40 20 45 20 20 20 75 120 80 100 85 80 16 Note Payable - Bank 17 Note Payable - Other 18 Accounts Payable 19 Accruals 20 Income Tax Payable 21 Current Portion LTD 22 23 24 LIABILITIES & NET WORTH 25 CURRENT LIABILITIES 26 Long Term Debt 27 Subordinated Officer Debt 28 29 30 TOTAL LIABILITIES 31 Common Stock 32 Cap. Surplus & Paid in Cap. 33 Retained Earnings 34 (Less) Treasury Stock 35 TOTAL NET WORTH 36 TOTAL LIABILITIES & NW 37 38 195 40 180 40 165 40 10 22 50 245 62 242 78 243 RESTAURANT CO. PROFIT & LOSS STATEMENT Year 1 Year 2 Year 3 39 SALES 950 1100 1250 401-COGS 380 440 500 41 GROSS PROFIT 5701 660 750 42 -SGA 315 425 465 43 OPERATING PROFIT 255 235 285 44 -OWNERS SALARY 1201 100 140 45 -DEPR & AMORT EXP 30 30 30 46-INTEREST EXP 47 -RENT 85) 90 951 48 +/- OTHER INC/EXP 49 EBT 20 15 21 50 -INCOME TAXES 4 4 511 PAT (Profit After Tax) 16 12 17 Week 4 PWC Analysis Name: Part I: THE OPERATING CYCLE Year 1 Year 2 Year 3 Days Receivables Days Inventory - Days Payable - Days Accrual = Operating Cycle (in days) Part II: PERMANENT WORKING CAPITAL 0 0 0 0 0 0 0 0 0 0 0 0 Accounts Receivable + Inventory - Accounts Payable - Accruals = PWC ($'s) PWC (Difference between two years) Gross Funds Flow (PAT +Depr.) -A PWC = Operating Cash Flow (GFF-A PWC) PART III: ANALYSIS 1. Is the company using too much cash in receivables and inventory? 2. Is the company getting too much cash from payables and accruals - In other words, are there unhappy creditors? 3. Is GFF(PAT + non-cash expenses) sufficient to purchase new PWC each year? - If not, we have to analyze the cash flow statement to determine the other sources of cash which are financing the increase in PWC. Yes or No Yes or No Yes or No Restaurant Co's Standards: Days Receivable Days Inventory Days Payable Days Accrual Days in Cycle 0 days 5-7 days 20 days 18 days (31 days) notice this is a negative RESTAURANT CO. Year 1 40 5 10 2 Year 2 Year 3 30 20 2 3 9 9 2 2 ASSETS 1 Cash & Mktable Securities 2 Accounts Receivable 3 Inventory 4 Prepaid Expenses 5 6 7 8 CURRENT ASSETS 9 Net Fixed 10 Notes Receivable 11 Investment in Subsidiaries 12 Intangibles 13 Other 14 15 TOTAL ASSETS 57 130 43 120 34 110 10 48 10 69 10 89 245 242 243 20 35 20 40 20 45 20 20 20 75 120 80 100 85 80 16 Note Payable - Bank 17 Note Payable - Other 18 Accounts Payable 19 Accruals 20 Income Tax Payable 21 Current Portion LTD 22 23 24 LIABILITIES & NET WORTH 25 CURRENT LIABILITIES 26 Long Term Debt 27 Subordinated Officer Debt 28 29 30 TOTAL LIABILITIES 31 Common Stock 32 Cap. Surplus & Paid in Cap. 33 Retained Earnings 34 (Less) Treasury Stock 35 TOTAL NET WORTH 36 TOTAL LIABILITIES & NW 37 38 195 40 180 40 165 40 10 22 50 245 62 242 78 243 RESTAURANT CO. PROFIT & LOSS STATEMENT Year 1 Year 2 Year 3 39 SALES 950 1100 1250 401-COGS 380 440 500 41 GROSS PROFIT 5701 660 750 42 -SGA 315 425 465 43 OPERATING PROFIT 255 235 285 44 -OWNERS SALARY 1201 100 140 45 -DEPR & AMORT EXP 30 30 30 46-INTEREST EXP 47 -RENT 85) 90 951 48 +/- OTHER INC/EXP 49 EBT 20 15 21 50 -INCOME TAXES 4 4 511 PAT (Profit After Tax) 16 12 17 Week 4 PWC Analysis Name: Part I: THE OPERATING CYCLE Year 1 Year 2 Year 3 Days Receivables Days Inventory - Days Payable - Days Accrual = Operating Cycle (in days) Part II: PERMANENT WORKING CAPITAL 0 0 0 0 0 0 0 0 0 0 0 0 Accounts Receivable + Inventory - Accounts Payable - Accruals = PWC ($'s) PWC (Difference between two years) Gross Funds Flow (PAT +Depr.) -A PWC = Operating Cash Flow (GFF-A PWC) PART III: ANALYSIS 1. Is the company using too much cash in receivables and inventory? 2. Is the company getting too much cash from payables and accruals - In other words, are there unhappy creditors? 3. Is GFF(PAT + non-cash expenses) sufficient to purchase new PWC each year? - If not, we have to analyze the cash flow statement to determine the other sources of cash which are financing the increase in PWC. Yes or No Yes or No Yes or No Restaurant Co's Standards: Days Receivable Days Inventory Days Payable Days Accrual Days in Cycle 0 days 5-7 days 20 days 18 days (31 days) notice this is a negative