Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please complete the bank reconciliation for JUNE 2022...instructions attached. Please attached answers using the BANK RECONCILIATION STATEMENT TEMPLATE TO FILL OUT THE BLANK ANSWERS. Bank

please complete the bank reconciliation for JUNE 2022...instructions attached. Please attached answers using the BANK RECONCILIATION STATEMENT TEMPLATE TO FILL OUT THE BLANK ANSWERS.

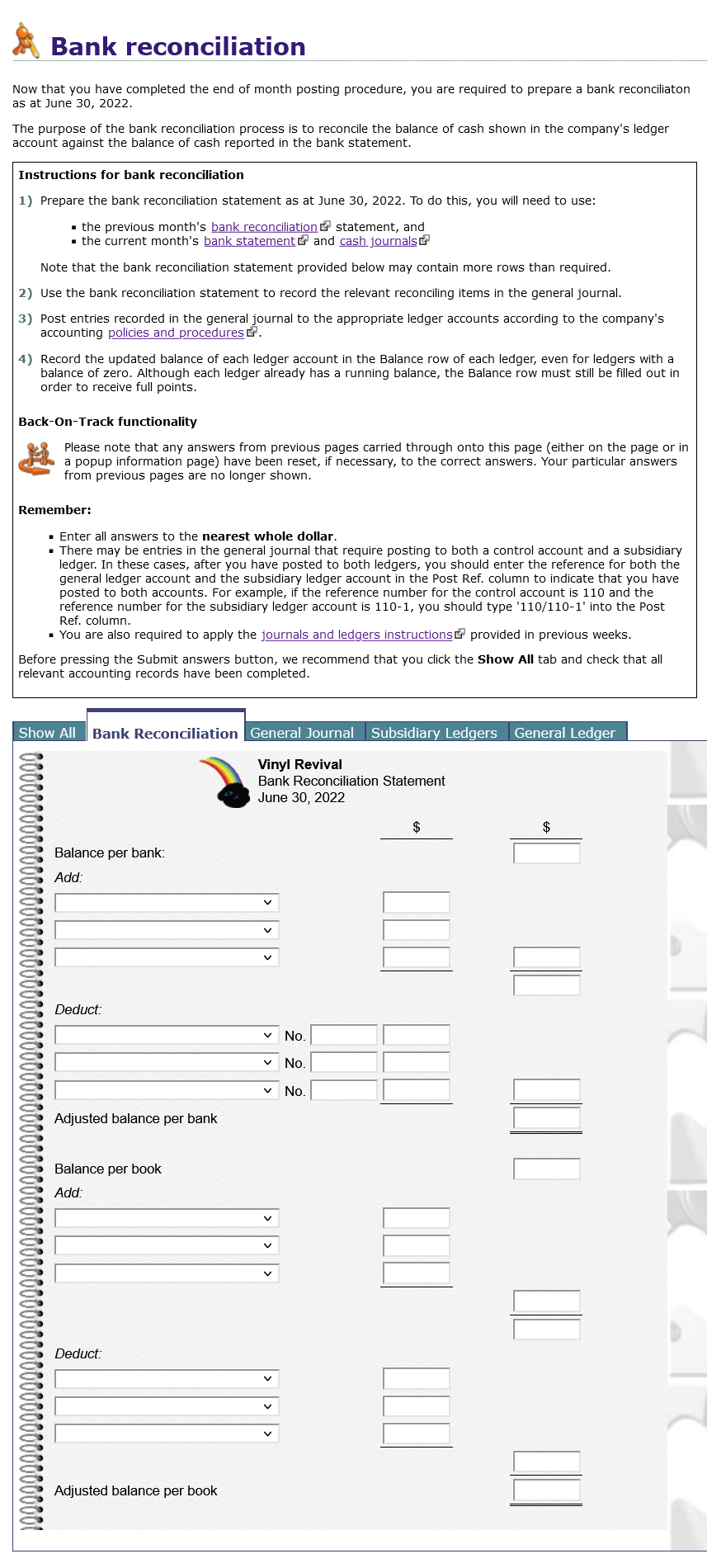

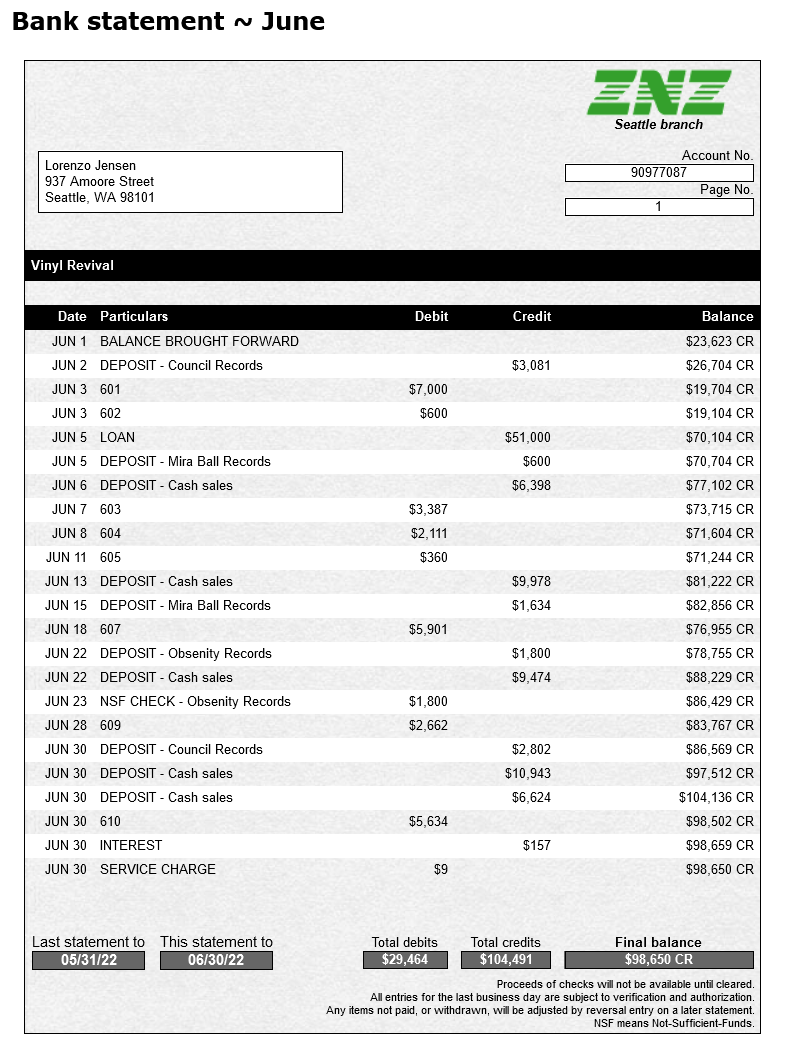

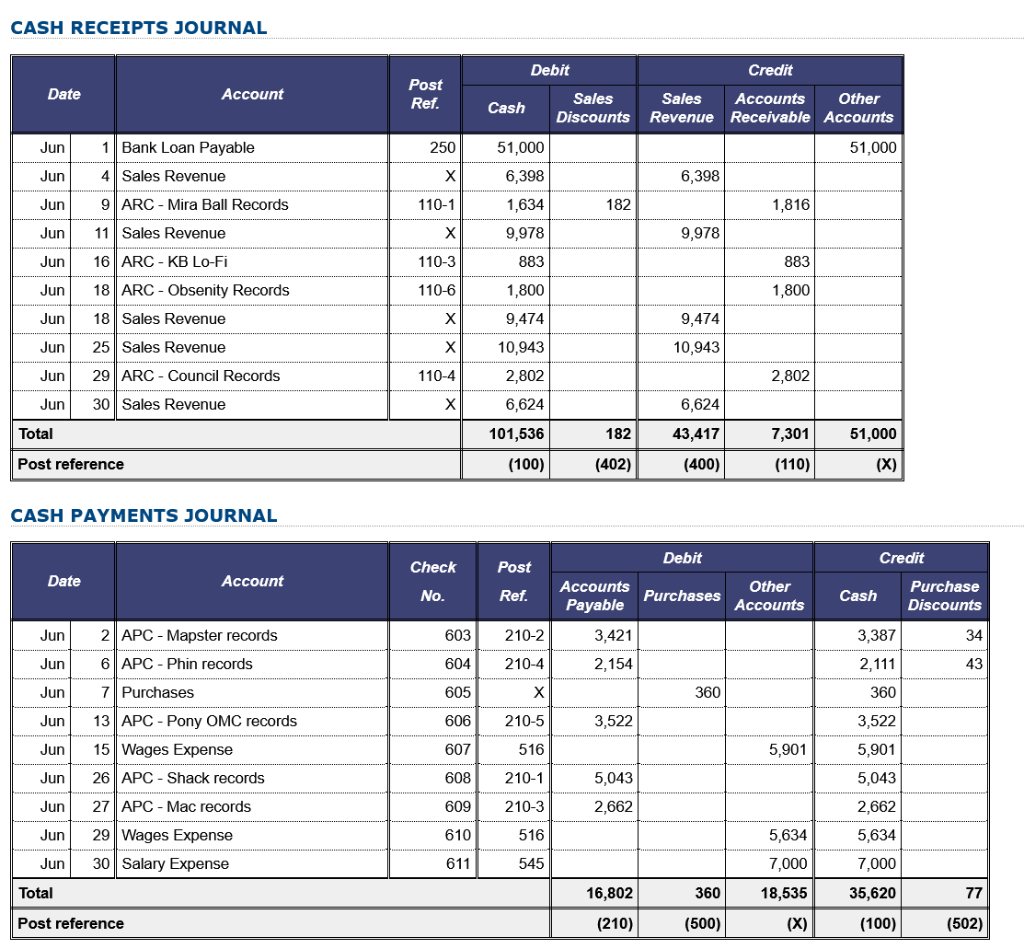

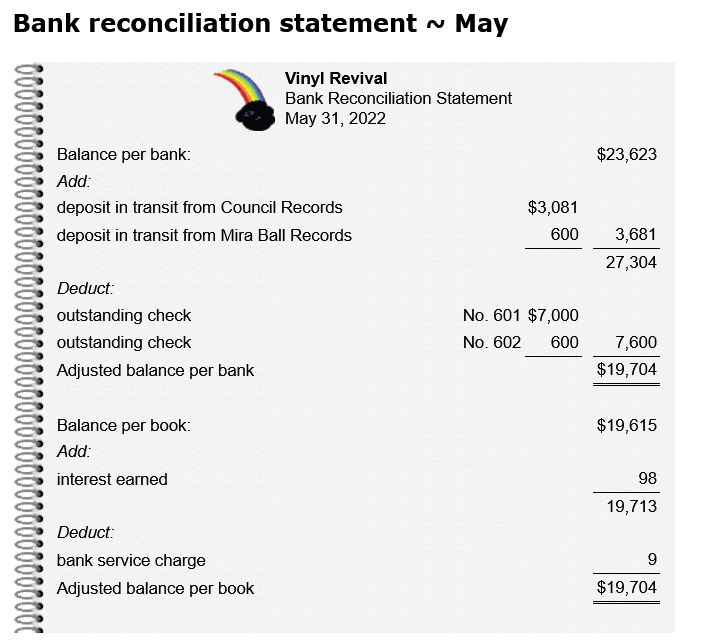

Bank reconciliation Now that you have completed the end of month posting procedure, you are required to prepare a bank reconciliaton as at June 30, 2022. The purpose of the bank reconciliation process is to reconcile the balance of cash shown in the company's ledger account against the balance of cash reported in the bank statement. Instructions for bank reconciliation 1) Prepare the bank reconciliation statement as at June 30, 2022. To do this, you will need to use: the previous month's bank reconciliation statement, and the current month's bank statement and cash journals Note that the bank reconciliation statement provided below may contain more rows than required. 2) Use the bank reconciliation statement to record the relevant reconciling items in the general journal. 3) Post entries recorded in the general journal to the appropriate ledger accounts according to the company's accounting policies and procedures. 4) Record the updated balance of each ledger account in the Balance row of each ledger, even for ledgers with a balance of zero. Although each ledger already has a running balance, the Balance row must still be filled out in order to receive full points. Back-On-Track functionality Please note that any answers from previous pages carried through onto this page (either on the page or in a popup information page) have been reset, if necessary, to the correct answers. Your particular answers from previous pages are no longer shown. Remember: Enter all answers to the nearest whole dollar. There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 110-1, you should type '110/110-1' into the Post Ref. column. You are also required to apply the journals and ledgers instructions provided in previous weeks. Before pressing the Submit answers button, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. Show All Bank Reconciliation General Journal Subsidiary Ledgers General Ledger Vinyl Revival Bank Reconciliation Statement June 30, 2022 $ $ Balance per bank: Add: V V Deduct: Adjusted balance per bank Balance per book Add: Deduct: Adjusted balance per book 100000000001 No. No. V No. V V Bank statement ~ June Lorenzo Jensen 937 Amoore Street Seattle, WA 98101 Vinyl Revival Date Particulars JUN 1 BALANCE BROUGHT FORWARD JUN 2 DEPOSIT - Council Records JUN 3 601 JUN 3 602 JUN 5 LOAN JUN 5 DEPOSIT - Mira Ball Records JUN 6 DEPOSIT - Cash sales JUN 7 603 JUN 8 604 JUN 11 605 JUN 13 DEPOSIT - Cash sales JUN 15 DEPOSIT - Mira Ball Records JUN 18 607 JUN 22 DEPOSIT - Obsenity Records JUN 22 DEPOSIT - Cash sales JUN 23 NSF CHECK- Obsenity Records JUN 28 609 JUN 30 DEPOSIT - Council Records JUN 30 DEPOSIT - Cash sales JUN 30 DEPOSIT - Cash sales JUN 30 610 JUN 30 INTEREST JUN 30 SERVICE CHARGE Last statement to This statement to 05/31/22 06/30/22 Account No. Page No. Balance $23,623 CR $26,704 CR $19,704 CR $19,104 CR $70,104 CR $70,704 CR $77,102 CR $73,715 CR $71,604 CR $71,244 CR $81,222 CR $82,856 CR $76,955 CR $78,755 CR $88,229 CR $86,429 CR $83,767 CR $86,569 CR $97,512 CR $104,136 CR $98,502 CR $98,659 CR $98,650 CR Total debits Total credits $104,491 Final balance $98,650 CR $29,464 Proceeds of checks will not be available until cleared. All entries for the last business day are subject to verification and authorization. Any items not paid, or withdrawn, will be adjusted by reversal entry on a later statement. NSF means Not-Sufficient-Funds. Debit $7,000 $600 $3,387 $2,111 $360 $5,901 $1,800 $2,662 $5,634 $9 Seattle branch 90977087 1 Credit $3,081 $51,000 $600 $6,398 $9,978 $1,634 $1,800 $9,474 $2,802 $10,943 $6,624 $157 CASH RECEIPTS JOURNAL Date Account Jun 1 Bank Loan Payable Jun 4 Sales Revenue Jun 9 ARC - Mira Ball Records Jun 11 Sales Revenue Jun 16 ARC-KB Lo-Fi Jun 18 ARC - Obsenity Records Jun 18 Sales Revenue Jun 25 Sales Revenue Jun 29 ARC - Council Records Jun 30 Sales Revenue Total Post reference CASH PAYMENTS JOURNAL Date Account Jun 2 APC - Mapster records Jun 6 APC - Phin records Jun 7 Purchases Jun 13 APC - Pony OMC records Jun 15 Wages Expense Jun 26 APC - Shack records Jun 27 APC - Mac records Jun 29 Wages Expense Jun 30 Salary Expense Total Post reference Post Ref. 250 X 110-1 110-3 110-6 XX w X 110-4 X Check No. Cash Debit Credit Sales Sales Accounts Other Discounts Revenue Receivable Accounts 51,000 6,398 182 1,816 9,978 883 1,800 9,474 10,943 2,802 6,624 182 43,417 7,301 (402) (400) (110) Accounts Other Accounts Payable 5,901 5,634 7,000 18,535 (X) 51,000 6,398 1,634 9,978 883 1,800 9,474 10,943 2,802 6,624 101,536 (100) Post Ref. 603 210-2 604 210-4 605 X 606 210-5 607 516 608 210-1 609 210-3 610 516 611 545 3,421 2,154 3,522 5,043 2,662 16,802 (210) Debit Purchases 360 360 (500) 51,000 (X) Credit Cash 3,387 2,111 360 3,522 5,901 5,043 2,662 5,634 7,000 35,620 (100) Purchase Discounts 34 43 77 (502) Bank reconciliation statement ~ May Vinyl Revival Bank Reconciliation Statement May 31, 2022 Balance per bank: Add: deposit in transit from Council Records deposit in transit from Mira Ball Records Deduct: outstanding check outstanding check Adjusted balance per bank Balance per book: Add: interest earned Deduct: bank service charge Adjusted balance per book 00000000000 00000000007 $3,081 600 No. 601 $7,000 No. 602 600 $23,623 3,681 27,304 7,600 $19,704 $19,615 98 19,713 9 $19,704Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started