Please complete the below question of Financial Mathematics BAB110 . I have also provided you with an example of how to solve this question . look at the example i am providing and solve the question exactly in the same manner. If anyone has a BA Financial calculator it would be very easy to solve this question i am providing you with examples of both ways to do with calculator and the formula. This question has two parts look at the example and solve the question in the same manner rem it has two parts . Two of my tutors provided wrong pls provide the correct answer .

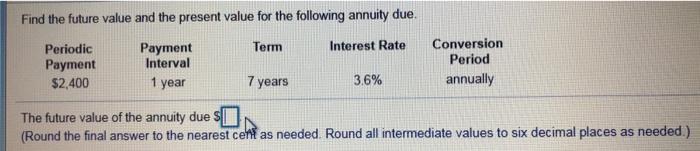

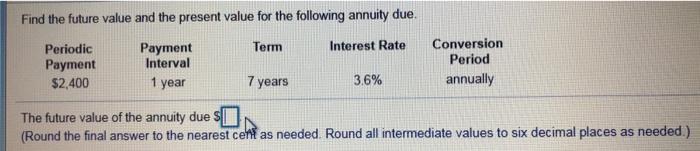

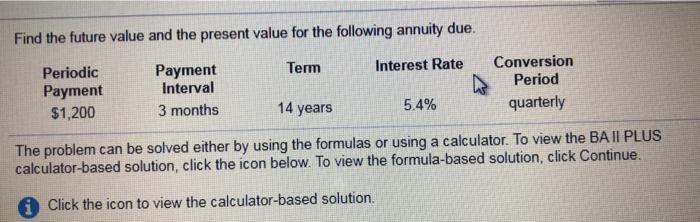

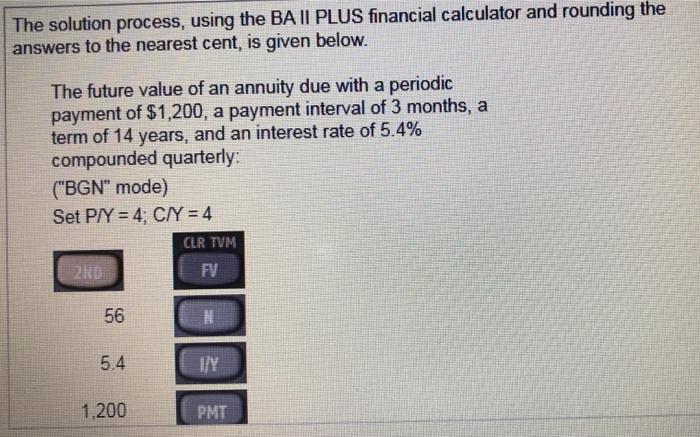

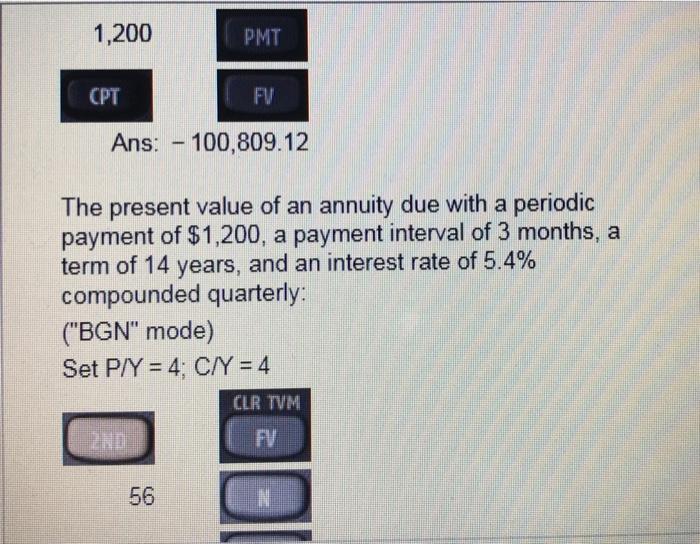

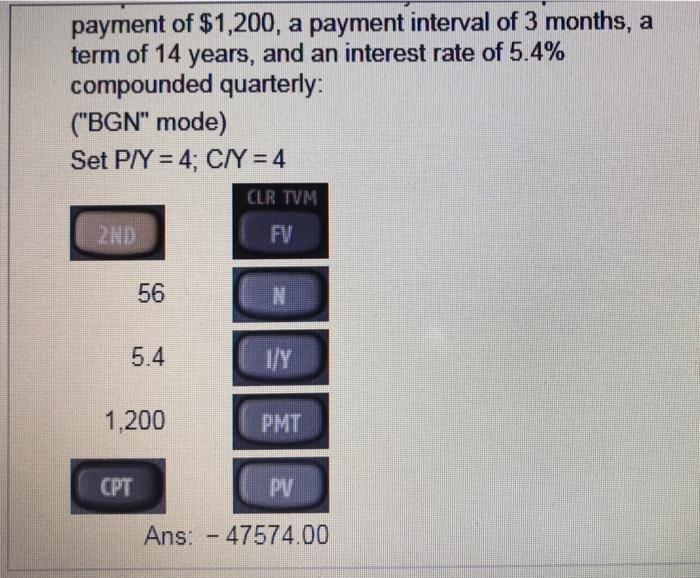

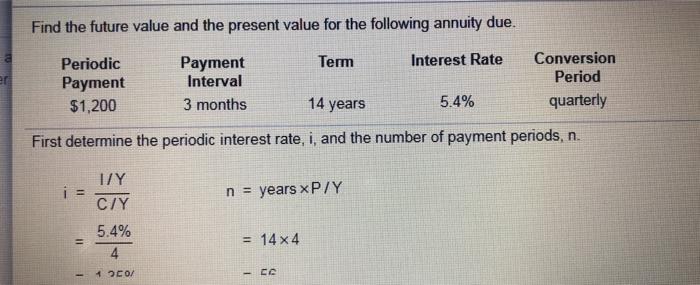

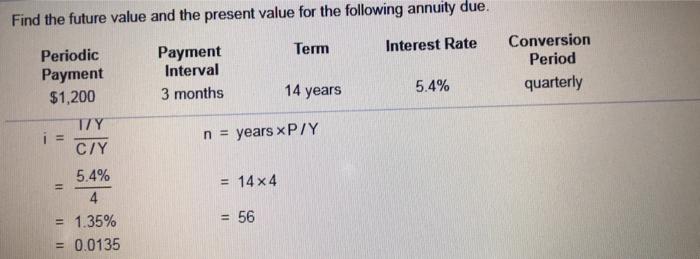

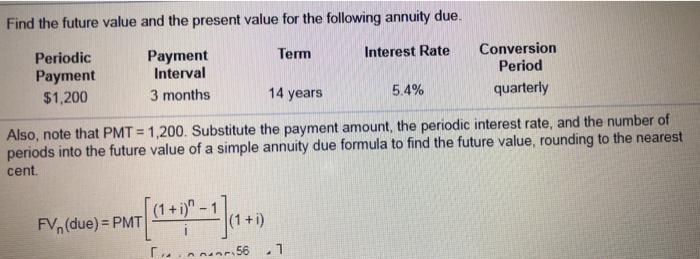

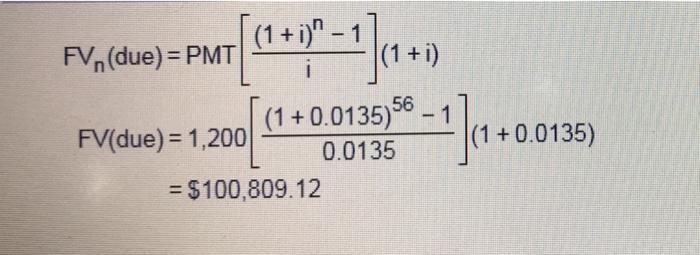

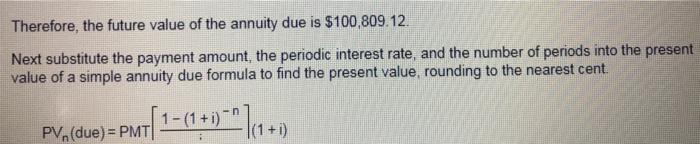

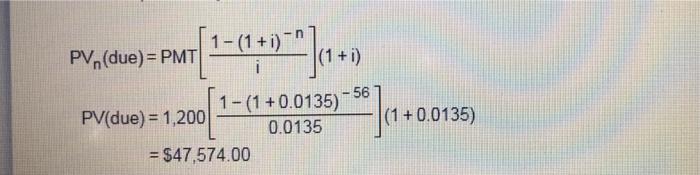

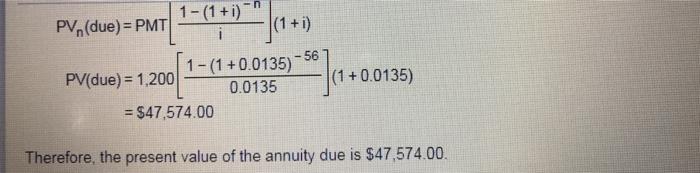

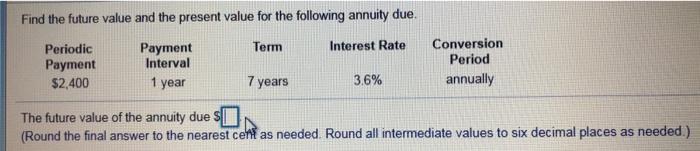

Find the future value and the present value for the following annuity due. Term Interest Rate Periodic Payment $2,400 Payment Interval 1 year Conversion Period annually 7 years 3.6% The future value of the annuity due SI (Round the final answer to the nearest cenf as needed. Round all intermediate values to six decimal places as needed.) Find the future value and the present value for the following annuity due. Term Interest Rate Periodic Payment $1,200 Payment Interval 3 months Conversion Period quarterly 14 years 5.4% The problem can be solved either by using the formulas or using a calculator. To view the BA II PLUS calculator-based solution, click the icon below. To view the formula-based solution, click Continue. Click the icon to view the calculator-based solution. The solution process, using the BA II PLUS financial calculator and rounding the answers to the nearest cent, is given below. The future value of an annuity due with a periodic payment of $1,200, a payment interval of 3 months, a term of 14 years, and an interest rate of 5.4% compounded quarterly: ("BGN" mode) Set P/Y = 4; CNY = 4 CLR TVM 2ND FV 56 N 5.4 IJY 1,200 PMT 1,200 PMT CPT FV Ans: - 100,809.12 The present value of an annuity due with a periodic payment of $1,200, a payment interval of 3 months, a term of 14 years, and an interest rate of 5.4% compounded quarterly: ("BGN" mode) Set P/Y = 4; C/Y = 4 CLR TVM 56 payment of $1,200, a payment interval of 3 months, a term of 14 years, and an interest rate of 5.4% compounded quarterly: ("BGN" mode) Set P/Y = 4; C/Y = 4 CLR TVM 56 N 5.4 J/Y 1,200 PMT CPT PV Ans: - 47574.00 Find the future value and the present value for the following annuity due. a Term Interest Rate Periodic Payment $1,200 Payment Interval 3 months Conversion Period quarterly 14 years 5.4% First determine the periodic interest rate, i, and the number of payment periods, n. n = years xP/Y T/Y C/Y 5.4% 4 = 14x4 CO/ Find the future value and the present value for the following annuity due. Term Interest Rate Payment Interval 3 months Conversion Period quarterly 14 years 5.4% n = years XP/Y Periodic Payment $1,200 TZY C/Y 5.4% 4 = 1.35% = 0.0135 = 14x4 - = 56 Find the future value and the present value for the following annuity due. Term Interest Rate Periodic Payment $1,200 Payment Interval 3 months Conversion Period quarterly 14 years 5.4% Also, note that PMT = 1,200. Substitute the payment amount, the periodic interest rate, and the number of periods into the future value of a simple annuity due formula to find the future value, rounding to the nearest cent. FV,(due) = PMT ...mor.56 21 (1 +i)" - 1 FV,(due) = PMT (1 + i) ( 1 +0.0135)56 - FV(due) = 1,200 0.0135 = $100,809.12 - 1)+0 (1 +0.0135) Therefore, the future value of the annuity due is $100,809.12. Next substitute the payment amount, the periodic interest rate, and the number of periods into the present value of a simple annuity due formula to find the present value, rounding to the nearest cent 1-(1 + i) 1 +)**] (9+) PV. (due) = PMT PV,(due)= PMT 1-(1+i) i (1 + i) - 56 le+ 1-(1 +0.0135) PV(due) = 1,200 0.0135 = $47,574.00 (1 +0.0135) 1-(1 + i) PV, (due) = PMT (1 + i) i 1-(1+0.0135) -56 PV(due) = 1,200 0.0135 = $47,574.00 (1 +0.0135) Therefore, the present value of the annuity due is $47,574.00