Please complete the below question of Financial Mathematics BAB110 . I have also provided you with an example of how to solve this question . look at the example i am providing and solve the question exactly in the same manner.

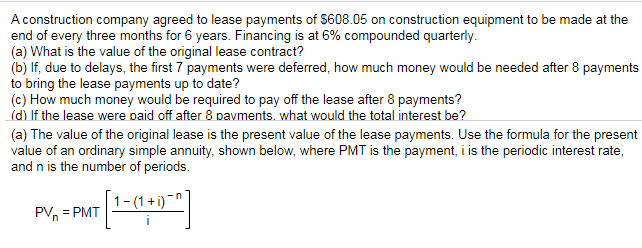

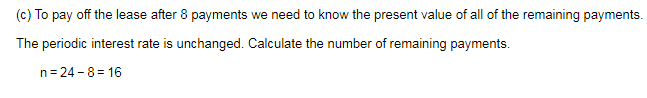

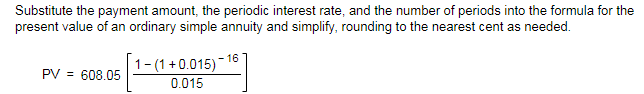

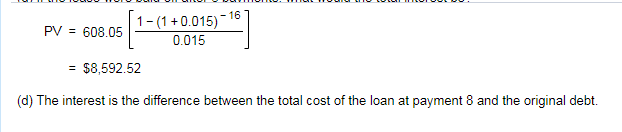

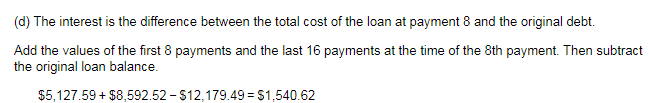

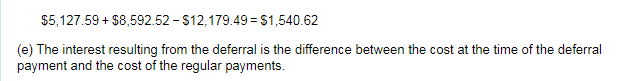

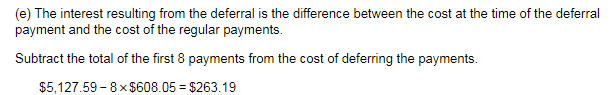

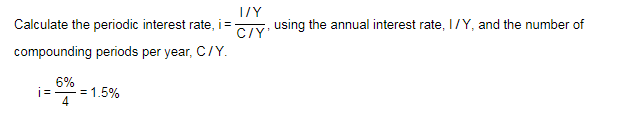

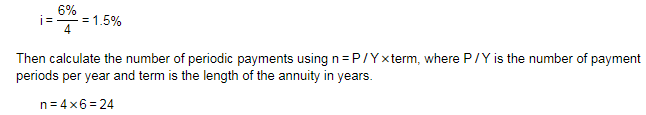

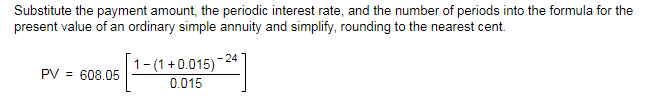

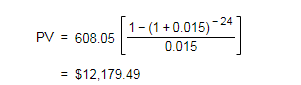

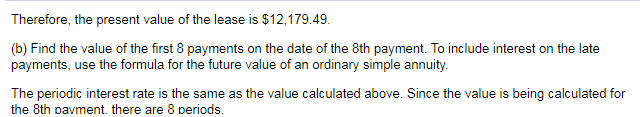

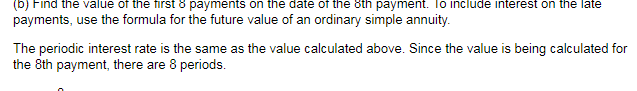

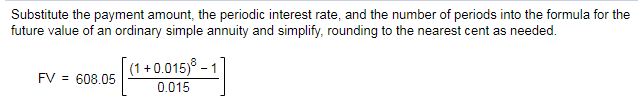

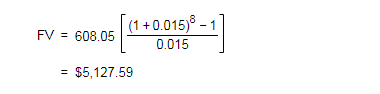

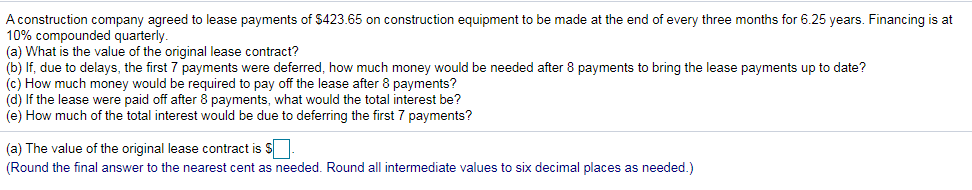

A consthction companyr agreed to lease payments of $E85 on construction equipment to be made at the end of every three months for 6 years. Financing is at 5% compounded quarterly. {a} What is the yalue of the original lease contract? {b} It, due to delays. the rst T payments were deferred, how much money would he needed after 3 payments to bring the lease payments up to date? {c} How much money would he required to pay off the lease after 8 payments? td'l If the lease were oaid off alter B oayments. what would the total interest he? {a} The value of the original lease is the present yalue of the lease payments. Use the formula for the present value of an ordinary simple annuity, shown below, where Ply'lT is the payment. i is the periodic interest rate, and n is the number of periods. 1{1+n'"] m=PMT[ I {c} To pay eff the lease after 3 payments we need to know the present value of all of the remaining payments. The periodic interest rate is unchanged. Calculate the number of remaining payments. n=24B=1E Substitute the payment amount, the periodic interest rate, and the number of periods into The formula for the present value of an ordinary simple annuity and simplify, rounding to the nearest cent as needed. 1 -{1+D.U15]_1E:| W = SUEDE [ lltl15 1{1+D.15]_15] W = EDBDE |: 11(115 = $8,592.52 {:1} The interest is the difference between the total cost of the loan at payment 8 and the original debt. {d} The interest is the difference between the total cost at the loan at payment 8 and the original debt. Add the values of the rst 8 payments and the last '15 payments at the time of the 3111 payment. Then subtract the original loan balance. $5.12?.59+$8.592.52 - $12,1iSJ-19 = $1.54_62 $5.12?.59+$8.592.52 - 512,1?949 = $1.54lll32 {e} The interest resulting from the deferral is the difference between the test at the time of the deferral payment and the cast ufthe regular payments. {e} The interest resulting from the deferral is the differe nee between the east at the time of the deferral payment and the nest of the regular payments. Subtract the total at the rst 8 payments from the east of defening the payments. 3265,1215? 3 x$EDELlIII5 = $263.19 \f._E%_ | 4 1.5% Then calculate the number of periodic payments using n = P H" xterm, 1.there P I Y is the number at payment periods per year and term is the length of the annuity in years. n=4x5=24 Substitute the payment amount, the periodic interest rate, and the number of periods into the formula for the present value of an ordinary simple annuity and simplify, rounding to the nearest cent 1 i1+o_n1s]'2'*] W = SUEDE |: 111115 \fTherefore the present value of the lease is $12.1?94'3. {b} Find the value of the rst 8 payments en the date of the 8th payment. Te include interest on the late payments use the fennula fer the future value of an ordinary simple annuity. The periodic interest rate is the same as The value calculated abeye. Since the value is being calculated for the 81!": payment. there are 8 periods. \fSuhetitute the payment amount, the periodic interest rete, end the number [if periods into The formula for the future 1value of en iJIrdinenir simple annuity and simplify, rounding to the neereet cent as needed. {1+D.15] 1] PM" = SUEDE [ [11115 \fAconstruction company agreed to lease payments of $423.65 on construction equipment to be made at the end of every three months for 6.25 years. Financing is at 10% compounded quarterly. (a) What is the value of the original lease contract? (b) If, due to delays. the rst 7 payments were deferred, how much money would be needed alter 8 payments to bring the lease payments up to date? {c} How much money would be required to pay oft the lease alter 8 payments? (:1) It the lease were paid off alter 8 payments, what would the total interest be? (e) How much of the total interest would be due to deterring the first 7' payments? (a) The value of the original lease contract is $l: _ (Round the nal answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)