Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete the book to tax reconciliation for the 2 0 2 2 tax year on the work paper provided. Please ensure you show any

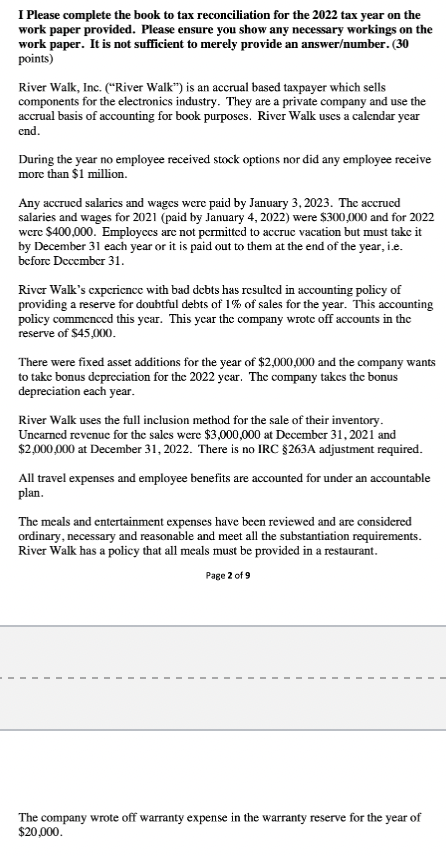

Please complete the book to tax reconciliation for the tax year on the

work paper provided. Please ensure you show any necessary workings on the

work paper. It is not sufficient to merely provide an answernumber

River Walk, Inc. River Walk" is an accrual based taxpayer which sells

components for the electronics industry. They are a private company and use the

accrual basis of accounting for book purposes. River Walk uses a calendar year

end.

During the year no employee received stock options nor did any employee receive

more than $ million.

Any accrued salaries and wages were paid by January The accrued

salaries and wages for paid by January were $ and for

were $ Employecs are not permitted to accruc vacation but must take it

by December each year or it is paid out to them at the end of the year, ie

before December

River Walk's experience with bad debts has resulted in accounting policy of

providing a reserve for doubtful debts of of sales for the year. This accounting

policy commenced this year. This ycar the company wrote off accounts in the

reserve of $

There were fixed asset additions for the year of $ and the company wants

to take bonus depreciation for the ycar. The company takes the bonus

depreciation each year.

River Walk uses the full inclusion method for the sale of their inventory.

Unearned revenue for the sales were $ at December and

$ at December There is no IRC $A adjustment required.

All travel expenses and employee benefits are accounted for under an accountable

plan.

The meals and entertainment expenses have been reviewed and are considered

ordinary, necessary and reasonable and meet all the substantiation requirements.

River Walk has a policy that all meals must be provided in a restaurant.

Page of

The company wrote off warranty expense in the warranty reserve for the year of

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started